President Trump appears to be achieving his key objectives on trade. Several major trading partners have acquiesced to tariffs while agreeing to enhance market access for US firms. Financial markets, which were initially unsettled by the overhaul of global trade, seem to have adjusted to an environment where US import duties are at their highest in almost a century. Encouraged by the de-escalation of trade tensions, US equities reached new highs, despite the strain that tariffs could exert on businesses and consumers. Over the coming months, corporate earnings and hard economic data will be key in determining whether current market valuations are justified.

At present, we are comfortable with our portfolio positioning, maintaining a measured, wait-and-see approach until the longer-term effects of tariffs become clearer, including how they might influence monetary policy. Targeted adjustments to the fixed income segment of portfolios were made in order to enhance yield capture. We also maintain the measures taken throughout the year to limit downside risk, such as stepping up exposure to gold and hedging segments of the portfolio.

Macroeconomic Outlook

The US

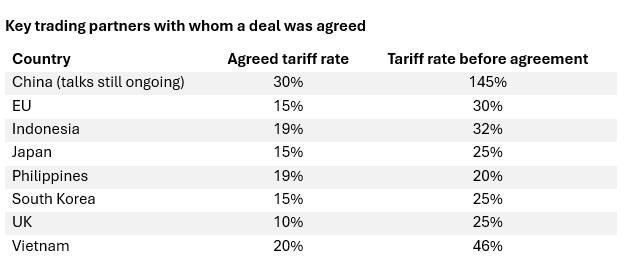

Global trade tensions have moderated since “Liberation Day”, with tariffs mostly lower than initially announced and most US trading partners reluctant to escalate. This de-escalation has supported sentiment: the Composite PMI recently rose to 54.6. US tariffs collections reached USD 64bn in Q2 and President Trump has also secured expanded market access for American firms, as well as headline commitments from trading partners to invest in the US and purchase more US goods.

However, the details behind these agreements are not so black and white and a lot of grey areas remain. Some foreign investment pledges are largely structured as loans[1], while commitments to buy US goods may face practical limits: shareholder-driven companies are unlikely to overpay for American products if cheaper alternatives exist elsewhere.

As tariff levels stabilise, uncertainty has not evaporated, it has only shifted. Companies now face the challenge of managing higher import costs. They are likely to use a mixed approach – absorbing some, passing some to consumers and negotiating harder with suppliers. Early signs of consumer impact are visible in July’s inflation print when we look at import-heavy categories such as toys, audio equipment and large household appliances like washing machines. Larger US multinationals are better positioned to absorb and distribute these pressures across global markets, while domestic consumers become increasingly price sensitive.

The Fed stands firms in its wait-and-see mode, with tariffs complicating its dual mandate by risking slower growth alongside rising prices. Markets now expect just one 25bp rate cut in December, with resilient macro data tempering easing expectations.

Despite trade-related headwinds, other forces continue to underpin US growth such as:

- Government stimulus – The newly-signed tax bill is expected to save US businesses around USD 100bn this year, mainly in tax breaks

- AI-related investment – US hyper-scalers expect to boost capex to USD 360bn in 2025, up from USD 259bn in 2024. AI optimism is thought to be keeping financial conditions looser than they would otherwise be, with major tech stocks pushing up the overall stock market

Eurozone

The Eurozone economy continues to struggle for momentum, with demand subdued and the PMI new orders index still in contraction. The recently announced 15% blanket tariff on EU goods – covering key exports such as automobiles and pharmaceuticals - threatens to further pressure European order flows, although a last-minute deal avoided the harsher 30% tariff threatened by President Trump. As part of the agreement, the EU has committed to significant purchases of US energy products and defense equipment, while both sides continue negotiating a list of goods eligible for zero tariffs.

Meanwhile domestic conditions remain soft. Slowing wage growth and weak consumer confidence are constraining household spending, which accounts for more than half of the bloc’s GDP. Nonetheless, there are tentative signs of stabilisation: Germany’s industrial recession has ended, with annual production turning positive for the first time since early 2023 (+1.0%).

Inflation edged up to 2% in June, prompting the ECB to adopt a more hawkish tone at its July meeting. Markets still anticipate a single 25bp cut by year-end, though conviction has weakened.

China

China’s economy outperformed expectations in the first half of the year, helped by the front-loading of exports to the US and government-led stimulus measures. GDP grew 5.3% YoY over the first six months. This strong start gives Beijing some flexibility to accommodate a mild slowdown in the second half while still meeting its “around 5%” growth target. Market attention now turns to the upcoming Politburo meeting, where further policy signals are expected; nothing major is foreseen in the way of economic support. A trade agreement with the US is also still outstanding, with Washington and Beijing having pushed out the August 12 discussion deadline.

Investment Strategy

Equities

We continue to favour US equities over European counterparts. From a market standpoint, rather than from a macro perspective, the much-discussed “end of US exceptionalism” has not materialised. Investors who rotated aggressively from US to European markets earlier in the year are now facing performance headwinds, consistent with the view outlined in our midyear outlook.

In the US, corporate earnings remain a bright spot. Of the S&P 500 companies that have reported so far, 80% have delivered both earnings-per-share and revenue surprises, according to FactSet. Large-cap earnings revisions continue to outpace small caps, supported by international revenue exposure and a weaker dollar. For context, the NASDAQ 100 derives roughly 45% of its revenue from abroad, compared with just 20% for the Russell 2000. In addition, the recently enacted tax bill provides an incremental tailwind for large-cap profitability.

In contrast, European equities remain rangebound. Breaking higher will likely require a meaningful pickup in earnings momentum – something not yet evident amid soft business activity, currency headwinds and ongoing trade uncertainty. The newly announced 15% US tariff, combined with the impact of a stronger euro, will add further pressure to European corporates in the months to come, though our portfolios retain downside protection on this exposure.

Fixed Income

In the latest review of our asset allocation, we implemented targeted adjustments to our fixed income portfolios to capture additional yield opportunities.

First, we reallocated 2% of investment grade corporate exposure into high yield (HY) bonds. [2] Investment grade spreads remain near year-to-date lows, limiting upside potential, whereas HY spreads – though tight – retain scope to compress further if they are to revisit this year’s lows. With recession fears easing and optimism around trade improving, investors are returning to the asset class. Limited new issuance provides a favourable technical backdrop, and HY bonds’ shorter durations (below three) help dampen volatility. US default rates remain stable, while Europe may be nearing the end of the recent default cycle.

Second, we shifted 2% of developed-market government bond exposure into EUR-hedged hard currency emerging market debt (EMD). Government bonds remain range-bound, with fiscal pressures on both sides of the Atlantic threatening to push long-term yields higher. France could become a near-term focal point while its new budget undergoes parliamentary review. While EM valuations are stretched and spreads are tight, the carry is sufficient to keep the asset class interesting. Continued US growth, eventual Fed easing, and a weaker-dollar-policy from the administration could support further EM outperformance after a temporary pause in July’s summer trading environment.

Conclusion – A strategic gamble in motion

While President Trump’s trade strategy may appear to be a checkmate, it could prove to be more akin to a gambit – a bold opening that sacrifices near-term stability in pursuit of longer-term advantage. Hard data will tell in the months ahead.

In the meantime, however, US equity markets continue to trade at historically rich valuations even as import duties sit near century highs. While the risk of stagflation cannot be dismissed, the broader forces supporting growth have thus far offset much of the drag from tariffs. As history reminds us, economies as complex and deep as that of the US are rarely driven by a single factor – even ones as disruptive as today’s trade regime.

[1] For example, Japan expects only 1% to 2% of its recently agreed upon USD 550bn US fund to be deployed as investment, with loans making up the bulk of the amount

[2] Preference for EUR HY in EUR-denominated portfolios due to hedging costs. US HY favoured in USD-denominated portfolios

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 9, 2026

Weekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...

January 26, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot After a volatile week, gold hit a record high on Monday, surpassing $5,000 a troy ounce for the first time as investors sought...

January 19, 2026

Weekly InsightsWeekly Investment Insights

Geopolitical uncertainty increased over the weekend as President Trump threatened to impose tariffs on Nato allies who oppose his intentions on Greenland. On Saturday, Trump...