Waters have been increasingly choppy since President Trump announced his “reciprocal” tariffs on April 2. In the week following the announcement, more than USD 5 trillion was wiped off the S&P 500, the Nasdaq saw a 20% correction, oil prices fell below USD 60 per barrel and the USD fell sharply. Now, central banks and companies around the world have gone into a wait-and-see mode as they try to determine the impact of the tariff announcements.

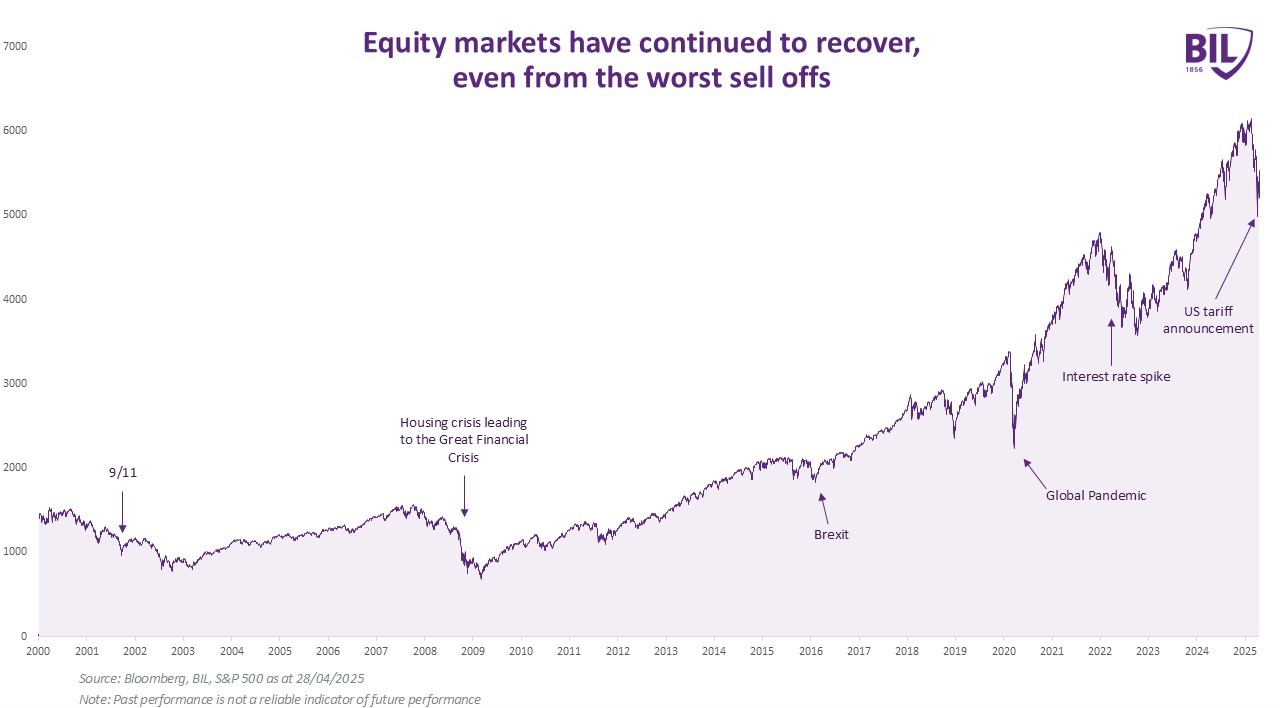

The many comments and announcements by the US administration continue to create big waves in the markets, leaving investors uncertain about what is to come. To put the recent volatility in perspective, we have to look at the big picture:

Market selloffs create a lot of uncertainty, but history demonstrates that stock markets continue to recover, time and time again. Although it is too early to say whether we have reached the so-called bottom of this correction, we do not expect this to be an exception.

Corporate earnings have, so far, beaten expectations and President Trump has already begun to soften his stance on certain tariffs, announcing exemptions for certain sectors and products. Most recently, Trump significantly adjusted his comments on the trade conflict with China, saying that the world's two largest economies would soon be able to reach a deal. The prospect of a softer stance on tariffs alone is a relief to markets, and it appears that tariffs may be a negotiating tactic after all. While the latest announcements have brought some calm to markets, we expect volatility to persist in the coming months. The tariffs which have already been implemented, and the uncertainty around others, will be negative for economies around the world.

The Macro Landscape

US

Growth expectations for many of the world's largest economies have been revised downwards due to the impact of President Trump's trade tariffs and heightened uncertainty, and the US is no exception. The International Monetary Fund now expects the US economy to grow by 1.8% in 2025, down from its January estimate of 2.7%, all because of the expected impact of tariffs. Consumers, long the engine of US exceptionalism, have brought forward spending to beat the implementation of tariffs. Auto sales in particular picked up in March as Americans rushed to buy the foreign and domestic made cars that will become much more expensive as the tariff pain hits the assembly lines. However, consumer spending is expected to taper off from here as inflation concerns weigh on confidence and wage growth begins to slow, meaning that other areas of the US economy will have to take the wheel to drive growth. There is still hope that business-friendly policies will catalyse an upturn in the corporate sector, supporting economic activity - and employment momentum - in the months ahead. For the time being, we are still waiting for these policies to materialise.

While the US economy is expected to slow as a result of the tariffs, we do not expect this to lead to a US recession this year. Hard data remains relatively robust. Economic activity continues to expand. Although the services sector grew at a slower pace in April than in the previous month, the expansion in the manufacturing sector picked up pace. Inflation cooled to a six-month low of 2.4% in March. The fact that underlying inflation is cooling ahead of tariffs may be a reassuring sign for the Fed, which is expected to keep rates on hold while it assesses the impact of tariffs on the inflation outlook.

Europe

Sailing across the Atlantic, optimism about an economic recovery in Europe seems to be floating further away on the horizon. Despite recent optimism about the potential impact of Germany's abandonment of the black zero debt brake, increased defence spending and a potential ceasefire in Ukraine, the recent market correction has served as a reminder that the lack of structural growth drivers in Europe persists and that tariffs have made the uphill battle of a European recovery even steeper. In Germany alone, exports to the US account for 3.7% of GDP, making the potential hit to growth from tariffs significant. Both the IMF and the German government now expect that the Eurozone’s largest economy will see a third year with no growth. Without its former “growth locomotive”, the eurozone recovery is fragile and PMIs suggest the bloc is edging back into stagnation territory. The ECB continued its rate cutting cycle in April, bringing the deposit facility rate to 2.25%, and markets expect two to three more 25 basis point cuts this year to support the economy.

China

In China, the economy surprised on the upside at the start of the year, expanding more than expected in Q1, driven by industrial production and exports. However, much of the growth has been attributed to manufacturers frontloading exports to beat tariffs. Factories are already seeing signs of the impact that US tariffs will have on Chinese production, with several factories pausing production and putting employees on temporary leave as they try to assess the impact on their businesses. The challenges that China has faced in recent years, including a lack of domestic demand, the property slump and disinflation risks, remain.

Investment Strategy

Jumping ship in the middle of a storm is never advisable. Being a long-term investor means holding on to your oars, making small adjustments to ensure that the big waves don't push you off course, and making the best of the volatility that the stormy conditions create.

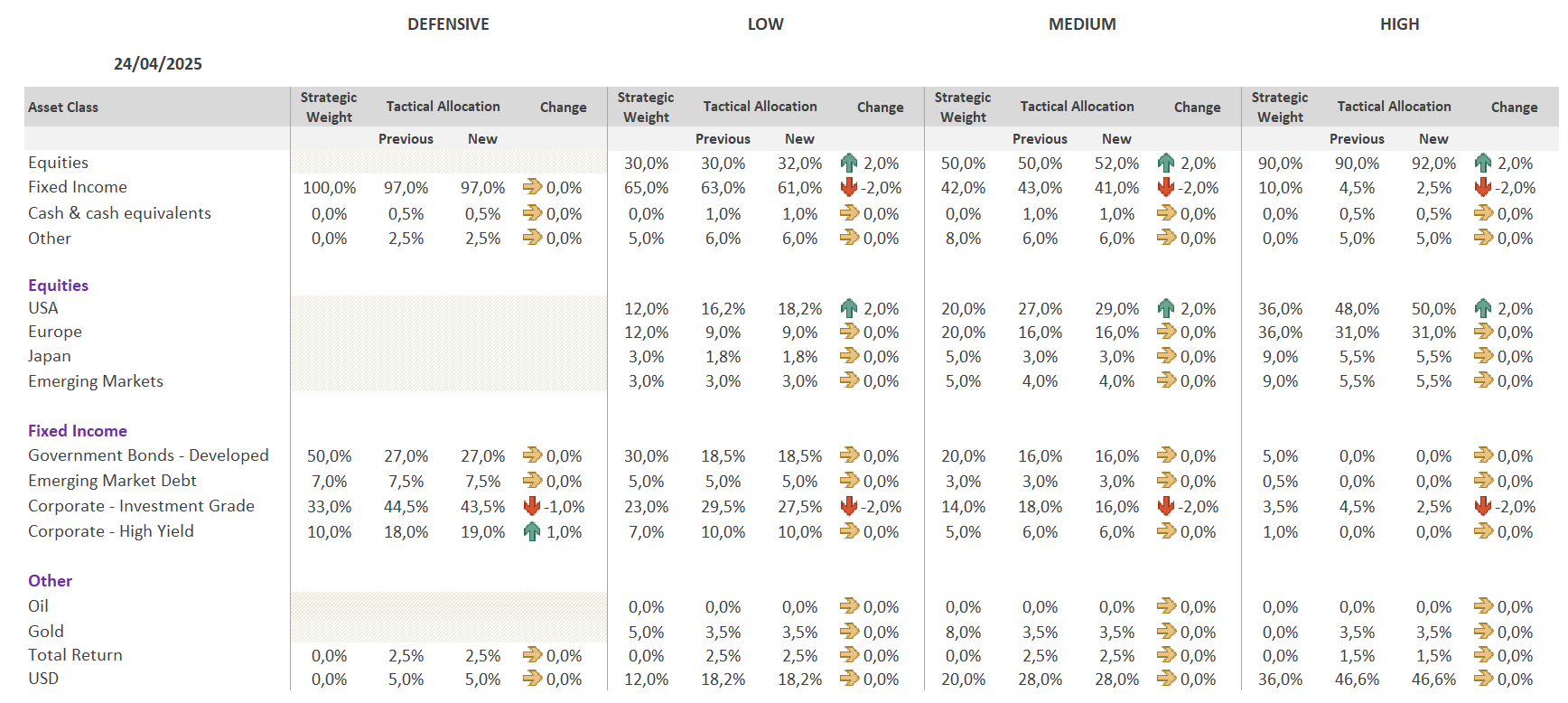

Within our equity exposure, we maintain a preference for the US and actually increased our exposure by 2% each in all eligible risk profiles this month. Although tariffs are expected to slow the economy, a US recession is not part of our base case. With this in mind, we feel comfortable allocating to the US following the market drift that has watered down some of our exposure. Although the pro-business policies that were part of President Trump's campaign have yet to materialise, the US House of Representatives passed Trump's budget in April, which includes trillions of dollars in cuts to both taxes and government spending. While there are still steps to be taken before the bill is signed into law, if implemented it could have a positive impact on US companies. If President Trump stays the course and continues withdrawing from the global trade system, the key beneficiaries of globalization – i.e. large American corporates, will suffer. However, we also have to consider an alternative scenario whereby Trump actually boosts globalization as other countries lower trade barriers to appease him.

The purchase of US equities was EUR-hedged in order to protect against FX volatility in the coming months, with downward pressure on the dollar still evident. The trade was financed by the proceeds from the sale of the equivalent weight of floaters in each profile, as we think carry will continue to be eroded as the ECB cuts rates.

We are also benefiting from a larger allocation to European equities due to the market drift.

In the Fixed Income space, investment grade remains the cornerstone of our exposure, complimented by high-yield to boost income. This month, we increased our exposure to CoCo bonds in Defensive profiles by 1%, financed by the sale of floaters. CoCo bonds offer a nice pick-up with better risk dynamics, being a niche section of the high-yield market associated with quality issuers.

Staying the course

While market corrections can be unsettling, history reminds us that resilience is a hallmark of equity markets, which have recovered from even the worst crashes. The key to compounding wealth over time is to remain invested, if your risk tolerance and liquidity situation allows. Market volatility can also provide opportunities for long-term investors to add exposure at more attractive entry points, as evidenced by our recent opportunistic addition of US equities. As there is still a lot of uncertainty around US trade policy and announcements continue to rattle the markets, we are sticking to our long-term convictions rather than making knee-jerk changes based on the everchanging newsflow.

Written by Lionel De Broux & Johanna Lindberg

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 1, 2025

Weekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...