Volatility on global equity markets continued last week amidst various announcements from the Trump administration, big tech earnings and a mixed bag of economic data.

Last week was a busy one in the US political sphere. A budget resolution which could lead to significant spending and tax cuts made it through the House of Representatives, and the next step is approval in the Senate. The White House also drafted a mineral deal with Ukraine which in the end was not signed, and announced a "gold card visa" scheme that would allow wealthy individuals to purchase residency and a pathway to citizenship for $5 million. Then, finally, it was announced that tariffs would be imposed on China, Canada, Mexico and the EU. Because Fentanyl is still pouring into the US, President Trump said his proposed 25% tariffs on Mexican and Canadian imports will go into effect on March 4, along with an additional 10% tariff on Chinese imports. For the EU, tariffs of 25% were promised.

Here on the Continent, following a heated exchange between Presidents Trump and Zelenskiy, European leaders held an emergency meeting to discuss a potential peace deal for Ukraine and agreed that they must spend more on defense. European defense stocks surged on the news.

A well-known tech bellwether delivered its earnings results on Wednesday, and although quarterly revenues had been strong, a tightening of its first-quarter margins was enough to spook investors. Seen as a gauge for the industry, US tech stocks underperformed at the end of the week on concerns that the artificial intelligence rally could be losing steam.

This week, we will see the release of Eurozone inflation and unemployment data, providing some final input before the ECB’s Monetary policy meeting on Thursday. Markets expect the ECB to cut interest rates by 25 basis points, bringing the deposit facility rate to 2.5%. In the US, labour market data could show the first signs of the impact of the Department of Government Efficiency (DOGE) layoffs of federal workers on the labour market. In the first month of the new Trump administration, thousands of federal employees have been laid off in an effort to reduce the size of the federal bureaucracy. According to the Office of Personnel Management, as of February 12, about 75,000 federal employees had accepted deferred resignation offers to leave their jobs in exchange for financial incentives.

Weekly Highlights

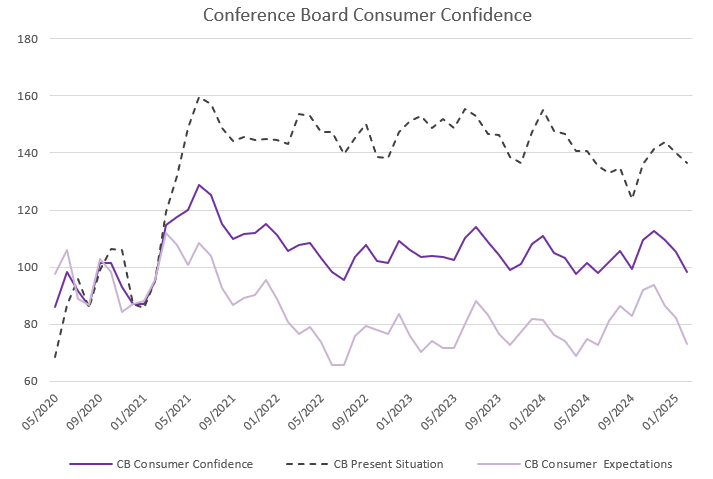

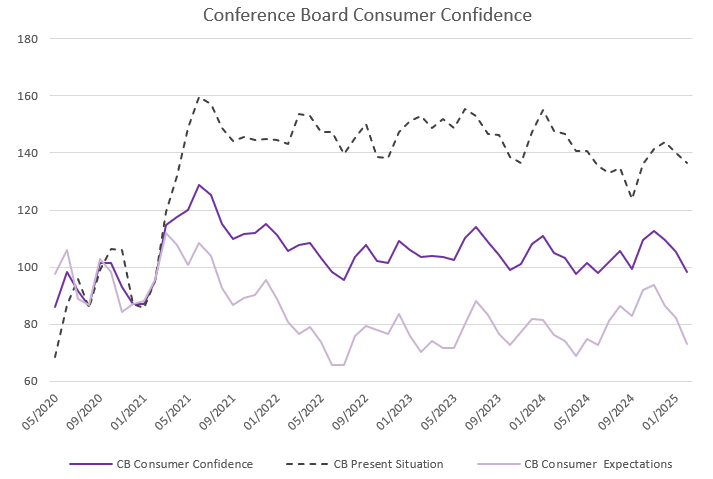

US Consumer Confidence falls by the most since 2021

Source: Bloomberg, BIL

The Conference Board’s Consumer Confidence Index declined for the third consecutive month in February, falling by seven points to 98.3. The decline was broad-based across age groups and income levels, with the expectations sub-index experiencing its sharpest drop in three and a half years, while assessments of present conditions saw a more moderate decrease. Consumers are increasingly concerned about a potential resurgence of inflation, particularly in light of the uncertain impact of new trade tariffs. The recent jump in prices of key household staples like eggs are perpetuating these fears. The share of Americans perceiving job availability as plentiful continued to decline, signaling further softening in the labour market. Meanwhile, the percentage of respondents anticipating a recession within the next year rose to a nine-month high.

Stocks sold off after the data release, with investors becoming increasingly nervous about mounting evidence of a slowing economy, while growing price pressures keep the Fed in a holding pattern. Higher for longer is already causing some pain in the housing sector, where existing home sales contracted in January amid persistently high mortgage rates and high prices.

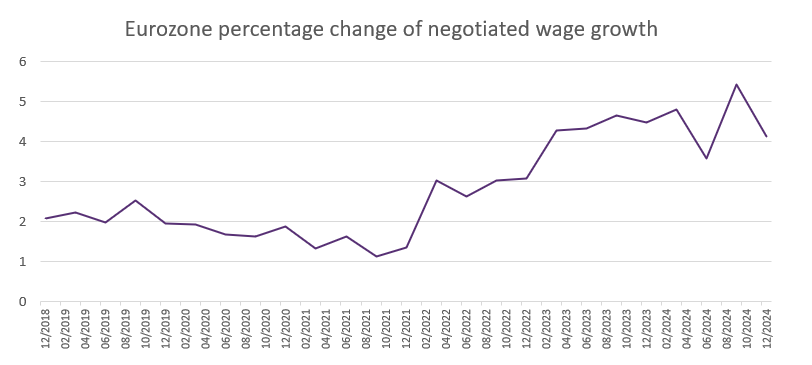

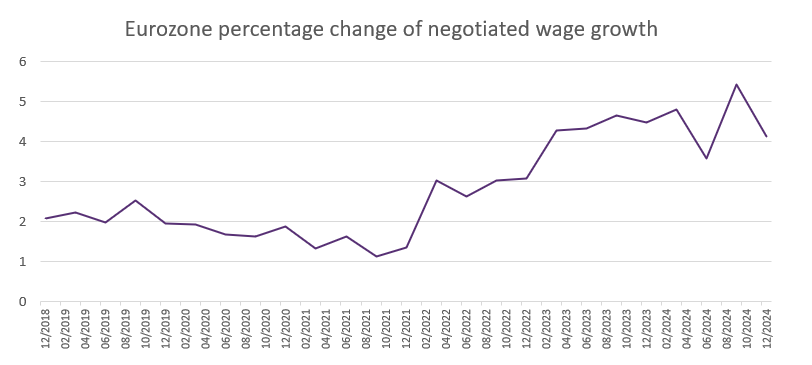

Eurozone negotiated wage growth slowed in Q4 2024

Data released Tuesday showed that negotiated wages in the Euro Area increased by 4.12% YoY in Q4 2024, slowing from the 31-year high of 5.43% recorded in Q3. The data likely provides some relief for ECB policymakers as they try to keep inflation at bay while supporting a weak economy. A mid-February ECB survey indicated that Eurozone firms expect wage growth to slow to 3.6% in 2025 from 4.3% in 2024, before further declining to 2.7% in 2026.

For the full year 2024, negotiated wage growth inched up to 4.48%, marking the highest annual increase since 1993 as households tried to recoup purchasing power lost during the post-Covid inflationary spike.

Source: Bloomberg, BIL

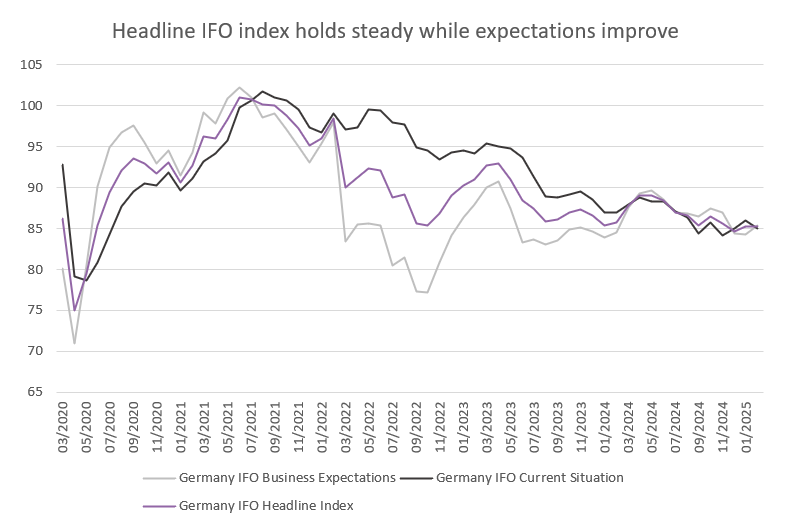

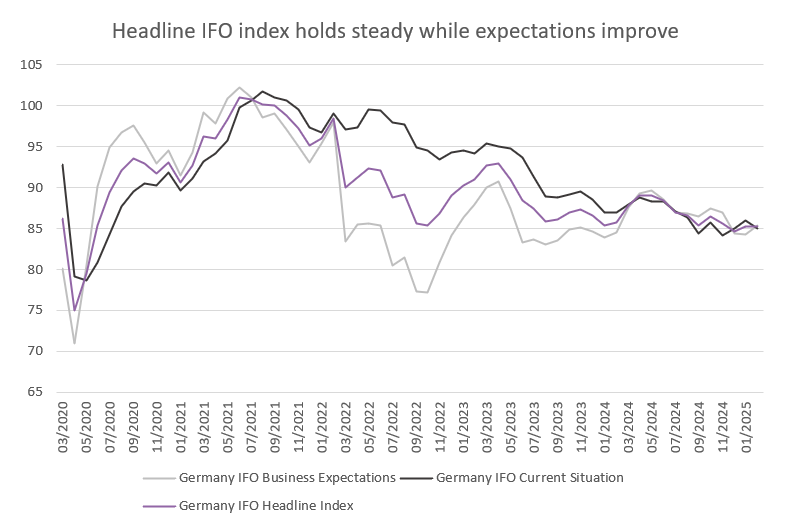

German business expectations continue to slowly improve

The headline IFO index, Germany’s most prominent leading indicator, held steady at 85.2 in February, with companies becoming more optimistic about the future outlook, even if their assessment of the current situation worsened. Across industries, sentiment weakened among service providers, especially those operating in the transport and logistics sector. Sentiment improved among manufacturers, traders and construction firms.

Despite ongoing tariff threats, export expectations improved slightly. Albeit the figure has been in negative territory for almost two years now. Among the handful of sectors expecting international sales to rise are the furniture and beverage industries, and manufacturers of electrical equipment. In the automotive sector, the export outlook has brightened considerably but still remains in negative territory. Manufacturers of machinery and equipment and the chemical industry also continue to expect a slight decline in international sales. Textile and clothing manufacturers are pessimistic about their export business.

Overall, the headline IFO still lingers well below its long-run average of 96.95. The economy is clearly in a waiting mode, to see how things develop under the new government. The parties that form a coalition will have no time to waste in stepping up the country’s defense and restoring its economic dynamism.

Source: Bloomberg, BIL

Switzerland’s economy grew 0.5% in Q4 2024

Swiss GDP adjusted for seasonal, calendar and sporting events grew by 0.9% in 2024 (1.3% in non-seasonally adjusted terms), after ending the year with growth of 0.5% in the fourth quarter. Growth was almost equally driven by industry and services.

In the industrial sector, a large portion of the growth was generated by the chemicals and pharmaceuticals, which contributed to the significant increase in exports in Q4. Within services, the hospitality sector was boosted by a substantial increase in the number of overnight stays. Domestically oriented services also grew, including retail trade, public administration and health and social services. Financial services were flat.

Domestic demand had a positive impact due to above-average growth in private consumption (+0.5% in Q4). Over the year as a whole, foreign trade made a negative contribution to overall growth, as export-oriented companies struggled with the impact of the strong Swiss franc.

Calendar for the week ahead

Monday – Switzerland Manufacturing PMI (February). Eurozone HCOB Manufacturing PMI (February, Final). UK S&P Manufacturing PMI (February, Final). Eurozone Inflation Rate (February, Flash). US S&P Manufacturing PMI (February, Final), ISM Manufacturing PMI (February).

Tuesday – Eurozone Unemployment Rate (January). France Budget Balance (January).

Wednesday – Switzerland Inflation Rate (February). Eurozone HCOB Composite, Services PMI (February, Final), PPI (January). UK S&P Composite, Services PMI (February, Final). US S&P Composite, Services PMI (February, Final), ISM Services PMI (February), Factory Orders (January), Fed Beige Book.

Thursday – Switzerland Unemployment Rate (February). Eurozone HCOB Construction PMI (February), Retail Sales (January), ECB Interest Rate Decision. US Balance of Trade (January), Jobless Claims.

Friday – Germany Factory Orders (January). US Non-Farm Payrolls (February), Unemployment Rate (February).

Saturday – China Inflation Rate (February).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more