On Friday, President Trump announced that the US will impose 100% tariffs on imports of branded or patented pharmaceutical goods from October 1. There will be an exception, however, for companies that are in the process of building new manufacturing sites in the US. The president also announced tariffs of 25% on heavy trucks, as well as 50% on bathroom vanities and 30% on upholstered furniture. The new levy on branded medicine will come as a blow to countries like Switzerland, that is still hoping to reach a better trade deal with the US, with pharmaceutical exports being a main concern.

US stocks declined last week as comments from the Fed and stronger-than-expected economic data led investors to temper their expectations regarding the pace of further interest rate cuts. On Monday, gold prices surged above $3,800 an ounce for the first time, as concerns over a potential US government shutdown sparked increased demand for the safe haven asset. The federal government is at risk of shutting down this week as Congress has yet to reach a funding agreement ahead of the new fiscal year starting on 1 October. President Trump is set to meet with congressional leaders from both the Republican and Democratic parties on Monday in an attempt to reach an agreement.

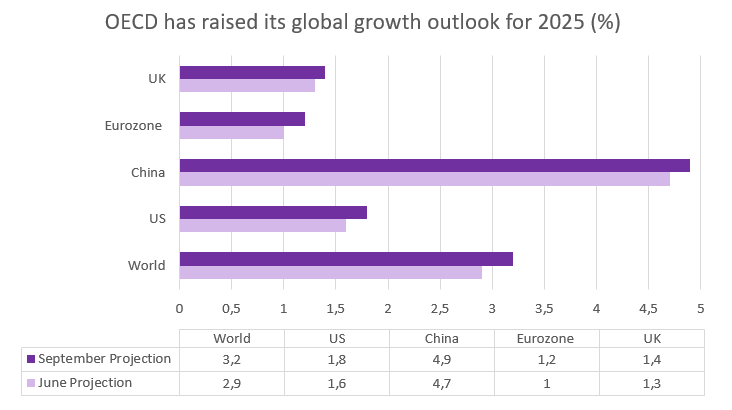

Global growth has held up better than expected this year, according to the OECD

We have yet to feel the full impact of US tariffs, said the Organisation for Economic Cooperation and Development (OECD) in its latest Economic Outlook Interim Report last week. Global growth has held up better than expected this year as investments in artificial intelligence have cushioned the tariff impact in the US, while fiscal support has boosted Chinese activity in the first half of the year. The OECD said that companies have absorbed much of the tariff impact so far, but this may not be sustainable in the long term. Many companies rushed to front-load shipments and stockpile goods ahead of the levies being implemented, but that stockpile is now dwindling.

Given that growth in the first half of the year was stronger than expected, the OECD has revised its growth outlook for the years ahead. The global economy is now expected to slow only slightly to 3.2% in 2025 compared to the 2.9% forecast in June. However, growth in 2026 is still expected to slow to 2.9%, in line with the June forecast, as some of the factors that helped growth exceed expectations this year begin to fade.

Source: OECD, BIL

Given the expected slowdown in growth in 2026, the OECD anticipates that major central banks will reduce interest rates and maintain loose monetary policies over the next year, provided that inflation remains under control.

Macro Snapshot

Europe

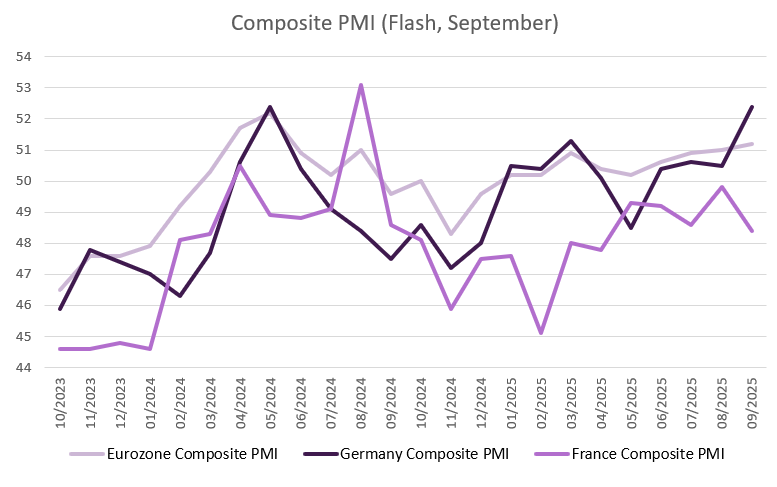

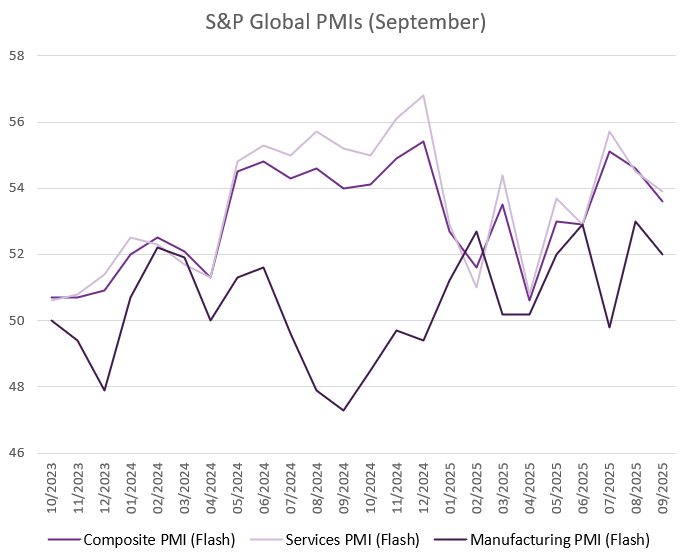

According to preliminary estimates, business activity in the Eurozone expanded at its fastest pace for 16 months in September, with growth in the service sector offsetting the contraction in manufacturing. The Composite PMI increased to 51.2, up from 51.0 in August. The expansion was driven by services, with the PMI climbing to 51.4 in September from 50.5. It marks the strongest growth this year and was supported by an improvement in new orders. Firms also reduced backlogs of outstanding orders at the fastest rate in three months. However, the manufacturing sector fell back into contraction in September, with the PMI falling to 49.5, after rising above the growth threshold of 50 in August. This renewed downturn was driven by a sharp drop in new orders and slower output growth.

On a country-by-country basis, the PMI survey showed a sharp divergence between the bloc’s two biggest economies. Germany registered solid growth, with the composite PMI jumping to 52.4 in September — the highest reading since May 2024. The improvement in business activity was driven by the services sector, which rebounded from a contraction in August. Meanwhile, the contraction in manufacturing worsened. In France, business activity declined for the thirteenth consecutive month, with the composite PMI standing at 48.4. Both services and manufacturing activity contracted. Services saw sharper output falls, while manufacturing suffered from weak demand. Heightened political uncertainty has contributed to weaker client demand.

Source: Bloomberg, BIL

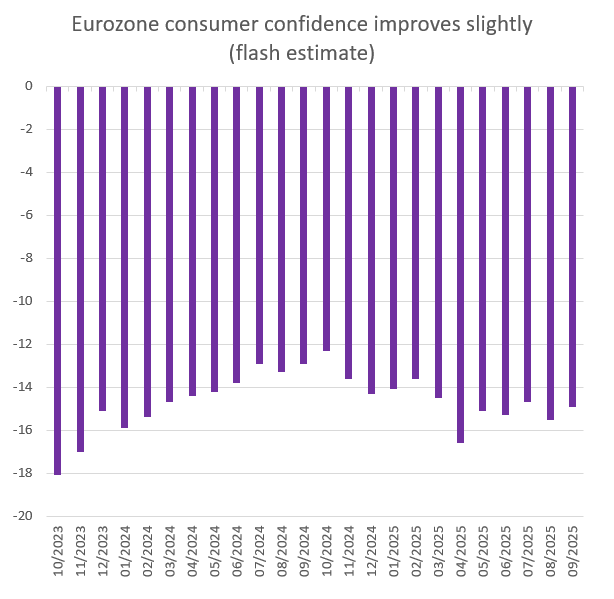

Looking to the bloc’s consumers, confidence remains muted. After falling to a four-month low in August of -15.5, consumer confidence in the Eurozone rose to -14.9 in September. While concern over trade tariffs and fiscal policies in Europe remain, lower borrowing costs and easing inflation in recent months led to a slight improvement in confidence.

Source: Bloomberg, BIL

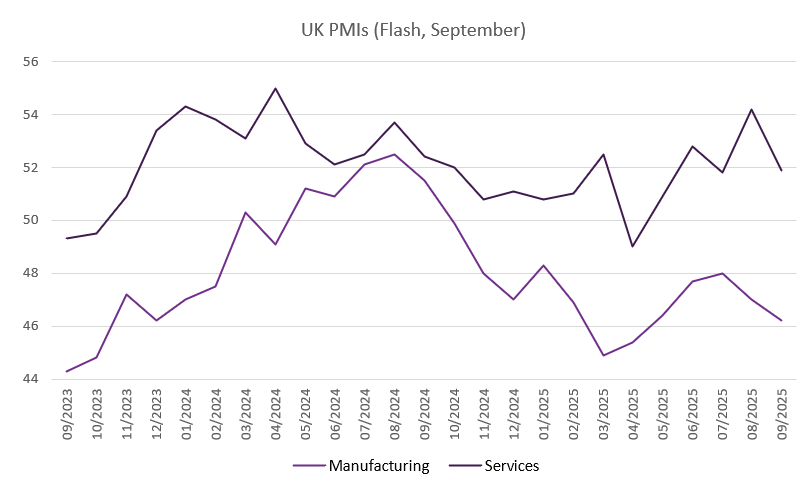

In the United Kingdom, fear about potential tax hikes in the upcoming Autumn budget caused business activity to slow in September. According to preliminary PMIs, UK firms lost momentum and confidence as they await the announcement of the Autumn budget in November. The composite PMI slowed to 51 in September, from 53.5 in August, below the expected softer fall to 53. As a sign of uncertainty, business activity expectations for the year ahead fell to a three-month low, mainly due to falling sentiment in services. The PMI decelerated to 51.9 from 54.2 in August. The manufacturing contraction worsened, with the PMI falling to 46.2 in September, from 47. Wage pressures continue to be a burden on businesses following the increase in National Insurance contributions in the last Autumn budget, causing employment levels to decrease for the 11th straight month.

Source: Bloomberg, BIL

The Swiss National Bank (SNB) held its benchmark interest rate steady at 0% on Thursday, as it waits to assess the impact of US tariffs on the Swiss economy. This decision was widely anticipated following the central bank's interest rate cut of 25 basis points in June, marking the sixth consecutive meeting at which rates were reduced. The SNB said that inflationary pressures are largely the same as in June. Assuming interest rates remain unchanged, the SNB expects average inflation to be 0.2% in 2025, 0.5% in 2026, and 0.7% in 2027.

This was the first monetary policy meeting since President Trump announced a 39% tariff on Swiss exports to the US in August, and the SNB noted that while machinery companies and watchmakers had already felt the impact of tariffs, the services industry had mostly been spared. The SNB also said that the economic outlook for Switzerland had deteriorated due to the higher tariffs imposed, which are likely to dampen exports and investments. The SNB continues to expect GDP growth of 1–1.5% for 2025 as a whole, but anticipates a slowdown to just under 1% in 2026.

US

The US economy grew by more than was previously estimated in Q2, following a sharp upward revision of consumer spending figures. In its third estimate of GDP growth, the Bureau of Economic Analysis increased second-quarter growth to 3.8% year on year, up from the previous estimate of 3.3%. This followed negative growth of 0.6% in the first quarter of the year. It was largely due to a significant increase in consumer spending, which rose from 1.6% to 2.5%, as well as an increase in business investment. The data shows a steep fall in the trade deficit, as the surge in imports that negatively impacted GDP growth in Q1 turned into a decline in imports in Q2. The smaller trade deficit added a substantial 4.83 percentage points to GDP growth.

US equities fell upon the release of the data, as market participants viewed it as providing little support for further interest rate cuts by the Fed. Following last week's 25-basis-point interest rate cut, the Fed stated that it would continue to review incoming data to inform future monetary policy decisions. While the GDP revision shows that the US economy grew stronger than expected in Q2, more recent data, such as the September employment report, will be crucial in informing the Fed's decision-making process in October.

US firms seem to be absorbing most of the tariff costs for the moment, as weak demand and rising competition are making it difficult to pass on increased costs to consumers. According to preliminary estimates, business activity moderated in September, with the Composite PMI falling from 54.6 in August to 53.6. This marks the second consecutive month of falling activity, with both the services and manufacturing sectors slowing to 53.9 and 53, respectively. Input costs reached their highest level since May, largely due to tariffs, while output costs increased at their slowest pace since April, as companies struggle to raise prices. New orders in both industries slowed, and slower-than-expected sales led to a sharp rise in factory inventories of unsold goods.

Source: Bloomberg, BIL

Despite the moderation in activity, business sentiment for the future improved as firms hoped that lower interest rates might offset the impact of tariffs and the wider economic situation.

Calendar for the week ahead

Monday – Eurozone Economic Sentiment (September), Consumer Confidence (Final, September).

Tuesday – UK Business Investment (Final, Q2). France, Italy & Germany Inflation Rate (Prel, September). Switzerland KOF Leading Indicators (September). US Housing Stats (July), JOLTs Job Openings (August), Conference Board Consumer Confidence (September).

Wednesday – Switzerland Retail Sales (August), Manufacturing PMI (September). Eurozone, UK & US Manufacturing PMI (Final, September). Eurozone Inflation Rate (Prel, September). US ISM Manufacturing PMI (September).

Thursday – Switzerland Inflation Rate (September). Eurozone Unemployment Rate (August). US Challenger Job Cuts (September), Jobless Claims, Factory Orders (August).

Friday – Eurozone, UK & US Services PMI (Final, September). US Non Farm Payrolls (September), ISM Services PMI (September).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 1, 2025

Weekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...

November 10, 2025

Weekly InsightsWeekly Investment Insights

US tech stocks experienced their worst week since President Trump’s “Liberation Day” last week, with investors growing increasingly concerned about high valuations and elevated artificial...