Trade was again the hot topic last week, with President Trump stating that letters would be sent to more than 150 countries notifying them that their tariff rates could be 10 or 15%. He clarified that this group will be composed of smaller countries with which the US doesn’t do much business. The final tariff rate that the Administration decides on, will be the same for all of the 150. On Tuesday, the European Commission published a list with EUR 72bn worth of US goods that it could hit with counter-tariffs if the two sides do not strike a deal. It includes aircrafts, cars and bourbon. However, the Commission put no specific tariff rates against individual products, in what was perceived as a way to avoid provocation. Earlier in July, President Trump threatened to impose a 30% tariff on EU imports starting on August 1, if no other deal is reached.

President Trump also renewed calls for the Fed to cut rates, while Treasury secretary Scott Bessent said that a “formal process” to select the successor to Powell as Chair of the US central bank had begun. US bond markets were visibly nervous about the pressure being heaped on Powell, who has held rates in a range of 4.25%-4.5% all year, as the Committee waits for more data on how tariffs will impact prices.

Across the Pacific, Japan’s 10-year yield hit its highest level since the 2008 financial crisis in the run up to Sunday’s election. Investors appeared to grow antsy about certain populist campaign pledges and general political uncertainty. As anticipated, the ruling Liberal Democratic party lost its majority in the upper house. This, in turn, could lead the LDP to concede to smaller parties that have campaigned on capital-intensive pledges to appeal to an electorate that is growing dissatisfied with rising inflation, high taxes and low wage growth. Japan already has the highest public debt among developed market peers.

Weekly Highlights

Tariffs start to show up in US consumer prices

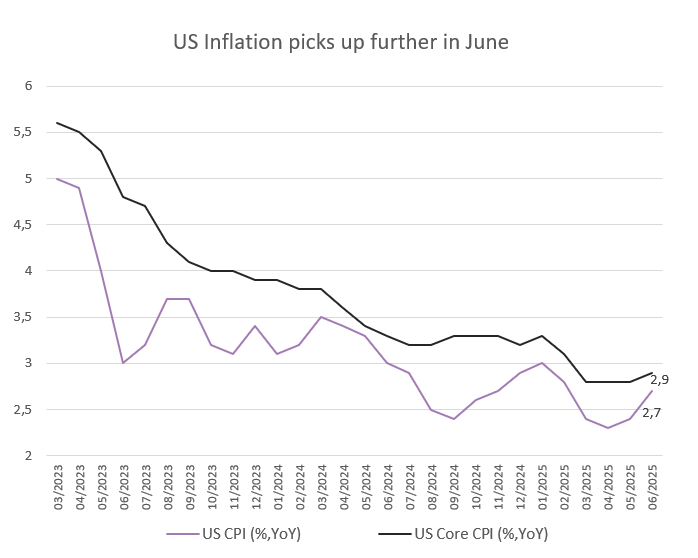

US CPI inflation accelerated for the second month in a row to 2.7% YoY in June, the highest level since February, up from 2.4% in May and in line with expectations.

On a monthly basis, the CPI edged up 0.3%, marking the largest increase in five months. Shelter and gasoline were the key contributors to the price rises. Worth noting is that goods prices, excluding food and energy commodities, rose 0.2% after stalling the prior month. Categories more exposed to tariffs including furniture, appliances, toys and clothing ticked up, suggesting companies are starting to pass higher costs onto consumers.

Core inflation, which excludes volatile food and energy prices, went up to 2.9%.

Later in the week, the Fed’s so-called Beige Book which gathers qualitative data on economic conditions, showed that businesses in all 12 districts reported “modest to pronounced” tariff-related increases in input costs.

Most members of the Fed’s rate-setting committee have indicated they want to hold fire on interest rate cuts until the inflationary impact of tariffs becomes clear. Markets see almost a zero chance of a rate cut at the next FOMC on 30 July, despite pressure from the President.

Source: BLS, Bloomberg, BIL

UK stock market hits a new high, despite complicated domestic situation

The UK made headlines on several occasions last week, with bond vigilantes paying close attention to communication regarding the upcoming Autumn budget. It is clear that the Chancellor Rachel Reeves faces difficult trade-offs between raising taxes and cutting spending, after the Office for Budget Responsibility said that the economy faces “daunting” risks to public finances.

At the same time, inflation picked up to an 18-month high of 3.6%, driven by food and fuel costs. Nonetheless, this is not expected to derail a Bank of England rate cut next month, against the backdrop of a slowing economy. The UK economy contracted in May for a second consecutive month.

Despite the complicated domestic situation, the UK’s FTSE 100 stock index reached the 9,000 mark for the first time ever, with investors diversifying away from the US. The UK is one of only a handful of countries to have already struck some form of trade deal with the US.

China’s economy surpasses estimates in Q2

According to official data, China’s GDP expanded 5.2% in Q2. Consensus had expected a slightly lower reading of 5.1%, after a pace of 5.4% in Q1.

In June, the pace of industrial output unexpectedly quickened to a 3-month high. However, retail sales grew the least in four months, despite government subsidies on electronic items.

The world's second largest economy has so far avoided a sharp slowdown due to policy support, as well as the front-loading of exports as factories capitalize on the temporary US-Sino trade truce. Investors are buckling up for a weaker second half as exports lose momentum as the August 12 tariff deadline looms. That said, traders were last week made hopeful about a deal after the US government reversed a ban on selling certain AI chips to China.

Trade worries aside, deflation pressures, weak domestic demand and a prolonged property downturn already represent a complicated stew.

Across the first six months of the year as a whole, the Chinese economy grew 5.3%. The official growth target for this year is around 5%. A relatively strong start means Beijing has more room to tolerate some slowdown in the second half. Last year, the Chinese economy grew 5%, bang in line with the target.

Professional investors continue warming up to the Eurozone

Each month, the ZEW institute measures the sentiment of hundreds of economists, analysts and financial professionals, to garner their opinion about the prospects of both the German and the Eurozone economies.

For Germany, the sentiment indicator has risen for three straight months, reaching its highest level since February 2022 in July. It seems that despite ongoing trade uncertainty, analysts are focusing on the Government’s planned emergency spending program. Expectations surged for mechanical engineering and metal production, followed by the electrical engineering sector. Overall, nearly two-thirds of the experts expect German economic conditions to improve.

Source: Bloomberg, BIL

The Eurozone indicator also continues to rise, hitting a four-month high, even if the incline of that rise is not as steep as for Germany. 48.1% of the analysts expect no change in economic activity at the bloc level. 44% expect improvement and 7.9% expect deterioration.

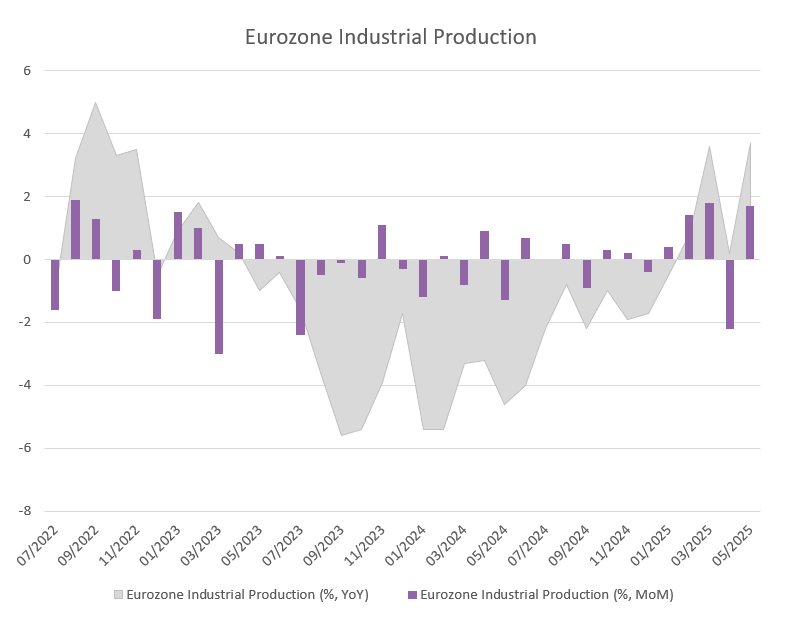

Data also released last week showed that Eurozone industrial production is back on its path of recovery after a blip in April.

Source: Bloomberg, BIL

Production in the single-currency union rose by 1.7% MoM, reversing from a 2.2% fall in April and beating market expectations for a 0.9% increase. The gains were driven by energy (3.7% vs -2.8% prior), capital goods (2.7% vs -1.3%) and non-durable consumer goods (8.5% vs -5.7%). Production fell further for intermediate goods and durable consumer goods. On an annual basis, industrial output growth accelerated to 3.7% in May from 0.2% in April.

Calendar for the week ahead

Monday – US Conference Board Leading Index.

Tuesday – US Fed Chair Powell Speech.

Wednesday – US Existing Home Sales. Eurozone Consumer Confidence (Flash, July).

Thursday – Eurozone New Car Registrations. Germany and Spain Consumer Confidence. France Business Confidence. US, UK, Eurozone, Japan Composite PMI (Flash, July). ECB Monetary Policy Meeting. US Weekly Jobless Claims, New Home Sales and Building Permits.

Friday – UK Consumer Confidence and Retail Sales. Eurozone M3 Money Supply. Italy Business and Consumer Confidence. Eurozone Consumer Inflation Expectations. US Durable Goods Orders.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 1, 2025

Weekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...