US stocks have enjoyed a six-month winning streak, with the artificial intelligence (AI) theme outshining tariff woes since volatility from US President Trump’s “Liberation Day” started to calm. The S&P 500 rose by over 2% in October, after having recorded gains in the five consecutive months prior. The Nasdaq Composite has seen seven straight months of positive returns, with a c.4% gain in October. AI expenditure is driving investor enthusiasm, and mega-cap technology companies show no signs of slowing down their spending.

Earnings season has been strong so far. Almost 50% of S&P 500 companies have reported earnings, with 80% of these exceeding expectations. Major tech companies have continued to report strong earnings. However, some AI spending plans have alarmed investors amid apprehension about the potential payoff from such aggressive increases in spending.

Oil prices rose on Monday following OPEC+’s decision to pause planned production increases next year, after adding another 137,000 barrels a day of crude in December. The group announced that it would pause supply increases in the first quarter, given that oil demand is generally weaker during this period of the year.

US President Trump and Chinese President Xi met face-to-face last week in South Korea and reached a one-year trade truce. The Americans agreed to cut the so-called “fentanyl tariff” in half to 10%, and further delayed reciprocal tariffs of over 100%. China agreed to resume soybean sales and the flow of rare Earth metals. Trump said the leaders had also discussed semiconductors, and that Nvidia would talk to China about exporting chips. The overall result is that the two superpowers have bought more time to reduce their dependence on each other in strategic areas.

The price of copper rose to a new high on Wednesday on supply concerns. Disruptions at important mines and disappointing forecasts from key producers threaten to reduce supply at a time when demand for the red metal is set to soar with the clean-energy transition and the artificial intelligence drive.

Macro Snapshot

Europe

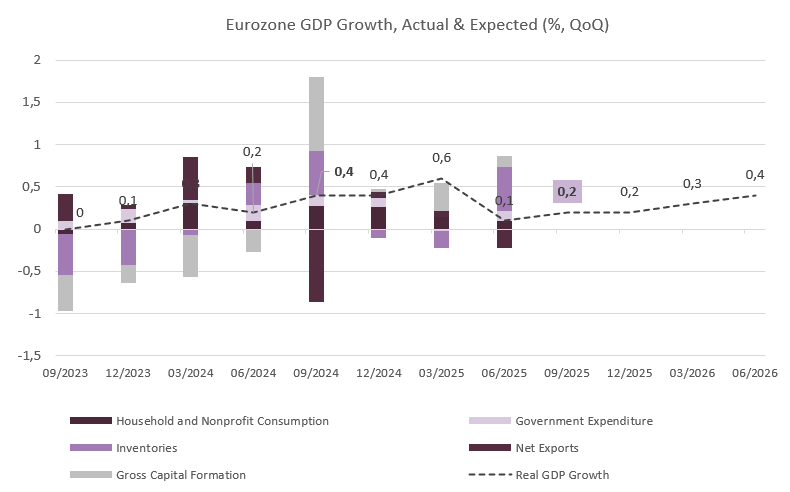

A flash data release on Thursday showed that the Eurozone economy expanded by 0.2% QoQ in the third quarter, up from 0.1% in Q2 and slightly above market expectations of 0.1%. Despite political turbulence, the French economy surpassed expectations, registering growth of 0.5%, driven by a sharp rise in exports and robust domestic demand. Spain remained the best performer among the bloc’s largest economies, expanding 0.6% as expected, supported by strong household consumption and fixed investment. Germany stagnated due to a decline in exports.

The better-than-expected GDP print, as well as the fact that inflation seems to be under wraps, allows the ECB to maintain its pause with regard to monetary easing. Indeed, the central bank held rates at 2% for the third consecutive meeting on Thursday.

In the accompanying statement, the ECB commented that the economy “has continued to grow despite the challenging global environment” with the labour market remaining “robust” and private sector balance sheets characterised as “solid”. It also described the outlook for inflation as “broadly unchanged”.

Eurozone unemployment held steady at 6.3% in September.

Source: Bloomberg, BIL. Only the headline figure is made available in the flash reading. Full composition will be released 14 November.

Zooming in on the bloc’s largest economy, the latest IFO index suggests that German businesses are starting to grow more optimistic about the future. While perceptions about the current situation slumped for a third consecutive month, expectations hit their highest level in more than three years.

Growing confidence appears to be the byproduct of greater clarity on trade, the scale of planned fiscal stimulus (EUR 500 Bn for infrastructure over the next 12 years) and a “whatever it takes” stance on defence. However, political infighting, bureaucracy, and supply-side constraints could mean that it takes longer than hoped for results to materialise on this front. Certain headlines have referred to Germany’s much-anticipated “Autumn of reforms” as a cold season of disappointment amid coalition disagreements, particularly over welfare and budget issues.

Source: Bloomberg, BIL

German households appear to be less optimistic than their corporate counterparts. On Tuesday, consumer confidence in the Eurozone’s largest economy fell to -24.1, missing expectations of -22.0. This was the lowest reading since April. While households also have rising economic expectations (0.8 from -1.4), this is eclipsed by worries about their own personal finances. Income expectations dropped sharply from 15.1 to 2.3, amid renewed inflation concerns, rising job security worries, and ongoing geopolitical tensions.

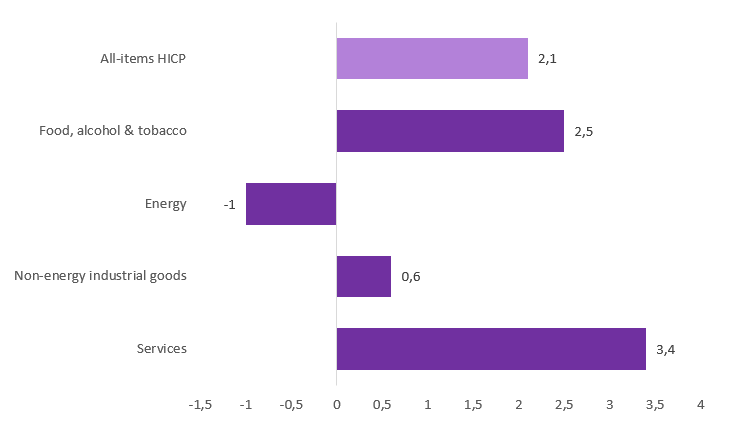

According to flash estimates, consumer price inflation in the Eurozone eased slightly in October, falling to 2.1% YoY from 2.2% the month prior. Prices for food, alcohol, tobacco, and non-energy industrial goods increased at a slower rate, while energy costs decreased more sharply. Services inflation accelerated for the second consecutive month, reaching 3.4%. However, core inflation, which excludes volatile categories such as food and energy, remained unchanged at 2.4%.

Source: Eurostat, BIL

This latest inflation reading remains close to the European Central Bank’s 2% target and corroborates the bank’s message that inflation is under control.

US

The Federal Reserve cut interest rates by 25 basis points on Wednesday, as expected, but warned that an additional rate cut this year should not be seen as “a foregone conclusion — in fact far from it”. Stocks initially fell following Fed Chair Powell’s comments, before recovering, as markets had been confident that the central bank would deliver another quarter point cut in December. The Fed lowered its benchmark rate to a range of 3.75 and 4%, stating that downside risks to the labour market had risen in recent months and that inflation remains elevated. The decision was not unanimous: one committee member favoured a larger cut of 50 basis points, while another preferred to leave rates unchanged. The meeting took place nearly a month into the federal government shutdown, which has made it difficult for the central bank to assess the state of the economy in the absence of key data releases. If the shutdown continues, it will become increasingly challenging for the Fed to determine whether interest rates should be lowered again in December.

Alongside the decision on interest rates, the Fed announced the conclusion of its asset sales to reduce its balance sheet on December 1.

Consumer confidence edged modestly lower in October, according to the Conference Board’s index, which came in at 94.6, down from 95.6. Inflation continues to weigh on consumer moods’, with households potentially still fearing more price pressures on the horizon as tariff costs are passed on by businesses. This is highlighted by the fact that the expectations index slid to 71.5 in October from 74.4, while the present situation index climbed to 129.3 in October from 127.5.

Interestingly, perceptions about the labour market improved – a fact that carries more weight this month while the US Government shutdown continues to cause a blackout in terms of official job market statistics.

Source: Bloomberg, BIL

Calendar for the week ahead

Monday – Switzerland Inflation Rate (October), Manufacturing PMI (October). Eurozone & US Manufacturing PMI (Final, October). US ISM Manufacturing PMI (October).

Tuesday – US Balance of Trade (September), JOLTs Job Openings (September), Factory Orders (September).

Wednesday – Germany Factory Orders (September). Eurozone, UK, US Composite & Services PMI (Final, October). US ISM Services PMI (October).

Thursday – Germany Industrial Production (September). Switzerland Unemployment Rate (October). Eurozone Retail Sales (September). Bank of England Interest Rate Decision. US Challenger Job Cuts (October), Jobless Claims.

Friday – China Balance of Trade (October). Germany & France Balance of Trade (September). Switzerland Consumer Confidence (October). US Non Farm Payrolls (October), Unemployment Rate (October), Michigan Consumer Sentiment (Prel, November).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

November 24, 2025

Weekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...

November 7, 2025

BILBoardBILBoard November 2025 – Two speed ec...

Divergence in growth is becoming increasingly prominent within major economies. In the US, it is the top earners and companies with the largest market capitalisation...

October 27, 2025

Weekly InsightsWeekly Investment Insights

Global stock markets rallied on Monday as trade talks in Malaysia over the weekend fuelled hopes that the US-China trade truce will be extended later...