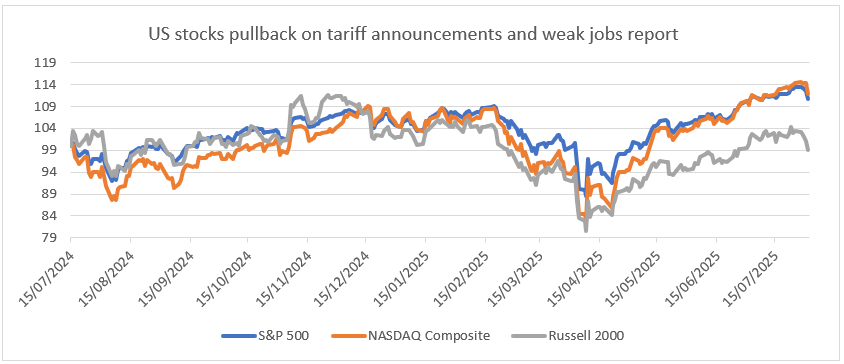

After rising towards new all-time highs at the start of last week, US equity markets closed in the red, with the S&P 500 experiencing its largest drop since May (-2.4%), and the Dow its worst week since April (-2.9%). The Russell 2000 which includes smaller players suffered the brunt of the decline (-4.2%), whereas the tech-heavy Nasdaq held up best (-2.2%). There were two key reasons for the pullback: President Trump’s tariff announcements and weaker-than-expected data on the US labour market. European equities hit a four-month high early in the week, with investors exhibiting a collective sigh of relief after the bloc was hit with a 15% tariff. It was, however, short lived, and sentiment deteriorated as the week progressed, with the EU failing to secure exemptions for key products such as European wine and spirits. Further negotiations are expected in Autumn. Now we enter the August to October period which can be jittery on equity markets – even in a good year, without the added noise of trade tariffs.

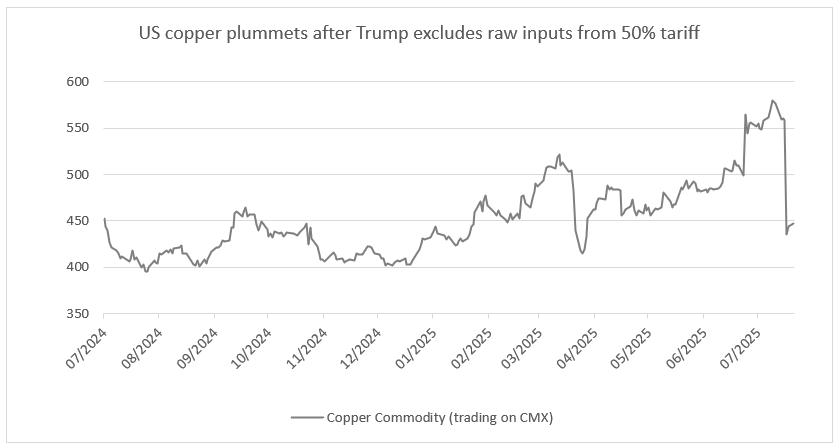

Copper was a major mover, with the red metal plummeting on US bourses, after the White House said the 50% tariff would actually only apply to semi-finished products such as pipes and wires.

On Friday, the weak jobs report (details below) ignited concern about the health of the US economy, leading yields at the short-end of the yield curve to experience their biggest drop in a year, as traders boosted bets for Fed easing.

Amidst the flood of tariff announcements, OPEC+ agreed to increase oil production by 547,000 barrels per day in September. This comes as the group of oil-producing countries continues to ramp up output in an effort to regain market share.

Source: Bloomberg, BIL as of 4 August 2025

Source: Bloomberg, BIL as of 4 August 2025. Normalised to 100

Weekly Highlights

White House releases new tariff rates

With the August 1 deadline for tariff negotiations expiring on Friday, markets had a flurry of details to digest, including:

- A 25% tariff rate on imports from India

- A 25% tariff rate on imports from Taiwan

- A 50% tariff rate on most Brazilian goods

- A 39% tariff on Swiss goods

- A 15% tariff rate on South Korean imports on the condition of a USD350 bln investment deal in US projects

- A 35% tariff on many Canadian goods

- A 90-day reprieve for Mexico from higher tariffs of 30% on many goods to allow time for negotiations

Switzerland was particularly caught off guard, with a steep 39% tariff set to take effect on August 7. News of this new rate, higher than the 31% proposed on “Liberation Day”, pressured Swiss stocks and the currency. The US is a key export market for Swiss goods such as watches, chocolate and machinery, and it buys roughly 60% of Switzerland's pharmaceutical exports. Big pharma is already under pressure from the Trump administration to reduce drug prices, risking margin pressure ahead. Switzerland is also a major investor in the US, with many of its largest companies providing employment for thousands of Americans. Despite promising to invest even more in the States, it seems that Trump has chosen to focus on the trade imbalance. It is unclear whether tariffs will remedy this as the imbalance is largely due to exports of gold and pharmaceuticals, which fall out with the umbrella of reciprocal tariffs at this point.

Overall, it is still premature to assess how the latest tariff announcements will affect individual countries, industries, and companies. Firstly, there is still a degree of policy uncertainty, with the White House prone to change its mind on key topics quite abruptly. Moreover, negotiations are still ongoing with many countries, and some are still hopeful that they can secure additional carve outs for key industries. Beyond this, it is still to be seen how the implementation of these tariffs will look in practice – the devil will be in the details, beyond the headline numbers printed. Foreign governments and companies are still forming their responses; companies may prove nimble in finding loopholes, while retaliation from trading partners cannot be ruled out. Lastly, it is yet to be seen who will ultimately foot the bill for these new costs. We expect they will be spread out, with companies absorbing a portion, passing some onto consumers, and at the same time, negotiating lower prices with overseas suppliers.

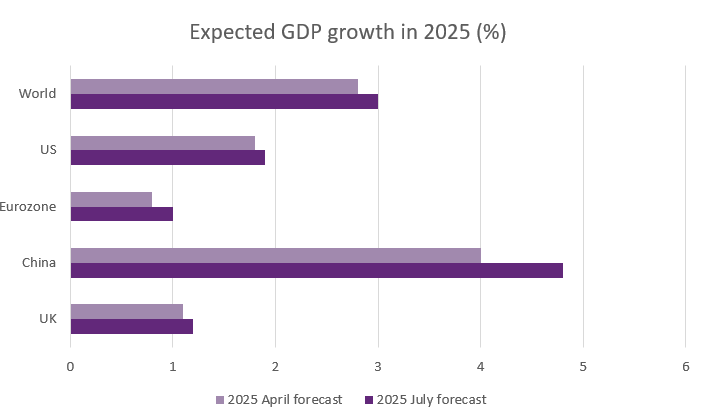

IMF upgrades global growth forecast

The International Monetary Fund (IMF) has updated its global growth outlook amid signs that a reorientation of the global trading system will do less damage than initially forecast. Indeed, the tariff rates on US imports are largely being finalised at lower rates than what was initially announced in April. The weaker dollar is also offsetting some of the tariff impact.

In its updated World Economic Outlook, the IMF forecast global growth of 3% this year, up from 2.8% in April. The world's two largest economies, the US and China, have also been upgraded. China received the biggest revision, with growth now expected to reach 4.8% in 2025, up from the 4% estimated in April. Growth exceeded expectations at the start of the year, driven by tariff front-loading and, to a lesser extent, fiscal measures boosting consumption. There has also been a significant reduction in US–China tariff rates, although a final trade deal is yet to be struck. It is this combined impact that has led to the revision in the Fund’s growth forecast.

Source: IMF, BIL

For the US, lower tariff rates than those announced on April 2 and looser fiscal conditions have led the IMF to announce a slightly more optimistic growth forecast, with GDP growth expected to reach 1.9% in 2025, up from 1.8%. Trump’s One Big Beautiful Bill Act is also expected to boost growth in 2026, with GDP growth forecast at 2%.

In the Eurozone, growth at the start of the year was also supported by investments and exports. However, the upward revision of GDP growth forecast from 0.8% to 1% in 2025 is mostly attributed to Ireland's strong GDP performance.

Despite the IMF's updated forecast showing greater optimism, global growth is still expected to slow from 3.3% in 2024. Trade talks are ongoing, and the full impact of the final tariff rates on respective economies remains to be seen.

US & Eurozone GDP growth both better than expected in Q2

US GDP growth rebounded by more than expected in Q2, rising by 3%. This follows a 0.5% contraction in Q1. However, the bulk of this improvement is attributed to a fall in the trade deficit (adding 4.99 percentage points, following intense front-loading in Q1), while domestic demand rose at the slowest pace in two and a half years. According to the Commerce Department's preliminary report, consumer spending increased moderately last quarter, while business investment in equipment slowed sharply following double-digit growth in Q1. Uncertainty surrounding trade policy has hindered firms' ability to plan ahead, affecting hiring and spending decisions.

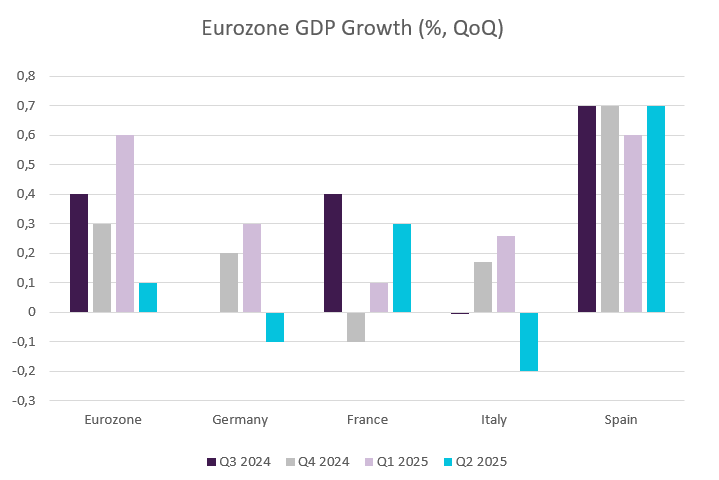

Across the Atlantic, the Eurozone economy grew by 0.1% in the second quarter, beating the expected 0%. While this is a positive sign for the health of the economy, it could mean that the European Central Bank sees less of a need for another interest rate cut this year to stimulate growth.

On a country-by-country basis, Spain and France performed better than expected, offsetting weakness in Germany and Italy. France's economy grew by 0.3%, surpassing expectations, though this was bolstered by inventory building and offset by weak domestic demand and declining capital investments.

Germany saw a slight decline of 0.1% due to reduced investment, although consumption remained steady. Italy contracted by 0.2%, impacted by tariff uncertainty and volatile commodity prices. In contrast, Spain's economy expanded by 0.7%, driven by strong domestic demand, despite challenges like a nationwide blackout. Population growth and services exports continue to underpin Spain's outperformance.

Source: Bloomberg, BIL

Looking at the first half of the year, the eurozone economy has shown resilience despite heightened uncertainty. Nevertheless, while a trade deal has now been agreed between the US and the EU, many details still need to be finalised before businesses can really breathe easily.

Fed holds interest rates steady despite pressure to cut

As widely expected, the US Federal Reserve kept interest rates on hold on Wednesday, maintaining the policy rate within the 4.25–4.5% range for the fifth consecutive meeting. The decision was not unanimous, with nine central bank governors voting to keep rates on hold and two calling for a rate cut. This follows several calls from President Trump for monetary policy easing.

In its policy statement, the central bank said that “The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated". Meanwhile, it noted that economic activity had moderated in the first half of the year. If this trend was to continue, it could strengthen the case for a rate cut later this year. However, risks to the Fed’s inflation and employment targets persist and could hinder the central bank from cutting interest rates in the near future.

Following Friday’s job report, the market now sees an 80% chance of a rate cut in September, and is fully pricing two Fed cuts before year end, somewhat pushing against Powell’s wait-and-see approach.

US labour market: a downturn in hiring

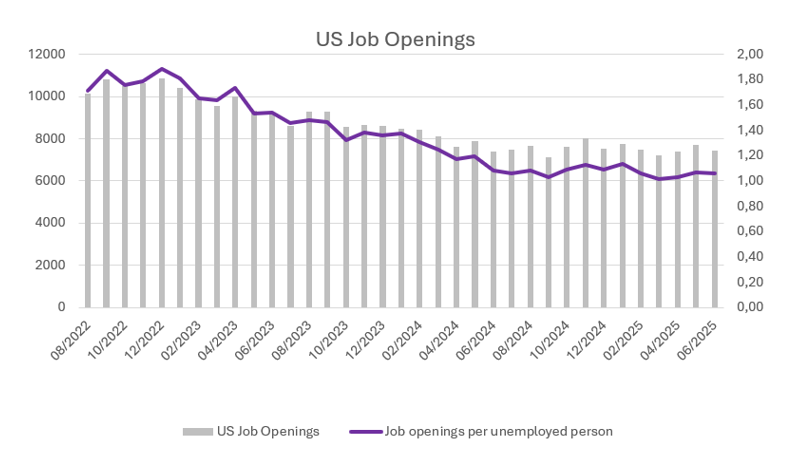

Last week brought disappointing data on the US labour market. Firstly, job openings were shown to have fallen by 275k in June, to 7.437 million in June, below expectations of 7.55 million.

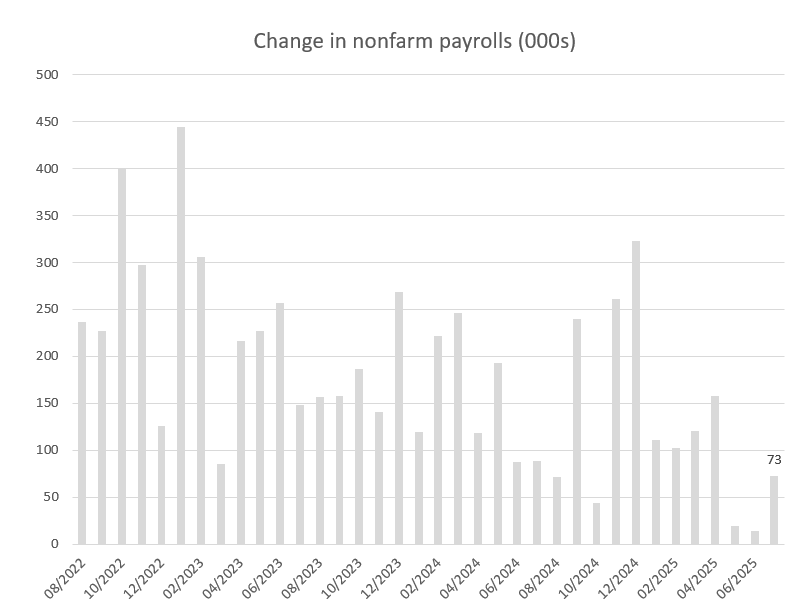

The clincher, however, was Friday’s jobs report that showed employers added a mere 73k jobs in July (versus 110k expected), while revisions to the data wiped off 258k jobs from the initial reading for May and June. Despite a shrinking workforce, the unemployment rate rose from 4.1% to 4.2%, and missed being rounded up to 4.3% by only a few basis points. The bulk of the decline in payrolls this year has been led by the Federal Government. Therein, employment continued to decline in July (-12K) and is down by 84K since reaching a peak in January. That said, we do note that economically cyclical industries have essentially hit the brake on hiring, and that’s something that needs to be closely monitored going forward.

The silver lining, however, is that the hiring slowdown has not (yet) been accompanied with a spike in firing. Layoffs and discharges, as reported in the JOLTs survey, were unchanged on the month.

Source: Bloomberg, BIL

Eurozone inflation remains at ECB target in July

The annual inflation rate in the Eurozone held steady at the European Central Bank’s target of 2% in July. The ECB expects inflation to remain close to this level in the medium term, which reduces the need to continue cutting interest rates for the time being, having already reduced its key rate to 2% in June.

Prices for food, alcohol and tobacco rose the most at 3.3%, compared to 3.1% in June. This was followed by services at 3.1%, compared to 3.3%; non-energy industrial goods at 0.8%, compared to 0.5%; and energy at -2.5%, compared to -2.6%.

Core inflation, which excludes volatile items such as food and fuel, also remained steady at 2.3%, as a slight slowdown in services inflation was offset by an increase in goods inflation.

This inflation rate release follows a series of reassuring economic indicators, suggesting that the Eurozone economy is holding up despite the uncertainty surrounding US trade policy. This has led markets to rein in their bets on further ECB easing this year, with market pricing implying less than a 50% chance of another interest rate cut. However, risks to the Eurozone economy remain. In particular, the 15% tariff agreed on European goods imported into the US, combined with a stronger euro, is expected to hurt growth. How the final trade deal negotiated between the US and China looks will also poses a significant risk as a high tariff rate on Chinese imports could lead China to start dumping surplus goods in Europe, which would push down prices and increase competition for domestic firms.

For now, the ECB remains in a wait-and-see mode, awaiting more clarity on the impact of tariffs on the economy now that the August 1 deadline for negotiating a trade deal has passed.

Calendar for the week ahead

Monday – Switzerland Inflation Rate (July).

Tuesday – China Caixin Composite & Services PMI (July). Eurozone, US & UK Composite & Services PMI (Final, July). US Balance of Trade (June), ISM Services PMI (July).

Wednesday – Germany Factory Orders (June). Eurozone Retail Sales (June).

Thursday – China Balance of Trade (July). Switzerland Unemployment Rate (July). Germany Balance of Trade (June), Industrial Production (June). Bank of England Interest Rate Decision. US Jobless Claims.

Friday – Switzerland Consumer Confidence (July).

Saturday – China Inflation Rate (July).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 8, 2025

Weekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...