Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher. Optimism about a potential interest rate cut by the Fed in December boosted the market. The Nasdaq recovered from the previous week’s sell-off, during which investors took some chips off the table due to fears about high valuations, as attention turned to the upcoming FOMC meeting on 10 December.

A UK gilts rally brought the 30-yr to the lowest levels since June this year as the newly announced Autumn Budget somewhat eased concerns for long-term bonds by instating a much bigger fiscal headroom. In addition, a planned reduction of long-term gilt issuance by the UK government, also helped push yields lower.

Macro Snapshot

Can Trump spare US consumption?

Data released last week showed US consumer spending slowed at the end of Q3. Retail sales grew 0.2% MoM in September – the smallest increase in four months and only half of the +0.4% expected by economists.

Miscellaneous store retailers and gas stations saw the strongest spending, while sales fell quite markedly at sports, clothing and book stores.

Core retail sales, which are used to calculate GDP, declined 0.1%. Nonetheless, consumption is still on track to make a solid contribution to Q3 growth statistics, given that real spending was robust in July and August.

The path from here is, however, less certain. The outlook has been further dashed by a dismal consumer sentiment reading from the Conference Board. Its gauge plummeted from 95.5 to 88.7 last week, with households increasingly pessimistic about the labour market and future income streams. The unemployment rate recently reached a four-year high of 4.4%, while wage growth continues its downward trend.

Sticky inflation is exacerbating the gloom. Cognizant of this, the Trump Administration has been actively trying to lower grocery prices by striking trade deals with several Latin American countries, covering items such as coffee and beef. At the annual Thanksgiving turkey pardoning ceremony, President Trump said, “This Thanksgiving, we’re also making incredible strides to make America affordable again.”

A fresh CBS News/YouGov survey* revealed that 36% of Americans approve of Trump’s handling of the economy, down from 51% in a poll conducted early March. The drop in economic approval is steeper than the overall decline: Today, 40% of Americans approve of Trump’s performance in office, down 11 points from the March survey.

Trump spared a turkey. But the most pressing issue now is whether he will be able to keep consumption alive ahead of the midterm elections. Household spending is the driving force behind the US economy, accounting roughly two-thirds of overall activity.

*The survey included 1,489 adults and was conducted Nov. 19-21.

UK Autumn Budget raises taxes by £26bn

Following the accidental early leak of the Office for Budget Responsibility's outlook on Wednesday, Chancellor Rachel Reeves finally unveiled her second Autumn Budget. This will increase taxes by around £26 billion and boost her fiscal headroom to £22 billion. The announced tax hikes will further squeeze household incomes at a time when British households are already struggling with high inflation and a weakening labour market. However, not all of the tax increases will be implemented right away, and they will come into force over the coming years. Many of the most significant personal tax changes will not take effect until 2028.

The main policy announcements in the budget include:

- A freeze on the personal income tax threshold until 2030-31.

- Salary sacrifice pension contributions to be capped at £2 000 a year before national insurance applies.

- A 2% tax increase on dividends, savings and property income.

- Council tax surcharge on homes worth more than £2mn from April 2028.

- Two-child benefit cap

- Cash Isa allowance for those under the age of 65 to be cut from £20 000 to £12 000, as of April 2027. Over-65s will retain the existing allowance.

- A 3p pay-per-mile tax on electric vehicles.

- Online gaming tax to rise from 21 to 40%, and the levy on online sports betting will increase from 15 to 25%.

- Fuel duty rates frozen until September 2026.

These measures are expected to increase the tax take to an all-time high of 38% of GDP in 2030-31.

The enlarged tax revenue should offset the additional spending of £11.3 billion included in the budget to fund the reversal of welfare cuts made over the summer and the lifting of the two-child benefit cap. However, the OBR has warned that the Chancellor’s margin for error is still small. Several tax hikes are only set to be implemented in the next few years, meaning spending will increase sharply now while much of the tax revenue will only come in later.

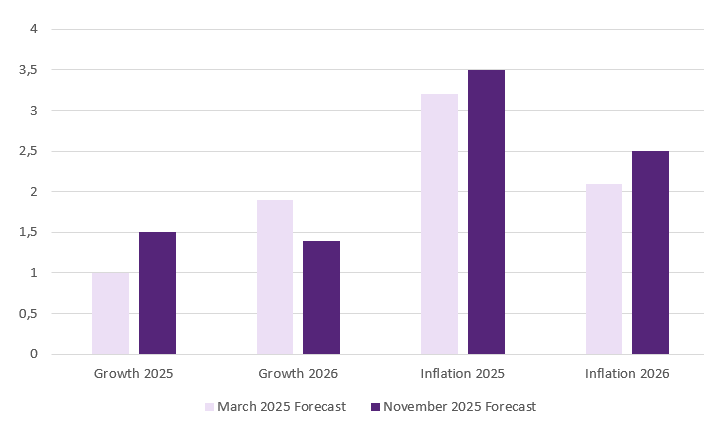

In its outlook, the OBR also updated its economic forecasts for 2025 and 2026. Stronger growth than expected is foreseen for this year, but growth in 2026 was downgraded. Inflation is also expected to remain stickier than initially expected.

Source: OBR, BIL

The OBR also forecasts that the productivity outlook will be 1% over the medium term, 0.3 percentage points below the March estimate.

UK stocks fell on the announcement as market participants anticipate weaker growth.

Chinese manufacturers continue to struggle despite trade deal with the US

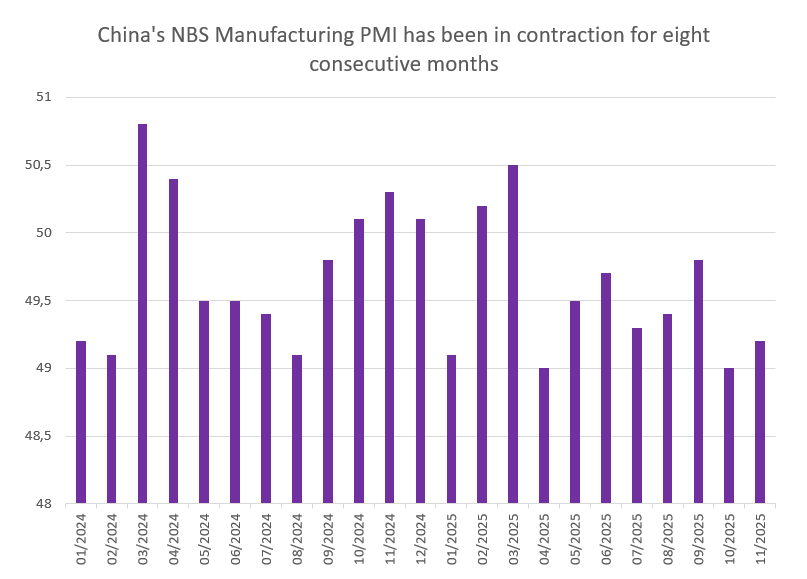

According to Beijing’s official manufacturing PMI, China’s factory activity continued to contract in November, albeit at a slower pace, with the index rising to 49.2, up from 49 in October. This marks the eighth consecutive month of contraction, despite the easing of trade tensions in November following the deal struck between the US and China. Manufacturers are still facing weak demand, intense domestic price competition, and global trade uncertainty. According to a private sector PMI (RatingDog), the manufacturing index contracted again after three months of expansion, with new orders stagnating amid job cuts and subdued demand.

Source: Bloomberg, BIL

Calendar for the week ahead

Monday – Switzerland Retail Sales (October), Manufacturing PMI (November). Eurozone, US, UK, France & Germany Manufacturing PMI (November, Final). US ISM Manufacturing PMI (November).

Tuesday – Japan Consumer Confidence (November). UK Housing Prices (November). Eurozone Inflation Rate (Flash, November), Unemployment Rate (October).

Wednesday – Switzerland Inflation Rate (November). Eurozone, France, Germany, UK & US Composite & Services PMI (Final, November). US ISM Services PMI (November).

Thursday – Switzerland Unemployment Rate (November). Eurozone Retail Sales (October). US Challenger Job Cuts (November), Jobless Claims.

Friday – Germany Factory Orders (October). Eurozone GDP Growth Rate (Final, Q3). US Michigan Consumer Sentiment (Prel, December).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...