Stepping into the final quarter of the year, we have recalibrated our asset allocation to reflect shifting global dynamics and evolving policy signals. One of the key changes we have made is to increase exposure to onshore Chinese equities, where selective growth opportunities are emerging. In fixed income, we further reduced exposure to the European yield curve, while increasing our allocation to US investment grade credit. At the same time, we have added US dollar hedges, believing we might still see additional pressure on the greenback. Together, these adjustments underscore our balanced approach aimed at capturing regional growth prospects while maintaining prudent risk management.

Macroeconomic Outlook

The US

While current economic momentum remains solid – Q2 GDP was revised up to 3.3% on the back of strong investment – the outlook for consumption, which drives two-thirds of growth, is becoming more fragile. Retailers are noting greater price sensitivity and, in the months to come, a softening labour market combined with higher prices could weigh on demand. Acknowledging growing risks to the “balanced” labour market, the Fed has signalled readiness to cut rates in September, with the path of further easing dependent on a) job market dynamics and b) how tariffs filter through to inflation.

Early signs already point to renewed price pressures. Producer prices and PMIs both suggest inflation pressures are already present, if not yet passed fully to consumer. This is partly because many retailers built inventories ahead of the levies, as well as the fact that tariffs announced in late July do not apply to goods already ordered and scheduled to arrive before October 5. Commentary also suggests businesses are cautious about price hikes, and they could opt to absorb some of the costs through their margins in order to defend market share. After all, consumers do not have the same savings buffers that cushioned them during the last inflationary wave. Against this backdrop, any inflation flare-up may prove more transitory than in the past.

On the corporate side, the Composite PMI rose to 55.4 in August, signalling a strong acceleration in private sector activity. Business investment in the AI and Tech sectors remains a bright spot; 2026 capex forecasts for the major players have surged 29% to USD 461 billion, a figure that rivals the GDP of entire nations. This is set to create positive spillovers across adjacent industries.

Eurozone

The Eurozone economy has shown resilience, with manufacturing activity returning to expansion for the first time in three years (PMI at 50.5), supported by stronger domestic orders, even if external demand continues to weaken. A 15% US trade tariff avoided the worst-case scenario of an escalating trade war, and the added clarity appears to have lifted business sentiment. On the household side, rising real wages and a firm labour market are encouraging consumers to gradually loosen their purse strings, putting a floor under growth, though no consumer boom is expected.

With recession fears fading, markets have scaled back expectations for an ECB rate cut this year. One cut before its March meeting is seen as a coin toss. Still, the region lacks a clear catalyst for a more convincing upturn. Defence spending is often cited as a potential growth driver, but its impact will depend on whether expenditures shift meaningfully towards domestic R&D and production. Currently, the bulk of EU defence budgets flow abroad: of the EUR 75 billion spent between June 2022 and June 2023, nearly 73% went to non-EU suppliers[1] with the US being the primary recipient. Until procurement patterns change, defence outlays are unlikely to translate into significant regional growth multipliers.

Given the above, we see Europe delivering stability but limited upside relative to other major regions.

China

The recent Shanghai Cooperation Organisation summit, attended by leaders representing roughly half of the world’s population, highlighted a shifting geopolitical balance, with American protectionism accelerating Eurasian integration, with China at its core.

China’s economy has outpaced expectations this year, supported by front-loaded exports to the US and targeted government stimulus. More recently, the drag from the property sector has begun to ease, and household consumption has been steady, with retail sales posting positive year-on-year growth each month this year. A full recovery, however, still hinges on a clear bottoming out in housing.

A further extension of the US-Sino trade negotiation deadline to 10 November could provide near-term support, as American retailers replenish inventories ahead of the holiday season. While trade tensions remain a key risk, to keep in mind is the fact that only around 3% of the gross value added originating in China ultimately flows to the US.

The economic trajectory will depend primarily on Beijing’s policy stance which, for the time being, remains proactive but measured, ushering the economy towards the self-imposed 5% growth target.

Investment Decisions

In our global allocation, we have a marginal preference for equities, focusing on the US and select emerging markets, while maintaining underweight positions to Europe and Japan.

At our latest Committee, we increased exposure to onshore Chinese equities (EUR- hedged), compelled by ongoing policy support and stabilising sentiment. This year’s rally has mainly been driven by domestic institutional players, but with earnings yields on equities exceeding those on bonds, households are starting to turn to the stock market. It is estimated that Chinese households are sitting on some USD 22 trillion, including USD 7 trillion in “excess” savings. Notably, A shares have proven more resilient to tariff headlines, as demonstrated after the April “liberation day” announcements. Innovation in AI and domestic semiconductor development (with a growing trend towards hardware-software co-design) could also infuse the market with fresh energy.

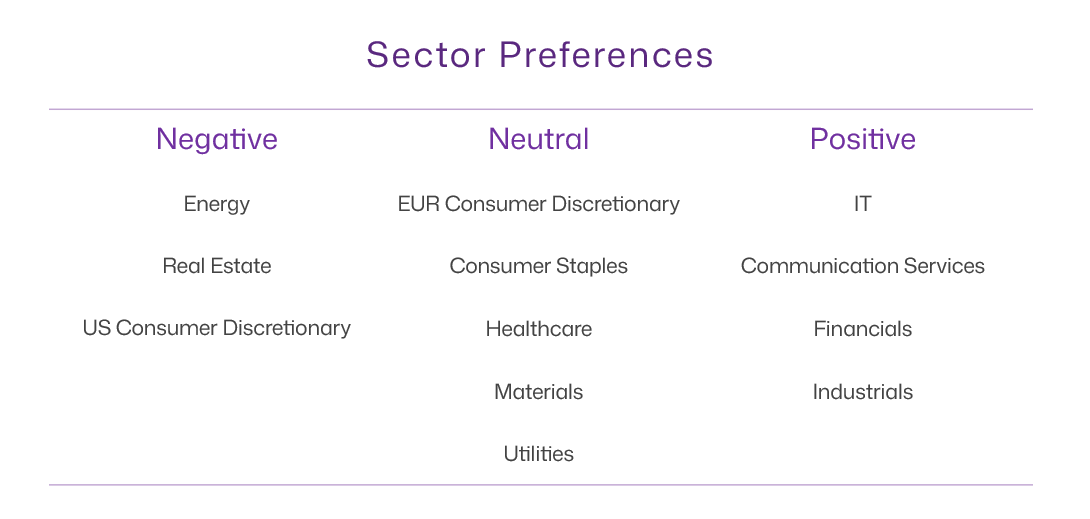

In terms of sector preferences, we downgraded US consumer discretionary from neutral to negative. Consumer sentiment has been weakening as of late, with perceptions of job availability declining for eight consecutive months. Households will bear some of the brunt of tariffs, but unlike in the post-pandemic period, there is no fiscal support offsetting higher prices. This could translate to margin pressure, and indeed, corporate commentary is underscores rising price sensitivity. Walmart has observed volume declines in discretionary categories where prices rose, while Target highlights growing consumer focus on value.

In the fixed income space, we further reduced European government debt exposure. While the short end of the curve should remain anchored with the ECB largely on hold, several factors could pressure the long-end higher: Germany’s fiscal pivot, France’s widening deficit combined with political uncertainty, and the Netherlands’ preparation for a complex EUR 2 trillion pension reform taking effect in January.

The proceeds have been redeployed to increase exposure to US investment grade (IG) credit. Should the Fed move ahead with rate cuts, the short end of the US curve has scope to decline, though upwards pressure on the long end remains possible given fiscal dynamics., making the intermediate segment of the US curve look most compelling. The carry on offer is more attractive than that of EUR equivalents while credit technicals remain strong with significant inflows and limited primary issuance.

Emerging market debt remains an area of opportunity. Hard currency EM bonds offer an attractive combination of high carry and low volatility. While spreads are tight, the carry on offer keeps the asset class palatable. Note that we see greater resilience in sovereigns than in corporates given ongoing trade uncertainty.

We also retain selective exposure to European high yield (HY). Despite limited room for further spread compression, the asset class offers eye-catching yields and upbeat sentiment as recession fears fade. HY bonds’ relatively short duration (below three), has kept volatility low, while the default cycle may have peaked. Together, these features could position European HY as an interesting complimentary allocation for investors with higher risk tolerance.

For risk management, we have increased currency hedging on a portion of our US equity exposure. While the US economy remains resilient, growing strain on consumers, the hit from tariffs and general political uncertainty could present headwinds in the coming months. On the policy side, Fed intervention may cushion growth but could simultaneously weaken the dollar.

Conclusion

In sum, our September allocation reflects a preference for equities over bonds, with a deliberate tilt towards regions and sectors offering stronger cyclical or structural growth potential. We are glancing east with greater conviction, while remaining disciplined in managing risks through selective credit exposure and currency hedges. The result is balanced positioning: leaning into opportunities, especially those backed by policy support, while keeping portfolios resilient in the face of fiscal and macro uncertainty.

[1] According to the European Economic and Social Committee

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 23, 2026

Weekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...