Published early, on 5 June 2025, in light of the public holiday weekend

As ash and gas billowed from Sicily’s Mount Etna, some steam also escaped from the S&P 500, following its best May in over three decades. Stocks, bonds, and the dollar all retreated early in the week as trade tensions flared up and geopolitical risks resurfaced, with high-stakes peace talks between Russia and Ukraine in Istanbul failing to secure a ceasefire. Gold shone brighter on renewed demand for safe haven assets.

With the 9 July deadline on trade negotiations still some weeks away, trade tensions continue to bubble beneath the surface, already having an impact on economic fundamentals, confidence and corporate decision-making. This was highlighted by weak economic data from the US, with the ISM services PMI declining to 49.9, and private employers adding a mere 37k jobs in May.

On Wednesday, the US’ trade offensive hit a new frontier, with tariffs of 50% on steel and aluminum coming into effect, doubling the 25% tariffs introduced in March. Canada is the US largest supplier of those metals and the industry has warned of disruption and job losses.

Washington and Beijing both accused each other of breaching a trade deal struck in Geneva, before a call took place between Trump and Xi on Thursday. Trump said that the two agreed to further talks and cleared up disputes surrounding rare earth exports.

The EU, on the other hand, said it could speed up retaliatory measures against the US. The bloc has already approved tariffs on USD 21 billion of US goods, while another USD 95 billion dollars of goods are tabled for levies, should trade negotiations fail to deliver what is perceived as a balanced outcome.

Weekly Highlights

Eurozone inflation falls below the ECB’s 2% target, clearing the way for another 25bp rate cut

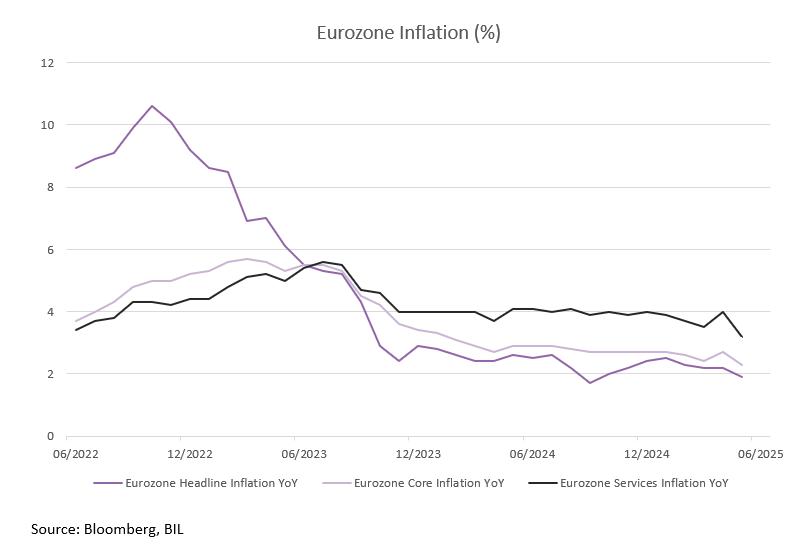

Eurozone inflation fell to 1.9% YoY in May, down from 2.2% and below market expectations of 2.0%. That cooling might continue into the second half of the year, with the ECB’s wage tracker forecasting a steep drop in negotiated wage growth. Higher pay has been keeping services inflation elevated, and only now is it beginning to come down (3.2% in May, down from 4.0%, and its lowest level since March 2022).

Energy dropped further, falling by 3.6% YoY, while inflation for non-energy industrial goods held steady at 0.6%. Prices for food, alcohol, and tobacco accelerated, rising 3.3% up from 3.0% the previous month. Core inflation, which excludes volatile food and energy components, was 2.3%, the lowest reading since January 2022.

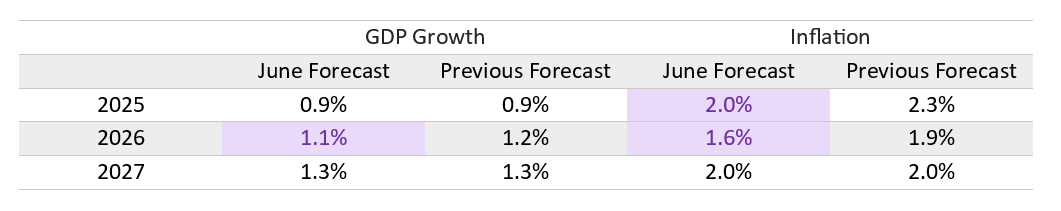

With inflation now below its 2% target, on Thursday, the ECB delivered its eighth rate cut of this easing cycle, lowering its three main rates by 25 basis points. It also trimmed its inflation projections for this year and next, citing lower energy costs and a stronger euro.

Source: ECB, BIL

The cut, which had been almost fully priced in by markets, takes the deposit facility rate to 2%, down from a mid-2023 high of 4%. Given that the rate is now at the midpoint of the estimated neutral range, the bar for further cuts has risen and the ECB Chair, Christine Lagarde, hinted that the central bank was nearing the end of its cutting cycle. Following the meeting, traders pared back bets for further cuts. Whether we will see more cuts largely depends on how the inflation outlook evolves; Lagarde herself noted, “the outlook for euro area inflation is more uncertain than usual.” If it remains in check, a pause through summer and another 25bp cut before the end of this year to support economic momentum, would seem the most likely scenario.

Economic growth has left much to be desired, even as interest rates have come down. In the first quarter of 2025, the Eurozone expanded by 0.3%. The ECB maintained its 0.9% growth target for this year, but said this reflects a stronger than expected first quarter combined with weaker prospects for the remainder of the year. Bloomberg consensus estimates see growth at 0.8% this year, in line with IMF forecasts.

The ECB expects growth to pick up to 1.1% next year, noting that while trade uncertainty could weigh on business investment and exports, especially in the short-term, rising government investment in defence and infrastructure will increasingly support growth over the medium-term. It added that higher real incomes and a robust labour market will allow households to spend more.

Swiss inflation drops into sub-zero territory

In Switzerland, inflation fell below zero for the first time in four years, coming in at -0.1% in May. The figure was pulled down by falling airfares and accommodation rates. Traders boosted bets that the Swiss National Bank will revert to zero or subzero interest rates to tackle tepid price pressures and a surging currency. The franc is one of the best-performing major currencies this year, up nearly 11% against the dollar.

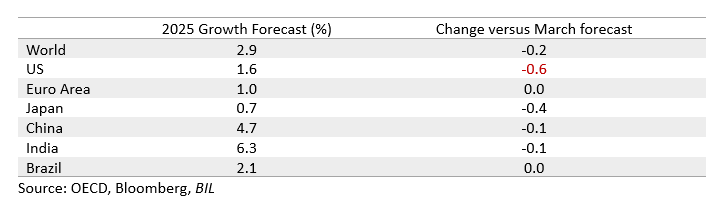

OECD trims growth forecasts citing trade barriers

The OECD, a club of the world’s 38 richest countries, last week cut its global growth projections, adding that agreements to ease trade barriers would be “instrumental” in reviving investment and avoiding higher prices. Global growth is expected to be 2.9% in 2025 and 2026, the OECD said in its latest full outlook. The figure has been above 3% every year since the pandemic.

GDP growth in the US will slow substantially said the Paris-based organization, falling from 2.8% in 2024 to just 1.6% this year and 1.5% in 2026. The OECD expects that price pressures as a result of input levies will prevent the Federal Reserve from cutting rates this year. The key risk is that after a recent spike, consumer inflation expectations become de-anchored leading to spiraling prices. Markets are clearly more optimistic on this front and still price in around two 25 basis point cuts this year.

The OECD expects weakened economic prospects will be felt around the world, with almost no exception, hitting incomes and job growth. Fiscal risks were also noted as pressure mounts on countries to splurge on defense, climate action and ageing populations. It called on leaders to trim non-essential spending and increase revenues by widening tax bases.

German cabinet approves EUR 46 billion corporate tax relief package

The German cabinet has approved a bundle of tax breaks for firms in an effort to strengthen the competitiveness of the Eurozone’s largest economy, and catalyse growth.

The purpose of the package – which will cost EUR 46bn in total by 2029 - is to boost investment with measures like "super depreciations" on the cost of new machinery and other equipment, amounting to 30% per year for three years.

In addition, the package includes an investment incentive for companies that buy electric vehicles – buyers will be able to depreciate 75% of the purchase price in the year of purchase.

It also provides for a reduction in the corporate tax rate by 1 percentage point in each tax year from 2028 to 2032 inclusive.

“Starting from 2032, the total tax burden on companies will be slightly less than 25% instead of the current 30%. This is an important signal at the international level for Germany as a place to do business,” the ministry said in a statement.

This new initiative comes in addition to a debt-funded defense and infrastructure package worth some EUR 1 trillion.

US imports and exports hit as trade talks continue

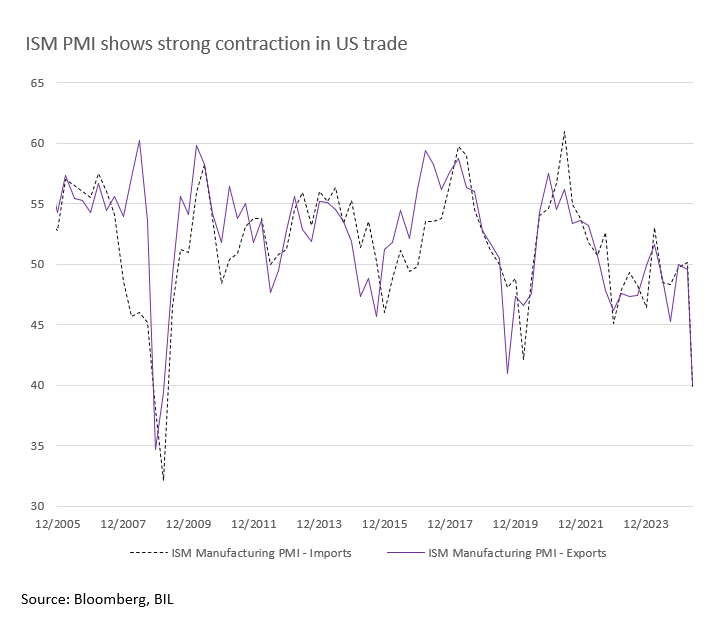

Last week, we wrote about how US goods imports tanked by some 20% amid temperamental trade policies. Subsequent to this, the ISM Manufacturing PMI suggests that general uncertainty might continue to dent the hard data in the months to come. The ISM Manufacturing PMI fell to 48.5 in May, while consensus had expected an increase to 49.5. This marked the sharpest decline in the sector since November 2024, highlighting mounting economic uncertainty and sustained cost pressures. Indeed, as the chart below shows, the imports gauge fell to 39.9, the lowest level since 2009. Export orders fell to a 5-year low of 40.1. Further, the Supplier Deliveries Index signaled ongoing delays, reflecting persistent bottlenecks at ports of entry.

Calendar for the week ahead

Monday – China Inflation, Unemployment and Balance of Trade. US Consumer Inflation Expectations.

Tuesday – UK Unemployment. Italy Industrial Production. US NFIB Business Optimism Index.

Wednesday – US Inflation (May).

Thursday – UK GDP Growth (April) and Industrial Production. US PPI and Weekly Jobless Claims.

Friday – Eurozone Industrial Production. US Michigan Consumer Sentiment (Preliminary, June).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...