Stocks around the world rose last week as a risk-on mood took hold. Equities touched new heights at the global level, in the US and in China.

In the US, it was an eleventh-hour extension of the US-Sino trade truce and a better-than-expected CPI report that allowed the S&P 500 index to hit its 16th new high of the year. It is yet to be seen if we will see another year like 2024, which enjoyed 57 fresh highs. Stocks are also being buoyed by confidence that the Fed will deliver a 25bp cut at its next meeting on September 16-17. Two cuts in total for 2025 are now priced.

In China, stocks rose to their highest level in a decade, fuelled by the reduced trade tensions with the US. Retail investors have rotated out of bonds and into the stock market as expectations on interest rate cuts were scaled back. This switch also appears to have been accelerated by Beijing’s decision to reintroduce taxes on interest payments made on government bonds. The Shanghai Composite Index climbed to the highest intraday level since August 18, 2015, whilst the CSI 300 Index hit the highest level since October 2024.

An additional driver for equities, has been a benign earnings season. Reporting is now in the final innings, with around 90% of S&P 500 companies and 70% of Stoxx 600 companies having reported, leaving us in a better place to draw conclusions. In the US, performance has been strong overall, with 80% of reporting companies beating earnings per share (EPS) estimates, with an aggregate surprise of 8%. Overall, EPS growth is currently 11% YoY. In Europe, however, only 41% of companies beat EPS estimates, with an aggregate surprise of 6%. EPS growth is, insofar as now, just 3% YoY. Looking ahead to the next quarter, tariffs are expected to have a more pronounced impact as companies grapple with higher costs. Retailers are at risk of margin pressure if they do not have the pricing power or brand strength to pass the increases onto consumers. In Europe, sales and earnings growth estimates for 2025 are weak, particularly in sectors that rely heavily on exports.

Moving to fixed income, the key highlight was the fact that the 30-year Bund yield hit a 14 year high amid concerns about European fiscal spending, as well as Dutch pension reforms. High-yield and emerging market debt enjoyed strong performance over the week.

In Commodities, oil declined after the IEA released its latest forecasts, predicting a record supply glut in 2026. Brent crude is down by over 12% YTD, as increasing supply is met with fears about slowing economic growth. OPEC is more optimistic, forecasting better demand growth. The contrasting estimates reflect the elevated uncertainty surrounding the global economy at large.

Bearish factors for oil include the fact that consumption has been weaker-than-expected in both emerging and developing economies, while world oil inventories reached a 46-month high in June. Global supply is expected to rise more rapidly than expected this year and next as OPEC+ members further increase output and as supply from outside the group grows.

On the other hand, travel is still in high demand, boosting jet fuel demand, while sanctions on Russia and Iran may curb supplies from the world’s third and fifth largest producers. Continued Chinese stock-building aimed at enhancing energy security may help absorb the surplus.

Over the weekend, all eyes were on the summit between Presidents Trump and Putin Alaska to discuss the end of the war in Ukraine. Despite Trump having pushed for a ceasefire, the meeting fell short of delivering this. With a lot of questions remaining about how a peace deal can be reached and what concessions would have to be made by both Russia and Ukraine, Trump is set to host President Zelenskiy, among other European leaders, on Monday to continue discussions.

Stocks wavered and bond yields declines at the beginning of the week, with the extent of progress towards a peace deal, as well as signals from the Fed on the path of monetary policy, expected to set the tone in the coming days. Central bankers will gather at the Fed’s annual retreat at Jackson Hole.

Weekly Highlights

US

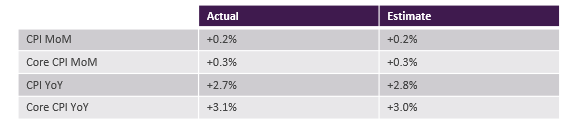

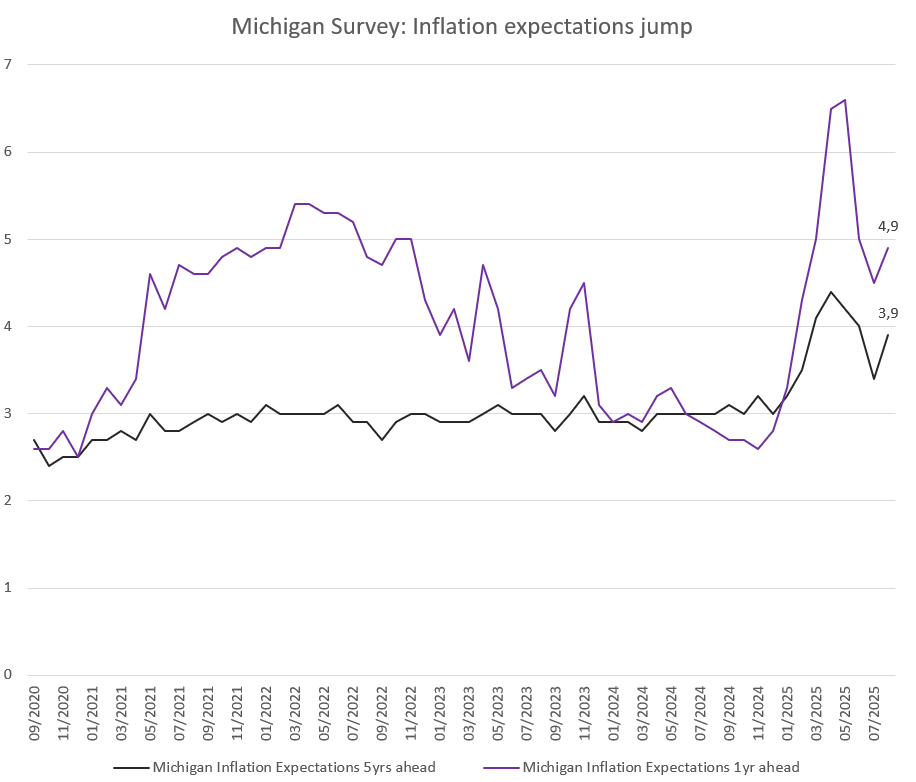

The surprise last week was that US consumer prices have not risen as much as expected. The annual inflation rate held steady at 2.7% YoY in July, suggesting that it could still take some time for the tariff impact on inflation to show up.

Source: Bloomberg, BIL

Looking under the surface though, we can already see pressure creeping in. On a monthly basis, core inflation (which excludes volatile categories such as energy and food) accelerated to a five-month high. To keep in mind, is that businesses had built up quite an inventory of goods before many of the tariffs were put in place, meaning that the impact on prices will lag as those inventories are slowly being depleted.

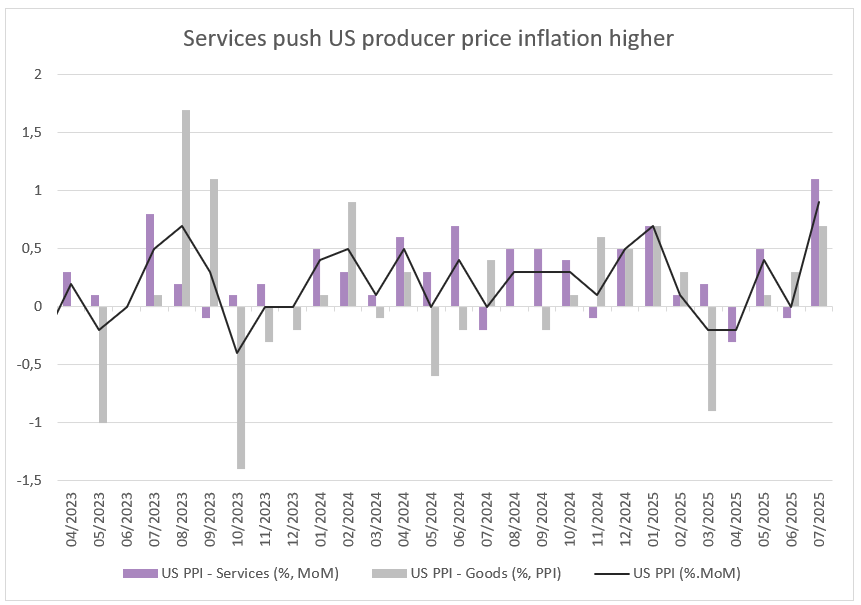

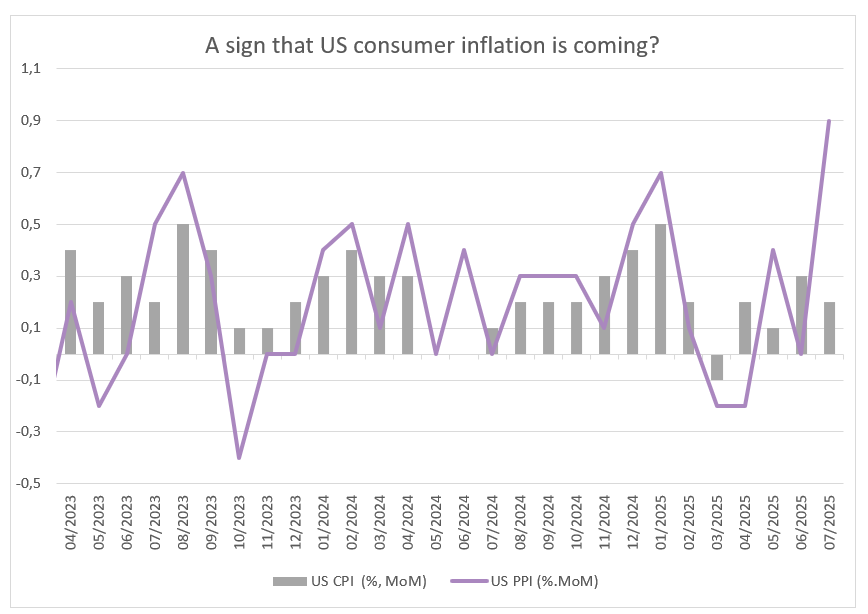

Later in the week, data showed that US inflation at the wholesale level gathered steam last month, with prices rising by the fastest monthly pace since June 2022. Headline PPI jumped 0.9% MoM, suggesting that it might only be a matter of time before wholesalers and retailers pass their higher tariff-related costs on to inflation-fatigued consumers.

Drilling down into the data, the cost of services went up 1.1%, led by a 3.8% surge in margins for machinery and equipment wholesaling. Telling is the fact that industrial goods have been the targeted area of tariffs, and we are now seeing spillover into the services associated with this segment of the economy. Costs also increased for financial services and for traveler accommodation. Goods prices increased 0.7%, led by a 38.9% jump in fresh and dry vegetables. Clearly, levies on Mexican agricultural imports are having an impact.

On an annual basis, headline producer inflation accelerated to a five-month high of 3.3% and above expectations of 2.5%. The large spike in PPI shows inflation is coursing through the economy, even if it hasn’t been felt by consumers yet.

Source: Bloomberg, BIL

Source: Bloomberg, BIL

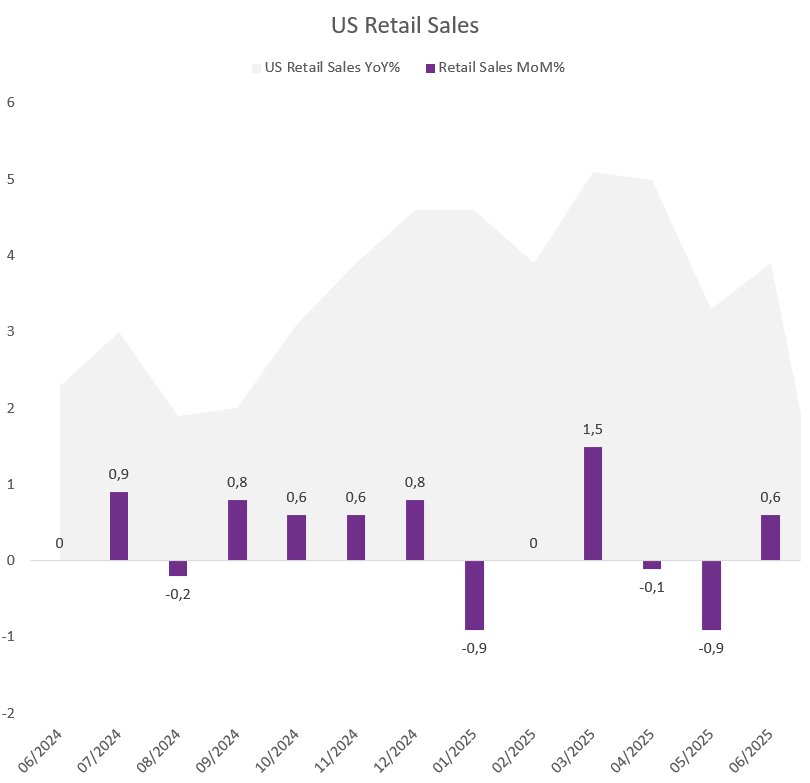

With businesses eating the higher costs for the time being, consumers have kept up their spending habits. Indeed, retail sales rose 0.5% MoM in July, in line with market expectations and following an upwardly revised 0.9% rise in June. The largest increases were seen in sales at motor vehicle & parts dealers (1.6%) and furniture stores (1.4%). Control group sales, which are used to calculate GDP, were up 0.5%, following an upwardly revised 0.8% increase and also above expectations of 0.4%.

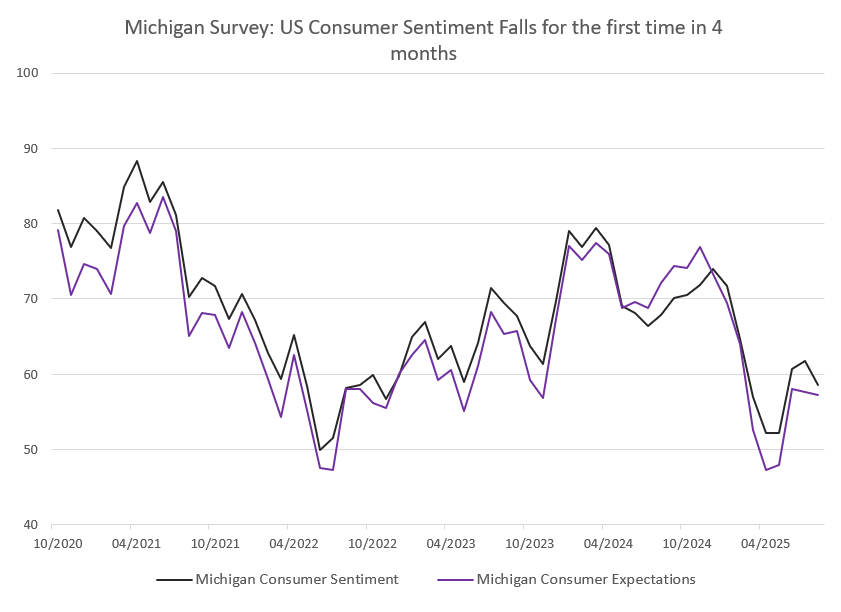

The question is whether this momentum can last. According to the preliminary Michigan survey, released Friday, consumer sentiment dropped to 58.6 in August, down from 61.7 in July and well below market expectations of 62. It was the first drop in confidence seen in four months, and it is mainly down to growing inflation concerns and sharply worse buying conditions for durable goods. While expectations for future personal finances improved slightly, consumers still anticipate worsening inflation and unemployment ahead.

Those who underestimated the US consumer have been wrong until now, but flagging sentiment and the pass-through of tariff-induced inflation could definitely throw a spanner into the workings of US consumption.

Source: Bloomberg, BIL

Source: Bloomberg, BIL

Source: Bloomberg, BIL

Europe

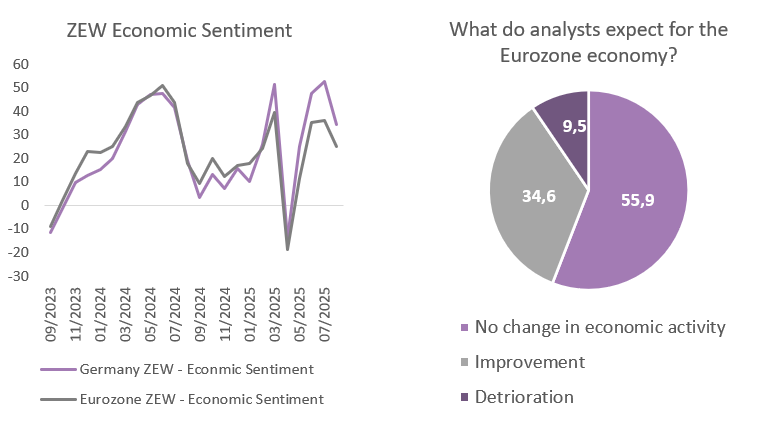

In Europe, the latest ZEW surveys imply that financial market experts are disappointed with the announced EU–US trade deal; For both Germany and the broader Eurozone, the sentiment index retreated in August. This squares with comments made by the Federation of German Industries after the 15% tariff on EU goods was communicated, warning that even though a worst-case 30% tariff had been avoided, a 15% US rate will still “have a huge negative impact on Germany’s export-oriented industry”. The outlook has worsened in particular for the chemical and pharmaceutical industries, though mechanical engineering, metal sectors and the automotive industry are also affected. Regarding the latter, major manufacturers like Volkswagen and BMW are warning of reduced margins and production adjustments. The German Chamber of Commerce commented that the tariff will “burden the industry at a critical time of transition to electric mobility.”

Source: ZEW, Bloomberg, BIL

The Eurozone industrial sector is already struggling, with output falling more than expected on the month in June at -1.3%.

While the tariffs put European exporters at a structural disadvantage, in the near-term it seems that a 15% tariff is better than the chaos of an escalating trade war. This helps explains why only 9.5% of analysts surveyed expect economic deterioration at the Eurozone level.

In the United Kingdom, fears are growing about the potential tax hikes in the upcoming Autumn Budget. Although growth in the first half of the year has been stronger than expected (0.7% in Q1 and 0.3% in Q2), the underlying condition of the economy remains fragile. The labour market is cooling, business costs are mounting, and overall confidence is weak. In addition to continuing changes in US trade policy, which caused a lot of uncertainty in the first half of the year, businesses are now increasingly concerned about potential tax hikes. Business investment dropped by 4% in Q2, in a worrying sign for Chancellor Reeves who has made boosting growth one of her main objectives. Additionally, she is struggling to stick to her self-imposed fiscal rules and might have to raise taxes to keep budgets in check.

Asia

As mentioned in the introduction, China and the US announced last Monday that their tariff truce would be extended for another 90 days, sparing exporters from facing higher tariffs a little longer. The new deadline now lands on November 10, which gives US importers plenty of time to stockpile ahead of the Christmas season, for which they rely heavily on Chinese exports. Asian stocks rose as the news boosted sentiment.

The stock market is not the economy, however, with weak household demand depicting a less optimistic image. Retail sales rose 3.7% YoY in July, down from 4.8% in June and the slowest pace since December, according to the country’s statistics bureau. Corporate demand for loans is also weak - yuan loans shrunk for the first time in 20 years in July. Despite this, the People’s Bank of China, like many other central banks around the world, is adopting a wait-and-see approach, as the Chinese economy slowed less than expected in the second quarter thanks to tariff front-loading and, to a lesser extent, policy support.

In an attempt to lather up demand, Beijing did, however, announce that it will subsidise interest rates by one percentage point on some consumer loans for purchases worth up to RMB 50,000 (around EUR 6,000). Certain businesses in the catering and tourism industries can also apply for interest rate subsidies of up to one percentage point on loans of up to RMB 1 million (approximately EUR 119,000).

This measure was chosen over a broader rate cut because the latter would put pressure on banks' profit margins. The Ministry of Finance will cover 90% of the cost and local governments will cover the remaining 10%. As local governments are struggling with the decline in land sales amid the country’s property slump, it is welcome news that the government is covering most of the cost, given that local governments have been left to foot the bill for many of the other subsidies announced since last year.

Boosting consumption is one of the Chinese government's main priorities this year, as was reiterated at the latest Politburo meeting. With the growth engine of previous years, manufacturing exports, under threat from trade tariffs, China must boost consumer confidence and consumption to generate growth. While this measure will benefit banks, businesses and consumers financing projects, it is not expected to have a significant impact on consumer confidence.

Data on Friday also showed that China’s factory output growth fell to an eight-month low in July, at 5.7% YoY, with extreme weather having curbed capacity. Despite the extended trade truce, manufacturers continue to suffer from subdued domestic demand and factory-gate deflation. The yuan eased against the US dollar on Friday, as the weaker than expected economic data weighed on sentiment.

Calendar for the week ahead

Monday – Switzerland Industrial Production (Q2). Eurozone Balance of Trade (June).

Tuesday – US Housing Starts (July), Building Permits (Prel, July).

Wednesday – UK Inflation Rate (July). Eurozone Inflation Rate (Final, July).

Thursday – US Jackson Hole Symposium. Switzerland Balance of Trade (July). Eurozone, France, Germany, UK, US Composite, Services & Manufacturing PMI (Flash, August). US Jobless Claims. Eurozone Consumer Confidence (Flash, August).

Friday – US Jackson Hole Symposium. UK GfK Consumer Confidence (August), Retail Sales (July).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

September 5, 2025

BILBoardBILBoard September 2025 – Glancing east

Stepping into the final quarter of the year, we have recalibrated our asset allocation to reflect shifting global dynamics and evolving policy signals. One of...

August 29, 2025

Weekly InsightsWeekly Investment Insight

Thursday saw the S&P 500 notch a fresh high for the second day in a row, buoyed by revised Commerce Department data showing that the...

August 22, 2025

Weekly InsightsWeekly Investment Insights

Echoing the old adage that innovation is often overestimated in the short-term but under-estimated in the long run, US tech stocks lost momentum this week...

August 11, 2025

Weekly InsightsWeekly Investment Insights

In last week’s newsletter, we wrote about how the copper market was upended by an abrupt change to the practicalities of how tariffs would be...