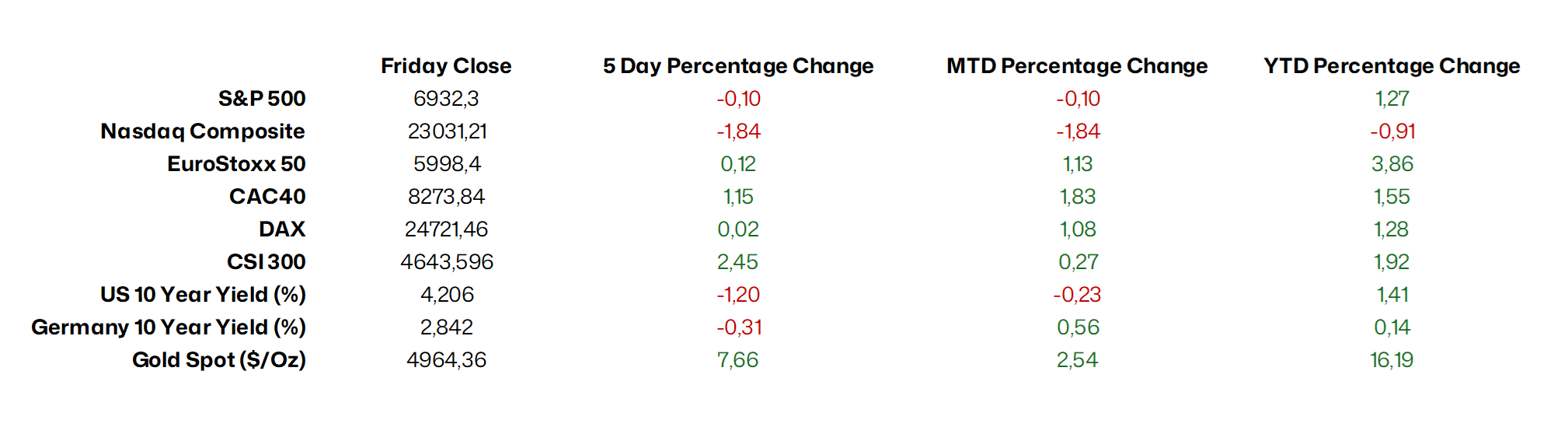

Market Snapshot

Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The Nikkei 225 broke though the 57,000 level for the first time as investors expect that the prime minister’s unprecedented majority will allow her to implement economic stimulus and drive investment in key strategic sectors.

Fears of an AI bubble were reignited last week when major tech companies announced plans to invest $660 billion in AI this year. Investors expressed concern that these impressive spending announcements might exceed the actual earnings potential of the investments. Software stocks were also affected due to concerns that new AI coding tools could disrupt their businesses. Pressure on equity markets increased further when data on the US labour market showed further weakening, with high layoffs and weak job openings.

On Friday, however, US stock markets rose again as tech stocks recovered much of their losses from earlier in the week.

The earnings season is well underway, and, in the US, positive EPS surprises have driven the Q4 earnings growth rate for the S&P 500 higher to 12.1%, from the expected 8.42%. It is the fifth straight quarter of double-digit growth for the S&P 500. IT, Industrials, and Communication Services have exceeded expectations, while Consumer Discretionary has undershot. Companies that make less than 50% of their revenues in the US have managed to see an increase in earnings of 17.2%, while companies that make more than 50% of their revenues in the US saw their earnings rise by only 9%.

In Europe, the first wave of results points to mixed results, with banks, mining and data-centre equipment makers holding up better than consumer and chemical companies facing tariffs and currency headwinds. With 20% of the MSCI Europe market cap companies having reported, 40% have beaten expectations compared with a miss rate of 24%. The year-on-year EPS growth rate for 4Q25 is 1.6% so far, broadly in line with initial market expectations.

Similar to the past, banks are taking the lead with a 57% beat rate driven by stronger net interest income and lower-than-expected operating expenses and loan-loss provisions. This lifted EPS by 7%. Within technology, results were generally solid, but share-price reactions appeared driven more by valuations and the impact of AI on business models.

Source: Bloomberg, BIL as of February 9

Macro Snapshot

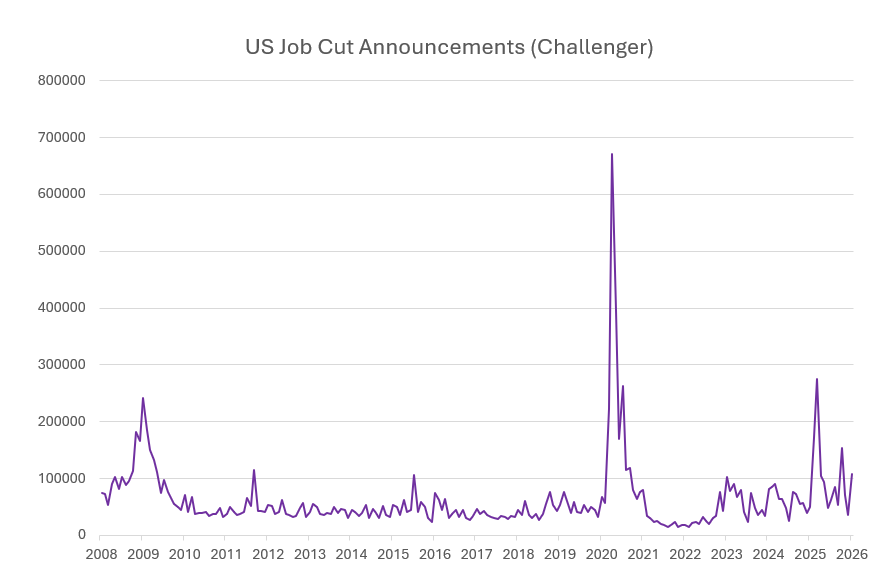

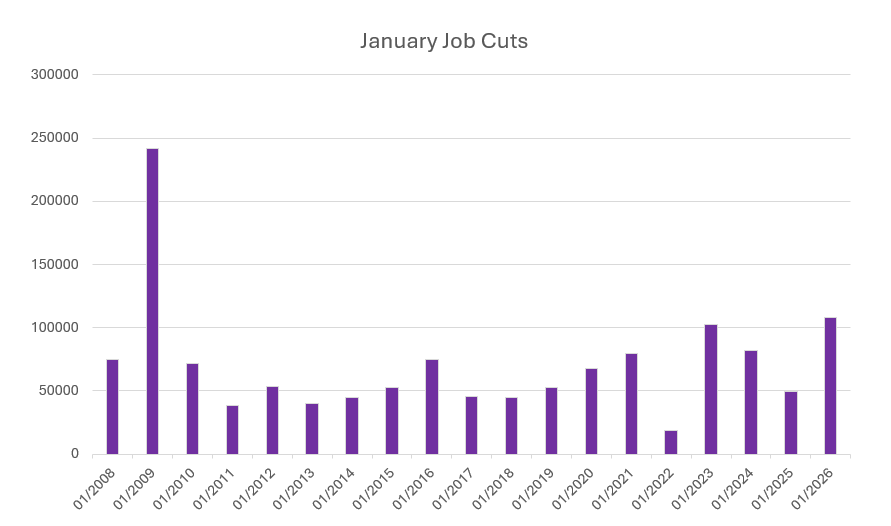

US job cuts surge at the start of the year

US employers announced 108,435 job cuts in the first month of the year, according to a survey by employment services company Challenger, Gray and Christmas released on Thursday. This compares to just 33,553 job cuts announced in December and is the worst start to the year since 2009. Transportation saw the highest number of cuts, followed by technology and healthcare and health product manufacturers. Meanwhile, employers announced 5,306 hiring plans, the lowest total for the month since records began in 2009.

Source: Bloomberg, BIL

The job cuts reflect companies taking steps to reduce their workforces, after having boosted workforce numbers following the pandemic. Although the survey usually sees a spike of job cuts in January, this year’s numbers are higher than in previous years.

Source: Bloomberg, BIL

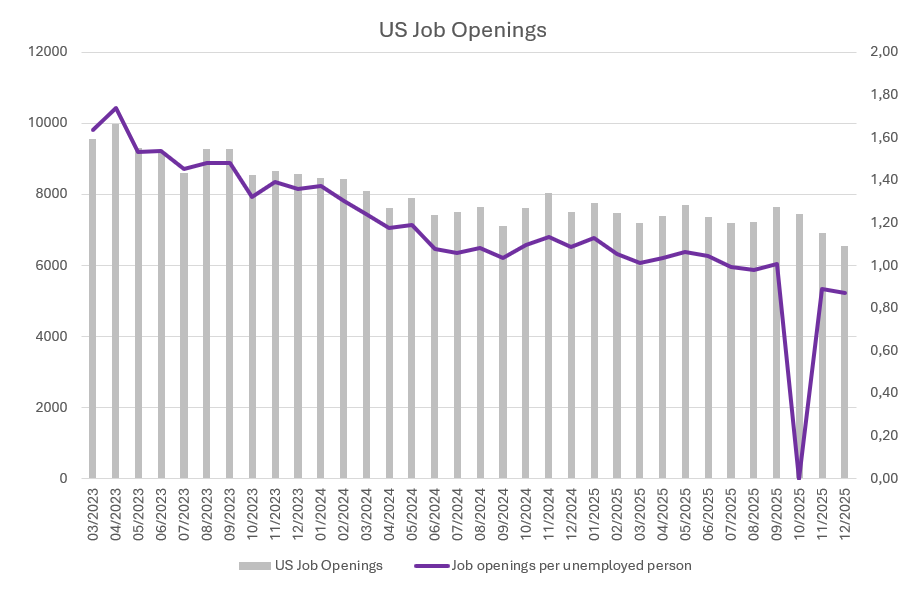

Data from the Bureau of Labour Statistics earlier in the week showed that job openings in the US fell by 386,000 in December, the lowest since September 2020 and below market expectations, in another sign of cooling in the US labour market. In addition, jobless claims jumped by more than expected, reflecting business disruptions following a series of storms across several parts of the county causing more households to apply for unemployment benefits.

Source: Bloomberg, BIL, October 2025 dip is due to the US government shutdown.

Eurozone inflation rate falls to 1.7% in January

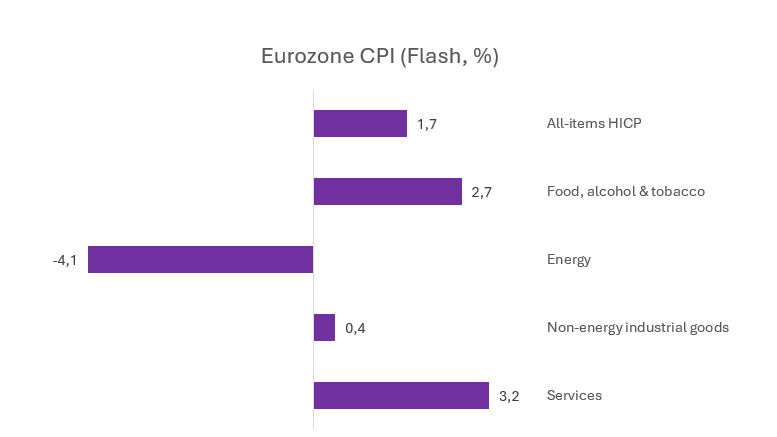

According to flash estimates, the annual inflation rate in the Eurozone was 1.7% YoY in January, marking the lowest level since September 2024 and down from 2% in December.

Services inflation slowed to a four-month low, while energy prices continued to fall. Additionally, the strengthening of the euro (which surged above $1.20 at the end of January, its highest level in more than four years) helped to keep consumer prices down. Inflation increased for unprocessed food and non-energy industrial goods. Meanwhile, price growth for processed food, alcohol, and tobacco remained unchanged. Core inflation, which excludes volatile categories such as food and energy, fell to 2.2%, the lowest figure since October 2022.

Source: Eurostat, BIL

ECB holds rates steady, as expected

The European Central Bank (ECB) held interest rates at 2% for the fifth consecutive meeting on Thursday, following stronger-than-expected recent growth. This unanimous decision follows the ECB’s governing council’s view that “the economy remains resilient in a challenging global environment”, with a low unemployment rate and increases in public investment and defence spending. However, the council noted that the outlook remains uncertain due to global trade policy uncertainty and geopolitical tensions.

Although the inflation rate in the eurozone fell to 1.7% in January, the central bank reiterated its view that inflation should stabilise at its 2% target in the medium term. Nevertheless, the strengthening of the euro this year has raised concerns that it could weigh on European exporters and hold down inflation in the bloc.

The ECB is widely expected to keep interest rates on hold this year. However, falling inflation combined with a stronger euro has led traders to price in a slim chance of further ECB easing later in the year.

Bank of England holds rates at 3.75% following a narrow vote

On Thursday, the Bank of England (BoE) kept borrowing costs steady at 3.75% in a close vote, signalling that further monetary policy easing is possible in the near future.

Following a 25 basis point cut in December, the Monetary Policy Committee voted five to four in favour of keeping rates on hold, as the central bank awaits clearer signs that inflation is heading down towards the 2% target. Four members voted to reduce the Bank Rate by 0.25 percentage points to 3.5%.

The central bank also lowered its growth forecasts for the next two years, predicting 0.9% GDP growth in 2026, below the previous forecast of 1.2%, and raised its unemployment outlook. It anticipates that the weakening labour market will keep price pressures under control. The BoE expects inflation to fall back to around its 2% target from April this year, leaving the door open for further easing. “All going well, there should be scope for some further reduction in Bank Rate this year,” said Governor Andrew Bailey, however stressing that there is no set timeline for further easing.

As the vote was closer than expected and there were signals of further easing, market expectations of a rate cut in March increased to almost 50%, up from around 20% before the announcement. Markets expect the BoE to cut interest rates twice this year.

France adopts 2026 budget

France has adopted a budget for 2026 after months of back and forth after Prime Minister Lecornu survived a no-confidence vote last Monday. The premier had activated a special constitutional power which allows the government to enact a budget without parliamentary support, on the condition that it survives a no-confidence vote. The budget, which is expected to cut the country’s fiscal deficit to about 5% of GDP this year, does not include the increase of the retirement age from 62 to 64 (something that President Macron has fought hard to implement), as a concession to the left in exchange for backing during the no-confidence vote. The French bond market has stabilised in recent weeks, as market participants saw the likelihood of a budget being passed increasing.

Calendar for the week ahead

Monday – Switzerland Consumer Confidence (January). US Consumer Inflation Expectations (January).

Tuesday – US Retail Sales (December), NFIB Business Optimism Index (January).

Wednesday – China Inflation Rate (January). US Inflation Rate (January).

Thursday – UK GDP Growth Rate (Prel, Q4), Balance of Trade (December). US Jobless Claims.

Friday – China House Price Index (January). Switzerland Inflation Rate (January). Eurozone Balance of Trade (December), GDP Growth Rate (Q4, 2nd Est).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more