US equity markets locked in on monetary policy last week, pushing major indices higher on hopes that the Fed will cut interest rates by at least 25 basis points on Wednesday. The S&P 500, the Dow Jones Industrial Average and the Nasdaq Composite all reached new all-time highs, as investors looked past the high inflation reading, assuming that cracks in the labour market will prompt the US central bank to lower rates. Excitement surrounding artificial intelligence (AI) also helped push stocks up following positive guidance from blue chip players. Asian stocks also rallied at the end of last week, with the MSCI Asia-Pacific index nearing a record high, boosted by rallies in China, Japan, South Korea and Taiwan, driven in part by the AI theme.

Notably, Chinese government bond yields rose to the highest level since November with investors switching into equities. Analysts suggest that China’s “anti-involution” campaign against overproduction is starting to gain traction and will lead to a pick-up in price pressures in the remainder of the year.

France in political turmoil

Last Monday, the French government collapsed for the third time in a year after Prime Minister François Bayrou lost a confidence vote. He called the vote to gain parliamentary support for his deficit-cutting budget, which included tax increases and spending cuts. Following strong opposition from several parties, Bayrou resigned. On Tuesday, President Macron appointed his fifth Prime Minister in less than two years, loyalist Sebastien Lecornu. Lecornu faces the same challenge as his predecessors: passing a budget to tackle the third highest debt burden in the bloc, with a deficit of 5.4%. Without action, the Ministry of Finance expects public spending to increase by EUR 51.1bn in 2026, resulting in a budget deficit of 6.1% of GDP, which significantly exceeds the 4.6% target submitted to the European Commission. The situation is causing significant bond market volatility, with French yields now higher than those of Greece.

Lecornu is expected to take a more conciliatory approach to gain support from opposition parties and French equities edged slightly higher on his appointment.

However, political turmoil continued later in the week, with widespread demonstrations on Wednesday protesting potential spending cuts. The "Block Everything" protests, organised via social media, aimed to showcase public dissatisfaction with President Macron and his government.

Source: Bloomberg, BIL

Macro Snapshot

Europe

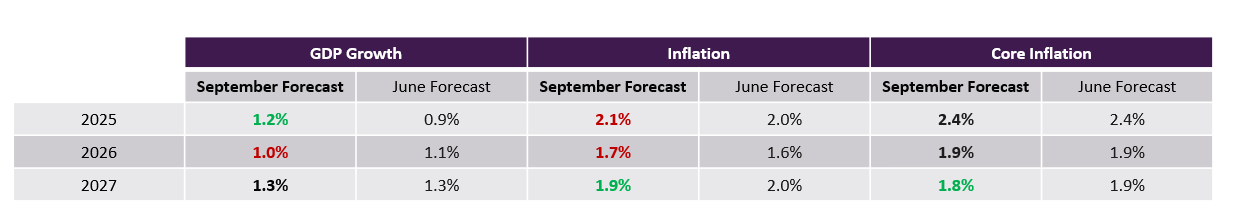

On Thursday, the European Central Bank held its deposit facility rate steady at 2% for a second meeting, maintaining its “wait-and-see” approach amid steady inflation, a resilient labour market, and ongoing uncertainty surrounding trade policy. The central bank updated its growth projection as the economy proved more resilient than anticipated in the second quarter of the year. It now expects growth of 1.2% in 2025, compared to the 0.9% predicted in June. However, the growth projection for 2026 was lowered slightly to 1%. Meanwhile, the central bank expects inflation to remain close to the target this year, before dipping below 2% in 2026 and 2027. Core inflation expectations were left largely the same as in June.

Source: ECB, BIL

The ECB reiterated its commitment to ensuring that “inflation stabilises at its 2% target in the medium term”, and that it will continue to adopt a meeting-by-meeting approach to determine the next steps in its monetary policy. The central bank will be closely monitoring the evolution of core inflation while assessing the time it will take for monetary policy to be transmitted into the economy. In recent weeks, investors have reduced their expectations of another cut in 2025, with swap markets currently pricing in a less than 30% chance of a 25 basis point reduction by the end of the year. This figure has remained largely unchanged following the interest rate decision.

US

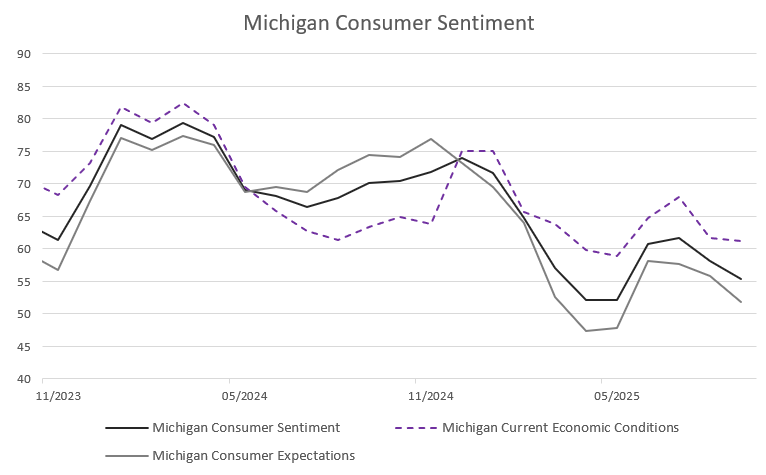

Fed easing bets dominated last week, fuelling a risk-on mood. The Bureau of Labor Statistics’ preliminary annual revisions showed job growth in the year to March 2025, was overstated by 911k, reinforcing the view that the labour market is slowing. Adding further confirmation was the sharp and unexpected rise in Weekly Jobless Claims, which shot up by 27,000, to 263,000 – the most since October 2021. With the labour market on a less firm footing, consumer spending – the key growth engine – could be in jeopardy. Consumer sentiment, as measured by the University of Michigan, dropped to 55.4 in September, well below consensus expectations of 58.

Source: Bloomberg, BIL

Easing factory gate prices also added to the case for interest rate cuts. After registering a hotter-than-expected 3.3% YoY in July, producer prices cooled to 2.6% in August, well below the 3.5% consensus estimates. Core PPI, which strips out food and energy, even fell 0.1% on the month.

Separate data released Thursday, however, showed US CPI hit 2.9% in August, the highest since January, showing that price pressures continue to linger, with expenses picking up, including for groceries, gasoline, electricity and car repairs. Core consumer price inflation held steady at 3.1%, in line with expectations.

The Fed still faces the delicate challenge of balancing maximum employment with price stability, but the market reaction to the data over the week implies it thinks jobs matter more than inflation now. Three Fed rate cuts are now priced before year-end.

Asia

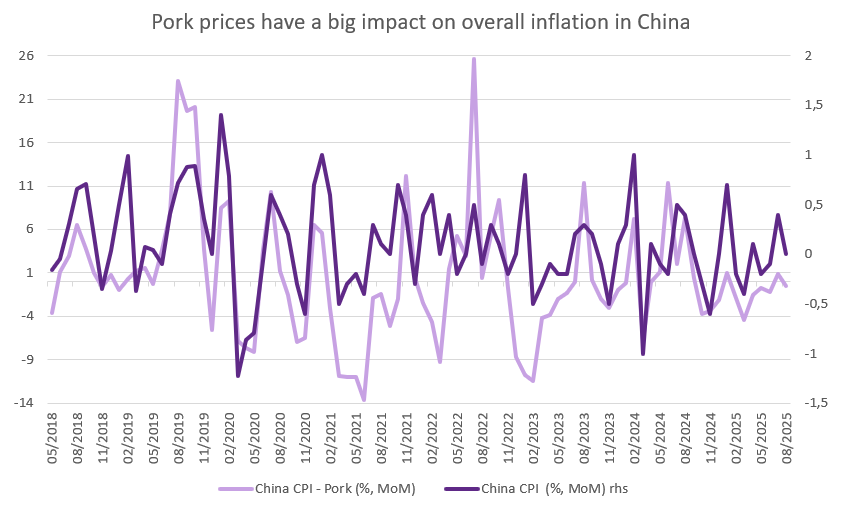

Pork is an important staple of Chinese cuisine, accounting for around 60% of total meat consumption in China. A key ingredient in many traditional dishes, many consumers eat pork several times a week, or even daily. Despite this, the price of pork fell in August due to ample supply but weak demand. This trend is not a new one and has been attributed to consumers growing more health conscious and financially sensitive, opting for leaner, cheaper meat such as poultry.

Pork prices significantly impact the calculation of inflation in China due to its weighting in the basket of consumer goods used to calculate the consumer price index. Consumer prices fell into deflation again in August, dropping 0.4% compared to a year earlier, as the Chinese economy continues to show signs of cooling. Food prices fell sharply (-4.3%, compared to -1.6% in July), dropping by the most in nearly four years, with falling pork prices exacerbating the decline. However, core inflation, which excludes volatile categories such as food and energy, rose by 0.9% year on year, the highest increase in 18 months. Meanwhile, China’s producer price index fell by 2.9% on the year in August, easing from a 3.6% drop in July.

Source: Bloomberg, BIL

The fact that core inflation remains stable in positive territory and deflation in producer prices is easing can be seen as positive signs for the economy, and analysts suggest that China’s “anti-involution” campaign could be to thank for this. The campaign aims to curb overcapacity leading to price wars and falling profitability among Chinese firms by controlling production in highly competitive industries and overseeing pricing and subsidies in EVs and food delivery, amongst other measures.

Still, there are still a number of other factors showing that the Chinese economy is still struggling to gain momentum. Last week, official data revealed that growth in imports and exports slowed in August. While the trade surplus was higher than anticipated at USD 102.33 billion, exports slowed to a six-month low of 4.4% year on year, down from 7.2% in July. Imports also fell well below expectations, rising by just 1.3%. Exports to the US continued their downward trend, falling by 33%. However, this was offset by an increase in exports to other regions, such as South-East Asia, which grew by 22.5%.

In addition, both retail sales and industrial production slowed by more than expected in August, growing at the slowest pace this year. Retail sales rose 3.4% YoY while industrial production output grew 5.2%.

Calendar for the week ahead

Monday – China House Price Index (August), Industrial Production (August), Retail Sales (August), Unemployment Rate (August). Eurozone Balance of Trade (July).

Tuesday – UK Unemployment Rate (July). Eurozone Industrial Production (July). Germany & Eurozone ZEW Economic Sentiment (September). US Retail Sales (August), Industrial Production (August).

Wednesday – Japan Balance of Trade (August). UK Inflation Rate (August). Eurozone Inflation Rate (Final, August). US Housing Stats (August). Fed Interest Rate Decision.

Thursday – Switzerland Balance of Trade (August). Bank of England Interest Rate Decision. US Jobless Claims.

Friday – UK Gfk Consumer Confidence (September), Retail Sales (August). Japan Inflation Rate (August), Bank of Japan Interest Rate Decision.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...