A choppy start to 2025

When we published our 2025 Outlook, Tides of Change, we anticipated a year defined by turbulence—and indeed, the first half has been nothing short of eventful.

A global bond sell-off rattled markets at the onset of the year, driven in part by concerns over inflationary policies in the US and uncertainty around the Federal Reserve’s path forward. After taking office on January 20, President Trump prioritised his wish to reduce the US trade deficit, while business-friendly policies such as tax cuts and deregulation, remained on the backburner.

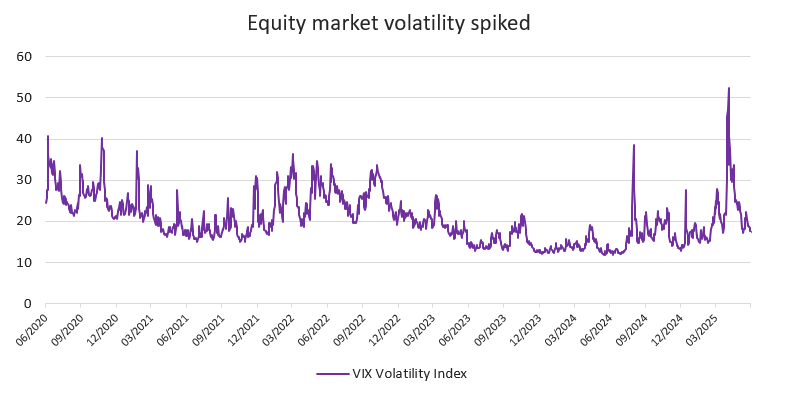

On April 2, so-called “Liberation Day”, the US Administration unveiled a long list of “reciprocal” tariffs, leaving layers of complexity for investors to decode. Tariffs on key trading partners were higher than anticipated and retaliation from China catalysed a tit-for-tat trade spat between the world’s two largest economies. Economists rushed to revise growth expectations downwards, while warning that levies could rekindle US inflation. Equities sold off quite violently, with trade tariffs—more than central bank policies or earnings—becoming the dominant market driver. Most of the draconian measures announced on Liberation Day have now been diluted. A notable moment came on May 12, when a partial US-China tariff deal spurred a relief rally. The agreement included significant reductions in duties, offering a brief reprieve and a glimpse of potential stability. But even if the hardline tariffs have been dialled back, the average effective US tariff rate on its trading partners is still higher than it has been since the 1930s and that will impact growth over time if it remains to be the case.

The trade situation could remain volatile, perhaps even beyond the end of the 90-day negotiation period on July 9. Lasting uncertainty threatens to limit the extent of any recovery in business and consumer confidence, deter hiring, obscure the outlook for company earnings growth, and bring further market volatility.

Indeed, executives used earnings calls to warn that real clarity over trade policy was needed for companies to resume making significant decisions. Despite headwinds, however, corporate earnings have shown resilience. European equities enjoyed additional tailwinds after Germany’s historic decision to boost spending, and the EU’s announcement of a EUR 800 billion spending package to bolster the continent’s defence capabilities.

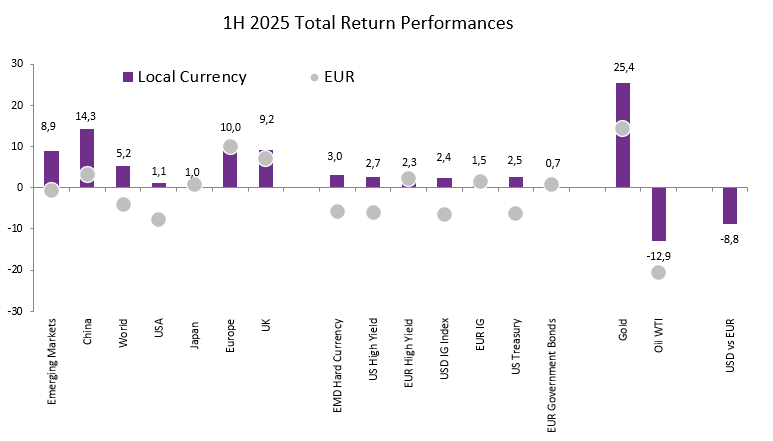

The repatriation of investor capital to Europe amid fading US exceptionalism and fears over the Fed’s independence was painful for the US dollar. The currency effect was doubly painful for EUR investors in US equities. Overall, it was a rough start to 2025, with both equities and fixed income assets both experiencing volatility.

With markets in flux, gold benefitted with prices hitting multiple all-time highs.

Source: Bloomberg, BIL as of 31 May 2025

Source: Bloomberg, BIL

As we enter the second half of the year, volatility seems inevitable. Nonetheless, our perspective remains that instead of reacting to the waves above, we should prioritise going deeper and exploring the calm beneath. Afterall, the economy and the market are not one in the same. Even in slowing economies, select sectors and globally positioned companies can do well, while sharp market moves can also offer attractive entry points for long-term investors.

Macro Outlook

The US

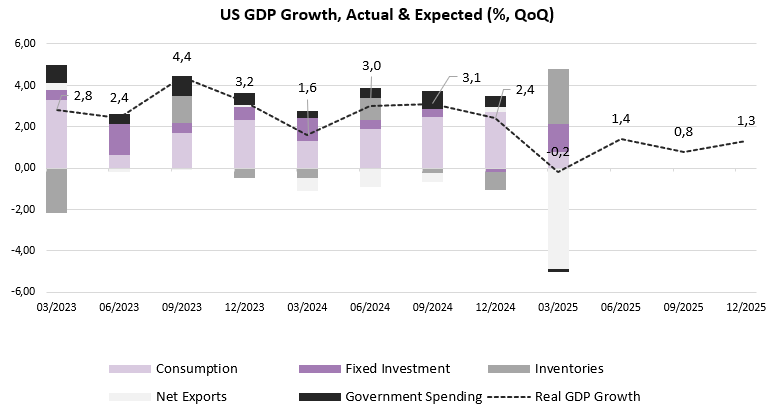

At the start of the year, we anticipated a moderation in US growth. By midyear, it’s clear the deceleration might be steeper than originally forecast. Even if ongoing trade negotiations yield some success and tariffs settle at lower levels, some of the damage has already been done: The economic impact of earlier uncertainty is already affecting macroeconomic data.

The first quarter saw a surge in pre-tariff purchasing, with imports far outpacing exports—an imbalance that weighed heavily on US GDP, which contracted by 0.3%. Looking ahead, goods consumption has been front-loaded ahead of tariffs, likely leaving less spending momentum for the second half. As a result, we now expect a sequential slowdown in US real GDP growth through the remainder of 2025, though it can avoid a recession if worst-case trade scenarios are avoided.

The current consensus among economists points to 1.4% growth this year and 1.5% in 2026—roughly half the 2.8% pace recorded in 2024.

Source: Bloomberg, BIL as of 4 June 2025

This weakening growth trajectory reflects the hit to both consumer and corporate sentiment. Households appear less willing—and increasingly less able—to spend. Given that consumption accounts for roughly two-thirds of overall economic activity, a lasting slowdown would have a significantly negative impact on both corporate margins and stock markets. Still, resilience in the labour market limits the extent of the slowdown. Real wage growth remains in positive territory, and PMI data suggests employment levels should remain broadly stable in the near term. This would suggest that household consumption remains supported for the time being, even if we expect it to be more subdued.

On the policy front, deregulatory momentum is gaining traction. US regulators are reportedly preparing to reduce capital requirements for banks, potentially easing some of the safeguards introduced in the aftermath of the 2008 financial crisis. Tax reform is also back on the agenda. Lawmakers are working to extend provisions from the 2017 Tax Cuts and Jobs Act, with some breaks potentially being expanded further.

Europe

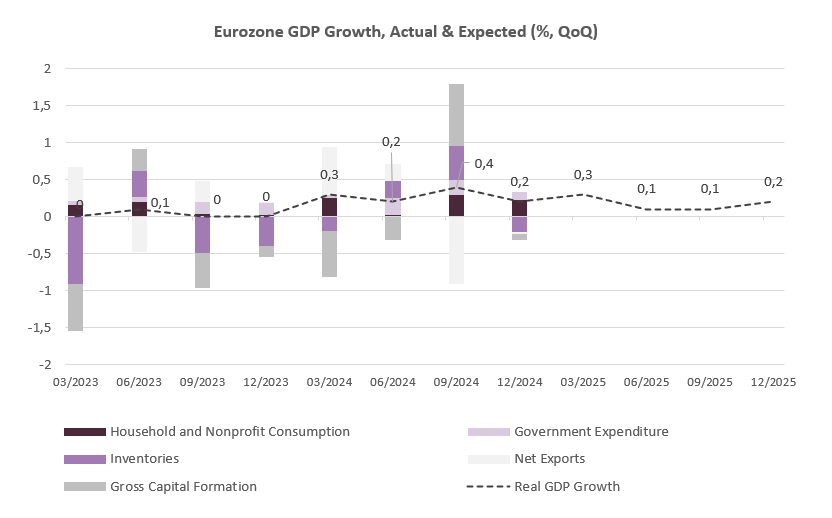

Across the Atlantic, the Eurozone’s recovery is faltering amid weak domestic demand and a strengthening euro, which is eroding export competitiveness. Much now hinges on trade negotiations with the US, which accounts for about 3% of EU GDP through exports. Germany, the bloc’s largest economy, is especially exposed, and the IMF projects a third consecutive year of stagnation for its economy. Bundesbank President Joachim Nagel has warned of rising recession risks.

While the election of Friedrich Merz as Chancellor has ended a six-month period of political gridlock and signals a shift toward more pro-business and socially conservative policies, it is crucial to remember that the positive impacts of these changes will take time to materialise. Increased EU defence spending will provide long-term benefits, but in the short-term, trade developments are overshadowing these potential gains. Fiscal stimulus in the realm of defence will take time to scale and deliver its full effect, particularly given import dependencies and implementation lags.

Insofar as now, it is difficult to predict how trade dialogue between the US and the EU will conclude. The EU has prepared a list of US exports worth EUR 95 billion that could face retaliatory tariffs if talks fail. With little progress reported, Brussels may implement countermeasures as early as July 9. Additionally, negotiations between the US and China also carry weight for Europe. A diversion of Chinese goods into European markets could suppress prices and increase competitive pressure on domestic firms.

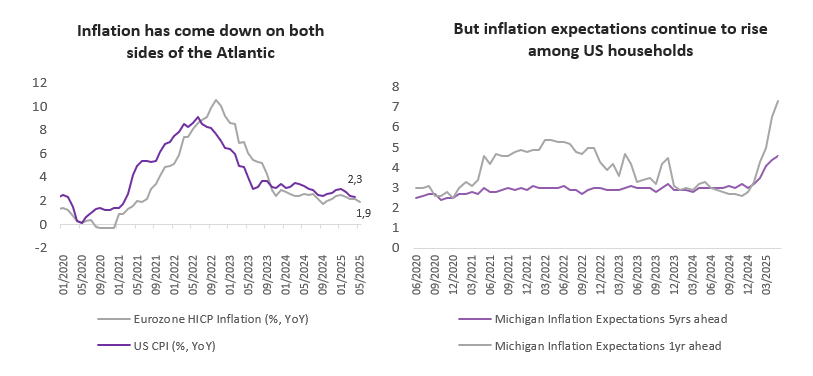

On a more encouraging note, inflation in the Eurozone appears to be under control and now sits just below the 2% target. This should allow the European Central Bank to continue cutting rates in an effort to stimulate growth—an appropriate response given persistently weak corporate and consumer demand. Although European households have built up savings, confidence remains fragile, limiting the potential for a strong consumption rebound.

In contrast, the US Federal Reserve remains in a holding pattern, with the potential impact of tariffs threatening its dual mandate. One-year-ahead US consumer inflation expectations have surged to 6.5%—the highest level since 1981—while PMI data shows that prices recently saw their largest increase in nearly two years. With risks to growth rising and pricing pressures heating up again, the Fed’s policy calculus is becoming increasingly complex heading into the second half of the year. While the US central bank will have to choose its wording and measure its actions very carefully, we do believe one or two rate cuts are still in play for this year.

Source: Bloomberg, BIL as of 4 June 2025

In all, although there have been several positive developments for the Eurozone economy this year, it is too early to say the economy is safely out of the woods. The promises of investment and policy change must first translate into tangible results before a lasting European recovery can be achieved.

Source: Bloomberg, BIL as of 4 June 2025

China

In China, the economy is weighed down by ongoing trade tensions with the US, fears of unemployment, weak domestic demand and deflationary pressures. While the agreement between China and the US to pause 'reciprocal' tariffs for 90 days was welcomed, the remaining 30% tariffs will still have a significant impact on the economy. Signs of the tariff hit are already evident in industrial output and retail sales growth, both of which slowed in April after a strong start to the year. Although factory output is likely to increase in the coming months as importers bring forward imports before the 90-day pause ends, this momentum is unlikely to continue. The real estate slump also persists, with new home prices continuing to fall.

At the same time, the stimulus offered by Beijing continues to underwhelm. While the expansion of the appliance trade-in scheme at the start of the year boosted sales in the relevant subsections, it likely frontloaded consumer spending, meaning future consumption may have been sacrificed in the process. The recent cut in China’s benchmark lending rates should ease mortgage costs; however, this is not considered enough to boost consumer confidence in the real estate sector.

Although Beijing has reiterated its commitment to boosting consumer confidence and consumption on multiple occasions, market participants are still awaiting a stimulus announcement that will deliver.

Investment Strategy

In an environment characterised by volatility and shifting circumstances, it is important to recognise the distinction between the broader economy and the companies operating within it. While news headlines influence market sentiment in the short-run, it is ultimately earnings and company performance that drives markets over the long-term. Rather than becoming overly reliant on momentum-driven strategies, it’s crucial to focus on identifying companies with strong fundamentals that can withstand challenging economic conditions. Prioritising this approach enables us to navigate uncertainty more effectively and identify hidden opportunities that may not be apparent within the broader economic narrative.

EQUITIES

US equities – Slowing growth but peak uncertainty may be behind us

After a volatile start to the year, equities appeared to find a degree of calm at the start of May as President Trump walked back some his most draconian tariffs. In fact, the S&P 500 enjoyed its strongest May performance in 35 years.

While shifting trade policies are likely to continue injecting volatility into markets, and while the US economy is set to slow, we do think a recession can be avoided. Even amid slower economic growth, select sectors and companies continue to offer strong return potential. And one potential upside scenario cannot be disregarded: as countries yield to Trump’s hardline tactics, the result could be a reduction in global trade barriers and ultimately more trade – even if the probability of this is low.

All things considered, we enter the second half of the year maintaining a slight preference for equities, particularly the US market, while emphasising selectivity.

Several tailwinds for US equities remain intact. The US leads the world in AI development, which promises to boost innovation and long-term productivity. As of late 2024, US companies had increased intellectual property spending by 36% versus pre-Covid levels. In Germany, that figure was only 11%. This investment edge, combined with the sheer superiority of its growth companies and tech giants suggests US dominance will remain intact over the long-term.

Additionally, US corporates stand to benefit from a more favourable earnings backdrop. Downward analyst revisions have lowered the earnings bar, while companies are also enjoying the silver linings of a weaker dollar. Anticipated Federal Reserve interest rate cuts and fading recession fears should also bolster sentiment. The initial “sell America” response to Trump’s “reciprocal” tariffs is already beginning to reverse.

Source: Bloomberg, BIL as of 6 June 2025

Another supportive factor for US equities is an anticipated record-setting wave of share buybacks. American companies are expected to repurchase around USD 500 billion of their own shares this year – deployment made possible by burgeoning cash reserves and subdued capital expenditure due to policy uncertainty. Following 2024’s record-setting USD 942.5 billion in buybacks (per S&P), 2025 could mark the first time annual buybacks exceed USD 1 trillion, with financials and tech groups leading the charge.

European equities – how much juice is left in the orange?

European equities began the year on a strong note, outperforming their US counterparts amid an exodus from dollar-denominated assets. If a worst case scenario with regard to trade is avoided, the bulk of this switch may be in the rearview mirror.

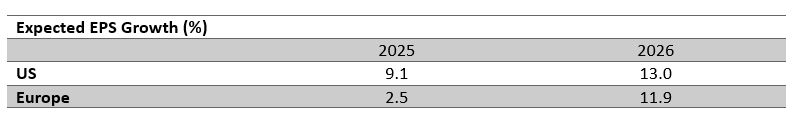

Looking ahead, the region could emerge more resilient, thanks to Germany’s fiscal expansion, and structurally higher defence spending – both of which are expected to catalyse broader technology investment. However, these drivers are more medium-to-long-term in nature. For now, equity market fundamentals look unappealing with only muted earnings growth forecast for 2025.

As we approach the July 9 tariff deadline, European stocks may experience renewed pressure, particularly in light of the hardening tone in trade negotiations. In response to these uncertainties, we have added downside protection on our European equity exposure. Stability is a key pillar of our investment philosophy, and given the recent sharp market moves, this gives us additional comfort to navigate through summer, without exiting the market altogether.

Equity Thematics | A focus on Digitalisation & Defence

Despite market volatility digitalisation remains a powerful long-term investment theme. From artificial intelligence and cloud computing to cybersecurity and data analytics, digital transformation will remain a central narrative to both corporate strategy and public policy across both developed and emerging markets. This trend spans beyond the tech sector, with industrials, financial services and traditional manufacturers rapidly integrating digital tools, creating multi-sector investment opportunities with long-term earnings visibility.

For chipmakers, recent earnings reports have been encouraging, highlighting resilient capital spending by tech hyperscalers—a signal of continued investment in digital capacity. That said, investors should be cautious about assuming that today’s leaders will remain at the top indefinitely. The recent demise of Skype, once one of the world’s most popular websites, serves as a reminder that technological leadership can shift quickly in dynamic markets. The next wave of winners may not be those who built the tools, but those who use them most effectively. As the cost of AI tools declines, we believe the biggest beneficiaries will likely be companies capable of embedding specialised technologies directly into their operations, creating a significant competitive edge.

Meanwhile, renewed geopolitical tensions and driving a structural upswing in global defence spending, particularly in Europe. Major funding packages from the EU and Germany point to a sustained build-up, with cyber-security and local manufacturing being key priorities. Defence stocks are increasingly viewed as a hedge against uncertainty, with rising budget’s expected to exceed NATO’s 2% GDP target in the coming decade. As access to EU funds becomes more selective, European defence firms are likely to gain greater market share. We view the sector as well-positioned for long-term growth.

FIXED INCOME

Bond markets were not spared from the volatility that defined the first half of the year. In Europe, concerns over increased fiscal spending and expanded defence budgets, triggered expectations of higher bond issuance, causing a temporary spike in continental risk-free rates. In the US, evolving trade policy dynamics challenged the safe-haven status of Treasuries, prompting a broad sell-off of in both US government bonds and the dollar. As a result, investors shifted toward European government bonds and safe-haven currencies like the Swiss Franc and Japanese Yen. However, as market conditions stabilised, credit spreads began to tighten.

Looking ahead, diverging economic trajectories between the US and Europe could persist:

- In the US, tariffs are expected to have inflationary effects for consumers. The Federal Reserve, wary of this risk, could keep its key rate in a target range of 4.25-4.50% until it gains more clarity on the situation. We expect the first rate cut in September.

- In Europe, we anticipate the ECB might pause its rate cut campaign over summer. However, if inflation remains in check, another cut to support growth could be warranted, and we maintain a target of 1.75% for year-end.

While both regions share the overarching concern of slower economic growth, we do not subscribe to the scenario of a full-blown recession. In Europe, subdued inflation should provide continued support for European rates. We do not see an obvious domestic catalyst that could drive yields substantially higher; in the short term, the most significant risk would be a spillover from US market movements that cause European yields to rise in sympathy. Structural factors – such as Germany’s expansive fiscal plans or Dutch pension reforms – pose longer-term risks, but these are unlikely to materialise in the second half of 2025.

Intra-European bond spreads remain tight and given that the historically “weaker” links, such as Italy, Greece, and Spain, have demonstrated favourable fiscal momentum, these tight spreads appear justified.

In the US, long-term rates face several obstacles before they can trend lower. The fiscal outlook, especially considering the new “big, beautiful spending bill”, and questions about the stickiness of tariff-induced inflation are potential roadblocks. As previously mentioned, the Fed will maintain steady rates throughout the summer but is likely to initiate rate cuts later in the year, with an acceleration expected in 2026. We would not be surprised to see Treasury yields decline by the end of the year, driven by lower growth and a weaker job market; however, the market must first navigate the hurdles mentioned above, presenting a genuine risk of US rates trending higher in the coming months.

We maintain a constructive view on investment-grade (IG) bonds, which we see as the anchor of a well-balanced fixed income portfolio. Spreads have retraced their “Liberation Day” widening and are now trading as if the tariff disruptions were merely a bad dream. This recovery reflects stronger investor demand, not necessarily due to tighter spreads, but rather driven by the attractiveness of yields. IG bonds tend to perform well in an environment characterised by slow yet positive growth, high yields, solid credit metrics, and supportive central banks. We believe that all these essential ingredients are in place.

While company fundamentals remain solid, and default rates are low, these are, however, lagging indicators, and a greater degree of selectivity is warranted in the months to come.

We recommend scaling back exposure to the riskiest segments of the US high-yield market. Rising long-term borrowing costs – amplified by mounting concerns over US debt levels and Moody’s downgrade of the US’ triple-A credit rating – pose risks for highly leveraged companies. A softening economy and elevated rates could begin to test the resilience of this segment.

In Europe, the situation is somewhat different, with lower rates and a relatively steep corporate bond yield curve offering investors a compelling carry-and-roll-down opportunity, making selective exposure more attractive in Europe than in the US high yield space.

USD – Dominance under scrutiny but far from over

Tariff announcements and the accompanying depreciation of the US dollar have reignited debate about the potential end of dollar dominance. Short-term risks for the greenback still linger, stemming from growth concerns and the ongoing trade narrative.

But while there is a trend towards broader diversification in global transactions, the dollar remains the cornerstone of the global financial system, accounting for approximately 60% of global foreign exchange reserves. The greenback continues to serve as the primary currency for international trade, with volumes far above those of alternatives like the euro and the Chinese yuan.

At present, viable alternative to the dollar are limited:

- The European financial system remains fragmented. Deeper fiscal integration would require substantial political will and further mutualisation of European debt

- Japan’s bond market is heavily controlled by the Bank of Japan, limiting its appeal as a global benchmark

- China’s capital markets continue to operate under strict capital controls, constraining international adoption of the yuan

Looking ahead, monetary policy will play a crucial role in the dollar's trajectory. With the Fed expected to proceed cautiously with rate cuts, the ECB appears to have adopted a decidedly dovish stance. Widening interest rate differentials could provide support for the dollar.

Overall, we think the USD is likely to retain its status as the world's leading reserve currency for the foreseeable future. A gradual erosion of perceived US exceptionalism could, however, lead to greater currency volatility and an increasingly nuanced dollar outlook in the years to come.

Gold

In a world increasingly shaped by economic friction, geopolitical tension and market volatility, gold has reasserted itself as the ultimate safe-haven. Despite a recent pullback, we remain constructive on the precious metal. Gold functions best as a strategic asset in a diversified portfolio rather than a tactical one. Investors who attempt to time entries and exits from gold positions might miss its most powerful moves. This is because gold’s protective properties often manifest suddenly during crisis periods. Maintaining a consistent allocation helps preserve portfolio resilience when other assets come under pressure.

Central banks are key players in the bullion market. They have been net buyers for fifteen consecutive years, and that trend has continued into 2025. Data from the first quarter shows a 244-tonne increase in reported global central bank gold reserves – highlighting sustained institutional demand. We expect this trend to remain robust through the end of the year, underpinned by ongoing diversification away from fiat reverses and rising geopolitical uncertainty.

Conclusion

The first half of 2025 was defined by significant turbulence. Markets were roiled by shifting geopolitical crosscurrents, diverging monetary policy pathways, and trade uncertainty. As these forces churned at the surface, we stayed the course, remained committed to our strategy and avoided reactionary selling – an approach that has proven beneficial, as equities have since regained much of their earlier losses.

Our perspective remains clear: rather than reacting to the waves above and surface-level noise, we should prioritise exploring the calm beneath, where enduring value often resides. Afterall, the economy and the market are not one in the same. Even in slower-growth environments, well-positioned companies and carefully selected sectors can still do well.

A US study published in March revealed the average retail investor spends just six minutes analysing a stock before buying it, with most of that time spent looking only at the current day’s price action.

In today’s fragmented market, it is more important than ever that investors go deeper—not just into company fundamentals, but also into portfolio construction, evaluating how different asset classes behave and interact across a variety of macroeconomic scenarios. Our investment team devotes days—often weeks—to their research, identifying resilient companies, promising sectors, and asset class combinations that can weather volatility.

As we look to the remainder of 2025, volatility is likely to persist. The challenges are multi-facted: a cooling US economy, underwhelming momentum in the Eurozone, and a backdrop of global uncertainty. In this environment, selectivity will be key. While volatility can be uncomfortable, it can also be constructive, presenting opportunities for long-term investors, particularly those with cash on the sidelines and the discipline to act decisively when valuations become attractive.

Our guiding objective remains unchanged: to help investors avoid the pitfalls of short-termism, navigate complexity, and uncover long-term value. This approach boils down into three essential principles which underpin our investment philosophy: Stability, adaptability and performance.

References:

Laarits, Toomas and Wurgler, Jeffrey A., The Research Behavior of Individual Investors (March 20, 2025)

Contributors

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

December 15, 2025

Weekly Investment Insights

US stock markets celebrated the Federal Reserve’s interest rate decision last week, with several major indices touching all-time highs. However, on Friday, the S&P 500...

December 8, 2025

Weekly InsightsWeekly Investment Insights

Major US stock indices ended last week in the green, with investors betting that the US Federal Reserve will give markets an early Christmas present...

December 1, 2025

Weekly InsightsWeekly Investment Insights

Thanksgiving meant that last week was cut short for the US stock market, but that did not stop major indices from ending the week higher....

November 24, 2025

Weekly InsightsWeekly Investment Insights

Even though last week brought some good news from both corporate earnings reports and economic data, global stocks ended in the red as fear over...

November 14, 2025

Weekly InsightsWeekly Investment Insights

The longest federal government shutdown in US history finally came to a close after President Trump signed the new funding package - which was narrowly...