Trade talks are moving forward, with a deal between the US and the UK announced last week, while China and the US have agreed to significantly reduce tariffs for the next 90 days. The US will lower tariffs on Chinese goods from 145% to 30%, and China will reduce tariffs on US imports from 125% to 10%. Global markets rose on the announcement of this major de-escalation in the trade war.

After failing to win an initial vote, on the second attempt, Friedrich Merz secured parliament’s backing to become Germany’s chancellor. This decisive vote marks the conclusion of six months of near-gridlock in Germany’s government, a period that ensued after the collapse of former chancellor Olaf Scholz’s coalition in November. The new coalition faces formidable challenges and time is of the essence. The country is projected to experience no growth for a third consecutive year, while economic threats, particularly from US tariffs, are rising. Chancellor Merz and French president Macron published a joint article in Le Figaro pledging to reset ties between the two countries.

A new frontier in geopolitical tensions opened up with India launching a strike on Pakistan. The two sides exchanged attacks before a US-brokered peace deal.

In the bond world, relief was visible on fixed income markets after strong demand for an auction of USD 42 billion in 10-year Treasury bonds.

Weekly Highlights

Fed holds interest rates steady amidst rising economic risks

The Fed kept US interest rates in a range of 4.25% to 4.5% on Wednesday, highlighting growing concerns about the potential impact of President Trump's tariffs on the economy. In particular, the Fed expressed concern about the risks of rising inflation and a weakening labour market. This is the third meeting in a row where interest rates have been kept on hold, and Fed Chairman Jerome Powell has reiterated that the central bank is in no hurry to change its policy stance.

Surveys have shown that both businesses and consumers are concerned about the potential impact of Trump's tariffs on them and their businesses. However, demand has remained relatively robust so far this year. The decision followed stronger-than-expected labor market data, which led markets to push back expectations for the first rate cut this year slightly.

With both ends of its dual mandate at risk, the Fed is likely to remain in a wait-and-see mode until the impact of Trump's tariffs becomes clearer.

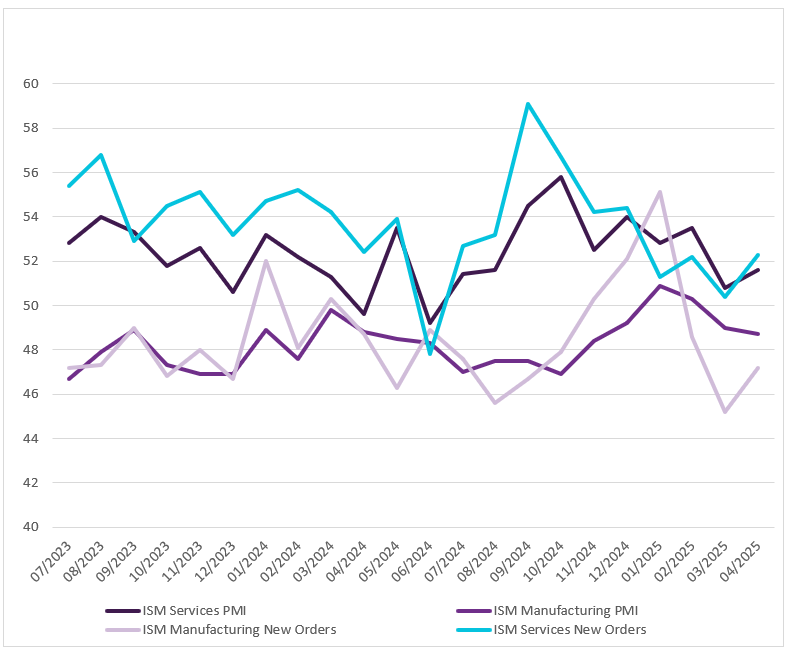

US service sector activity strengthens in April - ISM

Recently released PMI data suggests that for the time being, the US economy is doing alright. The manufacturing index fell slightly (from 49.0 to 48.7), however, that was above economist expectations of 48.0 and new orders declined at a slower pace. A lot now depends on the outcome of trade talks between the US and its counterparts, with the 90-day grace period spanning until early July. Failure to reach common ground with key trading partners could inflict serious economic damage. Companies surveyed said that the uncertainty is already disrupting supply chains, causing shipping delays, complex duties, and frequent changes in cost structures. Price pressures also continue to heat up, leading some companies to report margin pressure.

Things look a little brighter in the services sector, for which the PMI jumped to 51.6 in April from a nine-month low of 50.8. New orders (52.3 vs 50.4) and inventories (53.4 vs 50.3) grew at a faster rate. In another inflationary red flag, however, price pressures jumped to the highest since February 2023. Services sector activity dominates consumer spending by far and the latest ISM PMI suggests it is still expanding. This is a good sign for the economy and indeed, the US dollar strengthened against the euro following the data release.

There is, however, a catch. Until last week, the Trump administration’s tariffs had largely focused on goods. Now, the US President has asked his staff to “immediately begin the process of instituting a 100% tariff” on foreign movies. Details are yet to be released but this implies that services will not be immune from ongoing trade narratives and potential retaliation.

Source: Bloomberg, BIL

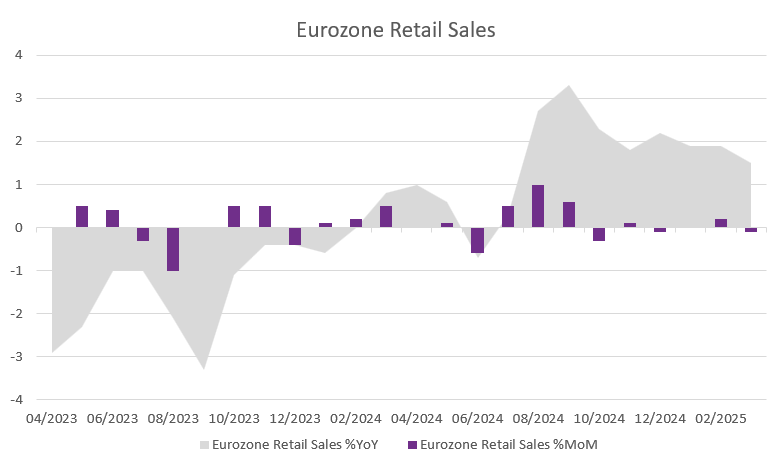

Eurozone retail sales leave much to be desired

2025 was to be the year when consumers in the Eurozone started spending their heaped-up savings. But trade tensions and an ongoing war on its doorstep, are hardly inspiring consumer confidence.

The Eurozone’s Retail Sales increased 1.5% year-over-year in March, down from 1.9% in February, and below market estimates of 1.6%. Month-on-month, Retail Sales in the old continent declined 0.1%.

Source: Bloomberg, BIL

Bank of England cuts rates by 25 basis points

On Thursday, the Bank of England (BoE) cut its key interest rate to 4.25% as it prepares for the impact of Trump's trade policies. The decision was split, with five policymakers in favor of the quarter-point cut, two favoring a larger half-point cut, and two wanting to keep rates on hold.

“Inflationary pressures have continued to ease, so we’ve been able to cut rates again today,” said BoE governor Andrew Bailey, while also noting that the central bank needs to “stick to a gradual and careful approach to further cuts”.

The BoE is expecting Trump’s trade tariffs to have a negative impact economic growth and push down inflation but said that the outlook remains unclear. In its policy meeting minutes, it also said that the impact of trade tensions “should not be overstated”.

The BoE expects the economy to grow by 1% this year, slightly stronger than its February forecast of 0.75%, due to a strong finish to 2024 and robust official data in early 2025.

Later in the day, President Trump announced that a trade deal with the UK had been reached. While a 10% tariff on most goods import will remain, other concessions included in the deal are:

- The UK will be able to export 100,000 cars a year to the US at a 10% tariff, down from 27.5%

- Tariffs on steel and aluminium will fall from 25% to 0%

- The two countries have agreed “reciprocal” market access for beef, with British farmers receiving a tariff-free quota of 13,000 metric tonnes. Stramer has insisted that food safety standards will not change

- The UK will remove the tariff on US ethanol

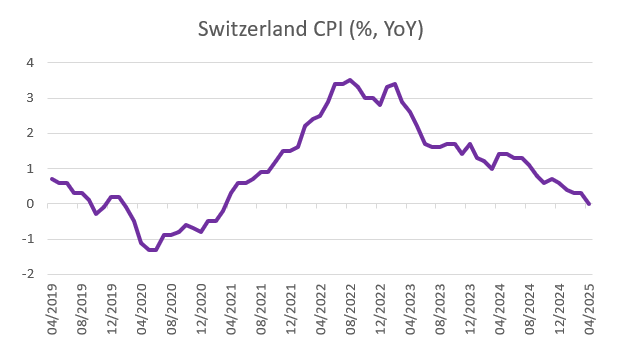

Swiss inflation drops to 0%, as strong franc drives down the costs of imports

Consumer prices in Switzerland were unchanged year-on-year in April, falling short of the expected 0.2% rise. This marks the lowest reading since March 2021, largely driven by the lower cost of imported goods caused by the appreciation of the Swiss franc. The only source of major price growth was housing, with residential rent increases offsetting the falls in the other categories.

Local exporters have long warned that the strong Swiss franc is a threat to their businesses and April saw the franc further appreciating as investors sought a safe haven amidst the trade turmoil unleashed by the announcement of President Trump’s “reciprocal” tariffs.

This puts the Swiss National Bank (SNB) is under renewed pressure to continue lowering interest rates at its next meeting in June to battle the appreciation of the Swiss currency and resulting disinflation. Weaker consumer prices have already led the SNB to lower interest rates to 0.25%, and analysts have anticipated that the central bank will enter negative rates again in 2025.

Last week, SNB Chairman Martin Schlegel said that the central bank is ready to intervene in the foreign currency markets and that it could even cut interest rates even below zero to prevent inflation falling below its price stability target.

Source: Bloomberg, BIL

Calendar for the week ahead

Monday – Japan Eco Watchers Survey.

Tuesday – UK Unemployment Rate. Eurozone and Germany ZEW Economic Sentiment Index. US Inflation.

Wednesday – Germany and Spain Inflation (final, April). OPEC Monthly Report.

Thursday – UK GDP Growth (Preliminary, Q1). France Inflation (final, April). Eurozone GDP Growth (2nd Estimate, Q1). US Retail Sales, Industrial Production, PPI and Weekly Jobless Claims.

Friday – Japan GDP Growth (Preliminary, Q1). France Unemployment Rate (Q1). Italy Inflation (final, April). US Housing Starts and Building Permits and Michigan Consumer Sentiment (Preliminary, May).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 1, 2025

Weekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...