Choose Language

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels of Hurricane Helene, which hit the southeastern US at the end of September. Hurricane Helene is estimated to have caused up to $47.5bn in losses to property owners, and Milton was no less destructive. Losses from Milton are expected to be partly covered by catastrophe bonds, which are used to hedge risks from major hurricanes in the US. The impact is expected to show up in labour market data and activity in the months ahead. Western Europe also braced for heavy wind, rain and flooding as the remnants of Hurricane Kirk passed over France, Portugal and Spain.

Brent crude spiked early last week as the aforementioned storms in the US, as well as conflict in the Middle East sparking supply fears. However, the surge was short-lived and halted by concerns over Chinese demand, with Beijing’s fiscal stimulus plan undershooting expectations.

Turning to the stock market, the continued strength of the US economy indicated in the latest labour market and corporate profit releases drove stocks higher, with the S&P 500 closing at a new record high. Cyclical stocks led the gains, these are stocks that tend to mirror the ups and downs of the economic cycle more than others.

The week concluded with bulge bracket US banks reporting their third quarter earnings. Among some of the biggest names, the results topped forecasts.

Weekly roundup

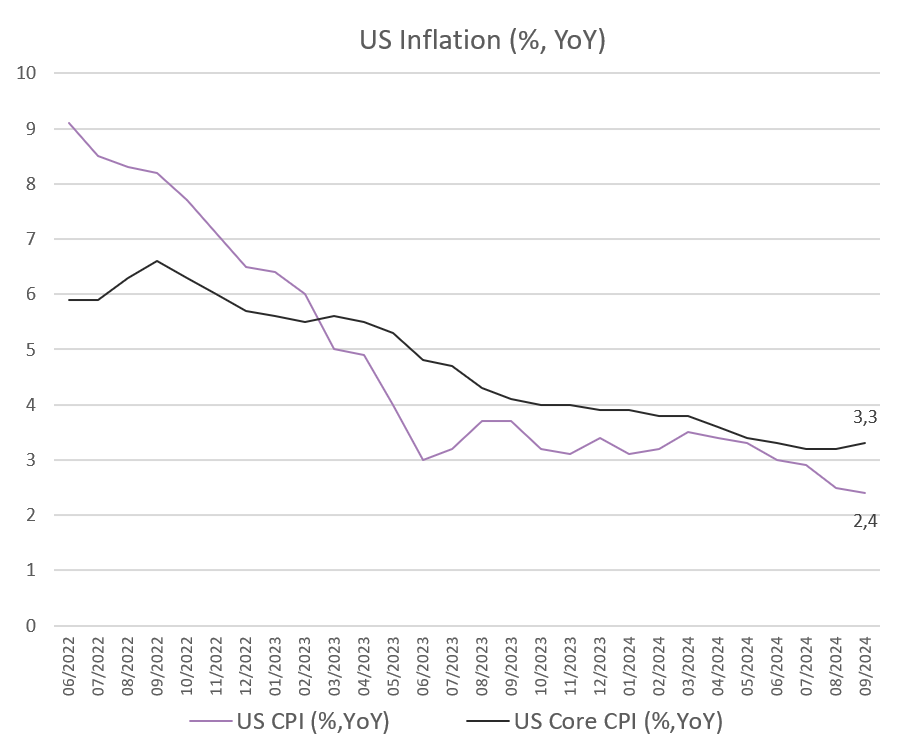

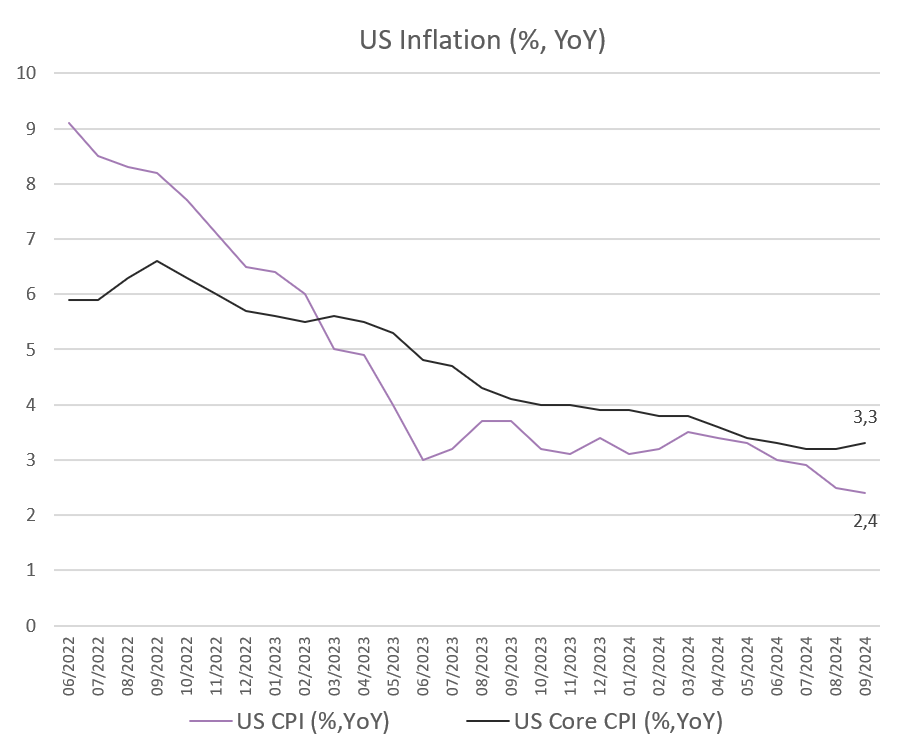

US inflation falls to its lowest since February 2021

US headline inflation printed at 2.4% in September, down from 2.5% in August but above market expectations of 2.3%. Core inflation, excluding items such as food and energy, rose unexpectedly to 3.3%. However, the increase was driven by volatile items, making the rise less concerning.

Source: Bloomberg, BIL

While services inflation is falling, it remains elevated at 4.7% YoY, pushed up by medical care, vehicle insurance and airfares.

There were some new all-time highs in the data... With a new school year having kicked off, college textbooks rose an unprecedented 4.2% month on month. Jewellery and watches also saw their largest month-on-month increase (+5.2%). The surge in watch prices is likely linked to the strong Swiss franc, which we wrote about a few newsletters ago. Swiss watchmakers have expressed concerns about the strong currency hurting exports, urging the Swiss central bank to take action. Admission to sporting events also hit a new high (10.5%).

Following the print, traders still believe the Fed will enact another rate cut in November, albeit by a smaller 25 basis points.

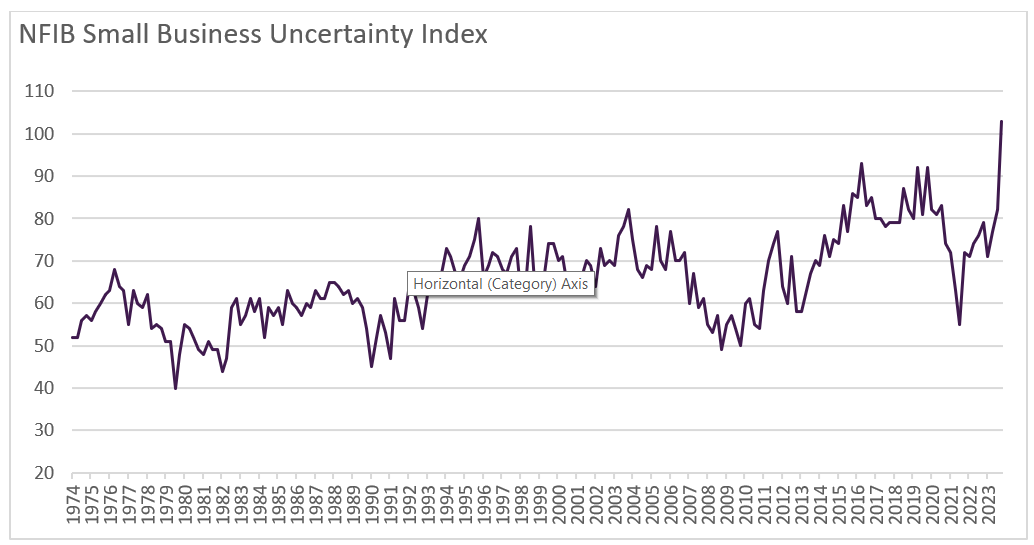

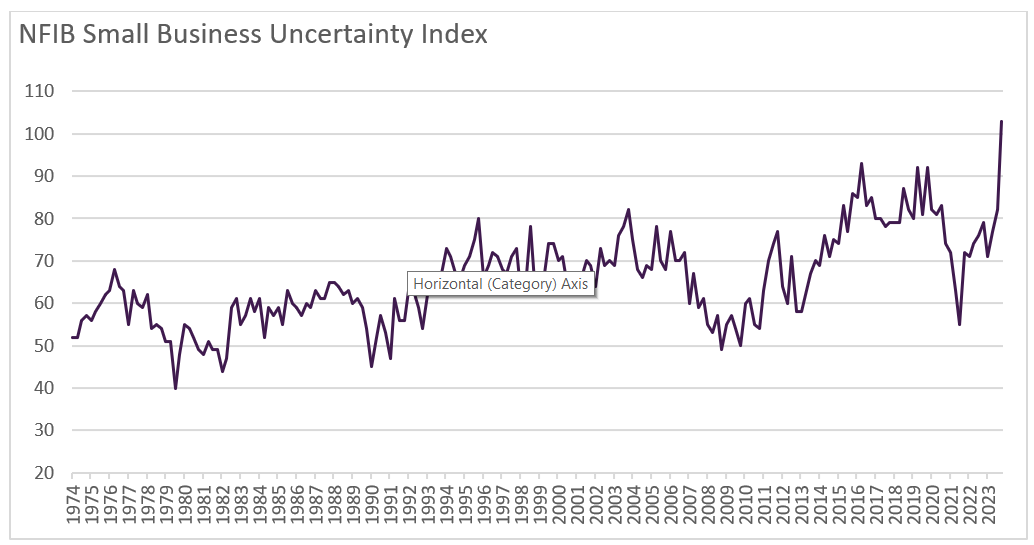

American small businesses frozen by election uncertainty

The latest NFIB survey has shown that uncertainty among small US firms is at an all-time high ahead of the highly polarized US Presidential election on November 5th. With the near-term future difficult to predict, companies are holding back on capital expenditures and drawing down inventories.

On a brighter note, sales expectations rose to -9, from -18, though this subcomponent typically ebbs and flows with political developments and the stock market rather than underlying business conditions.

Overall, it seems that companies (even larger ones tracked by PMIs) are having difficulty seeing beyond an election in which the two candidates have such contrasting campaigns. However, once election uncertainty subsides, the tailwinds look promising…

Consumers continue to exhibit a willingness to spend, and the holiday shopping season is teeing off. Moreover, while Fed interest rate cuts act with a long lag, eventually looser monetary policy should begin to kick-in, giving investment a boost.

Source: Bloomberg, BIL

Cautious European consumers begin to loosen their purse strings

The US consumer is notorious for its power to drive economic growth, even in the most uncertain circumstances. The European consumer, on the other hand, tends to play it safer.

During the pandemic, household savings around the world hit highs as entire populations went into lockdown and spending patterns changed drastically. Once the world opened up again, the hope was that consumers would begin to spend those savings, perhaps even leading us into a new version of the Roaring Twenties.

In the US, consumers have now spent all of their pent-up savings, according to analysis by the Federal Reserve. In Europe, however, a lot of cash is still parked under the metaphorical mattress. In fact, Eurozone household saving rates are still higher than they were before the pandemic, having risen to a three-year high of 15.7% in the second quarter of this year. In the US, personal savings rate was 5.2% in Q2. European consumers are known to be more cautious than their American counterparts, but the uncertainty created by Russia's invasion of Ukraine has made European consumers particularly wary.

Another issue that has contributed to European consumers' caution is interest rates. Shorter-term mortgages are more popular in Europe, forcing homeowners to set aside more money for higher interest rates on new loans, while many Americans are locked into record-low rates on 15- and 30-year fixed-rate mortgages.

Offering a glint of hope for Europe’s struggling economy, signs are now emerging that the European consumer might finally be awaking from its slumber. With inflation declining and the ECB in an easing mode, consumer confidence is returning.

Source: European Commission, Bloomberg, BIL

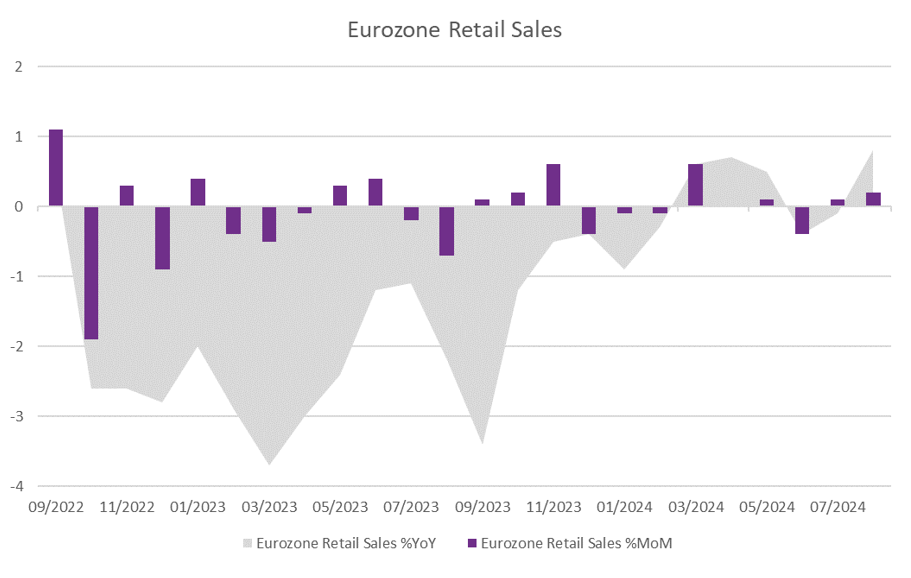

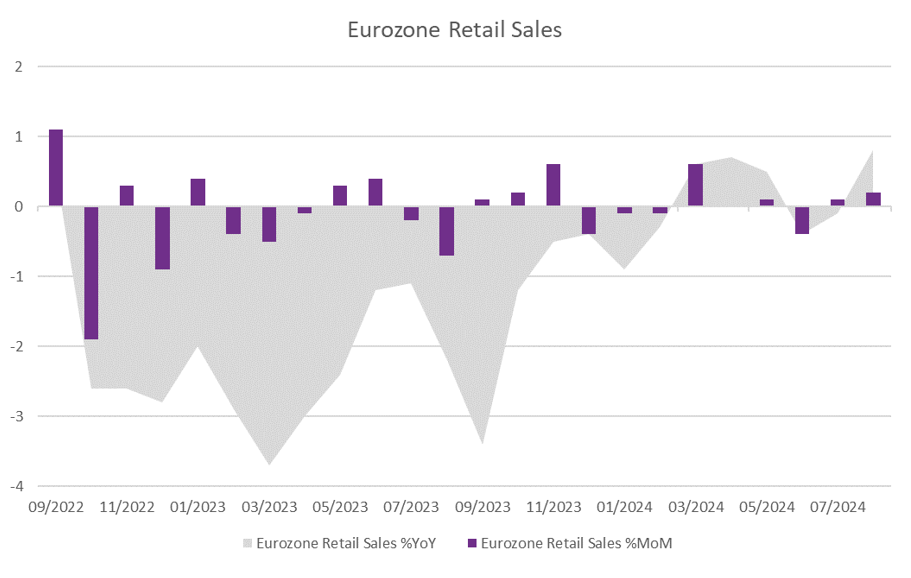

Hard data appears to be following, with Eurozone retail sales showing a mild pick up in spending.

Source: Bloomberg, BIL

Worth mentioning is that German retail sales account for around one-third of the Eurozone total. However, with data unavailable from Destatis for four months running, the Eurozone sales figures have been collated without including the bloc’s biggest economy. Last week, Destatis finally released retail sales data after a hiatus and the news was good. Retail sales in Germany climbed by 1.6% month-to-month in August, extending the increase after a 1.5% rise in July. This will likely result in upward revisions to the broader Eurozone data and also suggests that the consumer might bring some light tailwinds for the bloc’s economy as we move into 2025.

Portugal: a new tax haven for the young?

For years, Portugal has struggled with a brain drain, with young people leaving the country to seek better opportunities in other European countries. Even though the country has invested heavily in education, a large proportion of its young still choose to leave after completing their studies to pursue careers elsewhere. Last week, Portugal's prime minister announced a plan to stop this; one that would make the country a tax haven for the youth.

The government has unveiled a plan that offers a decade's worth of tax breaks for people starting out in their careers. Young people will be exempt from paying income tax for the first year of their career, exempt from paying 75% in years two to four, 50% in years five to seven and 25% in years eight to ten. The tax breaks will also be available to non-Portuguese citizens, making it a bid to attract talent, as well as retain it.

Nonetheless, comparatively low wages and high housing costs remain a problem. The plan still has to be approved by parliament, but if it goes through it will be a major incentive for young people to stay in Portugal while they start their careers.

EU China trade tensions

The EU’s decision to impose tariffs on imports of Chinese electric vehicles sparked some controversy last week. In an attempt to protect European car makers for Chinese competition, the EU decided at the start of October to impose tariffs of up to 45% on imported electric vehicles from China. The purpose of the tariffs is to give European car makers the possibility to compete with the Chinese brands that have rapidly expanded in Europe in recent years.

These tariffs apply not only to Chinese automakers, but also western companies who produce electric vehicles in China for the EU, and have not been warmly welcomed by some European car makers. BMW’s chief executive Oliver Zipse said that a trade conflict with China would “severely slow down . . . the fight against climate change”.

China, too, has expressed its frustration. In retaliation, it announced provisional anti-dumping measures on EU brandy imports, which will hit French cognac hard. French cognac stocks took a hit on the news. Beijing has also launched an investigation into European dairy and pork imports.

Economic calendar for the week ahead

Monday – US Consumer Inflation Expectations (September).

Tuesday – UK Unemployment Rate (August), HMRC Payrolls Change (September). Eurozone Industrial Production (August), Eurozone & Germany ZEW Economic Sentiment Index (October).

Wednesday – UK Inflation Rate (September). US Export & Import Prices (September).

Thursday – Japan & Switzerland Balance of Trade (September). Eurozone Balance of Trade (August), Inflation Rate (Final, September). ECB Interest Rate Decision. US NAHB Housing Market Index (October).

Friday – China GDP Growth Rate (Q3). UK Retail Sales (September). US Building Permits (Prel, September), Housing Starts (September).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...