US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial intelligence spending. However, stocks rallied and bonds fell on Monday as optimism about the potential end to the longest US government shutdown on record fuelled optimism. A group of Democratic lawmakers voted with Republicans to advance a deal to reopen and fund the government until the end of January. The plan would reverse shutdown-induced layoffs and ensure that furloughed workers receive back pay. It also includes a concession by the Democrats on healthcare credits, which has been a sticking point. The deal must now be passed by the Senate and signed off by the House of Representatives before the 41-day shutdown can come to an end. Each week that the federal government remains shut down costs the economy between $10 billion and $30 billion, and the private sector is beginning to feel the impact as well. On Friday, the Federal Aviation Administration instructed airlines to reduce flights by 4% amid air traffic control staffing concerns, a figure that could soon rise to 20% if the shutdown continues.

Macro Snapshot

Europe

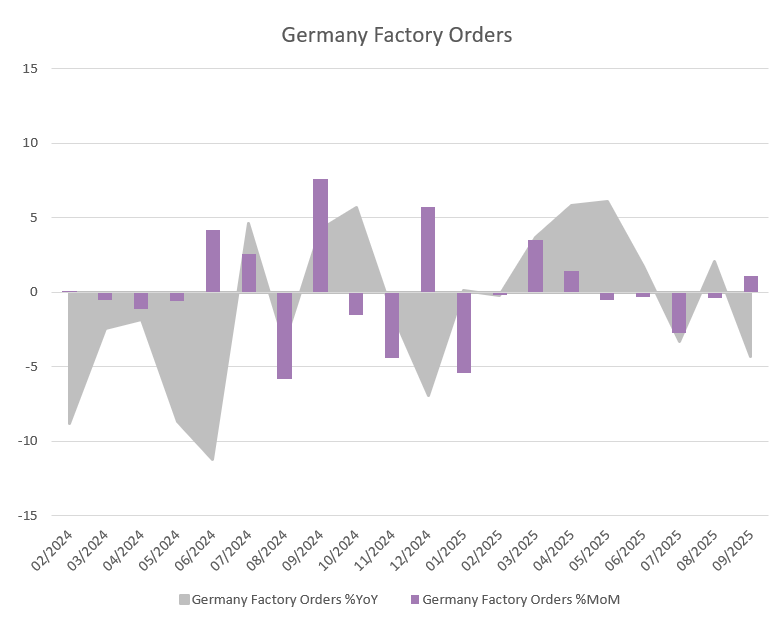

German factory orders rose by 1.1% month on month in September. This was driven by increases in the production of electrical equipment, aircraft, ships, trains, military vehicles and cars. It was the first increase since April, with foreign orders rising while domestic orders fell. With the US tariff on EU automobiles having been lowered to 15% at the end of September, there is hope that foreign orders in the automotive industry can recover in the months ahead.

Source: Bloomberg, BIL

The Bank of England (BoE) held interest rates on hold at 4% on Thursday but signalled that another rate cut could come as soon as December amid weakening in the labour market. According to the central bank, inflation in the UK likely peaked at 3.8% in September and is now on a downward trajectory. Recent jobs data has also hinted at weakening price pressures. If this trend is confirmed in upcoming CPI and labour market data, the BoE looks poised to cut interest rates next month. It was a close vote, with five members of the monetary policy committee voting to keep rates unchanged, while four voted to cut rates by 25 basis points. "We still think rates are on a gradual path downwards, but we need to be sure that inflation is on track to return to our 2% target before we cut them again," said BoE Governor Andrew Bailey. The central bank expects inflation to remain above the 2% target until the fourth quarter of 2027. In terms of growth, the BoE predicts GDP growth to slow from of 1.5% this year, to 1.2% in 2026, before picking up again to 1.6% in 2027 and 1.8 per cent in 2028.

US

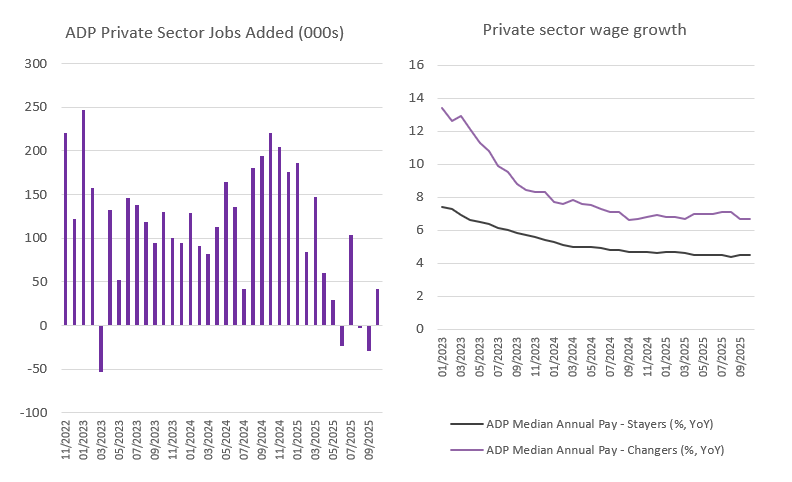

With the longest government shutdown in US history creating a blackout of official data, private sources such as the ADP are being used to fill in the blanks. ADP is one of America’s largest human resources technology companies. It processes payrolls for more than 500,000 US employers covering some 26 million workers; that’s roughly a fifth of the country’s private sector workforce.

Rather encouragingly, private businesses added 42K jobs in October, rebounding after an upwardly revised 29K jobs cut in September, and above forecasts of 25K. The services sector added 33K jobs, led by trade, transportation & utilities (47K), education/health services (26K) and financial activities (11K). The goods producing sector added 9K jobs, driven by natural resources & mining (7K). Manufacturing lost 3K jobs. Annual pay growth remained steady in October from the month prior, at 4.5% for job-stayers and 6.7% for job-changers. ADP’s Chief Economist Dr Nela Richardson commented: "Pay growth has been largely flat for more than a year, indicating that shifts in supply and demand are balanced."

Source: Bloomberg, BIL

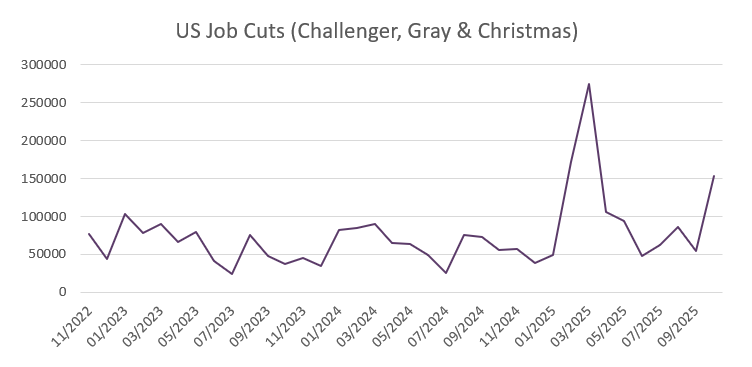

On a less optimistic note, it proved to be the worst October for layoffs since 2003. US-based employers announced 153,074 job cuts during the month, up from 54,064 in the prior month. Layoffs were concentrated in the warehousing (47,878), tech (33,281), food (10,662) and government (7,883) sectors. Andy Challenger, chief revenue officer for Challenger, Gray & Christmas who compile the data, said: “Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes. Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market.”

Data on job openings and weekly jobless claims are missing pieces of the puzzle needed to draw solid conclusions on the health of the job market…

Source: Bloomberg, BIL

Against the backdrop of a weaker labour market, and still-elevated prices, consumer confidence is taking a hit. According to preliminary data from the University of Michigan, consumer confidence fell in November to its second-lowest level on record, just above the low recorded in June 2022. The index dropped from 53.6 in October to 50.5, as consumers became more concerned about the government shutdown. Assessments of current personal finances dropped by 17%, while year-ahead business expectations fell by 11%, as sentiment weakened across different age groups and income brackets. However, there was one exception: households in the top third of stock ownership reported a rise in confidence, boosted by recent stock market strength.

Asia

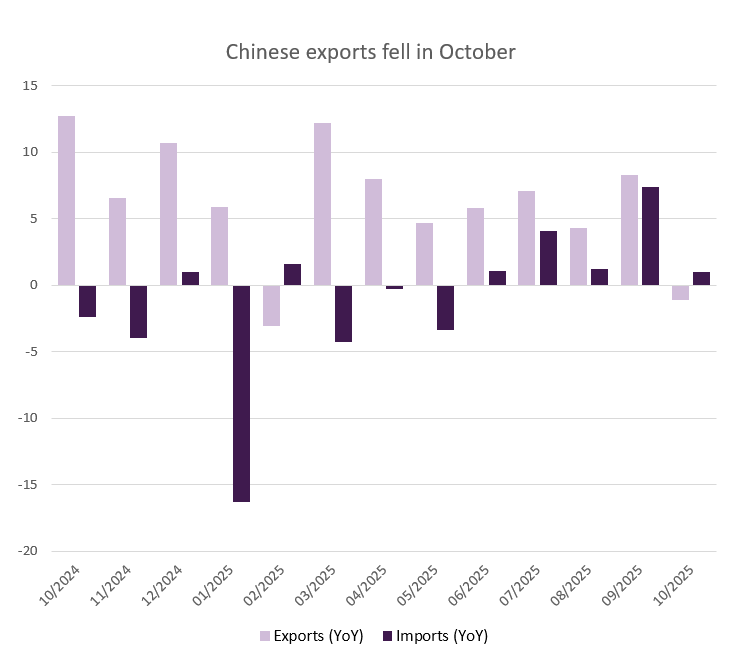

China’s exports unexpectedly fell for the first time since February, before the US announced “reciprocal” tariffs, dropping by 1.1% year on year in October. This decline follows strong export growth throughout most of the year, including an 8.3% increase in September, as tariff frontloading begins to fade. The Golden Week holiday, which resulted in fewer working days, along with a high base effect from last year, also contributed to the decline.

Exports to the US have fallen sharply since the “Liberation Day” in April, but the one-year trade truce agreed by Presidents Trump and Xi at the end of October should provide some relief going forward. The decline in exports to the US has been offset by increases in exports to other regions. However, in October, exports to both Europe and South East Asia rose at the slowest pace since February.

Imports grew by just 1% in October, slowing significantly from September's 7.4% rise. This weak growth highlights subdued domestic demand, despite holiday spending, and fears about the health of the jobs market.

Source: Bloomberg, BIL

The fall in exports raises concerns about Beijing’s ability to achieve its “around 5%” growth target in the final quarter of the year, given that growth in the third quarter was largely driven by exports while domestic demand remained subdued. Last month, officials reiterated their commitment to significantly increasing the proportion of household consumption in GDP, but the specifics of how this will be achieved are still lacking.

Calendar for the week ahead

Monday – Spain Consumer Confidence (October).

Tuesday – UK Unemployment Rate (September). Eurozone & Germany ZEW Economic Sentiment (November). US NFIB Business Optimism (October). China New Yuan Loans (October).

Wednesday – Italy Industrial Production (September).

Thursday – UK GDP Growth Rate (Prel, Q3), Balance of Trade (September), Industrial Production (September). Eurozone Industrial Production (September). US Inflation Rate (October), Jobless Claims.

Friday – China House Price Index (October), Industrial Production (October), Retail Sales (October), Unemployment Rate (October). Eurozone Balance of Trade (September), GDP Growth Rate (Q3, 2nd Est). US PPI (October), Retail Sales (October).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...