In France, prime minister Sébastien Lecornu survived two votes of no confidence last week, offering hope that the country might have a budget before the end of the year. Nevertheless, this did not stop the rating agency S&P from stripping France of its AA status over debt sustainability concerns. And that was not the only loss for France over the weekend: the French police are on a hunt to catch four thieves who broke into the Louvre Museum on Sunday and stole some of Napoleon III's royal jewels.

US stocks fell last week amid growing concerns about the credit risk among regional US banks after two lenders said on Thursday that they had been hit by either bad or fraudulent loans. The market is becoming increasingly attentive to any strain on the credit side, with the private credit market (where companies arrange loans from non-bank lenders) under close scrutiny.

However, equities recovered on Friday as comments from President Trump suggesting that the US and China would overcome trade tensions calmed markets. The most recent flare-up in tensions occurred when China announced tighter controls on rare earth exports, prompting President Trump to threaten tariffs of up to 100% on Chinese imports. Shares in rare earth companies have soared this year as President Trump pushes to reduce China’s dominance of the supply of critical minerals. However, comments made throughout the week suggest that the world's two largest economies could move past this episode and resume trade discussions later this month. In addition to renewed trade talk hopes, stocks were also supported by some dovish comments from the Federal Reserve and a strong start to the earnings season, with major US banks reporting strong results across the board. Profitability stemmed largely from investment banking divisions, with deals and M&A activity picking up. Capital ratios remain solid.

In the commodity space, oil prices fell to a five-month low last week, following a report from the International Energy Agency that predicted a “large surplus” of crude supply in 2026. However, prices rose again on Wednesday on concerns that escalated trade tension between the US and China could disrupt global freight flows with both countries imposing additional port fees on ships carrying cargo between them.

Perceived Fed dovishness helped gold continue its striking rally, with the precious metal now trading above $4300 per troy ounce. To dive deeper into that topic, please refer to our latest BIL Investment Insights article.

Macro Snapshot

Europe

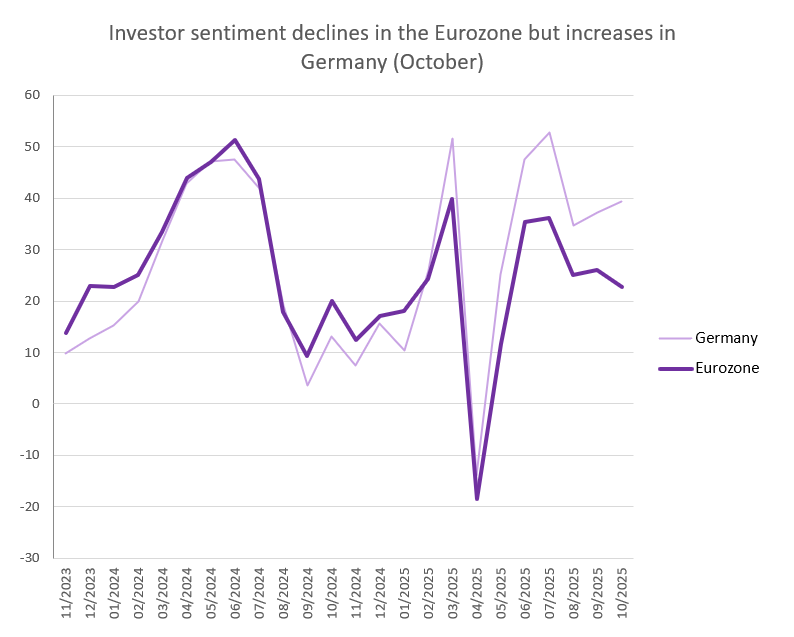

German investor morale rose by less than anticipated in October, according to the ZEW survey, as sluggish economic performance weighed on sentiment. The index rose to 39.3, from 37.3 points in September but below expectations. The improvement was driven by the expectations component, which improved noticeably in the export-oriented sectors such as metal production, pharmaceuticals, mechanical engineering and electrical equipment manufacturing. However, sentiment declined in the beleaguered automotive sector. Although the assessment of the current economic situation remained negative, the improvement in expectations indicated growing optimism that conditions for exporters would improve. The survey was conducted before the recent flare up of trade disputes between the US and China, however, which could dampen expectations in the near term. China’s curbs on exports of rare earths (which are used in everything from smartphones to electric vehicles) are likely to cause collateral damage in Europe, while the US government is making bold moves to support its own rare earth industry.

At Eurozone level, the ZEW economic sentiment index fell to its lowest level in five months in October: 22.7 points, down from 26.1 in September. This decline was largely attributed to political uncertainty surrounding France's budget.

Source: Bloomberg, BIL

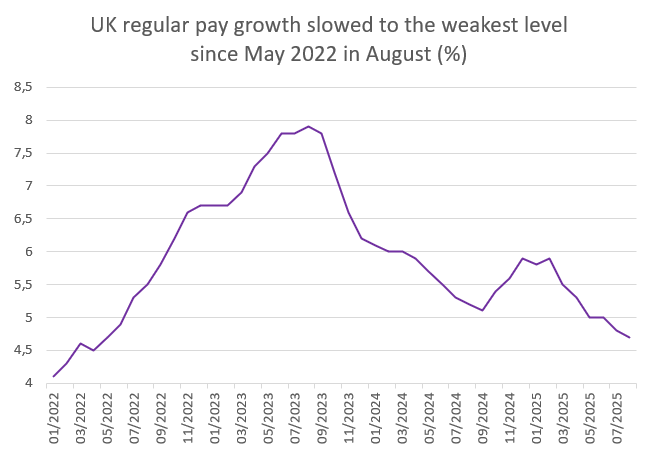

In the UK, tax increases and high interest rates are putting pressure on the economy, which grew by just 0.1% in August. The economy has slowed since the first quarter of the year, when activity increased by 0.7% in anticipation of US trade tariffs. Businesses have struggled with an increase in taxes and a higher minimum wage, which came into effect in April, as well as uncertainty surrounding US trade policy. Meanwhile, Chancellor Rachel Reeves is preparing to unveil her autumn budget in November, which is expected to include several new tax increases aimed at filling a fiscal deficit estimated to be between £20 billion and £30 billion. The anticipation of these tax increases has further dampened activity, with businesses delaying investment decisions and pulling back on hiring. In the three months to August, the UK unemployment rate rose to 4.8%, from 4.7% in July. This marks the highest unemployment rate since the three months to June 2021. In another sign that the labour market is cooling, regular pay growth slowed to 4.7% in the June–August period compared to a year earlier — the weakest growth since May 2022.

Source: Bloomberg, BIL

US

The US federal government remains in shutdown, with official data releases being held hostage. In a week when the inflation rate, producer price index, retail sales, weekly jobless claims and industrial production were due to be released, markets had to make do with speeches from Federal Reserve committee members and some housing data. On Tuesday, Fed chair Jerome Powell gave a speech in which he noted that the labour market continues to show signs of cooling, indicating that another interest rate cut could come as soon as this month. Despite the fact that the Bureau of Labor Statistics data is on hold, Powell said that private data combined with internal Fed research has provided enough indication that the jobs market is slowing. Longer term inflation expectations also remain “aligned with our 2 per cent goal”, according to Powell, leading markets to increase bets on two more 25 basis point interest rate cuts this year.

Asia

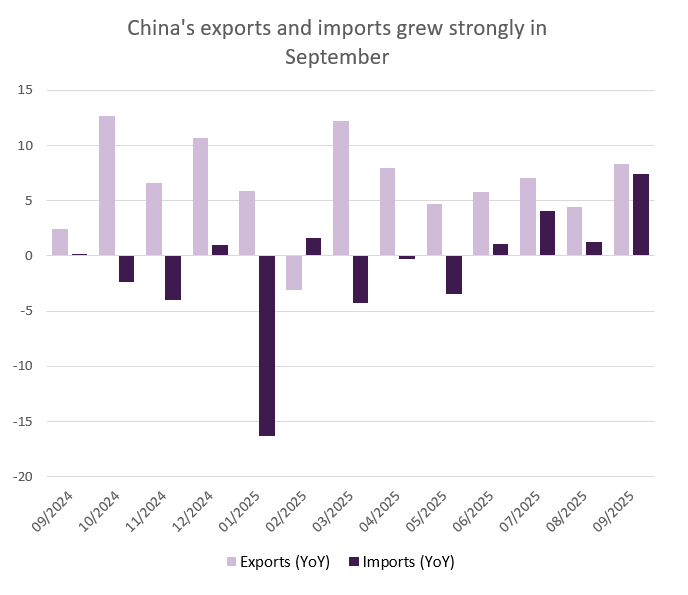

China’s exports continued to grow in September, with exporters shrugging off uncertainty surrounding the upcoming trade talks between China and the US to focus on diversifying export markets. China's trade surplus was USD 90.45 billion in September, which is below expectations, but above the USD 81.69 billion recorded in the same month last year. Exports continued to grow, rising by 8.3% year on year — up from 4.4% in August — marking the fastest expansion in export growth since March, when Chinese producers were rushing to frontload tariffs. Despite exports and imports to and from the US continuing to fall (by 27.0% and 16.1%, respectively), exporters diversified into new markets to offset the impact. Exports to Africa rose by 56.6%, while those to Latin America increased by 15.2%. Meanwhile, shipments to the EU, which has expressed concern about being flooded with goods originally intended for the US, increased by 14.2% in September. Exports to south-east Asia increased by 15.6%. Nevertheless, while exports have held up well overall, industries that are more exposed to the US as an export market, such as apparel and accessories, footwear, furniture, and toys, have still felt the impact of tariffs. Imports also grew strongly, rising from 1.3% in August to 7.4%, as domestic demand spiked ahead of the Golden Week holidays.

This demonstrates continued resilience of China’s trade machine, despite the escalating tensions between the world’s two largest economies ahead of President Trump and Xi’s scheduled meeting later this month. As domestic consumption has remained relatively subdued this year, exports continue to play a key role in achieving Beijing’s growth target of around 5% for 2025.

Source: Bloomberg, BIL

Looking to consumption, consumer prices in China remained deflationary in September, falling 0.3% year on year. Food prices fell at the fastest pace (-4.4%) since January 2024 on weak demand, with an oversupply of pork ahead of the Golden Week holidays driving down prices. Non-food inflation, on the other hand, quickened in September (0.7% vs 0.5%), supported by the ongoing consumer trade-in schemes to boost consumer demand. Core inflation, which excludes food and energy, rose 1.0%, the highest in 19 months.

Source: Bloomberg, BIL

Factory gate prices also declined 2.3% year-on-year in September, compared with a 2.9% in August, and has been negative for three straight years.

Calendar for the week ahead

Monday – China House Price Index (September), GDP Growth Rate (Q3), Retail Sales (September), Industrial Production (September), Unemployment Rate (September), Communist Party Fourth Plenum.

Tuesday – Switzerland Balance of Trade (September). China Communist Party Fourth Plenum.

Wednesday – Japan Balance of Trade (September). UK Inflation Rate (September). China Communist Party Fourth Plenum.

Thursday – France Business Confidence (October). US Jobless Claims. Eurozone Consumer Confidence (Flash, October). China Communist Party Fourth Plenum.

Friday – UK Consumer Confidence (October), Retail Sales (September). France, Germany, UK, US Services, Manufacturing & Composite PMIs (Flash, October). US Inflation Rate (September), Michigan Consumer Sentiment (Final, October).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more