Based on the Asset Allocation Committee of February 2 2026

This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking viewers into a world of tumultuous emotions and windswept grasslands. For market watchers the title is somewhat relatable, with “wuthering” referring to the blustery, windy conditions on an exposed hillside – an apt description of today’s market landscape. After an impressive rally, equity indices hover near record highs: the S&P 500 crossed the 7,000 mark for the first time in late January, while safe havens like gold and silver retreated. At such great heights, stocks appear increasingly exposed to various crosswinds whether it be shifting policy signals from Washington, persistent geopolitical risks, growing discernment around the AI theme, or simply profit-taking. Against this backdrop, at our latest Investment Committee, we continued our measured rotation away from large-cap US equities toward a broader opportunity set.

More specifically, we chose to shift an additional portion of our US equity holdings into an equally-weighted basket, resulting in exposure to a wider swathe of US companies. This reflects our observation that earnings growth is beginning to broaden beyond the megacaps, supported by a resilient economic backdrop. The most recent earnings season has also highlighted the high expectations bar facing the largest US companies. Sharp reactions to what were decent results from several large technology firms underscore the growing scrutiny around the AI theme and the scale of capital expenditure required.

To be clear, we continue to view AI as a compelling structural growth theme. Ongoing technological advances have the potential to accelerate capital investment and, over time, translate into meaningful gains in productivity and economic growth. That said, we remain mindful of certain shorter-term risks. These include the circular nature of many AI ecoystsems – where suppliers, customers and investors overlap – as well as the challenge, further downstream, of achieving sufficient visibility on ROI before AI adoption can be scaled sustainably. As the initial hype fades, companies are grasping the reality of implementing AI technology, with a more sober focus on factors such as governance, data readiness, and execution. In the near-term, this suggests the theme could prove vulnerable to episodes of volatility, which might be amplified by the rise of passive investing. This reinforces our preference for diversification and our desire to avoid excessive concentration in megacap names.

We have also diversified part of our US equity exposure towards Emerging Market (EM) equities. Until 2025, EM had lagged developed markets for more than a decade, but that narrative has begun to shift. Our move toward greater diversification does not reflect pessimism: we remain overweight US equities overall. Rather, a modest rotation toward non-US markets and less correlated return streams reflects an acknowledgement that market climates can change. Indeed, EM equities are benefitting from a favourable environment, consisting of a weaker dollar, an improved fiscal standing and good economic growth prospects, supported by structural trends such as favourable demographics, rising consumption and investment flows. The IMF expects Emerging & Developing economies to grow 4.2% in 2026, vis-à-vis 1.8% for Advanced Economies. Moreover, some upstream and downstream winners of the AI theme are located in EM.

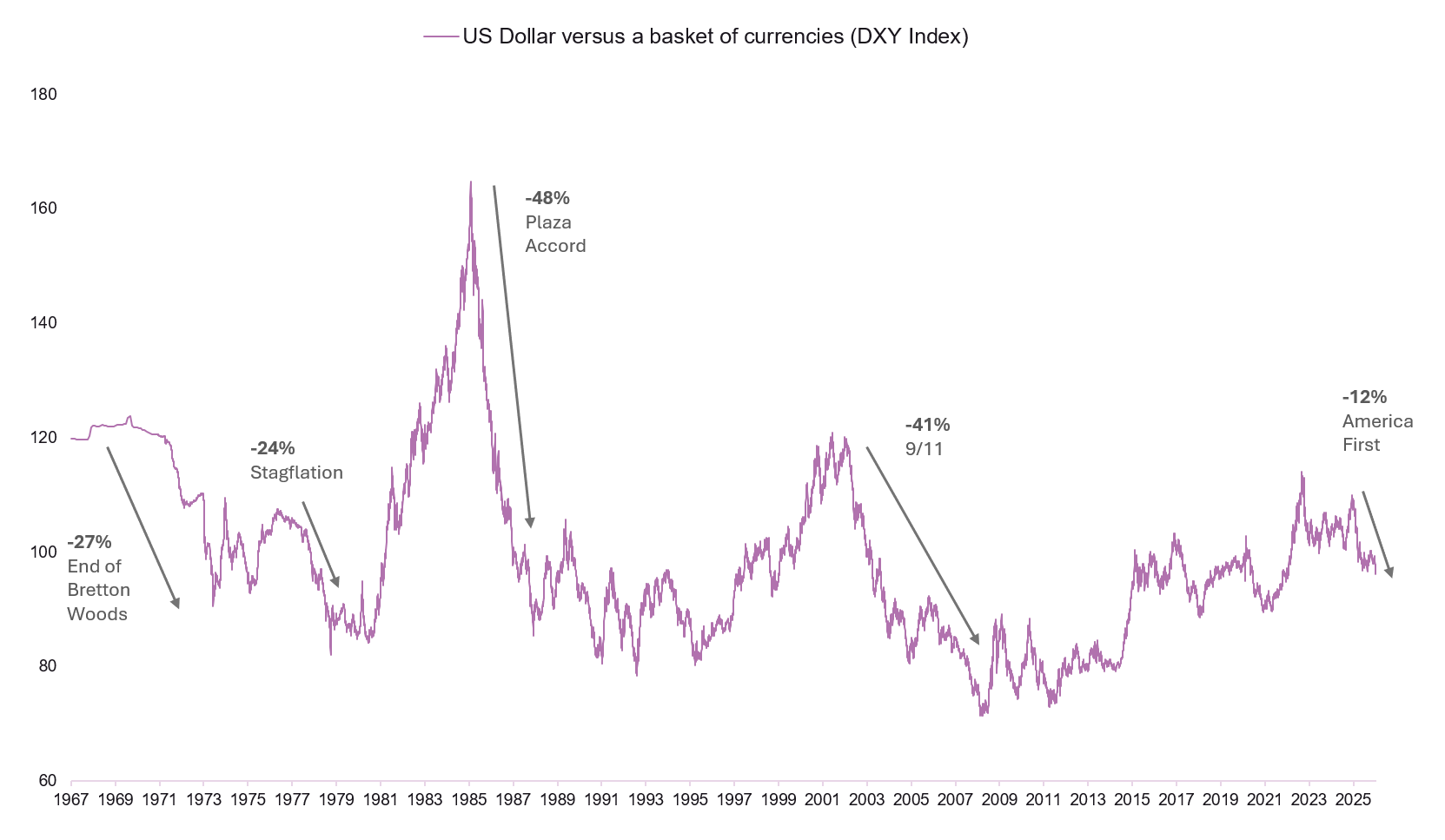

With regard to our currency allocation, we further reduced our USD exposure, sizing the opportunity to increase hedging during a recent moment of dollar strength. Since President Trump’s inauguration, the US dollar has retreated from a decade of momentum, recently touching a four-year low against a basket of currencies. Looking ahead, the currency remains vulnerable to Presidential pressure for lower interest rates, unorthodox policymaking from the White House, concerns about the fiscal deficit, and a global trend of greater diversification beyond US assets. Markets are also pricing in two further Fed rate cuts this year, which could present an additional headwind. While President Trump’s nomination of Kevin Warsh to succeed Jerome Powell has raised speculation about a more dovish stance, markets are for now, still pricing a more pragmatic approach.

When the dollar moves lower, it tends to do so in structural way

Source: Bloomberg, BIL

Turning to fixed income, corporate investment grade credit remains the cornerstone of our bond allocation. European investment grade spreads have remained relatively stable, supported by what might be described as a “Goldilocks” environment: steady growth, low and stable inflation, robust demand and a supportive primary market. In the Sovereign space, we rotated into Italian government bonds, which offer attractive yields relative to core Europe and should continue to benefit from yield-hunting behaviour in the first half of the year. Political risk remains at bay, rating agencies note an improving outlook, and recent data point to stronger-than-expected growth into late 2025.

The central message of Wuthering Heights is that when passion is your sole focus, it comes at a cost. For investors, blue-chip market leadership in the US has been powerful, yet concentration brings risk. While abandoning the heights altogether would be excessive, remaining fully exposed to the gathering winds would be imprudent. Investors who endure over time are rarely those who chase the storm, but those who build shelter before the winds shift.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 23, 2026

Weekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...

January 26, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot After a volatile week, gold hit a record high on Monday, surpassing $5,000 a troy ounce for the first time as investors sought...