There will be more fish in the sea for the EU following Britain’s agreement to open its fishing waters for 12 more years to EU boats, as part of a post-Brexit reset agreement discussed over the weekend. This agreement comes ahead of a London summit at which a security and defence partnership between the EU and UK is set to be signed. It also includes a veterinary deal to facilitate the export of British farmers' and fishers' produce to the EU. While this agreement sets a positive tone for future UK-EU cooperation, many issues, such as youth mobility, remain unresolved.

Last week, markets were on a high as trade tensions between the US and China eased, with the two countries agreeing to lower tariffs for 90 days while negotiating a long-term deal. The S&P 500 recorded its second-best week of 2025. Gold, on the other hand, experienced its worst week since November, as investors became less risk averse.

Yields increased following Moody’s announcement that it had removed the US’s triple-A credit rating due to fiscal concerns, with the 30-year Treasury yield rising above 5%. Yields were also boosted by the news that a key congressional budget committee had approved Trump’s tax bill on Sunday, bringing his promised tax cuts closer to implementation.

Trump announced that he would cut US drug prices by 30 to 80% through an executive order aimed at reducing prescription drug prices. He also said that the US would introduce a 'most favoured nation' policy, meaning drug companies would have to match the lowest international price when selling drugs to US consumers.

The first 100 days of President Trump’s second term in office were very much focused on trade. However, another of the main pillars of his presidential campaign was deregulation, which appears to be coming to the fore. US authorities are reportedly preparing to announce a significant reduction in banks’ capital requirements, moving away from the safeguards introduced after the 2008 financial crisis. Over the next few weeks, regulators could reduce the supplementary leverage ratio (SLR), which requires banks to hold a certain amount of high-quality assets against their total leverage. Analysts suggest that reducing the SLR could benefit the Treasury market by potentially lowering borrowing costs and enabling banks to purchase more government debt.

Weekly Highlights

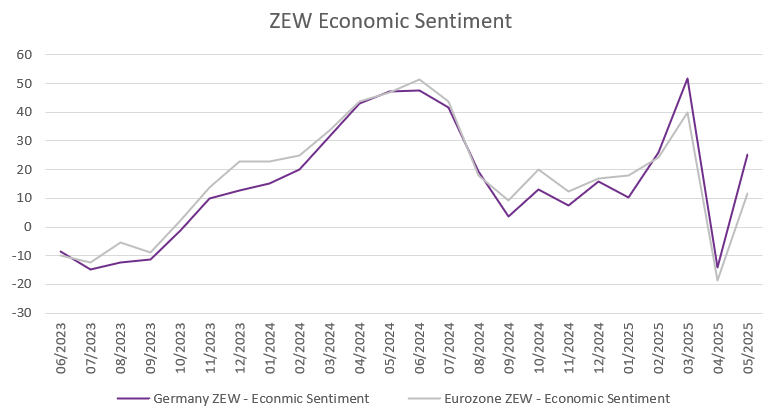

ZEW - Investor confidence jumps on tariff progress

Source: Bloomberg, BIL

The ZEW Indicator of Economic Sentiment for Germany surged by 39.2 points to 25.2 in May, marking a strong rebound from April’s near two-year low of -14.0 and significantly surpassing market expectations of 11.9. This sharp improvement reflects growing confidence among investment analysts, as the initial shock from US tariffs begins to fade and the newly formed federal government signals plans to boost public spending. According to ZEW President Achim Wambach, "Expectations are brightening… With a new government in place, some progress in the tariff disputes and a stabilising inflation rate, optimism has increased." The survey, conducted between May 5–12, may not fully capture the thawing in tensions between the US and China. Sentiment improved across nearly all sectors, most notably for banking and export-driven industries such as automotive, chemicals, metals, machinery, and steel. The ECB’s recent interest rate cut—and expectations of further easing—are also seen as supportive, especially for a recovery in the construction sector. Respondents anticipate a pick-up in domestic demand, which has been sluggish lately.

The outlook for the Eurozone as a whole also improved. Inflation expectations fell by 18.1 points to -15, while 55.8% of the surveyed analysts expected no changes in economic activity. 27.9% saw an improvement and 16.3% anticipated a deterioration.

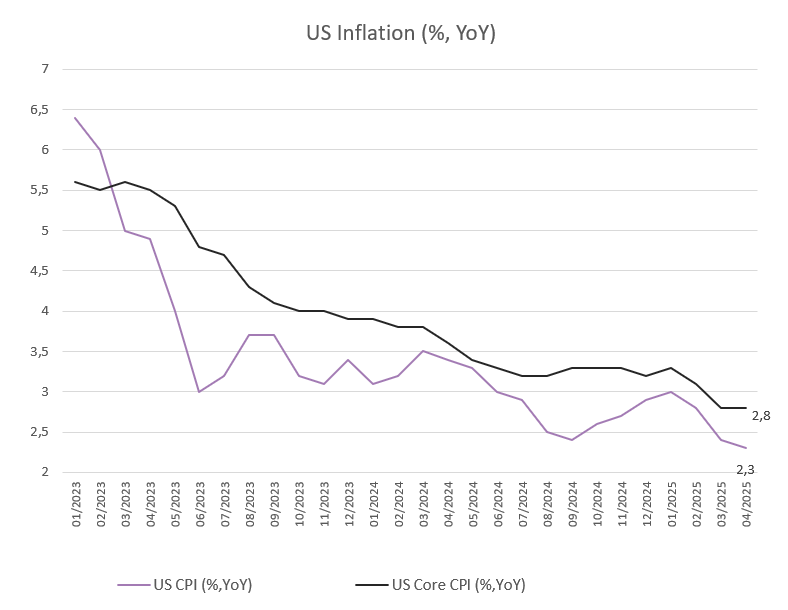

US inflation falls to 2.3%, the lowest level since February 2021

Source: Bloomberg, BIL

The US Consumer Price Index (CPI) rose 2.3% YoY in April —slightly below market expectations of 2.4%, and the slowest increase since February 2021. The slowdown was led by a 3.7% decline in energy costs: Gasoline and fuel oil prices fell more sharply, while natural gas prices surged 15.7%, accelerating from 9.4% the previous month.

Inflation cooled for food (2.8% vs 3%) and transportation (2.5% vs 3.1%), while we saw deflation in key service industries (Airfares -2.8%; Hotels -0.2%), suggesting weaker demand for discretionary experiences.

Prices rose more quickly for used cars and trucks (1.5% vs 0.6%). Goods heavily impacted by Liberation Day tariffs, particularly those with high Made-in-China content, also saw price upticks, including furniture (+1.5%), appliances (+0.8%), audio equipment (+8.8%), and sporting goods (+0.6%). Tariffs on Chinese goods have now been lowered from 145% to 30% for a 90-day period as relations between the world's two largest economies thaw.

The annual core inflation rate held steady at 2.8%, in line with expectations.

On a monthly basis, CPI rose 0.2%, rebounding from a 0.1% decline in March but coming in below expectations of +0.3%. Shelter costs—up 0.3% on the month or 4% annually—accounted for more than half of the overall rise.

Looking forward, economists caution that the full impact of tariffs has yet to materialise, and Federal Reserve officials are preparing for potential upward pressure on prices. The central bank, which has held interest rates steady at 4.25%–4.5% for six months, is scheduled to meet next on June 17–18. Markets are currently pricing in roughly two rate cuts for the remainder of the year.

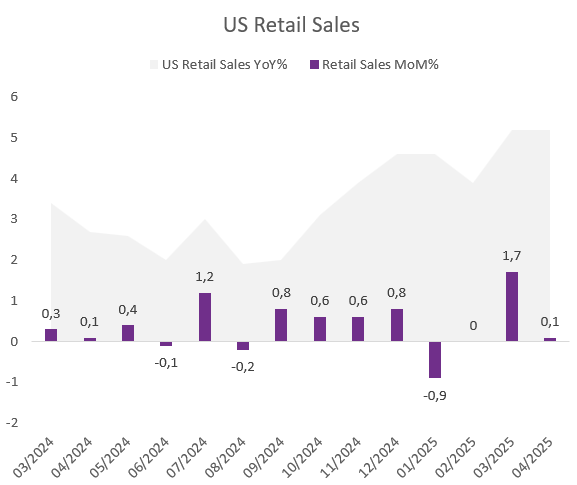

US retail sales barely grew in April, suggesting some spending pullback

US retail sales exhibited a marked deceleration in April, registering a modest increase of 0.1% month-over-month, following an upwardly revised surge of 1.7% in March as consumers rushed to front-run tariffs.

Out of the 13 categories, seven experienced declines. However, spending at restaurants and bars (the only service-related category), demonstrated robust growth, rising firmly for a second consecutive month by 1.2%.

Worries over tariffs seem to have led consumers to curtail their expenditures on automobiles (after a buying spree the previous month), sporting goods, and other imported items.

Control-group sales — which contribute to the government’s calculation of goods spending for GDP — declined by 0.2% in April, while economists had anticipated a 0.3% increase.

Concerns regarding the outlook for consumer spending and the broader economy were partially alleviated when the US and China reached a temporary agreement to de-escalate the trade war last week. Nevertheless, President Trump has cautioned that tariffs could be reinstated, and forecasters predict that the levies will exacerbate inflation and hinder growth.

Source: Bloomberg, BIL

US consumer confidence has been severely dented by tariff talk, dropping to the second lowest level on record in May, according to the University of Michigan consumer confidence survey. The index fell from 52.2 in April to 50.8 in May, while the expectations gauge also fell sharply. Inflation expectations have reached their highest level since 1981, with consumers anticipating higher prices due to President Trump’s trade war. Although the markets have welcomed the trade deals that have been agreed so far, US tariffs on foreign goods remain much higher than before Trump took office, which is likely to push up prices for US consumers.

UK economy records strong growth in Q1 while labour market shows signs of cooling

The UK economy grew by 0.7% in the first quarter of the year — the fastest pace in a year and slightly above the expected 0.6%. Following an expansion of 0.1% in Q4 of last year, the British economy got off to a strong start in the new year. However, growth in the coming quarters is expected to be significantly impacted by President Trump’s trade policies, which are not reflected in the Q1 data. According to the Office for National Statistics, growth was driven by an increase in investment and a positive contribution from net trade.

Although the US and UK announced a trade deal last week that provided relief for some of the most affected sectors, the 10% tariff remains in place and is expected to dampen growth in the coming months. Before Trump’s tariff announcement on 2 April, businesses hurried to export their products to the US, causing export volumes to rise by 3.5% in Q1.

Also in the first quarter of the year, the unemployment rate rose slightly to 4.5% (up from 4.4% in the previous quarter). This is the highest unemployment rate since the three months ending in August 2021. The UK labour market is showing signs of cooling, with job vacancies becoming scarcer amid a rise in employer national insurance contributions and pay growth is weakening. In particular, the retail and hospitality sectors saw sharp falls in employment in March and April. If the trend continues, the Bank of England will likely maintain its cautious approach to interest rate cuts.

Calendar for the week ahead

Monday – China Industrial Production (April), Retail Sales (April), Unemployment Rate (April). Eurozone CPI (Final, April).

Tuesday – Eurozone Consumer Confidence (Flash, May).

Wednesday – Japan Balance of Trade (April). UK Inflation Rate (April).

Thursday – France Business Confidence (May). France, Germany, Eurozone Composite, Manufacturing & Services PMI (Flash, May). Germany Ifo Business Climate (May). UK Composite, Manufacturing & Services PMI (Flash, May). US S&P Composite, Manufacturing & Services PMI (Flash, May), Jobless Claims.

Friday – UK Gfk Consumer Confidence (May), Retail Sales (April). Japan Inflation Rate (April). Germany GDP Growth Rate QoQ (Final, Q1).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...