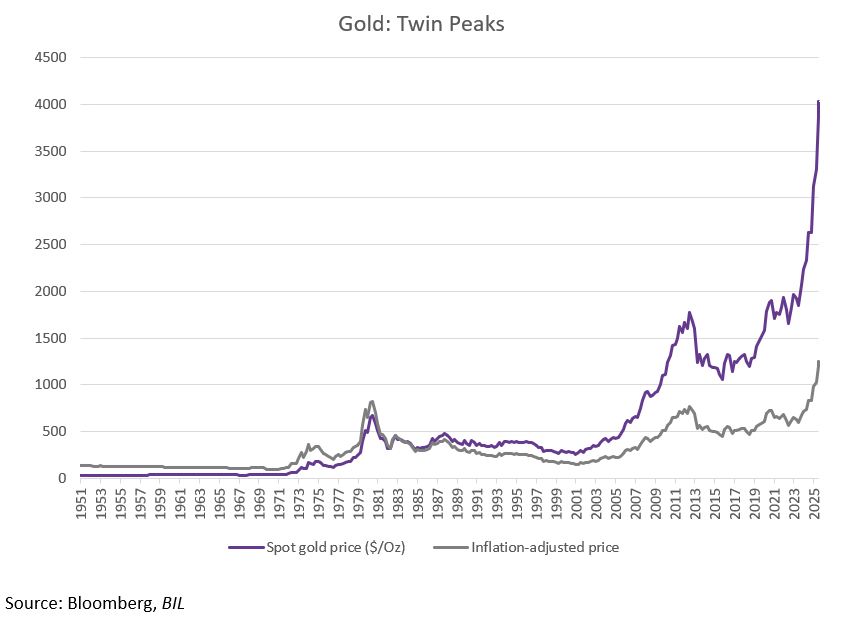

A filigree of forces, both fleeting and fundamental, has pushed gold to new all-time highs this year, rising above $4,000 per troy ounce last week. And the records don’t stop there: for the first time in 45 years, gold has also surpassed its inflation-adjusted peak. Year-to-date, the precious metal has recorded gains of over 50%, trouncing the S&P 500 (up by c. +13%), the NASDAQ (c. +18%), Bitcoin (+20%) and most of the AI superstars to boot. The question now for investors is whether gold can keep shining...

A confluence of forces

Recent moves in the gold price are closely linked to interest rate expectations, the US dollar, and its enduring role as a safe haven asset.

Following the Federal Reserve’s 25 basis point rate cut in September, the market is eyeing the weakening US labour market and betting that rates will be about 100 basis points lower by mid-2026. Yet inflation remains stubborn (US CPI recently accelerated to 2.9% and we believe full impact of trade tariffs is yet to be captured in price data), suggesting real rates could drift lower. That backdrop enhances gold’s relative appeal versus cash or fixed income.

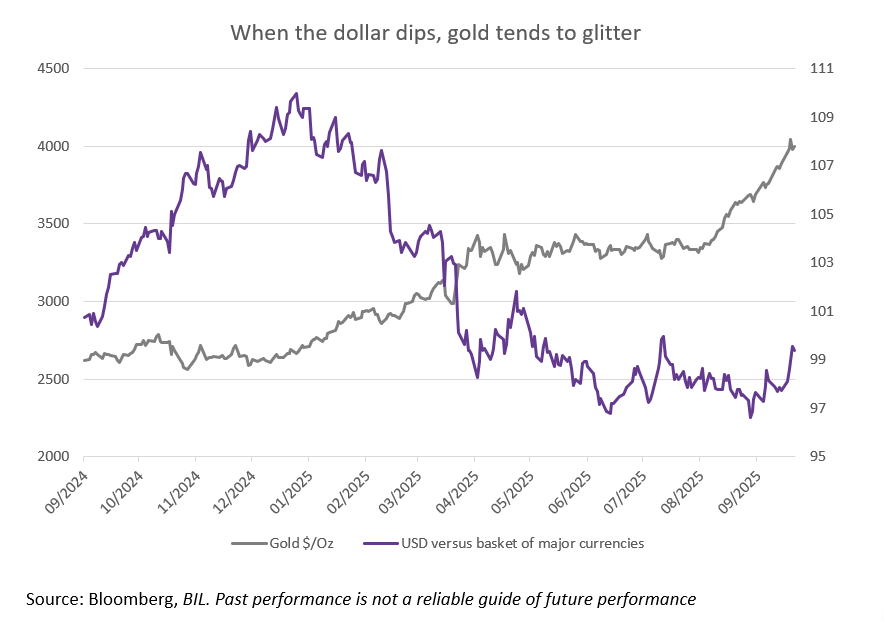

While that explains some of the most recent price movements, the rally predates the Fed’s dovish pivot. Another major factor underpinning gold has been the weakening of the US dollar. The greenback is down by around 9% this year - its worst performance since 1973. As the dollar falls, investors naturally gravitate towards alternative stores of value, while a cheaper dollar makes gold more affordable for non-US buyers.

And of course, there has been no shortage of anxiety-inducing headlines for the safe haven to feast on. Whether it be ongoing armed conflicts, a US government shutdown, unpredictable White House policies, or renewed concerns about surging fiscal deficits, it is understandable why investors are looking for a safe harbour.

Momentum has also played its part. As gold breaks new highs, classic FOMO behaviour has kicked in, with more and more non-professional investors jumping in.

Global gold ETFs recorded their largest monthly inflow in September, resulting in the strongest quarter on record.

Structural demand: central banks take centre stage

Beyond cyclical and speculative forces lies a powerful structural story: central bank demand. Since 2022, central banks have collectively purchased over 1,000 tonnes of gold annually – more than double the annual pace seen in the preceding decade. There are three core motivations behind this:

- Reserve diversification

Many central banks, particularly in emerging markets, are seeking to reduce reliance on US Treasuries and the dollar. Gold, as a non-sovereign and apolitical reserve asset, offers protection against shifts in foreign exchange regimes, sanctions, and the erosion of confidence in major fiat currencies.

- To hedge against debt and inflation

With US debt surpassing USD 37 Trillion, and fiscal positions deteriorating globally, gold provides insurance against currency debasement and the erosion of purchasing power. One idea is that gold could play a future role in propping up or restoring trust in debt-fuelled monetary systems.

- Protection from sanctions and asset freezes

When the US and its allies moved to freeze Russia’s foreign reserves in 2022, the pace of central bank gold-buying doubled, as countries reassessed geopolitical and financial risks in an increasingly polarised world. Unlike digital reserves or assets held overseas, gold can be stored and controlled domestically.

Together, these dynamics represent a structural shift in reserve management – one that is relatively insensitive to price and unlikely to reverse soon. This persistent demand acts as a form of “gold put”, buoying the market, even during bouts of volatility.

Can gold continue to shine?

Unless inflation meaningfully surprises to the upside or US growth reaccelerates sharply, the backdrop – lower real rates, fiscal strain, and steady central bank demand – should continue to support gold.

There are also some important seasonal factors that should not be overlooked. The final quarter often brings a lift in physical demand, driven by India’s festival and wedding season. Other factors to watch include China’s pace of stimulus, which influences jewellery and bar demand, as well as year-end portfolio rebalancing which tends to favour safe-haven assets.

That said, the rally is not without risks. A sudden rebound in inflation could prompt the Fed to reassert its hawkish stance, lifting real yields and strengthening the dollar, both traditionally negative for gold. Since mid-September, the dollar has clawed back nearly 3%, a reminder that sentiment can shift quickly.

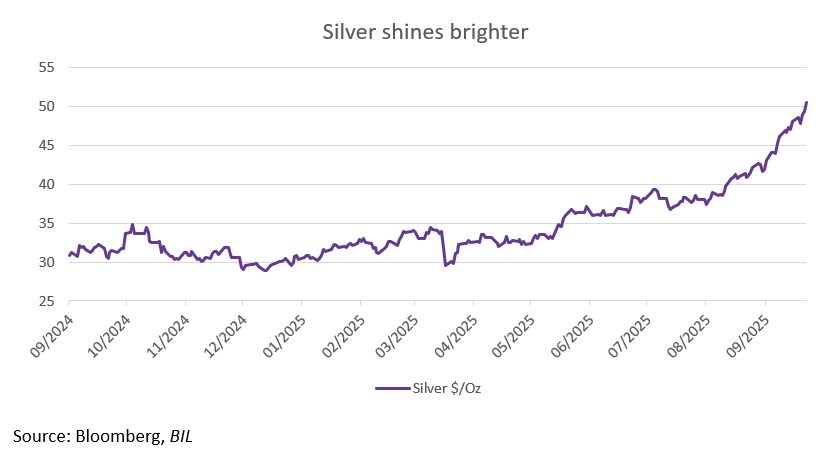

Profit-taking and short-term corrections are to be expected as traders respond to data releases and policy announcements. Silver’s sharp surge suggests that investors are already broadening their search for perceived stores of value – especially as gold trades at record levels.

Conclusion

There’s glitter in the air around gold right now, but that reflects more than speculative sparkle; it speaks to deeper currents reshaping the global monetary order. While the path ahead may not be linear, the forces driving this move – debt, diversification and de-dollarisation – are unlikely to fade out soon.

For investors, gold remains what it always has been: an asset that yields nothing in calm waters but proves invaluable when the tides turn; a stabiliser and source of value amid uncertainty. That’s why we continue to see merit in maintaining strategic, long-term exposure to the precious metal within a diversified portfolio.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

January 30, 2026

Weekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...

January 26, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot After a volatile week, gold hit a record high on Monday, surpassing $5,000 a troy ounce for the first time as investors sought...

January 19, 2026

Weekly InsightsWeekly Investment Insights

Geopolitical uncertainty increased over the weekend as President Trump threatened to impose tariffs on Nato allies who oppose his intentions on Greenland. On Saturday, Trump...

January 9, 2026

Weekly InsightsWeekly Investment Insights

Safe haven assets, including gold, rose at the start of the week in response to the US intervention in Venezuela which sparked questions about the...