Written 14 July

The US administration did not meet its self-imposed target of striking “90 trade deals in 90 days”. With the July 9 deadline now in the rearview mirror, only the UK, China and Vietnam have some form of a deal. August 1 is now being floated as the new go-live date for most levies, leaving a small window for further talks.

Mexico and the EU have now been threatened with a 30% tariff rate.

Maroš Šefčovič, the EU’s trade commissioner said that it will “be almost impossible” for the bloc to continue its current volumes of trade with the US if the Administration follows through with this. Up until now, the EU has not retaliated against new tariffs which include a 25% levy on cars and parts, a 50% tariff on steel and aluminium, and a baseline 10% tariff on most goods. The EU had planned to hit around €21bn worth of US imports with counter-tariffs this week, but has decided to hold fire in order to foster dialogue. Mexican officials also remain at the negotiating table.

Japan and South Korea were sent letters stating that the US will impose 25% tariffs on August 1, while Brazil has been threatened with a substantial increase in its tariff rate from 10% to 50% -- despite the fact that the US has a trade surplus with its Southern neighbour.

US consumers are concerned about the impact of tariffs on inflation, and the Brazil tariffs could really emphasise this notion in their daily lives, pushing up prices for key staples. A cup of coffee, for example, might be about to become much more expensive; Brazil is the world’s leading producer of arabica beans, used in most premium coffee blends. Prices of arabica and robusta coffee have already been rising in recent years due to poor harvests in the main producing countries. The tariff announcement caused coffee futures to jump. Further still, Brazil is currently the fifth-largest source of foreign beef, accounting for 21% of all US beef imports.

Moving from red meat to red metal, US copper prices also soared to a record high last week, after President Trump announced that all imports of the industrial metal would be subject to a 50% tariff.

US equities finished the week slightly lower, with growth stocks holding up slightly better than value. European equities managed a small gain amid hopes for a Transatlantic trade deal.

Focus will now fall on the Q2 earning season, with bulge bracket US banks kicking off proceedings on Tuesday.

Weekly Highlights

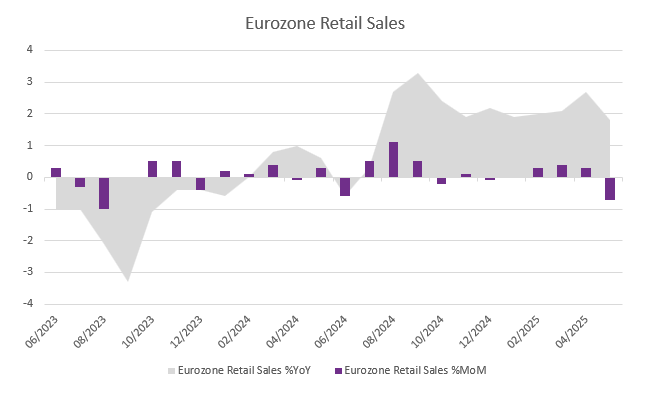

Eurozone retail sales see steepest decline since August 2023

Despite the fact that it was an unseasonably dry, summery May across Northern Europe, shoppers do not appear to have been hitting the high streets. Retail sales fell 0.7% in the Eurozone, the steepest monthly decline since August 2023. On an annual basis, retail sales growth slowed from 2.7% to 1.8%, underscoring a broader moderation in consumer activity across the bloc.

The decline can be traced back to depressed demand for non-food products (-0.6% vs -0.1% in April), fuel (-1.3% vs +1.3%), and food, drinks, and tobacco (-0.7% vs +0.8%). Among the major Eurozone economies, Germany saw the sharpest drop in retail volumes (-1.7%), followed by the Netherlands (-0.6%), Italy (-0.4%), and France (-0.2%). Spain was the exception, recording a modest 0.2% increase.

While the timing of holidays may have contributed to the monthly decline, the overall trend remains weak. Sluggish retail sales add to the cautious outlook for the region, where consumer demand has yet to gain traction amid a backdrop of persistent uncertainty.

Source: Bloomberg, BIL

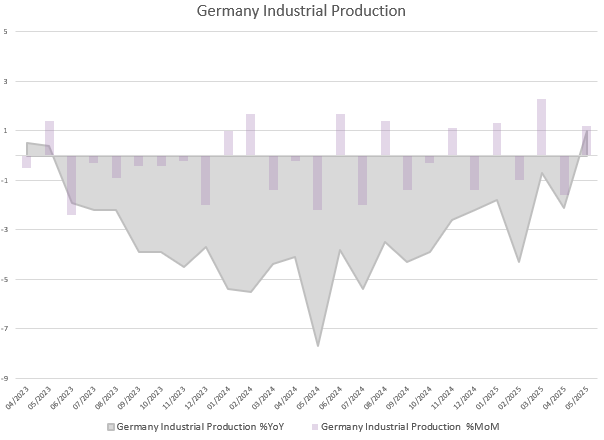

Annual industrial production in Germany turns positive for the first time since early 2023

In a positive sign for the German manufacturing sector, industrial production increased by 1.2% in May compared to the previous month, surpassing expectations. This positive development was driven by strong growth in the automotive sector, as well as in pharmaceuticals and energy production. Construction, however, contracted by 3.9%. On an annual basis, production increased by 1%, following a 2.1% drop in April. This ends a years-long slump catalysed by the Eurozone energy crisis.

Source, Bloomberg, BIL

Concerns raised about UK’s public finances

The UK government recently backtracked on its pledge to make £5 billion of savings through welfare budget cuts, following criticism from MPs. There are concerns that the cuts could push a significant number of people into poverty. The U-turn on welfare, combined with likely weaker growth forecasts, is expected to leave a significant gap in Chancellor Reeves’ budget that now needs to be filled. This has led to fears that the autumn budget will once again include tax increases, following last year's £40 billion tax-raising budget.

However, the government has promised not to increase taxes on “working people”, ruling out income tax, VAT and national insurance increases. One option could be to extend the existing freeze on the income tax and national insurance thresholds, which means that more people are brought into the tax paying brackets.

Another option that has been mentioned is a wealth tax on the UK's richest individuals, which could generate significant tax revenue for the government. However, Reeves has previously stated that a wealth tax is not part of the plan, given that taxes were already raised on non-doms, private jets and private schools last year. The Office for Budget Responsibility has also warned that relying on “small and mobile groups of taxpayers” for tax income is risky.

Analysts expect Reeves' fiscal headroom to be exhausted soon, so expectations for new tax increases in the upcoming autumn budget are high. What form those will take its yet to be seen.

Consumer prices in China rise while producer deflation continues

Producer price inflation in China fell by 3.6% year on year in June, the fastest pace since July 2023, as President Trump’s uncertain trade policies continues to put pressure on manufacturers around the world. This means that producers receive less money for their goods when they leave the factory, before they are sold in retail. Export-oriented industries are under the most pressure due to the uncertain global trade environment and subdued demand.

Meanwhile, annual consumer prices rose for the first time in five months, if only by a modest 0.1% (YoY). This was mainly driven by e-commerce shopping events and increased subsidies for consumer goods from Beijing. Core inflation, which excludes volatile food and fuel prices, rose 0.7% YoY, marking the highest reading in 14 months and following a 0.6% gain in May.

Despite the modest rebound in consumer prices, the slump in producer price inflation indicates that China is far from overcoming deflationary pressures.

Calendar for the week ahead

Monday – Japan Industrial Production (Final, May).

Tuesday – China GDP Growth Rate (Q2), Retail Sales (June), Unemployment Rate (June). Eurozone Industrial Production (May). Germany ZEW Economic Sentiment (July). US Inflation Rate (June).

Wednesday – UK Inflation Rate (June). Eurozone Balance of Trade (May). US Industrial Production (June), Fed Beige Book.

Thursday – Japan Balance of Trade (June). Switzerland Balance of Trade (June). UK Unemployment Rate (May). Eurozone Inflation Rate (Final, June). US Retail Sales (June), Jobless Claims.

Friday – US Housing Stats (June), Michigan Consumer Sentiment (Prel, June).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 8, 2025

Weekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...