Concerns are rising about France’s ability to reduce its debt burden amid political instability and debt rating downgrades. Meanwhile, Italy has made progress in reducing its budget deficit in recent years, prompting the question: are the countries roles reversing?

The political turmoil that has plagued France since President Macron called a snap election in June last year reached a new high in September, when the government collapsed after Prime Minister François Bayrou lost a vote of no confidence. Bayrou was ousted and replaced within a day after looking to gain parliamentary support for his deficit-cutting budget, which included tax increases and spending cuts. The baton was then passed to Sébastien Lecornu, who has now begun the race to get the budget across the finish line and approved by parliament before the end of the year. He is France’s fifth prime minister in less than two years — one more than is typical for a relay team sharing the sprint to the finish line.

Lecornu received a rather cool welcome to his new role as one of the three major rating agencies, Fitch, downgraded France’s debt rating to A+ (stable outlook) from AA- (negative outlook) only days after he took office. This was due to concerns that political instability will hinder the country's ability to reduce its deficit. Within a week, Morningstar DBRS followed suit, demoting France’s long-term issuer rating to AA from AA (high) and changing the outlook from stable to negative.

This growing lack of confidence in France's ability to reduce its debt burden, with a deficit of 5.4% of GDP, raises the question:

Is France becoming Europe’s new fiscal problem child?

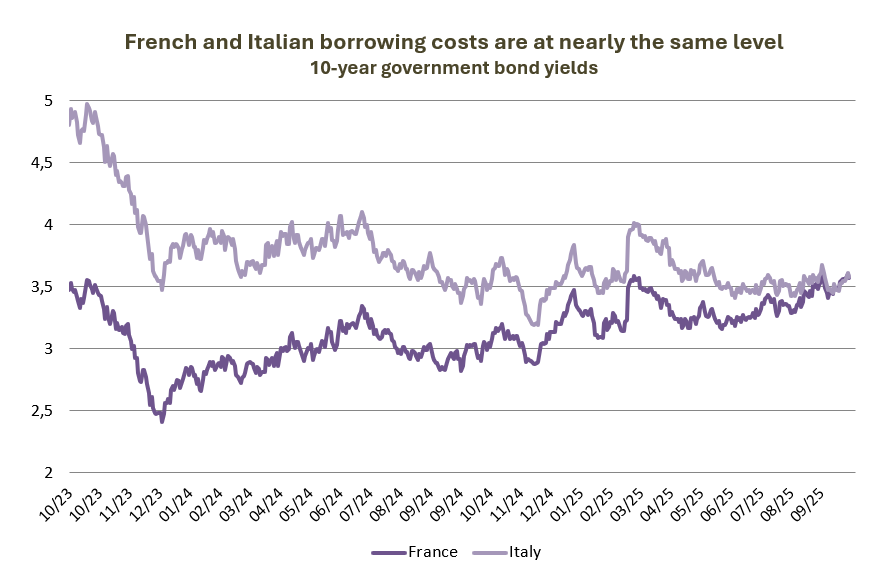

For the last 20 years, this title has often been attributed to Italy, which has become synonymous with reckless spending and unsustainable debt. However, just a few weeks ago, the borrowing costs of both Italian and French 10-year government bonds reached the same level, as the gap between their respective bond yields narrowed to zero basis points (bps). For comparison, the difference between the two countries' 10-year government bond yields was around 40 bps in April this year and 200 bps during the pandemic. A higher yield on government bonds means that governments have to pay more to finance their debt. In this case, it suggests that investors now consider French bonds to be as risky as Italian ones.

Source: Bloomberg, BIL

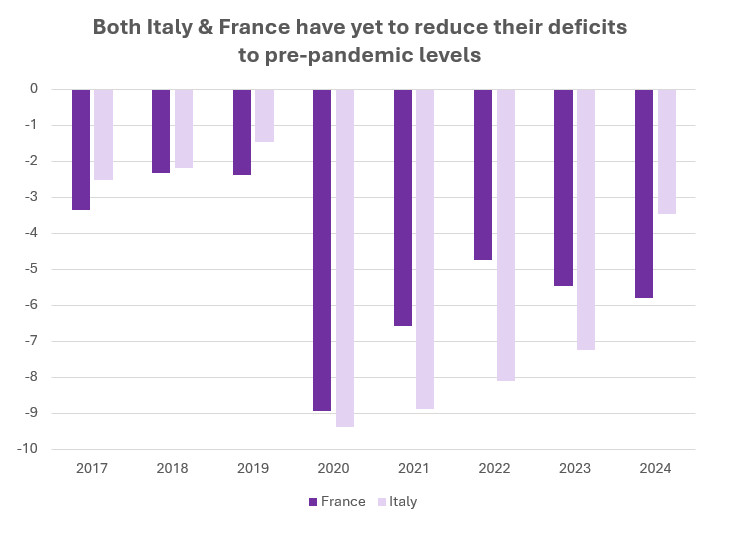

One clear difference between the two countries today is, one has had two prime ministers ousted by confidence votes in nine months, while the other has had the same government in power for almost three years. Furthermore, this government has made progress in reducing its country's deficit. When Giorgia Meloni became Italy’s prime minister in 2022, the country’s budget deficit stood at 8.1%. By 2024, this had fallen to 3.4%, and it is expected to drop below the EU target of 3% next year.

While both countries increased public spending significantly in response to the pandemic and the energy crisis that followed Russia’s invasion of Ukraine, France has not yet managed to reduce spending, having introduced tax cuts with the ambition to boost growth in the meantime.

Source: IMF, BIL

The risk perception of Italian government bonds has also improved since Meloni came into power. In October 2022, the BTP-Bund spread (a comparison between Italian government bonds and German Bunds, which is a key indicator of the market's appetite for Italian bonds) was around 250 basis points. Since then, it has narrowed significantly, reaching approximately 80 basis points. Meanwhile, the French equivalent, the OAT-Bund spread, has widened from around 50 basis points before President Macron called the snap election last year, to around 80 basis points. This illustrates the contrasting changes in perception of the two countries.

What are the practical consequences of France’s mounting fiscal problems and subsequent credit downgrades?

A downgrade typically increases the risk premium demanded by investors for buying sovereign bonds. However, in this case, it seems that the markets had already priced in France’s credit rating downgrade before it was announced. Nevertheless, these kinds of downgrades could prompt investors to review their sovereign risk frameworks, as certain investment mandates may include restrictions on acceptable bond ratings. This is unlikely to be the case with France’s downgrade though. After all, the country still holds A+ (stable), AA- (negative) and Aa3 (stable) ratings from the three biggest credit rating agencies, which is a strong assessment of France’s government bonds. France's rating also remains several notches above Italy's, which Fitch recently upgraded from BBB to BBB+.

Much will depend on the ability of France’s newest prime minister to forge a compromise that not only satisfies his political opponents but also effectively addresses the budget deficit, which the Ministry of Finance projects could rise to 6.1% of GDP by 2026 without intervention. For France to avoid being labeled as “Europe’s fiscal problem child”, and the diminished confidence that accompanies such a reputation, the new government will need to build a convincing plan to reduce the country’s debt burden, sooner rather than later.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 23, 2026

Weekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...