Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally was not driven by the “usual suspects”, but rather by energy, materials and consumer staples. Small caps also enjoyed superior performance to their larger counterparts, reflecting hopes of an accelerating US economy.

However, on Friday, US stocks pared some of their gains after Trump nominated former Federal Reserve governor Kevin Warsh to replace Jerome Powell when his term as Fed Chair comes to an end in May.

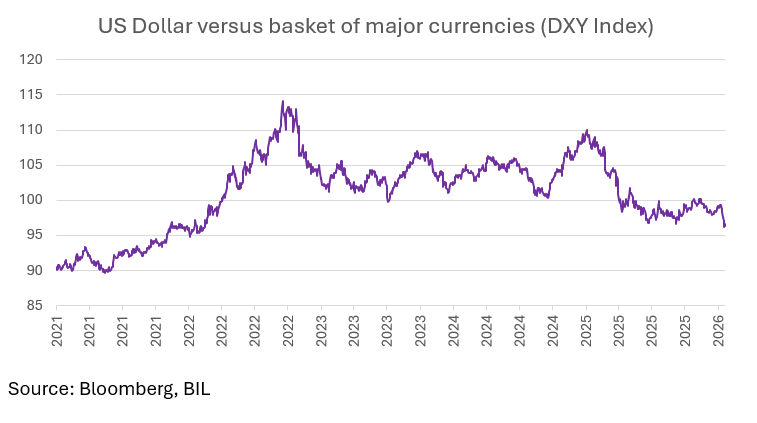

It seems markets view Warsh as more of an orthodox candidate -- after hitting a four-year low against a basket of currencies mid-week, his nomination allowed the US dollar to regain some muscle. Precious metals also fell victim to profit-taking at the end of the week, after a blistering rally.

Brent oil futures are trading near a six-month high on rising concerns about a possible US military attack on Iran, OPEC's fourth-largest producer with output of 3.2 million barrels per day. US President Donald Trump warned this week that “time is running out” for Iran to return to talks to reach a new deal on its nuclear programme, while Iran said it would instantly strike US bases and aircraft carriers in response to any attack.

Beyond geopolitics, earnings season also continues to capture the market’s attention. At the time of writing, 167 companies on the S&P 500, representing nearly half of all US market cap, had reported their results. Over 75% beat expectations – a decent outcome thus far, but not as good as in previous quarters.

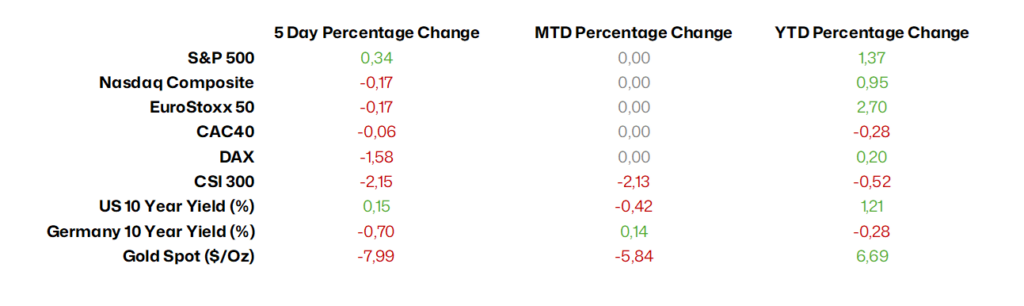

Market Snapshot

Source: Bloomberg, BIL as of Feb 2 2026

Macro Snapshot

Federal Reserve holds rates steady as US dollar touches a four-year low

At its January FOMC, the US Federal Reserve held interest rates steady as was widely expected. From an economic standpoint, the Fed’s statement and Chair Powell’s commentary suggest a few key things:

- Solid growth expectations

- A near-term boost to inflation driven by tariffs which the Fed believes will eventually fade

- A labour market that’s essentially at a standstill amid low hiring but no spike in layoffs

But one factor the Fed is undoubtedly watching closely is the US dollar. Last year, the greenback lost almost 10%, with the bulk of the decline occurring on the heels of the “Liberation Day” tariff announcement in March. Since then, the dollar has continued to lose strength against a backdrop of unconventional policymaking, threats regarding the sovereignty of Greenland, and attacks on Federal Reserve independence. Over the past week, the downturn continued as investors piled into alternative stores of value. Gold hit a new all-time high above USD 5,400/oz, silver above 118/oz, and the Swiss France hit a ten-year high against the dollar.

For the US, a weaker dollar might be helpful – until it isn’t.

A softer dollar, which President Trump appears to favour, makes US exports more competitive. It also boosts the repatriated profits of multinational US companies.

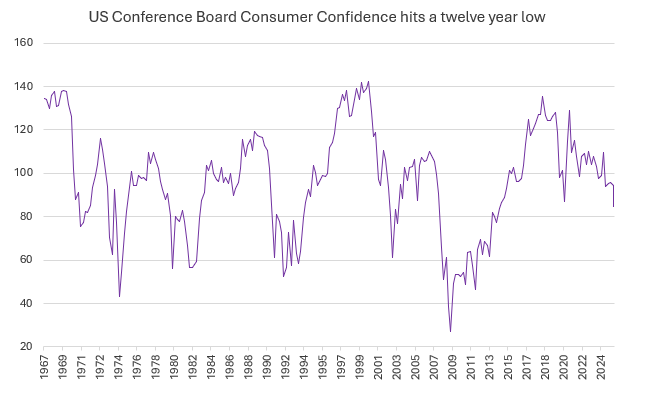

However, dollar weakness also poses risks for inflation. When you combine an effective tariff rate of around 10% with the dollar’s depreciation, it certainly complicates the Fed’s task of keeping prices in check. With consumer confidence already in the doldrums (see chart below), continued dollar weakness also risks being the straw that breaks the camel’s back when it comes to household spending.

Source: Bloomberg, BIL

Moreover, falling confidence in the dollar is also risky when you consider the US’s 39-trillion-dollar debt burden, as currency risk and falling foreign demand could push up Treasury yields (i.e. increasing government borrowing costs).

And a weaker dollar isn’t just a US problem. The euro briefly traded above 1.20/ USD this week – its highest levels since 2021 – and further strength could put real pressure on Europe’s export led economy. Weak external demand is already weighing heavily on Eurozone companies and further strengthening of the single-currency could compel the ECB to revise its inflation projections lower, and potentially even enact additional rate cuts if the move was pronounced.

Emerging markets, on the other hand, are benefitting from dollar weakness, with stocks, bonds and currencies all enjoying a boost as investors seek diversification. Fundamentals in many EMs are sturdier than they were in the past, and given that many hold dollar-denominated debt, they are improving.

Despite some gains on Friday, the greenback still remains vulnerable to Presidential pressure for lower interest rates, and to a global trend of greater diversification beyond US assets.

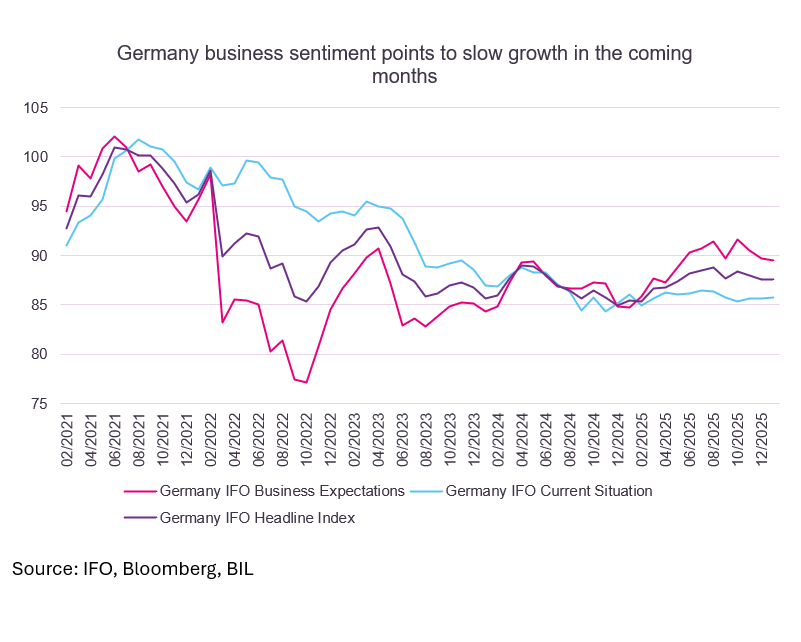

German economy off to a slow start in 2026

According to the country’s most prominent leading indicator – the IFO survey which gathers the opinions of roughly 9000 business leaders – the German economy did not start 2026 with a bang. The headline index held steady at 87.6, with assessments of the current situation edging up somewhat, while expectations about the future moved slightly downwards.

The goods-producing sector of the economy showed strong improvement, while trade and construction-specific indices also rose. Confidence in the services sector, particularly tourism, retreated.

The lacklustre reading squares with the Bundesbank’s prediction that sluggish growth with continue through Q1 2026, before picking up momentum as the year progresses on the back of Government spending, especially on infrastructure and defense. Consumption is also expected to pick up gradually, driven by gradual improvements in the labour market which will, in turn, underpin real incomes. Indeed, on Wednesday, the Gfk Consumer Climate Indicator rose from a two-year low to -24.1, with income expectations rebounding sharply (5.1 from -6.9). Economic expectations also strongly picked up (6.6 vs 1.2), pointing to a much more optimistic outlook. The willingness to buy improved (-4.0 vs -7.5), as inflation concerns faded.

Calendar for the week ahead

Monday – Switzerland Retail Sales (December), Manufacturing PMI (January). Eurozone & UK Manufacturing PMI (Final, January). US ISM Manufacturing PMI (January).

Tuesday – France Inflation Rate (Prel, January). US JOLTs Job Openings & Quits (December).

Wednesday – Eurozone & UK Composite, Services PMI (Final, January). Eurozone & Italy Inflation Rate (Flash, January). US ISM Services PMI (January).

Thursday – Germany Factory Orders (December). Eurozone & UK Construction PMI (January). Eurozone Retail Sales (December). Bank of England Interest Rate Decision. ECB Interest Rate Decision. US Jobless Claims, Challenger Job Cuts (January).

Friday – Germany & France Balance of Trade (December). Switzerland Unemployment Rate (January). US Non Farm Payrolls (January), Unemployment Rate (January), Michigan Consumer Sentiment (Prel, February).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more