Last week, the US government went into shutdown after the Republicans and Democrats failed to come to an agreement to fund the federal government. Without funding, federal agencies could end up having to furlough around 750 000 workers, and scale back public services, costing the economy billions of dollars of lost output. The shutdown also makes it more difficult to track the state of the economy, as several key economic reports will be delayed. US equities and the dollar fell on the news, with equities recovering towards the end of the week, finishing in the green, while gold reached a new high. US Treasury yields weakened on disappointing private employment data and weaker-than-expected consumer confidence.

In Europe, equities neared record levels as technology stocks rallied and expectations for lower US interest rates boosted sentiment.

Japanese stocks started this week on a record high as the “Takaichi trade” started to take hold. The Nikkei 225 index and the broader Topix share index rose on Mondy in response to the election of Sanae Takaichi as the leader of the ruling Liberal Democratic party (LDP). Meanwhile, the Japanese yen weakened against the US dollar. Takaichi’s victory means that she is on track to become Japan’s first female prime minister in a vote scheduled for late-October. Market participants anticipate increased fiscal spending and looser monetary policy under the new Takaichi-led administration.

In France, Prime Minister Lecornu resigned less than a month after having been appointed, making him the shortest-serving prime minister in the Fifth Republic, which was established in 1958. This was after allies in the centre-right Les Républicains party indicated that they would withdraw from the government over the number of ministers from Macron’s Renaissance party that Lecornu planned to include. French equities fell on the news, while yields on 10-year government bonds rose. The euro also fell amid growing concerns about the outlook for the eurozone’s second-biggest economy.

Macro Snapshot

Europe

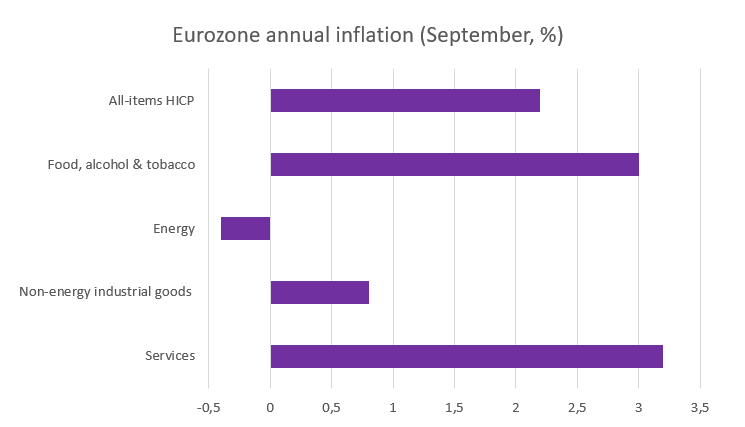

According to flash estimates, consumer prices in the Eurozone rose slightly, to 2.2% year-on-year in September, up from 2% in August. The increase was mainly driven by higher prices for services and food, alcohol and tobacco. It marked the first rise above the ECB’s 2% inflation target since April and was in line with analyst expectations. The slight increase in the annual inflation rate is unlikely to cause major concern for the central bank, which expects inflation to fall to 1.7% next year and remain below the target level throughout 2027.

Core inflation, which excludes volatile categories such as food and energy, remained at 2.3%, despite the increase in services inflation.

Source: Eurostat, BIL

This latest release reaffirms expectations that the ECB will hold interest rates steady at 2% for the third meeting in a row at the end of this month. Earlier in the week, ECB president Christine Lagarde said that the Eurozone inflation risk is “quite contained”.

US

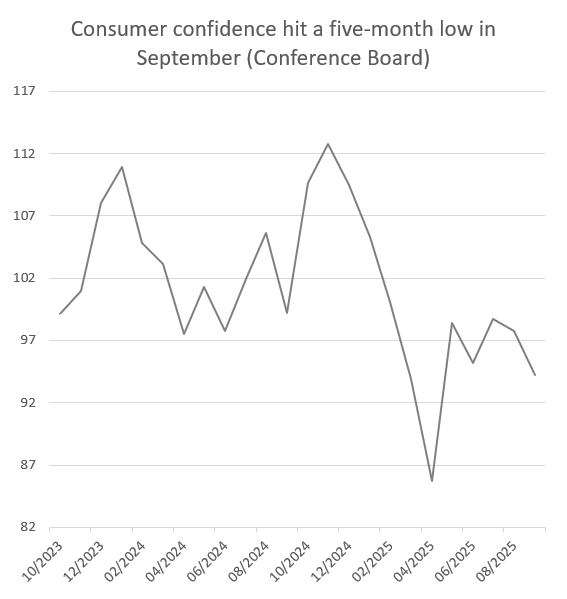

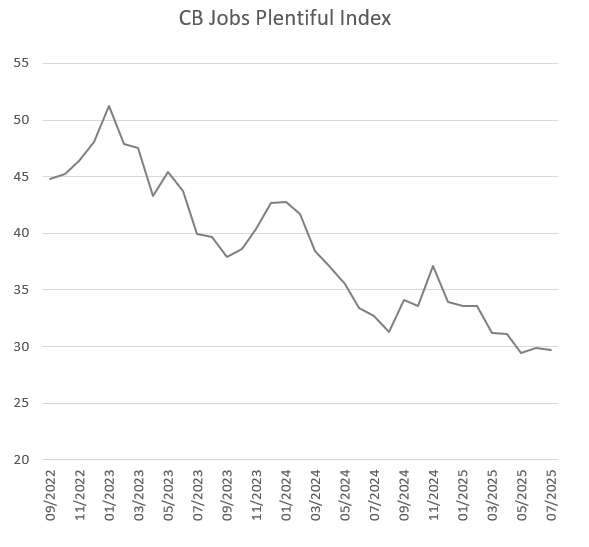

US job openings saw a slight increase in August according to the JOLTs report, but hiring declined during the same period. Consumers are also growing more pessimistic about the labour market and job availability. The Conference Board September survey showed that the share of consumers viewing jobs as “plentiful” fell to the lowest level since early 2021.

Source: Bloomberg, BIL

In August, there were 0.98 job openings for every unemployed person, down from 1.0 in July. The labour market has significantly slowed in recent months, driven by reduced demand for workers due to uncertainty surrounding tariff policies and the growing adoption of artificial intelligence. Additionally, US immigration policies have limited labour supply. Despite a decrease in layoffs, as employers are holding onto their workforce, weak hiring trends could make it more challenging for those who lose their jobs to find new ones.

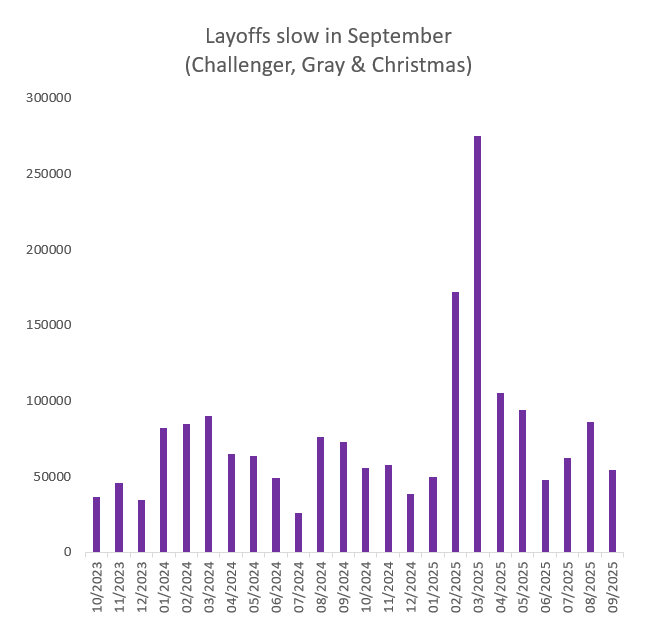

The Challenger Job Cuts survey supports the idea that employers are retaining their employees, as US companies announced the fewest job cuts in three months in September. Job cuts fell to 54,064 compared to 85,979 in August. However, when looking at the year as a whole, companies have announced the highest number of layoffs since the pandemic began. This increase is largely attributed to significant layoffs among federal workers, particularly by the Department of Government Efficiency (DOGE). This trend may accelerate in the coming weeks if the government shutdown persists, with the potential for federal workers to be fired rather than furloughed, as indicated by President Trump's warnings.

Source: Bloomberg, BIL

The Bureau of Labor Statistics was due to release its monthly jobs report on Friday; however, this has been postponed due to the federal government shutdown. This report is an important indicator of the state of the labour market and is closely monitored by analysts and the Fed. With official data reports suspended during the shutdown, investors are turning to private employment data, such as the ADP National Employment Report, to fill the gap. According to ADP, private employers in the US cut the most jobs in two and a half years in September. Although the ADP report is not usually the most closely watched labour market report, the Fed will have to find alternative sources in the absence of official data, and markets will be watching closely to see what data the Fed will rely on for its October interest rate decision.

Asia

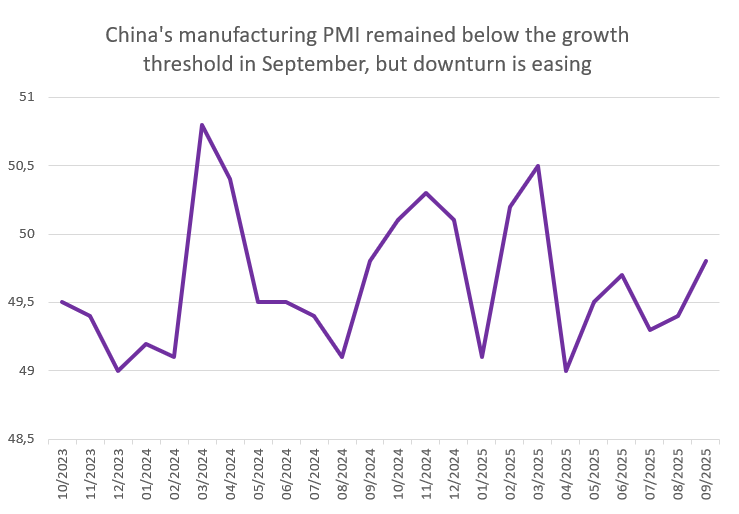

China’s factory activity contracted for the sixth straight month in September, according to the National Bureau of Statistics. The manufacturing PMI rose to 49.8 in September, from 49.4 the month prior. Although it continues to be below the growth threshold of 50, the pace of decline was the slowest since before US President Trump announced his “reciprocal” tariffs in April this year. Output grew at the strongest pace since March, and buying levels rose. Meanwhile, new orders, foreign sales and employment continued to decrease, albeit at a softer pace. The improvement comes as manufacturers anticipate more policy support from the government following the October plenum, during which the communist party will meet to map out the country’s social and economic development over the next five years.

Source: Bloomberg, BIL

Calendar for the week ahead

Monday – Switzerland Unemployment Rate (September). Eurozone Retail Sales (August).

Tuesday – Germany Factory Orders (August). US Balance of Trade (August).

Wednesday – Germany Industrial Production (August).

Thursday – Germany Balance of Trade (August). US Jobless Claims.

Friday – Switzerland Consumer Confidence (September). US Michigan Consumer Sentiment (Prel, October).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 1, 2025

Weekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...