Spring has sprung and as the green leaves return to the trees around us, so too did the green on our Bloomberg screens at the end of last week. Both the Nasdaq and the S&P 500 recovered the losses that they had endured in the aftermath of "Liberation Day" when the US announced broad tariffs on friends and foes alike. Market sentiment continues to be driven by the narrative on tariffs and the softer tones on trade thus boosted risk assets. Last week, Trump announced that automakers would be exempt from some of his steepest tariffs. He also seems to have pivoted away from a full-blown trade war with China, saying that the two countries would soon be able to reach an agreement. China too expressed that it was open for dialogue, and is also exploring ways to crack down on the Fentanyl trade – a key bone of contention with Trump. Bloomberg reported that China had quietly started to exempt certain products from the tariffs in an attempt to soften the tariff blow for its own domestic companies. Better than expected US jobs data and earnings also helped to push equities higher.

Today, oil prices slumped after Opec+ decided to increase production for the second month in a row, leading to renewed concerns of an oversupplied global market. Later this week, the US is expected to finalise some initial trade deals with countries such as India, and the Federal Reserve will meet on Wednesday to decide on the path of interest rates, which markets expect will be held steady for now.

Weekly Highlights

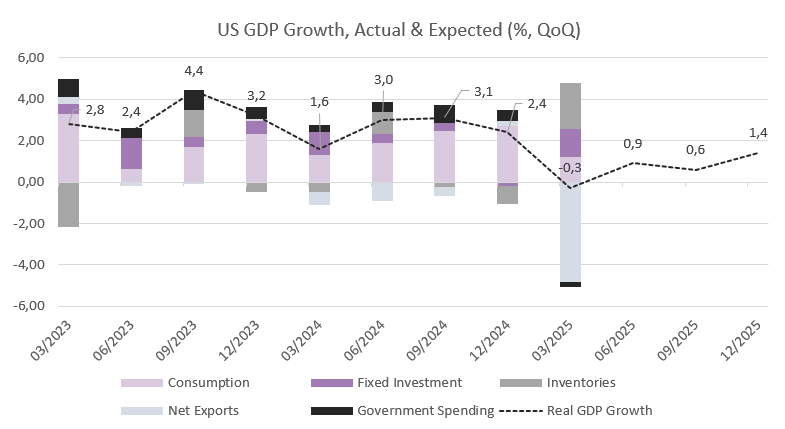

US economy contracts in Q1 as imports surge

In the first three months of the year, the US economy contracted by 0.3% year-on-year, following a 2.4% expansion the prior quarter. This was the first decline since early 2022, and it was primarily driven by a surge in imports, skewing net trade. American companies spent the first quarter stockpiling in anticipation of President Trump’s trade tariffs, with imports rising 41.3%, leading to a record trade deficit.

Source: Bloomberg, BIL

Consumer spending growth also cooled to 1.8%, the slowest pace since Q2 2023, while federal government expenditures fell 5.1%, the steepest drop since Q1 2022.

On the other hand, fixed investment surged 7.8%, the most since Q2 2023. Growth in the equipment and inventories component was particularly strong, as companies prepared for potential tariff impacts.

Looking ahead, economists are concerned about the potential for a recession if trade tensions persist and consumer confidence continues to wane. According to consensus expectations compiled by Bloomberg, the probability of a recession within the next twelve months is seen at 40%. The Federal Reserve faces the challenge of balancing inflation control with supporting economic growth.

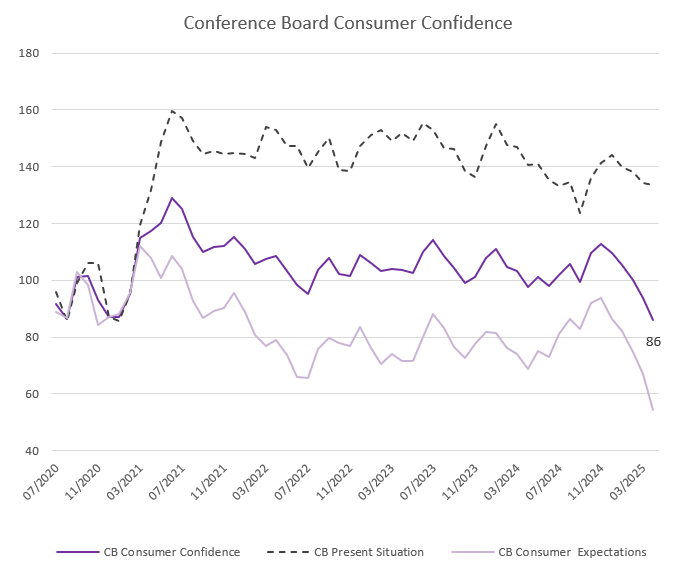

US Consumer Confidence Hits 5-Year Low Amid Economic Uncertainty

As the Trump administration approaches its 100th day in power, various surveys and polls continue to show growing pessimism among US consumers.

On Wednesday, Conference Board data showed consumer confidence tumbled in April to its lowest level since May 2020, as growing concerns over tariffs and the broader economic outlook weighed heavily on sentiment. Its headline index fell sharply by 7.9 points to 86.0—well below economists’ expectations.

The decline was particularly steep for the Expectations Index, which gauges consumers’ short-term views on income, business, and labour conditions. That index dropped 12.5 points to 54.4, its lowest level since October 2011 and far beneath the 80-point threshold typically seen as a warning sign of potential recession.

This marks the fifth consecutive month of declining confidence, with write-in survey responses pointing to tariffs as the top concern.

While past dips in sentiment haven’t always translated to reduced consumer spending, economists and Fed officials are watching closely. Consumer activity drives nearly 70% of the U.S. economy, and any pullback could have significant ripple effects.

Richmond Fed President Thomas Barkin recently noted, “Consumer sentiment has dropped… and consumers seem more worried about inflation and job security.”

Still, Treasury Secretary Scott Bessent is keeping an optimistic tone and recently told reporters, “we’ve got three legs to the president’s economic agenda: trade, tax and deregulation, and we hope that we can have this tax portion done by Fourth of July.”

Source: Bloomberg, BIL

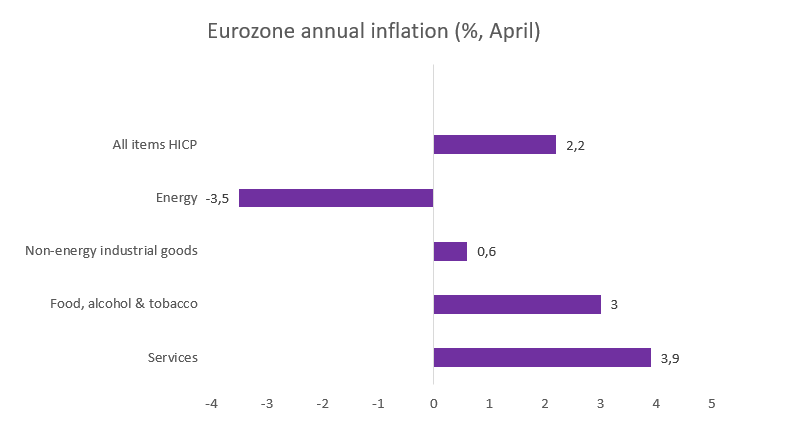

Eurozone Q1 growth beats expectations and inflation rate holds steady

According to flash estimates, the eurozone economy grew by 0.4% in the first quarter of the year, ahead of President Trump's tariff announcement in early April. This suggests a stronger-than-expected start to the year, although growth for the rest of the year is expected to be hit by tariffs.

Business confidence has deteriorated sharply in recent weeks as firms struggle to plan ahead amidst an ever-changing stream of tariff announcements. Although Trump's "reciprocal" tariffs have been delayed for 90 days, the continued uncertainty over which tariffs will be implemented and/or left in place will weigh on growth this year.

Looking to price pressures, the headline inflation rate held steady at 2.2% in April, according to preliminary estimates. Slightly above expectations, the inflation rate remains just above the ECB’s 2% inflation target. Energy prices fell sharply (-3.5% vs. -1.0% in March) but the fall was offset by faster inflation in services (3.9% vs. 3.5%) and food, alcohol, and tobacco (3.0% vs. 2.9%). Prices for non-energy industrial goods rose by 0.6%, unchanged from March. A pick-up in services inflation was largely expected given the later Easter holidays and it should reverse in May.

Core inflation, which excludes volatile categories such as food and energy, climbed to 2.7%, up from March’s three-year low of 2.4%.

Source: Eurostat, BIL

Despite an upside surprise in Q1 growth, and slightly higher-than-expected inflation, markets still expect the ECB to continue its rate cutting cycle in June. Slower growth amid global trade disruptions, a stronger euro and falling energy costs are all expected to tame price pressures in the coming months. The euro was flat at immediately after the inflation data.

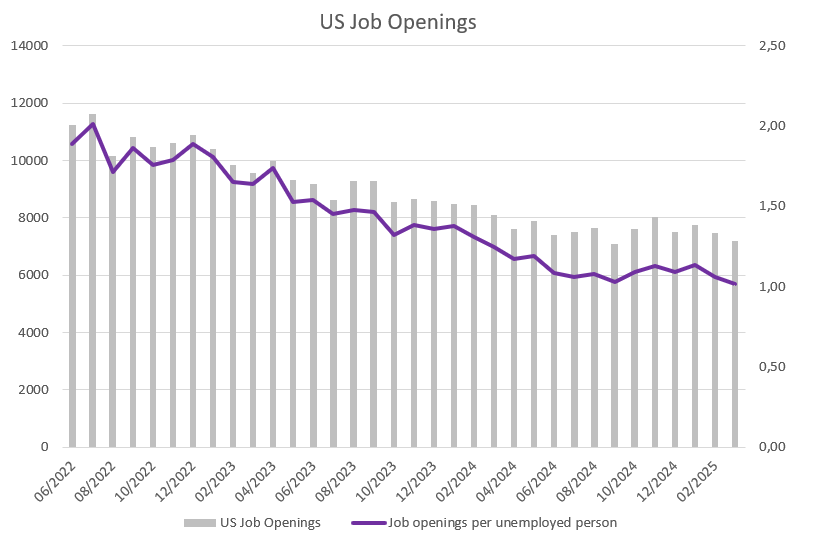

Data suggests US labour market is cooling only gradually…

Stocks gained and Treasury yields moved higher last week after reassuring labour market data which helped keep recession fears at bay.

On Wednesday, we learnt that US job openings fell to a lower-than-expected 7.2 million in March. This figure is the lowest observed in six months and the decline was broad-based. The largest decreases, however, were reported for transportation, warehousing, and utilities (-59K). Job openings increased in finance, other services and in education.

While the headline job openings number was underwhelming, the details of the JOLTs report still pointed to a labour market that is cooling only gradually. Hires held at 5.4 million and the quits rate rose from 2.0 to 2.1%. If quits were to decline, it would indicate that people are losing confidence in their ability to find a new position. Total layoffs and discharges fell slightly, and the layoff rate remained largely unchanged at 1%.

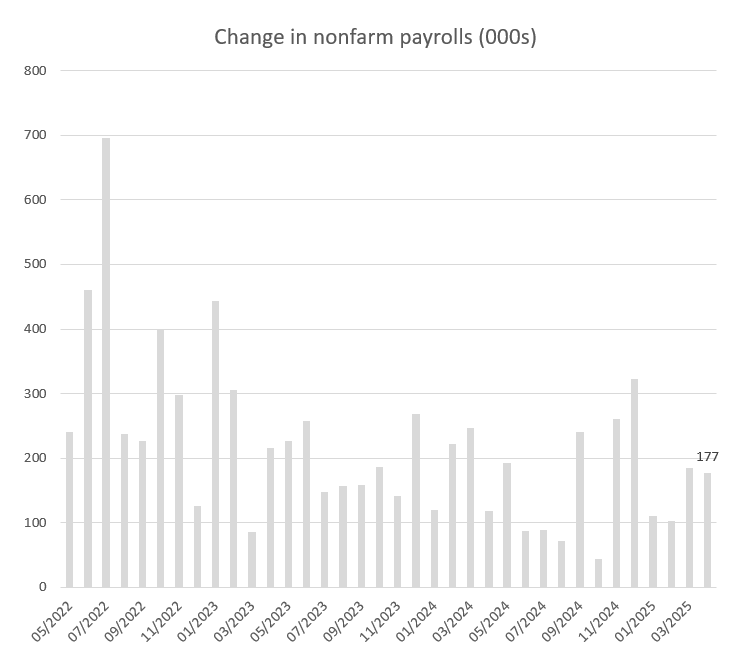

Then, on Friday, we learnt that the US economy added 177k jobs in March, far above expectations of 130k. This figure is comfortably above the average monthly gain of 152k over the past 12 months, despite growing uncertainty surrounding tariff policies

Hiring was particularly strong in healthcare and in the transportation and warehousing sector, Federal government employment, which has been closely watched given DOGE initiatives, fell by 9,000. Total government employment, which includes state and local hiring, rose by 10,000 last month.

Average Hourly Earnings grew 0.2% on the month (3.8% YoY), while the unemployment rate held at 4.2%.

To keep in mind, the hard data is yet to include the impact of tariffs which were announced on 2 April. The outlook from here is marred by growing concerns around US trade policy and tariffs. Combined with cuts to both federal employment and spending, as well as tighter immigration policy, we see potential for some deterioration in job market dynamics in the months to come. Insofar as now, however, weekly Jobless Claims data gives no cause for concern.

Source: BLS, Bloomberg, BIL

Source: Bloomberg, BIL

Calendar for the week ahead

Monday – Switzerland Inflation (April). US S&P Composite & Services PMI (April, Final), ISM Services PMI (April).

Tuesday – China Caixin Services & Composite PMI (April). Switzerland Unemployment Rate (April). Eurozone Composite & Services PMI (April, Final). UK S&P Composite & Services PMI (April, Final). US Balance of Trade (March).

Wednesday – Germany Factory Orders (March). Eurozone Retail Sales (March). Fed Interest Rate Decision.

Thursday – Bank of England Interest Rate Decision. US Jobless Claims.

Friday – China Balance of Trade (April). UK Industrial Production (March). Switzerland Consumer Confidence (April).

Saturday – China Inflation Rate (April).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 1, 2025

Weekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...