Last week saw a number of central bank meetings, including the highly anticipated interest rate cut by the US Fed. As expected, the Bank of England and the Bank of Japan held rates steady, while the Norwegian central bank surprised markets with a rate cut. This week, it is the turn of Sweden’s Riksbank and the Swiss National Bank to meet and discuss monetary policy.

US stocks hit new record highs last week, as the Fed’s interest rate cut, announcements on artificial intelligence spending and US-Sino trade talk news brought both large and small cap indices higher. With the Fed rate cut coming in as investors had expected, attention quickly turned to signs of further easing in the months ahead, with markets now anticipating a total reduction of 50 basis points by the end of the year. Long-term US Treasury yields increased in response to the Fed's comments, which the markets viewed as somewhat hawkish. The MSCI All Country World Index, which tracks stocks in developed and emerging economies, also rose, boosted by rising shares in Asia.

Macro Snapshot

Europe

The Bank of England (BoE) held interest rates steady at 4% on Thursday, in line with market expectations, as the UK economy struggles with both sticky inflation and meagre growth. The central bank also announced that it would slow its balance sheet reduction efforts, reducing its bond-selling programme from £100bn to £70bn, to curb rising bond yields. The slowdown is the first since 2022 when the BoE began to unwind Gilt holdings and will move sales away from long-dated Gilts to minimise the impact on volatile bond markets. Yields on 30-Year UK Government bonds hit their highest level since 1998 at the start of this month.

The BoE maintained its forecast that inflation will peak at 4% this month after holding steady at 3.8% in August. Consumer price growth in the UK continues to be significantly higher than in the Eurozone, and any other advanced economy. However, in August, services inflation, closely watched by the Bank of England, slowed to 4.7% from 5.0% in July. Core inflation, which excludes volatile categories such as food and energy, also slowed, from 3.8% in July to 3.6%. Despite this, consumers continue to suffer from higher prices, with food inflation rising at the fastest pace since January 2024. Wage growth is also still running hot at 4.7%, well above the 3% level that the Bank of England considers consistent with its 2% inflation target.

In Switzerland, the impact of US trade tariffs is starting to be felt. Seasonally adjusted Swiss exports fell by 1.0% in August compared to the previous month, weighed down by lower sales of watches and jewellery. Exports to the US fell to their lowest level since late 2020, dropping by 22.1% immediately after 39% tariffs on Swiss goods came into effect. Gold exports were hit particularly hard, falling by a hefty 99% in August, as uncertainty over whether “reciprocal” tariffs applied to the precious metal caused exports to nearly grind to a halt. It was later clarified that the 39% tariff would not apply to gold, however, that exemption was only formalised in early September. With high tariffs threatening several pillars of the Swiss economy, August's trade data also showed the country diversifying its export markets. Germany overtook the US to become Switzerland's largest export market.

US

Amid growing concerns about the weakening labour market, the Federal Reserve cut interest rates by 25 basis points on Wednesday. As market participants had anticipated, the federal funds target range was lowered to 4–4.25%, with signals that more easing lies ahead. According to the projections released on Wednesday, the majority of committee members anticipate at least two more quarter-point cuts by the end of the year.

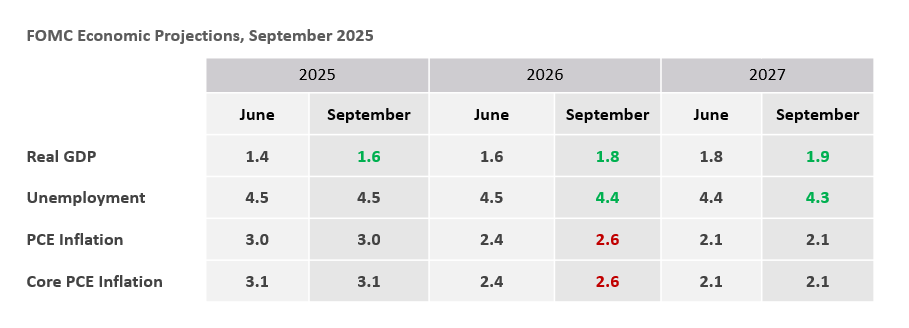

The US central bank has remained on hold since December last year while waiting to see the impact of President Trump’s trade tariffs on inflation. Meanwhile, cracks have started to appear in the labour market, prompting the Fed to cut rates to support the economy. “The labour market has softened. The case for there being a persistent inflation outbreak is less,” said Fed chair Jerome Powell at the press conference. The Fed also released its updated economic projections, showing that growth expectations have been revised upwards, and that the unemployment rate is expected to fall in 2026 and 2027, presumably with a fall in the labour supply acting as a factor amid immigration crackdowns. Expectations for inflation this year were left unchanged but were revised up for 2026.

Source: Fed, BIL

Markets were largely unmoved on the decision, as the outcome met expectations and provided little real guidance on what is to come. The most surprising outcome of the meeting was perhaps that only one committee member voted for a 50-basis-point cut rather than a 25-basis-point cut. While the decision was in line with market expectations of Fed easing in 2025, investors may be slightly over-optimistic about the extent of further easing in 2026, with Powell saying that the Fed “will continue to determine the appropriate stance of monetary policy based on the incoming data, the evolving outlook, and the balance of risks.” The fact that the word “solid” was dropped from the language describing the labour market, and the acknowledgement of downside risks to employment tell us where the balance of risks has shifted.

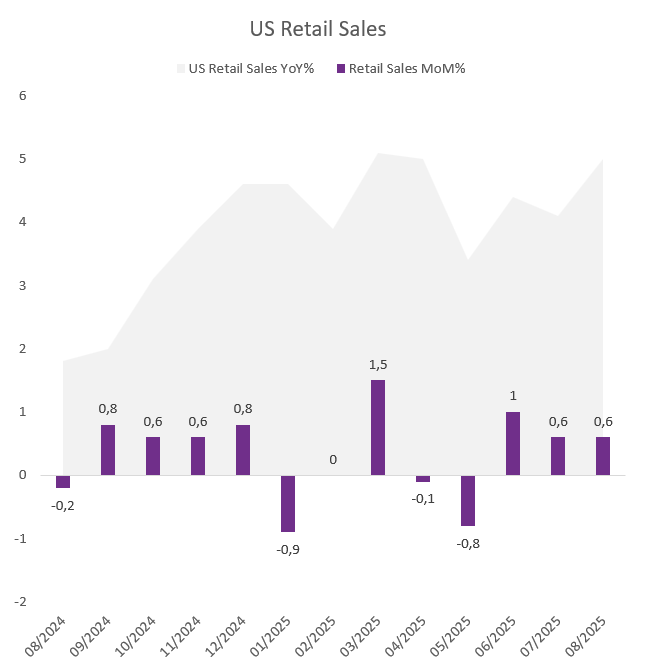

Despite this, consumption has held up – at least on the surface. Last week, we had another strong retail sales print, posting a 0.6% month-on-month gain, versus 0.2% expected. Spending was up across most categories. While back-to-school shopping was a factor, it is clear that a two-speed economy continues to take hold in the US, with the top 10% of earners driving the bulk of spending, driven in part by the wealth effect (with their perceived wealth boosted by rising stock markets and home prices).

Underlying weaknesses are therefore less apparent in the hard data. Soft data, on the other hand, shows weakening confidence, while anecdotal data suggests shoppers are “trading down”, trying to stretch their dollars further and seeking out good deals.

Data last week, also suggested that the housing market is increasingly strained by high rates. Housing starts tumbled 8.5% MoM in August to reach a near 2-1/2-year lows amid an inventory bloat. The NAHB survey reveals builder confidence remained low in September, but lower mortgage rates and expectations for a Fed rate cut helped push future sales expectations to their highest level in six months. In September, current sales remained at their lowest level since 2012, and buyer traffic inched lower.

All things considered, Fed Chair Powell’s characterization of the latest rate reduction as an “insurance” cut looks questionable and we, like markets, expect more cuts ahead this year.

Source: Bloomberg, BIL

Asia

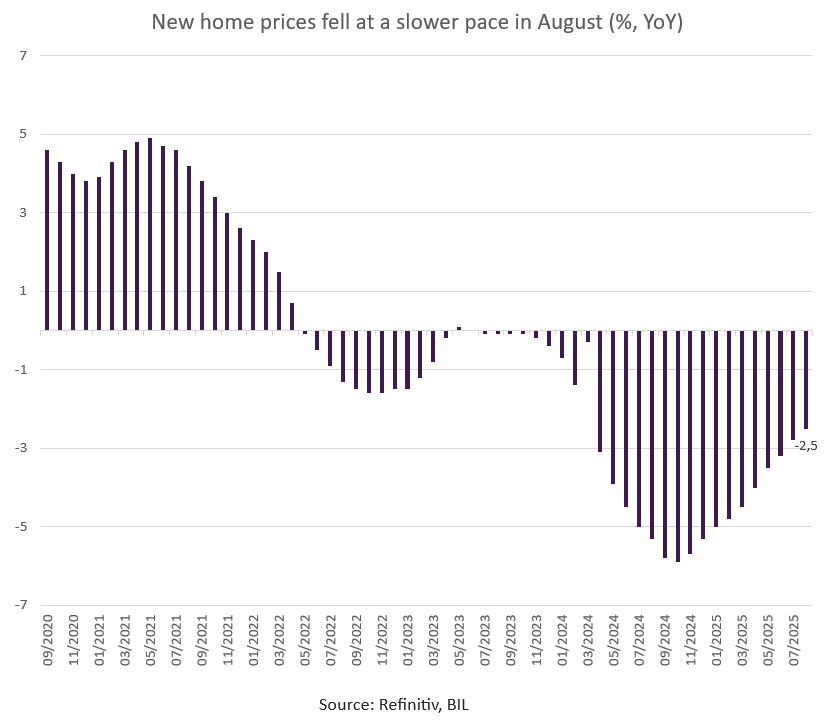

China’s new home prices dropped by 2.5% year-on-year in August, easing from a 2.8% drop in July. Of the 70 cities surveyed, 65 recorded falls in prices over the same period. Prices continued to fall in major cities such as Beijing (-3.5%), Guangzhou (-4.3%), Shenzhen (-2.7%) and Chongqing (-2.4%), while Shanghai was an exception, with prices rising by 5.9%. Over the past few weeks, Shanghai and Shenzhen have further relaxed homebuying restrictions, completely removing them in some districts.

China has been struggling with a real estate downturn since 2021. With many Chinese people having much of their wealth tied up in their properties, falling prices have dampened consumer confidence. Although the authorities have introduced several measures to boost consumption and prop up the real estate market, market participants are still hoping for stronger measures to stabilise the housing sector.

Calendar for the week ahead

Monday – Eurozone Consumer Confidence (Flash, September).

Tuesday – Eurozone, Germany, UK, US Manufacturing, Services & Composite PMI (Flash, September). Sweden Riksbank Rate Decision.

Wednesday – Japan Manufacturing, Services & Composite PMI (Flash, September). Germany Ifo Business Climate (September). Switzerland Economic Sentiment (September). US New Home Sales (August).

Thursday – EU New Car Registrations (August). Germany Consumer Confidence (October). France Consumer Confidence (September). SNB Interest Rate Decision. US Jobless Claims.

Friday – Italy Consumer Confidence (September). US Michigan Consumer Sentiment (Final, September).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 2, 2025

NewsFrance & Italy: Roles in reverse?

Concerns are rising about France’s ability to reduce its debt burden amid political instability and debt rating downgrades. Meanwhile, Italy has made progress in reducing...

September 15, 2025

Weekly InsightsWeekly Investment Insights

US equity markets locked in on monetary policy last week, pushing major indices higher on hopes that the Fed will cut interest rates by...

September 15, 2025

NewsChina’s stock market rally: Green sho...

Chinese stocks have rallied, despite a struggling economy Much of the gains appear to be driven by domestic institutional investors, potentially reducing bubble risk Some...

September 5, 2025

Weekly InsightsWeekly Investment Insights

Bond markets are back in the spotlight. After a period of calm, concerns about record borrowing among developed economies have resurfaced. The wake-up...