US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500 fell back and relinquished its gains as renewed concerns about artificial intelligence (AI) spending triggered a sell-off in the technology sector. The tech-heavy Nasdaq Index took the worst hit, with investors once again questioning whether elevated AI spending will pay off.

In Europe, the pan-European STOXX Europe 600 Index ended slightly lower, with mixed performances from major indices. A comment from ECB board member Isabel Schnabel saying that she is “rather comfortable” with market expectations that the central bank’s next move will be a hike, rather than a decrease in borrowing costs, caused the EUR to spike briefly. After the European Commission released stronger growth forecasts in November, we commented that this might precede upgrades to the ECB’s own projections in December. Indeed, this is something Schnabel also hinted at, describing risks to the economy and inflation as being tilted to the upside. Growth “has been much more resilient than could have been expected in the face of the greatest disruption of the international trade order since the Second World War,” she said.

Migrating south, watchers were surprised on Wednesday, when the Australian government pressed ahead with a nationwide ban on social media for minors under sixteen. Access was promptly revoked across various platforms including Instagram, Facebook, X, SnapChat, TikTok, Reddit and YouTube. According to reports, countries such as Norway and Denmark are contemplating similar moves.

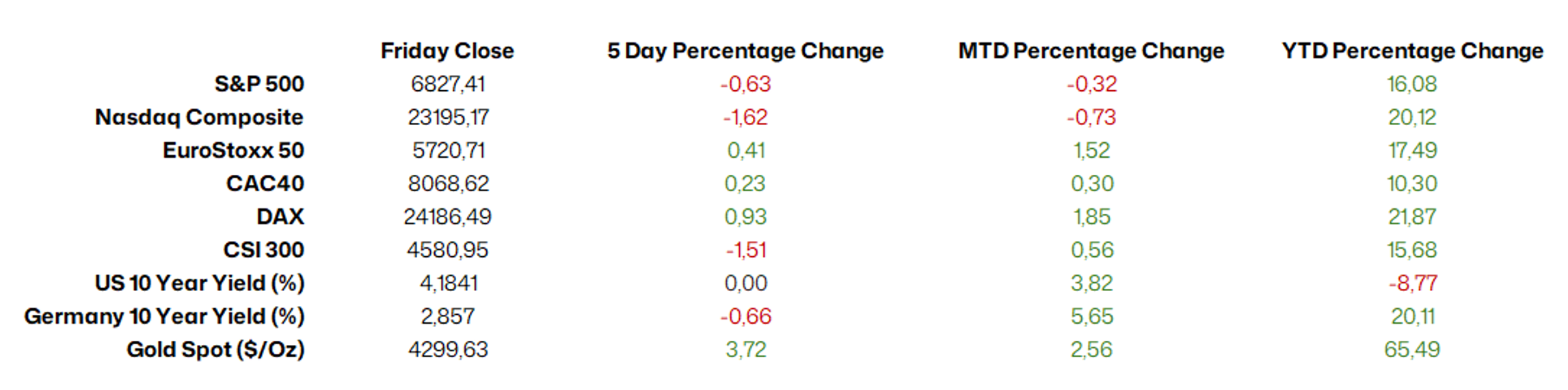

Market Snapshot

Macro Snapshot

US Federal Reserve delivers another quarter-point rate cut

- The Fed lowered its key rate by 25 basis points to a range of 3.50% to 3.75%

- Rates are now at the lowest level since 2022

- The decision to lower rates was not unanimous, with three voting members dissenting

- Refreshed economic projections show growth revised up, inflation down and unemployment steady

In its third and final interest rate cut of the year, the Fed lowered its key rate by 25 basis points to a range of 3.50% to 3.75%. The move, which was widely expected by markets, leaves rates at the lowest level since 2022.

The Fed also announced that it would re-start purchases of US Treasuries. It will begin with a USD 40 billion purchase on Friday, and it anticipates purchases will “remain elevated for a few months” and then reduce from there.

The Fed Chair, Jerome Powell, told reporters the decision was taken as the US labour market cools and "inflation remains somewhat elevated". Tariff-driven cost increases are still filtering into consumer prices, which could put the central bank's two key mandates in tension with one another, at least in the short term. During the press conference, Powell touched on this, commenting that "In the near term, risks to inflation are tilted to the upside, and risks to unemployment to the downside -- a challenging situation… There is no risk-free path for policy as we navigate this tension between our employment and inflation goals."

The decision was taken with a higher degree of uncertainty than usual due to the incomplete data picture caused by the government shutdown which delayed, and in some cases, prevented economic data collection.

Amid the uncertainty, the decision was not unanimous. Three of the twelve voting members opposed the cut.

Stephen Miran, who is on temporary leave from his role heading up Trump's Council of Economic Advisers, voted for a larger 50 basis point reduction. Policymakers Austan Goolsbee and Jeffrey Schmid voted to hold rates steady. The three dissents were the most since September 2019.

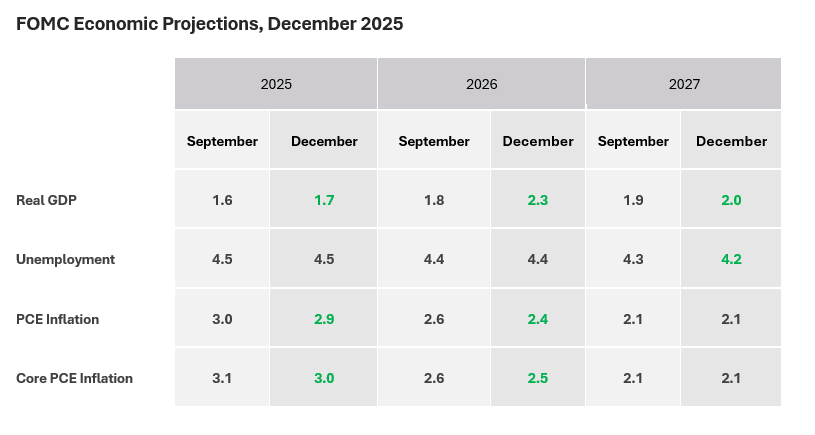

A refreshed set of economic projections showed that officials foresee stronger growth and more moderate inflation that they did in September. Powell pinned better growth prospects on a number of factors including "resilient" consumer spending and AI data centres that have been "holding up business investment".

With regard to future policy moves, the median projection suggested just one more rate cut in 2026, but eight out of nineteen members saw no need for any more cuts, raising uncertainty about the future path of monetary policy.

In any case, the Fed’s next move is unlikely to come immediately at the next meeting. Powell iterated that he thinks the Fed is now "well positioned to wait" to see what happens to both prices and the labour market.

Powell’s term comes to an end in May. Kevin Hassett, conservative economist and key Trump economic adviser, is seen as the front-runner to succeed Powell. Trump has been highly vocal about his wishes for the Fed to lower rates.

Source: US Federal Reserve, BIL

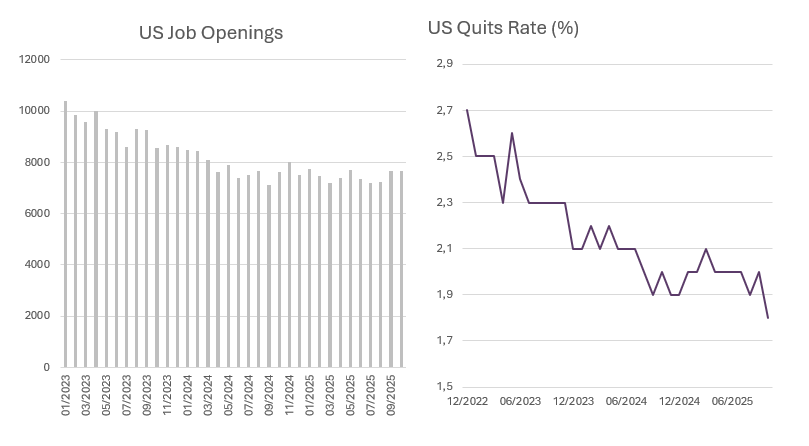

Job postings in the US surprise on the upside

In a glint of hope that the US labour market is stabilising, job openings were shown to have reached a five-month high in October. Some of the effect is likely due to seasonality, however, as companies began to beef up their staff levels ahead of the holiday period.

Digging into the details, postings increased by 12,000 to 7.670 million. Sectors that posted the most listings included trade, transportation, utilities, retail and wholesale trade.

Source: Bloomberg, BIL

However, hiring stalled while the quits rate — a good proxy for confidence in the labour market as people are unlikely to leave their job if they feel they will not easily find another — fell to 1.8%. That’s the lowest level in more than five years, indicating a lack of dynamism in the US employment market.

Non-farm payrolls data for November, delayed due to the government shutdown, will be the focal point for markets on Tuesday. This will offer a clearer snapshot of employment activity. Have employers put their money where their mouth is when it comes to hiring and actually filled the open positions?

China inflation rate rises to 21-month high but deflationary pressures persist

Consumer prices in China rose to the highest level since February 2024 in November, reaching 0.7%. Food prices increased for the first time in ten months, driven up by rebounds in prices for fresh vegetables and fruit, combined with a slower fall in pork prices. Non-food inflation increased further, boosted by Beijing’s ongoing consumer trade-in programs. Core inflation, which excludes volatile categories such as food and energy, rose 1.2% year on year, the same as in October.

At the same time, factory-gate deflation deepened, falling 2.2% YoY in November, which suggests that domestic demand remains weak despite the pickup in consumer prices. The government has increased its efforts to rein in industrial overcapacity and excessive competition this year, yet factory-gate deflation still indicates considerable price pressure.

As the year comes to a close, China is on track to achieve its 'around 5%' growth target for 2025, but the disparity in growth rates within the Chinese economy has become even more pronounced. This year, growth has continued to be driven by external demand through resilient exports, while domestic demand has been weak. To achieve a better balance in 2026, Beijing will need to introduce new stimulus measures to stabilise the housing market and reduce youth unemployment in order to boost consumer confidence.

UK economy unexpectedly contracted ahead of the budget announcement

Business activity slowed in October, causing the UK economy to shrink by 0.1% ahead of the announcement of Chancellor Reeves’ Autumn Budget. According to the Office for National Statistics, both businesses and consumers spent October in waiting, as speculation about what might be included in the budget dampened confidence. At the end of November, Reeves announced £26 billion in tax rises as part of the budget, which is expected to increase the tax burden to 38% of GDP by the end of the parliamentary term.

Attention is now turning to the Bank of England’s monetary policy meeting on Thursday, during which the central bank is widely expected to cut interest rates in an effort to support the economy.

Global trade: Tariffs remain a topic

Last week, Mexico announced tariffs as high as 50% on cars, steel and other goods coming from China, and other Asian countries with which it lacks a trade agreements. The measures, which President Sheinbaum said were necessary to boost domestic production, will come into effect 1 January 2026. The unexpected move drew consternation from Beijing, but aligns Mexico with US President Donald Trump’s protectionist policies, as it seeks to extend the US-Mexico-Canada trade pact next year.

With regards to the US’ own brand of tariffs, Switzerland finally has clarity on the application of lower levies that were agreed some weeks ago with the White House. US tariffs on Swiss goods will fall from 39% to 15%, effective retroactively from November 14.

Calendar for the week ahead

Monday – Japan Tankan Index (Q4). China House Price Index, Industrial Production, Retail Sales, Unemployment, Fixed Asset Investment (all November). Eurozone Industrial Production (October)

Tuesday – UK Unemployment Rate and Average Earnings. US, Eurozone, Japan, UK PMI (Flash, December). US Nonfarm Payrolls, Unemployment Rate, Average Hourly Earnings, Business Inventories, Building Permits and Housing Starts.

Wednesday – Japan Balance of Trade. UK Inflation data. Germany IFO Business Climate. Eurozone Inflation (Final, November). US Retail Sales.

Thursday – France Business Confidence. Bank of England Monetary Policy Meeting. European Central Bank Monetary Policy Meeting. US Inflation (November), Conference Board Leading Index.

Friday – Japan Inflation Rate. UK Consumer Confidence. Bank of Japan Monetary Policy Meeting. Germany Consumer Confidence and PPI. UK Retail Sales. Italy Business and Consumer Confidence, Industrial Sales. US Existing Home Sales, Michigan Consumer Sentiment (Final, December). Eurozone Consumer Confidence (December).

Saturday – China Loan Prime Rate

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...