The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies met in London to continue negotiations. However, concerns rose again later in the week when President Trump told reporters that he would be sending letters to trading partners with new tariff rates within the next couple of weeks. On Thursday, the dollar fell to its lowest level in three years as ongoing policy uncertainty continued to put pressure on the currency.

At the end of the week, stocks fell, and energy prices jumped as Israel and Iran launched a series of aerial strikes on each other. Oil prices rose by the most in more than three years, as the escalating conflict raised concerns about the security of supply. The safe-haven gold, as well as other metals such as silver and platinum, all strengthened. The US dollar also got some temporary reprieve.

Central banks will be in the spotlight this week, with meetings being held in Japan, Sweden, the US, the UK, Norway and Switzerland to discuss monetary policy. Rising geopolitical tensions and oil prices could complicate matters for policymakers that are currently working to bring inflation down closer to their targets before continuing to reduce interest rates. Both the Fed and the Bank of England are expected to keep rates on hold while they await more clarity on the path of inflation.

Weekly Highlights

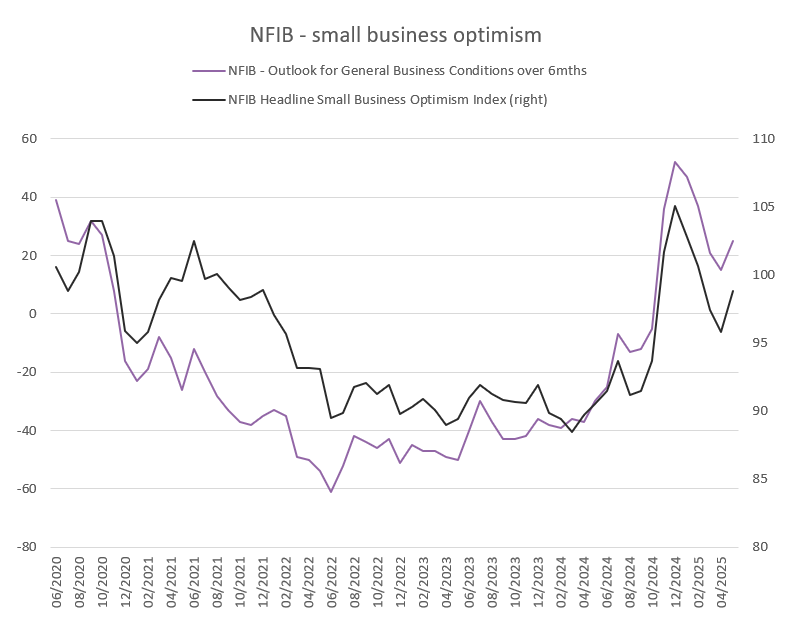

US small business optimism hits three-month high

Source: Bloomberg, BIL

It seems that business owners, at least on Main Street, are, to some extent, looking through the uncertain policy landscape, and growing more optimistic about the future. The NFIB small business optimism index hit 98.8 in May, the highest in three months, compared to 95.8 in April and forecasts of 95.9. Note that the 2024 average was 93.

18% of owners reported taxes as their single most important problem, with this replacing inflation as the single most pressing problem. The net percent of owners expecting better business conditions rose by a whopping 10 points to 25%.

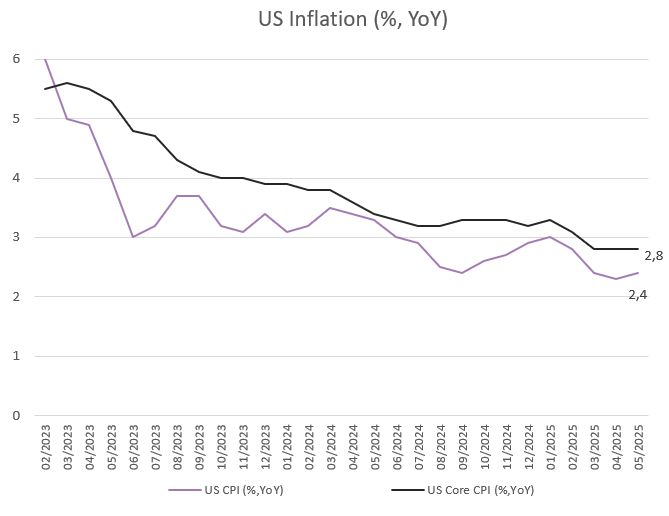

US inflation comes in below expectations – tariff impact yet to be fully felt

US CPI came in at 2.4% YoY in May, up from 2.3% and below expectations of 2.5%. Prices rose more for food (2.9%), transportation services (2.8%), and used cars and trucks (1.8%), while it fell for shelter (3.9%) – a category that has been notoriously sticky.

Energy costs declined 3.5%, with gasoline (-12%) and fuel oil (-8.6%) continuing their sharp fall. On the other hand, natural gas prices remained elevated (15.3%).

On a monthly basis, the CPI edged up 0.1%, below 0.2% in the previous month and forecasts of 0.2%

Annual core inflation remained steady at 2.8%, holding at 2021-lows, while expectations were pointing to a rise to 2.9%

Source: Bloomberg, BIL

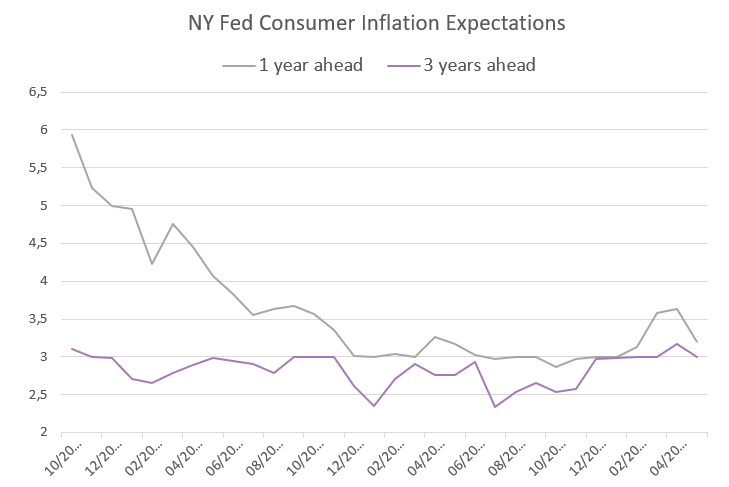

Consumer inflation expectations also softened, according to a survey by the NY Fed, as shown below. This eases concerns about a self-fulfilling feedback loop taking hold.

Source: Bloomberg, BIL

Despite the benign data, the US Federal Reserve must remain vigilant, with the impact of trade tariffs yet to fully pass through to consumers and businesses. On average, US businesses hold three-months of goods inventory in their supply chains, implying that the bulk of the impact should be felt late-June. At its monetary policy committee next Wednesday, the US Federal Reserve is expected to hold borrowing costs steady in a range of 4.25-4.5%.

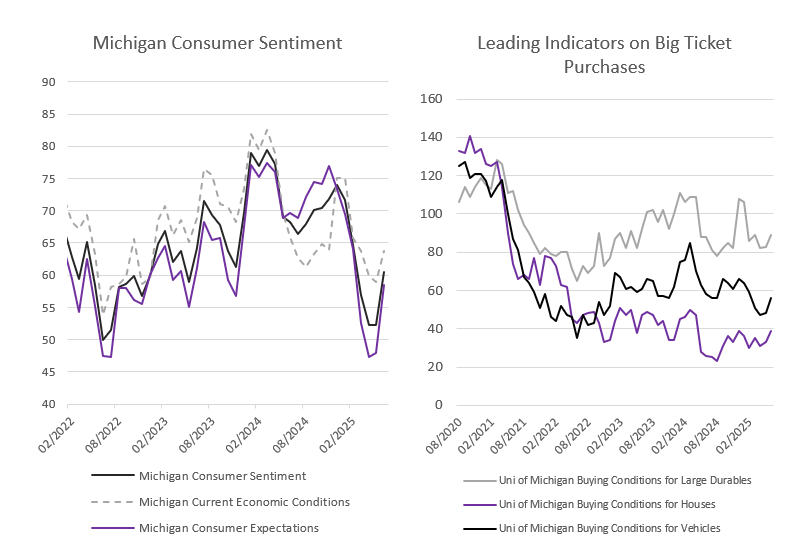

US consumer sentiment ends six month slide in May

According to the latest University of Michigan survey, US consumers are feeling more upbeat as the trade negotiation deadline on July 9th nears. The sentiment index rose to 60.5, up from a near-record low of 52.2 in both May and April, and well above market expectations of 53.5. It was the first increase in sentiment in six months, driven by broad-based gains in assessments of current conditions and future expectations.

However, to put things in perspective, we must also keep in mind that the index is still roughly 20% below its December 2024 level, when consumer confidence received a temporary post-election boost. A de-escalation in trade has boosted sentiment, but until more clarity is forthcoming, it is unlikely to close the gap.

In tune with the aforementioned NY Fed survey, inflation expectations moderated, while consumers expressed a greater willingness to buy big ticket items such as large durables, homes and vehicles.

Source: Bloomberg, BIL

UK economy contracts and unemployment hits 4-year high

After a strong growth in the first quarter, the British economy shrank by 0.3% in April, the worst performance in almost two years, caused by the negative impact of US trade policy and a decline in the services sector.

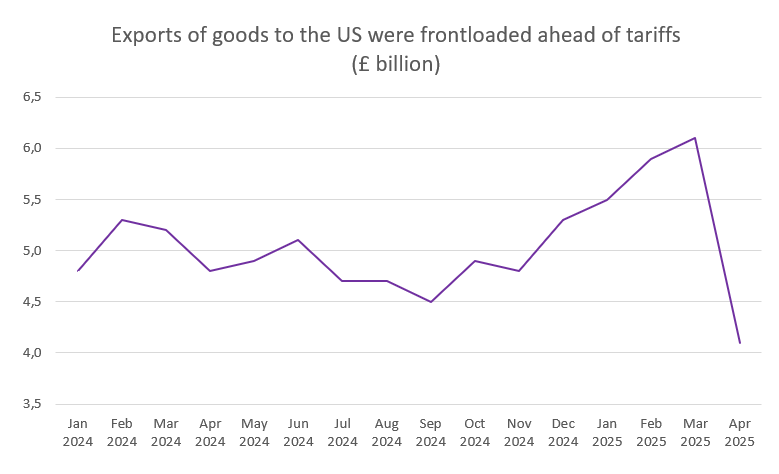

Tariffs on US imports have led goods exports from the UK to the US to fall by the most on record.

Source: ONS, BIL

In addition to the impact of US tariffs on UK exports, the services sector — a dominant driver of the UK economy — struggled, with output falling by 0.4% amid several tax increases that came into effect in April. British companies are grappling with the rise in national insurance contributions and the increase in the minimum wage, while households are facing higher utility bills. Against this backdrop, the Bank of England expects the pace of economic growth to slow to 0.1% in Q2, down from 0.7% in Q1.

These figures were released following the government spending review by Chancellor Reeves, in which a 3% increase in NHS funding and higher school budgets were announced, alongside cuts to the budgets of several government departments, including the Home Office, the Foreign Office and the Department for Digital, Culture, Media and Sport.

Turning to the labour market, the unemployment rate rose to a four-year high in the three months to April as employers came under pressure from the aforementioned tax increases. According to the Office for National Statistics, this led companies to reduce their payroll by 55,000 between March and April. Wage growth is slowing, which is a positive sign for the Bank of England, which is expected to continue its rate-cutting cycle later this year.

Calendar for the week ahead

Monday – China Industrial Production, House Price Index, Retail Sales, Unemployment and Fixed Asset Investment (May). Eurozone Balance of Trade and Wage Growth. OPEC Monthly Report.

Tuesday – Bank of Japan Monetary Policy Committee. Germany and Eurozone ZEW Economic Sentiment. US Retail Sales, Industrial Production, NAHB Housing Market Index. G7 Summit.

Wednesday – UK Inflation (May). Eurozone Inflation (final print, May). US Housing Starts and Building Permits. US Federal Reserve Monetary Policy Meeting with Economic Projections.

Thursday - Bank of England Monetary Policy Committee. US Weekly Jobless Claims. SNB Monetary Policy Meeting.

Friday – UK Consumer Confidence and Retail Sales. Japan Inflation (May) and BoJ Meeting Minutes. China Loan Prime Rate. France Business Confidence.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 1, 2025

Weekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...