Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present in the form of an interest rate cut on Wednesday. Weakening labour market data further cemented rate cut expectations for the FOMC’s last meeting of the year, allowing the S&P 500 to close a hairline away from an all-time high. Stocks in Europe also benefitted from optimism about US and UK rate cuts.

Japanese 10-year government bond yields rose to the highest level since 2007, while the 30-year yield rose to a record high, as investors grew more concerned of the government’s $135bn spending plan and prepared for a potential interest rate hike by the Bank of Japan following a speech by Bank of Japan Governor Ueda that was perceived as hawkish. Higher yields pressured Japanese equities.

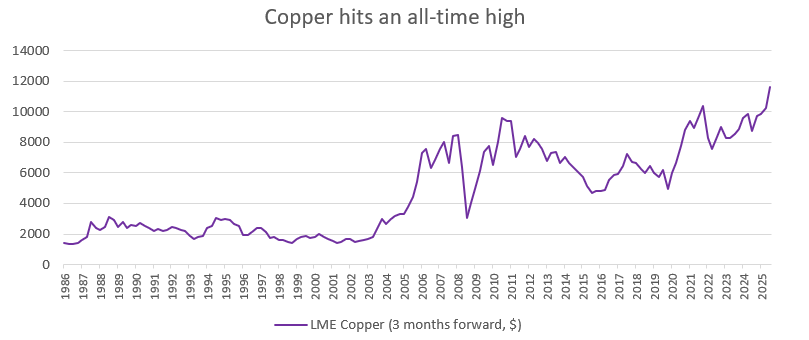

On the commodities side, copper is capping off a strong year with another all-time high. Additional tailwinds came last week from communication on China’s policy priorities and US stockpiling. Overall, the metal, which has high electrical conductivity and which is used extensively in industry, is up by roughly 30% year-to-date.

In the East, Beijing has announced that stoking domestic growth will be its top priority for 2026, which it aims to achieve with “more proactive” fiscal stance and “moderately loose” monetary policy. Traders are betting that the pink mental is poised to gain specifically from government efforts to upgrade China’s power-grid amid the ongoing global race for tech dominance.

In the West, an ongoing proliferation of data centres across the US and the adoption of electric vehicles, is boosting appetite for copper. Globally supply is tight, with smelters hardly able to keep pace with rising demand. US buyers are also building supplies on fears that copper could fall subject to trade tariffs next year.

Source: Bloomberg, BIL as of 8/12/25

Macro Snapshot

Will the Fed prioritise a weakening labour market?

Since the pandemic, the US Federal Reserve has been trying to bring inflation back to its 2% target. It is not there yet – PCE inflation (the Fed’s preferred measure), increased to 2.7% in August, and that’s before tariff impacts were fully reflected in consumer prices. There are a few factors working in the Fed’s favour on this front, however. Shelter costs (which are slow to show up in official inflation data) have come down strongly in “real life”. Wage growth is also sloping downwards which should trickle into services inflation and indeed, the ISM services PMI released Wednesday showed that prices paid in the sector fell to a seven month low.

Additionally, we also have to keep in mind that mid-term elections are scheduled for November 2026. It seems President Trump might have to turn his attention to supporting the domestic economy if he is to win the hearts and minds of his MAGA base.

According to a CBS/YouGov poll, late November, Trump’s overall approval was 40%. With regard to his handling of the economy, it was just 36%, down from 51% in March. Likely cognizant of this, the White House has been busy striking trade deals with Latin American countries to lower grocery bills for US households, and Trump declared his intention of “making American affordable again” over Thanksgiving.

So, while inflation could remain sticky around 3% in the near-term, there are reasons to expect that price pressures could begin to alleviate over the course of 2026.

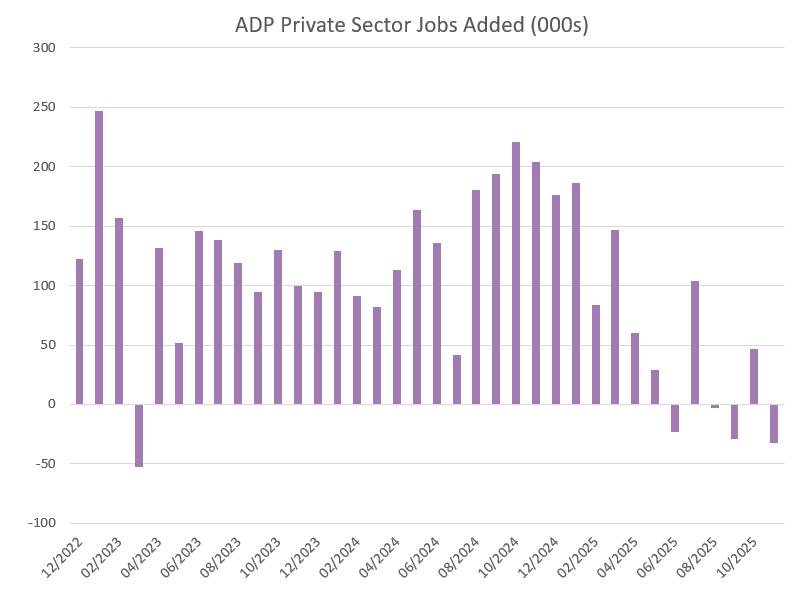

The Fed might therefore want to turn its attention to what seems to be a more pressing matter: the labour market. While cooling in the aftermath of the post-Covid pandemic hiring boom was somewhat “normal”, we now appear to be on the precipice of a deeper downturn which would be harder to come back from. Dwindling employment prospects are taking a toll on consumer confidence.

Last week brought further evidence of labour market weakening. According to the ADP report, private employers in the US unexpectedly cut payrolls in November, by 32,000. Markets had expected a 10k gain. This marked the biggest decline in payrolls since March 2023, led by a 120K drop at smaller companies. Medium companies added 51K jobs and large created 39K.

On Thursday, Challenger reported that US employers cut 71,321 jobs in November – much higher than November the 57,727 recorded in November 2024. Year-to-date, employers have announced 1,170,821 job cuts, the most since 2020 and a 54% compared to the first eleven months of 2024.

In light of weakening job data, markets now see a 90% probability of a rate cut at the FOMC meeting on Wednesday. Private data such as the ADP might carry more weight than usual in the Fed’s decision-making process given that official data is still subject to delays, stemming from the record-long government shutdown. The November jobs report from the Bureau of Labor Statistics, originally due December 5th, will now be released December 16th. This will also include nonfarm payrolls for October.

Source: Bloomberg, BIL

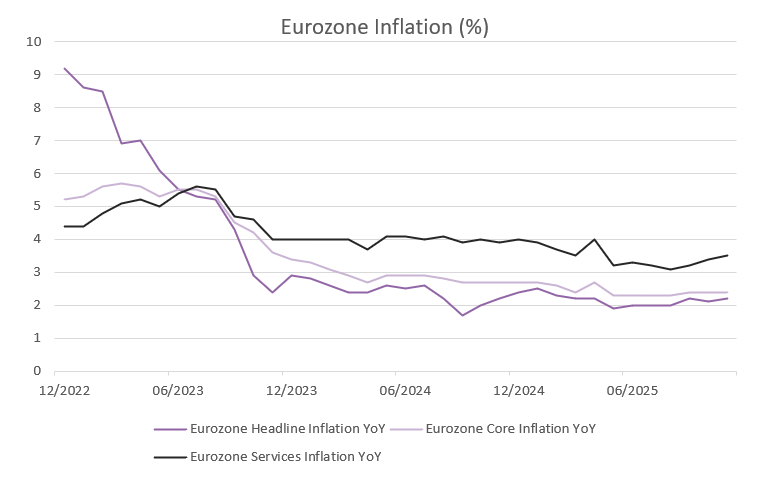

Eurozone Inflation reaches 2.2% in November

Source: Bloomberg, BIL

Consumer price inflation in the Euro Area rose to 2.2% YoY in November, up slightly from 2.1%, according to a preliminary estimate. Services inflation picked up from 3.4% to 3.5%, its highest level since the Spring. Energy prices declined at a slower pace (-0.5% versus -0.9% in October). Price pressures were unchanged for both non-energy industrial goods (0.6%) and food, alcohol & tobacco (2.5%).

Core inflation, which excludes volatile categories like energy and food, was steady at 2.4%, slightly below the forecast of 2.5%.

Looking at the largest of the bloc’s economies, Germany’s inflation rate accelerated to 2.6%, the highest since February and above the ECB’s 2% target. Spain’s HICP eased slightly to 3.1% from 3.2%, and the Netherlands’ rate fell to 2.6% from 3.0%. Inflation in France and Italy remained well below target, at 0.8% and 1.1%, respectively.

The ECB will hold its final monetary policy meeting of the year on December 18 and is largely expected to keep its benchmark interest rate unchanged at 2.0%.

Falling wages are expected to alleviate services inflation in the months ahead.

China trade surplus rises above $1tn for the first time as exports jump

China’s goods trade surplus increased to $1.076tn in the first 11 months of this year, surpassing the surplus recorded for the entire year of 2024. Exports rose by 5.9% year on year in November, after unexpectedly falling in October. Imports increased by a more modest 1.9%, reflecting the ongoing imbalance between domestic and external demand. China’s exports to the US have fallen sharply in recent months, dropping by 28.6% in November alone. This decline has been largely offset by increases in exports to other markets, such as ASEAN and the EU. However, amid an increasingly fractious global trading landscape, China’s cannot continue to rely so heavily on external demand for growth.

This was reiterated at the latest Politburo meeting, during which China’s top leaders made strengthening domestic demand their top economic priority for 2026. In a statement signalling further government support to boost consumption, the Politburo said that China will continue supporting the economy with proactive policies next year with the aim of expanding domestic demand, and pledged to strengthen “cross-cyclical” policy adjustments. Although more specific measures and the size of the budget deficit won’t be revealed before early March, the clear emphasis on boosting domestic demand at the Politburo meeting will be warmly welcomed.

Calendar for the week ahead

Monday – China Balance of Trade. US Consumer Inflation Expectations.

Tuesday – Germany Balance of Trade. US NFIB Small Business Optimism, JOLTs Job Openings.

Wednesday – China Inflation. Italy Industrial Production. US Federal Reserve Monetary Policy meeting with economic projections.

Thursday – SNB Interest rate Decision. US PPI and Weekly Jobless Claims.

Friday – UK GDP (October). France, Italy, Spain Inflation (Final Print, November). China M2 Money Supply.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...