Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over the valuations of artificial intelligence companies rose. The losses started on Wall Street on Thursday but made their way to Asia and Europe on Friday. Investors are becoming increasingly concerned about the significant AI spending by major US tech companies and how long it might take for the investments to generate significant return. By Monday, however, a cautiously optimistic mood was returning to markets, with global tech stocks leading gains, ahead of a busy data week. New York Fed President Johan Williams helped sentiment by commenting that a near-term rate cut remains a possibility.

This week, UK Chancellor Reeves will announce the much-awaited Autumn Budget, in which she is expected to raise taxes in order to plug an estimated £20 billion fiscal hole. Investors will be listening carefully to find out which taxes will be raised, given that Reeves recently backtracked on income tax hikes after revised forecasts from the UK’s fiscal watchdog showed that the country’s fiscal deficit is smaller than previously expected.

US markets will be closed on Thursday for Thanksgiving, and will close early on “Black” Friday, kicking off the major shopping weekend as consumers race to get the best deals for their holiday purchases.

Macro Snapshot

European Commission releases Autumn Economic Forecast

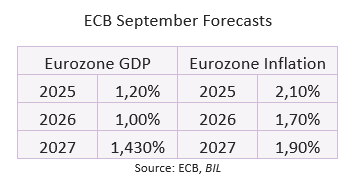

The European Commission’s Autumn Forecast projects growth of 1.3% in the currency union this year --up from 0.9% in its Spring forecast. It noted that economic growth had exceeded expectations in the first nine months of the year, thanks to export front-loading (ahead of US tariffs) and an uptick in investment in equipment and intangible assets, especially in Ireland. It added that the continuation of growth we are seeing now in Q3, is testimony to the “resilience of the European economy and its ability to navigate unprecedented shocks”. A resilient labour market, lower inflation and favourable financing conditions are also helping matters.

The question, however, is whether the bloc can now turn that resilience into renewal – and the verdict is still out. By the Commission’s estimates, growth is expected to slow to 1.2% next year, below the 1.4% predicted in Spring.

That said, the Commission’s upgrades might precede upgrades to the ECB’s projections, due December. If that materialises, it further corroborates the case for monetary policy to be kept as is for the coming months, especially considering that inflation is also expected to float around the target level of 2%.

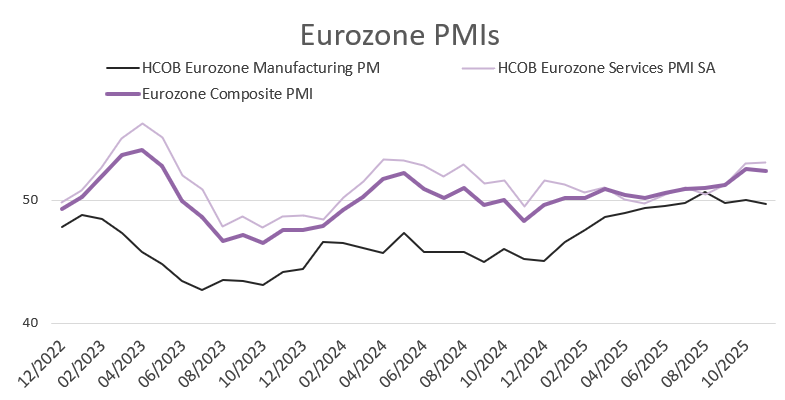

PMIs suggest the Eurozone economy is holding up, with the services sector doing the heavy lifting

Business activity in the Eurozone grew at a solid pace in November, with the Composite PMI at 52.4, down slightly from 42.5 in October, according to preliminary estimates. Growth continued to be driven by the services sector, which grew at the fastest pace in 18 months, while the manufacturing sector dipped into contraction territory. The services PMI rose to 53.1 in November, up from 53,, driven by solid growth in new orders. Employment rose at a slower pace, indicating that firms are becoming slightly more cautious when it comes to hiring. The manufacturing PMI slipped to a five-month low of 49.7, down from 50 in October, as input costs rose sharply, and output barely grew.

Source: Bloomberg, BIL

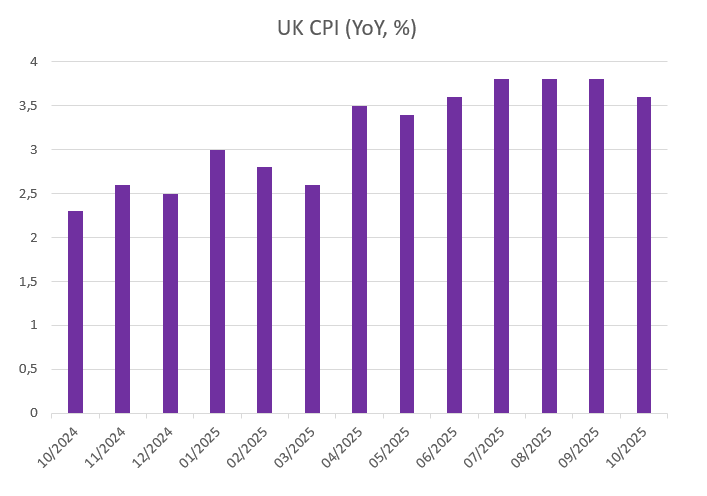

UK inflation eases but remains significantly above the BoE’s target

Price pressures in the UK eased in October, with the annual inflation rate dropping to 3.6% from 3.8% in the three months prior. A change to the energy price cap introduced by the Office of Gas and Electricity Markets in October led to slower price increases for housing and utilities, while smaller price rises were also seen for restaurants and hotels, services, and clothing and footwear. Meanwhile, inflation accelerated for food and non-alcoholic beverages, as well as for recreation and culture. Core inflation, which excludes volatile categories such as food and energy, fell to a six-month low of 3.4%. This easing of price pressures aligns with the expectations of the Bank of England (BoE) and strengthens the case for an interest rate cut in December, given the continued sluggish growth and weakening labour market.

Source: Bloomberg, BIL

US tariff impact hits Swiss growth

Switzerland struggled in the third quarter of the year when the US imposed 39% tariffs on Swiss goods. This caused the economy to contract by 0.5% quarter-on-quarter. The sharper-than-expected contraction followed growth of 0.1% in Q2 and was driven by a decline in the chemical and pharmaceutical sectors. Meanwhile, the services sector continued to grow, albeit at a 'below-average' rate. In November, however, the US and Switzerland reached a deal that lowered US tariffs to 15%, offering some relief to Swiss export-heavy industries.

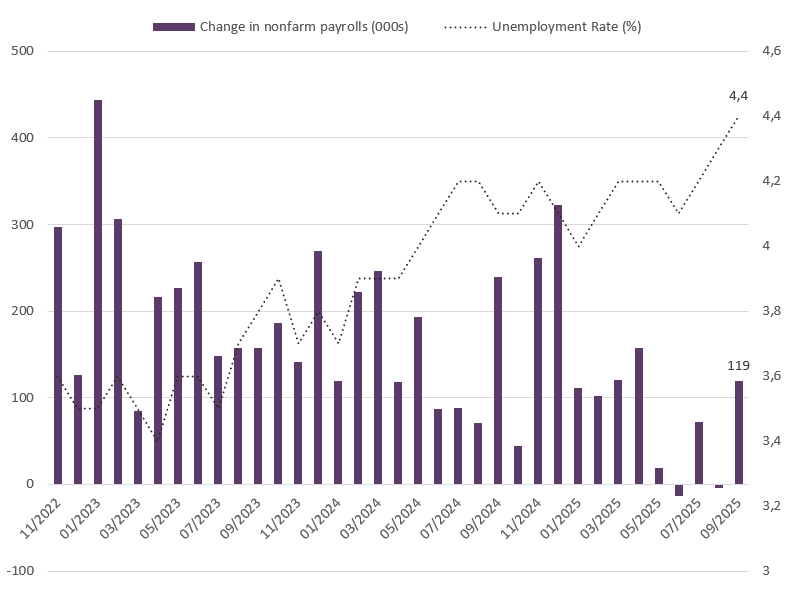

US unemployment rate rises, but companies are still hiring

Data on the US economy has finally started to roll back in following the reopening of the federal government, but the latest data may not provide investors and the Federal Reserve with as much clarity as hoped. Mixed messages from the labour market show that the unemployment rate has risen to its highest level since 2021, while the economy added 119,000 jobs in September — far more than the expected 50,000. While the acceleration in hiring is positive for the labour market, fears arose that it could cause the Fed to keep interest rates on hold in December while it considers the risks to inflation. However, the rise in the unemployment rate to 4.4% in September might compel a more dovish stance; it is a delicate balancing act. The central bank has reduced interest rates by 25 basis points twice this year and governors aren strongly divided on a December rate cut, according to the minutes from the October monetary policy meeting. With the October employment report cancelled due to the lack of data collected during the government shutdown, the Fed will have to base its decision on the September data, combined with weekly jobless claims and private data reports.

Source: Bloomberg, BIL

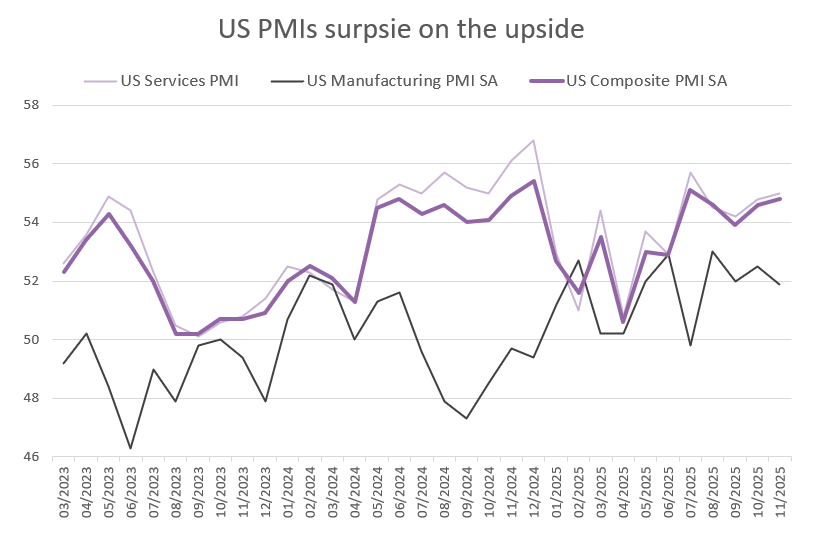

US PMIs point to continued growth momentum

Preliminary estimates of business activity in November were also released, showing that activity rose more than expected, with the Composite PMI rising to 54.8 from 54.6. This was the fastest expansion since July, driven by strong activity in the service sector (the PMI rose from 54.8 to 55), while manufacturing activity remained solid (the PMI eased from 52.5 to 51.9). New orders increased at the fastest rate since December, indicating robust demand despite high inflation and economic uncertainty. In manufacturing, employment increased at the fastest rate since August. However, employment growth in the services industry moderated as firms struggled to replace employees who had left. Most concerning was a rise in price pressures. Input costs rose at one of the fastest rates in the last three years, leading to an increase in selling price inflation attributed to tariff-related impacts. This fact adds to an already-complicated stew for the Fed: business activity is strong, inflation is picking up (albeit price increases might be transitory this time) and the labour market is still showing signs of cooling.

Source: Bloomberg, BIL

Japan’s new Prime Minister unleashes fiscal firepower

Japan’s Prime Minister, Sanae Takaichi, announced a stimulus package worth $135.4 billion, aimed at boosting economic growth and reducing the financial burden on households amid rising living costs. The package, which includes gas and electricity subsidies, financial support for parents and rice coupons, is Japan’s largest stimulus measure since the pandemic. Prior to the announcement, market participants were concerned that substantial government spending could damage the country’s finances, resulting in a sell-off of the yen and bonds. With the stimulus package smaller than anticipated, investors are now waiting to find out how much additional bond issuance will be needed to fund it.

Calendar for the week ahead

Monday – Germany IFO Business Climate.

Tuesday – France Consumer Confidence. US House Price Index, CB Consumer Confidence, Pending Home Sales.

Wednesday – US Durable Goods Orders, New Home Sales, Personal Income and Spending, GDP Growth and PCE Inflation (Q3, 2nd est.), Weekly Jobless Claims.

Thursday – Germany Gfk Consumer Confidence. Eurozone M3 Money Supply, Economic Sentiment, Consumer Confidence (final), Inflation Expectations. Spain Business Confidence. Italy Industrial Sales.

Friday – Japan Unemployment Rate, Industrial Productions, Retail Sales, Inflation. Germany Retail Sales and Inflation (Preliminary, November). UK House Prices. France Inflation and GDP Growth (Final, Q3). Spain Inflation and Retail Sales. Germany Unemployment Rate. Italy Inflation and GDP Growth (Final, Q3). France Unemployment.

Sunday – China NBS PMI (November).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

March 2, 2026

Weekly Investment Insights

Market Snapshot Global stocks fell and oil and gas prices spiked on Monday as tensions in the Middle East escalated. On Saturday, the US and...

February 23, 2026

Weekly InsightsWeekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...