As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust settles, businesses, economists and policymakers are left asking: what comes next?

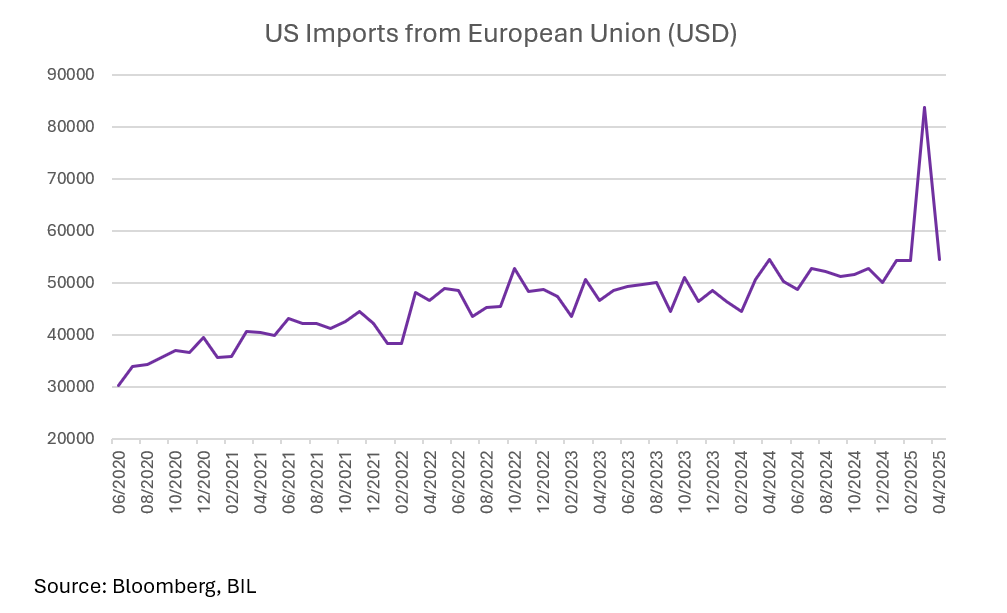

When President Trump took office on January 20, he had the US trade deficit in his sights. With “tariff” touted by Trump as the most beautiful word in the dictionary, companies around the world anticipated a shift in trade policy. They acted swiftly, accelerating goods shipments to the US in a global race to beat potential new duties.

The rush to front-load imports ahead of the April 2 release of “reciprocal” tariffs had significant economic repercussions.

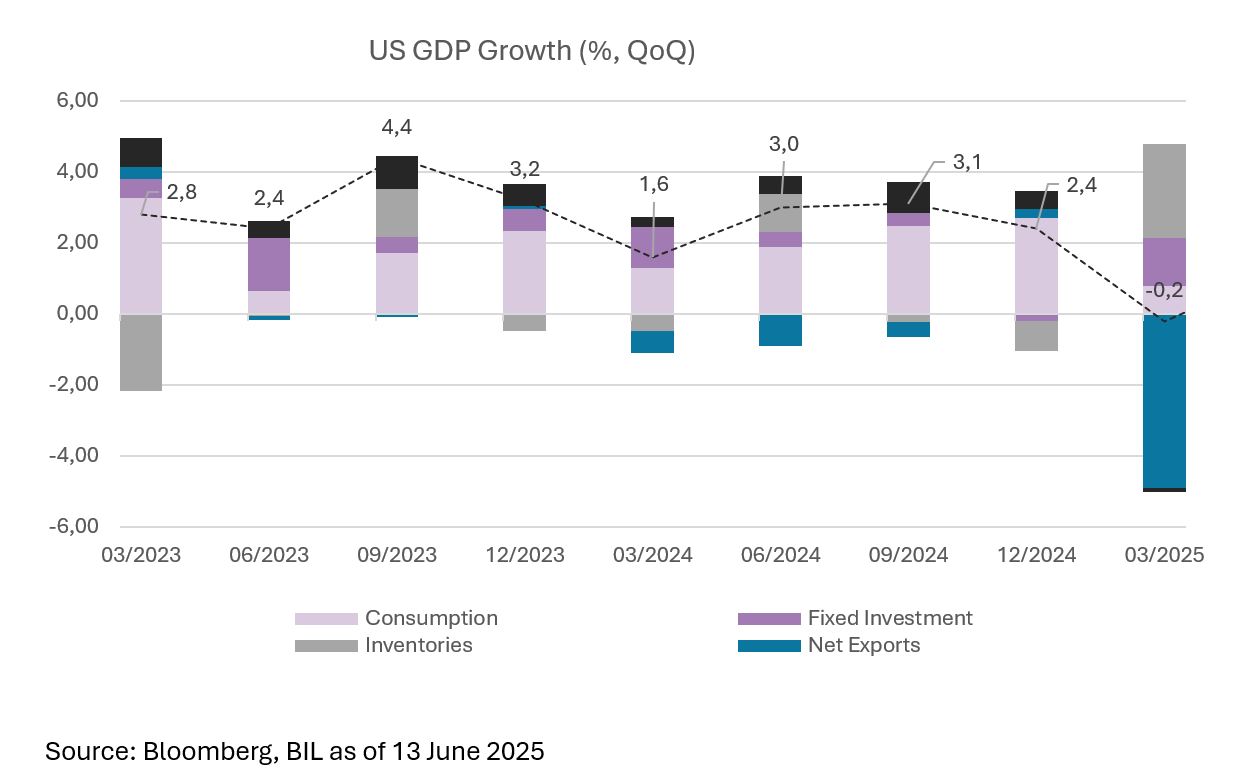

In the first quarter, the US economy contracted by an annualised 0.2%. This was largely due to a staggering 42.6% surge in imports that skewed net trade. Businesses, seeking to hedge against rising costs, stockpiled goods at a pace usually seen in the run up to the holiday season. However, with consumers growing more cautious, those inventories are lingering in warehouses – driving up costs and squeezing profit margins instead of cycling through to retail shelves.

The impact of front-loading wasn’t limited to US shores. Across the Atlantic, the European economy also felt the effects. Eurozone GDP grew by a stronger-than-expected 0.6% in Q1; the fastest pace since Q3 2022, underpinned by a surge in exports to the US.

The contrast between countries is striking. In Ireland, where manufacturing accounts for roughly one-third of economic activity, GDP expanded by 9.7% QoQ in Q1, driven primarily by multinational companies rushing to ship goods abroad. Meanwhile, Luxembourg exhibited very weak performance at the onset of the year, with the Grand Duchy’s economy shrinking by 1% QoQ. The Luxembourgish economy, with manufacturing accounting less than 5% of activity, did not benefit from front-loading, while its dominant services sector was hit by the increasingly uncertain landscape.

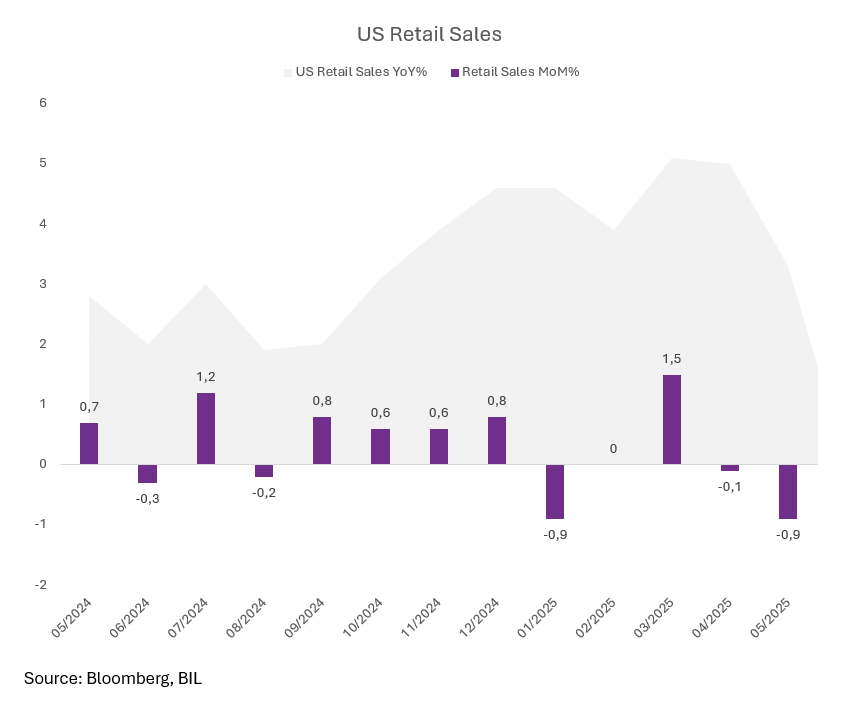

American consumers also joined the dash, seeking to beat inflationary pressures by buying earlier. Retail sales jumped in March, only to fall off in April and May, with notable pullbacks in cars, sporting goods and other import-heavy categories.

Evidence of tariff-induced inflation is beginning to appear in US CPI data. In April, prices increased faster for used cars and trucks and for goods affected by Liberation Day tariffs that are high on Made-In-China content, such as furniture, appliances, audio equipment and sporting goods.

However, the broader inflation picture remains muted for now; because companies typically hold about three months of inventory, the full impact of tariffs may not appear until late June or beyond. And while prices may rise in the near-term, sustained inflation requires strong and consistent consumer demand; that is something far from guaranteed in today’s economic environment.

Looking ahead, US GDP could show a stronger performance in the second quarter, thanks in part to a record decline in the trade deficit as imports fell more than 16% in April. This will boost net trade, but the benefits may be fleeting. As inventories from the front-loading phase are depleted and consumer demand softens, the true picture may be one of underlying weakness. Some of the purchases that normally would have occurred in Q2 and Q3 were effectively pulled forward into Q1, creating a potential soft patch ahead.

Much now hinges on what happens after July 9, the deadline for ongoing tariff negotiations. Until then, uncertainty looms large. Even if talks of a détente with China have buoyed market sentiment, we must keep in mind that a 55% tariff rate on Chinese goods remains a substantial burden. Businesses remain in a wait-and-see mode, delaying investment decisions. While this may spur more stock buybacks in the interim, it could also translate to muted capital spending and tepid growth prospects.

In the Eurozone, the picture is also clouding over. With the boost from front-loading fading, and a stronger euro eroding export competitiveness, the bloc may have already peaked when it comes to 2025 growth. Without new drivers, momentum is likely to wane.

For central banks, especially the Federal Reserve, the next steps are delicate. Consumption accounts for roughly two-thirds of US economic activity, so weakening retail sales data, paired with uncertain inflation trends complicate the case for additional rate cuts. Policymakers are closely monitoring how tariffs percolate through to consumer prices and labour markets before their next move.

In the wake of a tariff-fueled trade surge, the global economy now stands at a crossroads. What began as a rush to beat import duties may give way to a more subdued and uncertain period – one marked by fragile demand, policy ambiguity, and global supply chains once again in flux.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...