Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s stimulus roll-out last week brought Chinese stocks on an impressive upward journey, recording their best week since 2008, with many other stock markets also enjoying a boost.

Hope for a revival in China, however, was not enough to buoy the oil price. Brent crude fell on higher potential supply coming from Saudi Arabia, which is reportedly ready to abandon its $100/barrel price target in order to gain back market share, and on output from Libya resuming, following an agreement on the central bank head.

After US consumer confidence fell by the most in three years last week on growing fear about the job market, investors will be laser-focused on employment data due this week, including tomorrow’s JOLTs report and the Non-Farm Payrolls on Friday. These releases will be instrumental in guiding the Fed’s policy pathway.

Weekly Roundup

China attempts to lift growth

The Peoples’ Bank of China announced its biggest stimulus since the pandemic to support economic growth last week, lifting market hopes about the future of the Chinese economy. After a series of disappointing data releases and rising doubt about China’s ability to reach its 2024 growth target of “around 5%”, it was time for the central bank to step in.

The measures include:

- interest rate cuts

- lower reserve requirements for banks

- $114Bn lending pool to help asset managers, insurers and brokers buy more stocks and help companies perform stock buybacks

- Property market support package[1], aimed at addressing the property market crisis

However, the measures announced last Tuesday did not really hit the nail on the head. With loan demand muted, more direct government fiscal spending was perceived as the missing piece of the puzzle to improve the growth outlook.

The announcement lifted market spirits though, mainly because it opened the doors to potential fiscal support, in addition to the monetary measures. And indeed, on Thursday, the Politburo confirmed the hope that more is coming, announcing increased fiscal support to further boost the economy. Questions about the size of this support remain, but stock markets around the world took the news in their stride.

[1] Including a 50 bps reduction on average interest rates for existing mortgages, and a cut in the minimum downpayment requirement to 15% on all types of homes

Flash PMIs

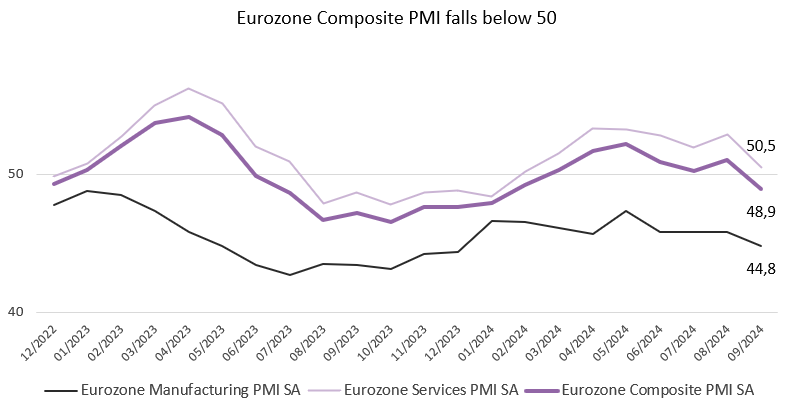

Eurozone private sector activity contracts in September

The composite PMI for the Eurozone fell below 50 in September entering what is considered contraction territory. This comes amid a deepening recession in the manufacturing sector (PMI at just 44.8), with weakness concentrated in Germany and France. Goods manufacturers saw output fall by the most in 9 months and in turn, employment levels were reduced by the largest amount in four years.

With the boost from the Olympic games fading, the services PMI dropped sharply. New business decreased for the first time in seven months, amid a weakening demand environment. Employment continued to rise, but at the slowest pace since August 2023. In good news for the ECB, which is keeping a close eye on sticky services inflation, input costs reportedly rose at the slowest pace in three-and-a-half years.

Some loosening in the labour market and more muted wage growth would give the ECB the green light to persist in its rate cut efforts to prop up growth in the eurozone, which is now heading towards stagnation, according to the PMI report.

Source: HCOB, Bloomberg, BIL

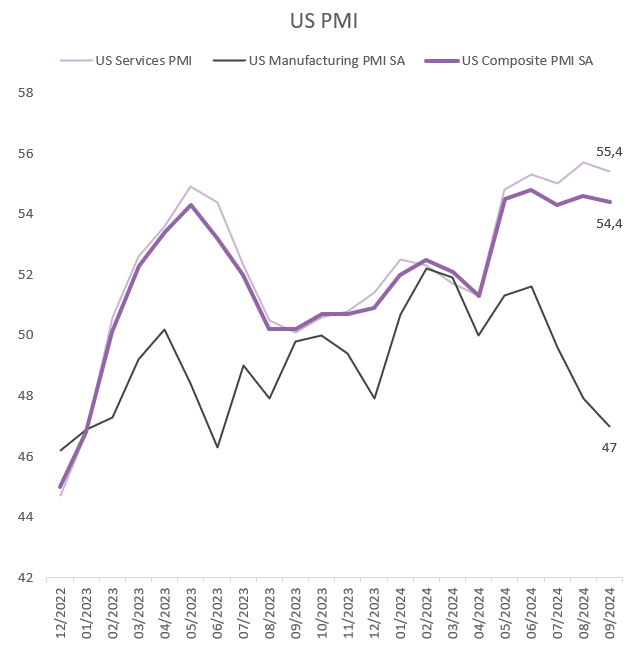

The service sector continues as the dominant force driving US activity

Source: S&P Global, Bloomberg, BIL

Private sector activity in the US remains robust, thanks to ongoing strength in the services sector. Therein, new business inflows remain strong, however, confidence was slightly diluted by concerns about the economic outlook and future demand. Employment declined, albeit at a slower pace than in August, as companies faced difficulties replacing departing staff and remained uncertain about future conditions. Challenging the notion that the US has “turned the page on inflation” (a comment by Biden’s National Economic Advisor, Lael Brainard), selling price inflation climbed to a six-month high, exceeding pre-pandemic averages, driven mainly by rising wage pressures.

The US manufacturing sector saw its third consecutive month of contraction, and its sharpest decline in new orders since December 2022. This led firms to shed the most jobs since June 2020. Input inflation eased to a six-month low amid lower energy prices and fewer supply chain price pressures.

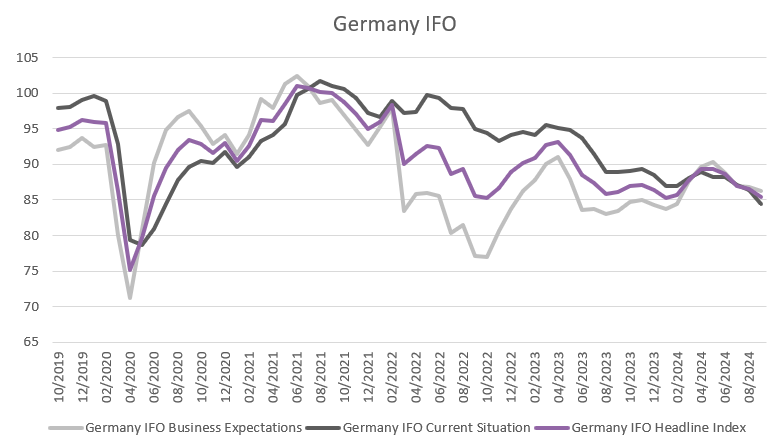

Gauging sentiment in Germany

Last week brought two important indicators offering insight into the mood in Germany, the Eurozone’s largest economy.

The Ifo Business Climate indicator dropped further to 85.4 in September from 86.6 in August. It was the lowest reading since January and missed expectations of 86. Across sectors, the manufacturing index dropped to -21.6 from -17.8 and the services gauge fell to -3.5 from -1.3%. Contrastingly, the construction index rose marginally.

Consumer sentiment showed a slight upturn however, according to the GfK Consumer Climate Indicator. The slight improvement was driven by increases in both income expectations (10.1 vs 3.5 in September) and the propensity to buy (-6.9 vs -10.9). However, it is premature to assume the start of a more protracted upturn. Inflation, unemployment, a rise in insolvencies, and potential job cuts continue to worry consumers. The latest PMI showed that job shedding in Germany hit a fifteen year high in September.

Source: IFO, Bloomberg, BIL

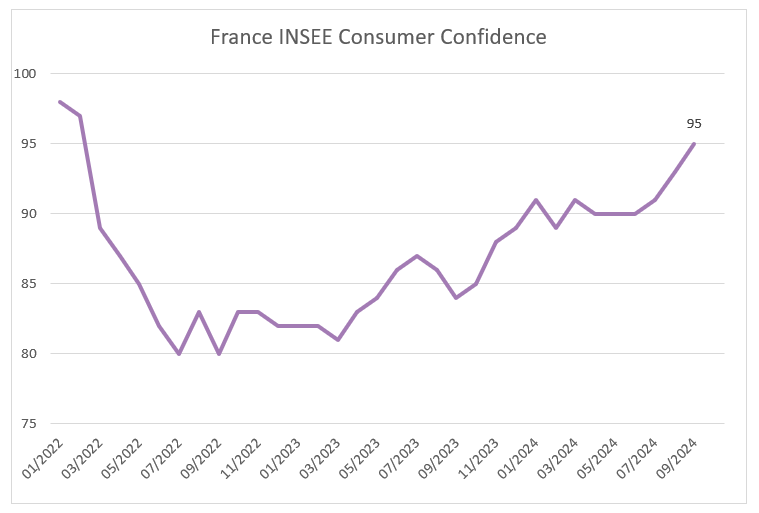

Post-Olympics France

Source: Insee, Bloomberg, BIL

While the French PMI left much to be desired, consumer confidence surprised on the upside last week, according to Insee. While it remains below the long-term average of 100, it reached its highest level since February 2022 in September. Consumers were less pessimistic about the outlook on their financial situation (-6 from -9) and standard of living (-38 from -44). Households were also slightly less negative about making major purchases and inflation expectations dropped. It is to be seen, however, how the upcoming announcement of the budget might have an impact on consumer confidence going forward. Especially with potential tax rises on the horizon.

Bond markets are wary of France’s budget situation. Illustrative of this, last week, we saw French borrowing costs rise above Spain’s for the first time since 2008, with the so-called spread between French and Spanish 10-year bonds briefly falling into negative territory.

France’s freshly appointed finance minister, the 33-year old Antoine Armand, commented last week that the country faces "one of the worst deficits in our history". The deficit could reach 6% this year, well above the European Union's limit of 3%.

Switzerland makes its third consecutive rate cut

The Swiss National Bank cut its rates by 25bp to 1% last week, noting that inflationary pressure has decreased significantly compared to the previous quarter. Outgoing Chairman Thomas Jordan also noted that they “remain willing to be active in the foreign exchange market as necessary”.

Jordan went on to say that he expects growth to “remain rather modest in Switzerland in the coming quarters due to the recent appreciation of the Swiss franc and the moderate development of the global economy”. The strength of the Swiss franc has been a hot topic for Swiss manufacturers, with concerns that it will damage, and already is damaging, export growth.

The SNB was dovish on the forward development of their monetary policy, noting that further cuts could still be on the table “if necessary to ensure inflation remains within the range consistent with price stability over the medium term.”

Economic calendar for the week ahead

Monday – China Caixin PMIs (September). UK GDP Growth (Q2, Final), Mortgage Approvals. Switzerland KOF Leading Indicators (September). Italy, Germany Inflation Rate (Prel, September).

Tuesday – Japan Unemployment Rate (August), Consumer Confidence (September). Switzerland Retail Sales (August). Eurozone HCOB Manufacturing PMI (Final, September), Inflation Rate Flash (September). US S&P Global Manufacturing PMI (Final, September), JOLTs Job Openings (August).

Wednesday – UK Nationwide Housing Prices (September). Eurozone Unemployment Rate (August).

Thursday – Switzerland Inflation Rate (September). France Budget Balance (August). Eurozone HCOB Services PMI (Final, September). US Challenger Job Cuts (September), Jobless Claims, S&P Global Services PMI (Final, September), Factory Orders (August).

Friday – Switzerland Unemployment Rate (September). Eurozone HCOB Construction PMI (September). US Non Farm Payrolls (September), Unemployment Rate (September).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 8, 2025

Weekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...