Choose Language

July 15, 2021

Focus5G: Bringing “smart everything” to life

Olivier Goemans, Jade Bajai

The advent of 5G technology holds great promise. With enhanced speed, functionality, and data processing, it could transform productivity and performance in almost every sector and serve as the digital nervous system of “smart everything”. As such, 5G is an indispensable component of the secular trend of digitalization and an important investment thematic that could provide tailwinds for investment portfolios for years to come.

Introduction

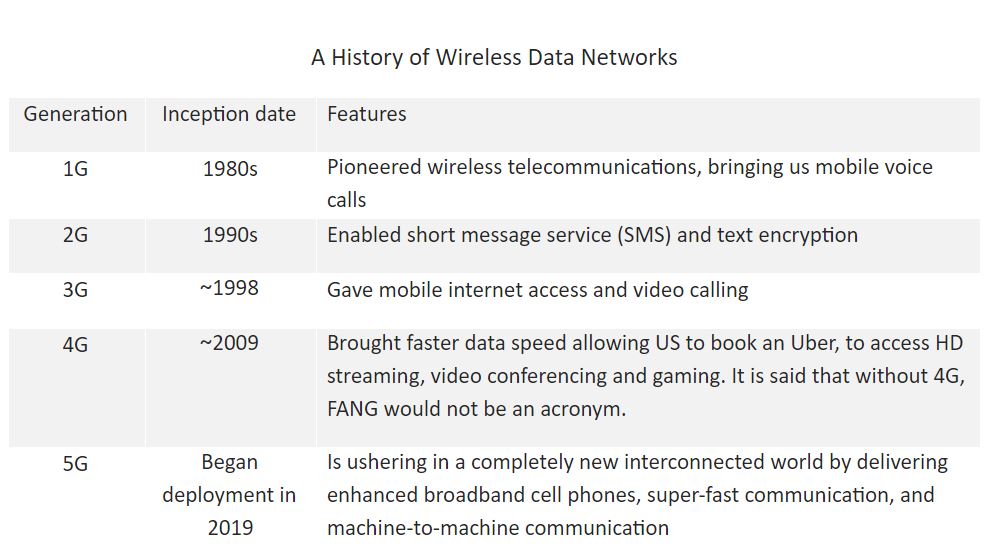

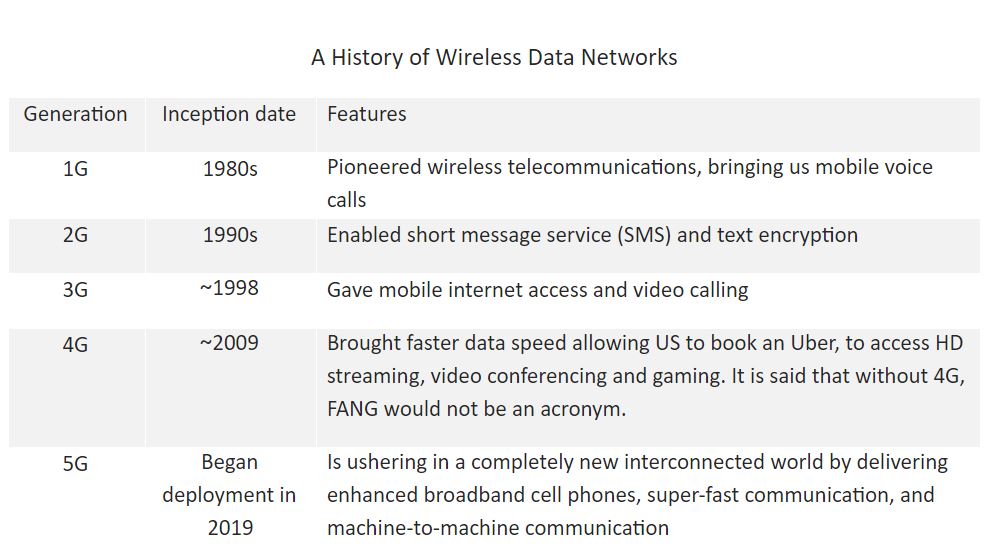

The evolution of wireless technology has fuelled a host of new mobile applications and has greatly enhanced our daily lives. Already, getting lost on car journeys while scrutinising a paper map is a thing of the past, thanks to digital navigation systems that track our location and tell us the quickest way to our destination. Such innovation had a halo effect on numerous industries, for example, travel and airlines, with foreign trips becoming much less daunting.

5G, the next iteration of wireless technology extends mobile connectivity beyond

Each of us, as consumers, will be able to enjoy a smarter, more connected world with, among other things, enhanced entertainment. But what is at stake is bigger. In a future powered by silicon and software, we expect the productivity improvements brought by 5G to be transformative, bringing “creative destruction”, otherwise known as Schumpeter’s gale of industrial mutation, revolutionising the economic structure, while destroying the old one.

5G Features

5G has three key features that differentiates it from 4G technology:

Negligible latency: Latency is the time it takes for data or a signal to be transferred between its original source and its destination. The lower the latency, the lower the delay in communications. 4G suffers from around a hundred milliseconds in response delay or latency. The 5G reaction time can be as low as 1 millisecond, meaning it is almost instant. This capability is essential for many use cases such as autonomous driving, industrial automation, and remote medical assistance.

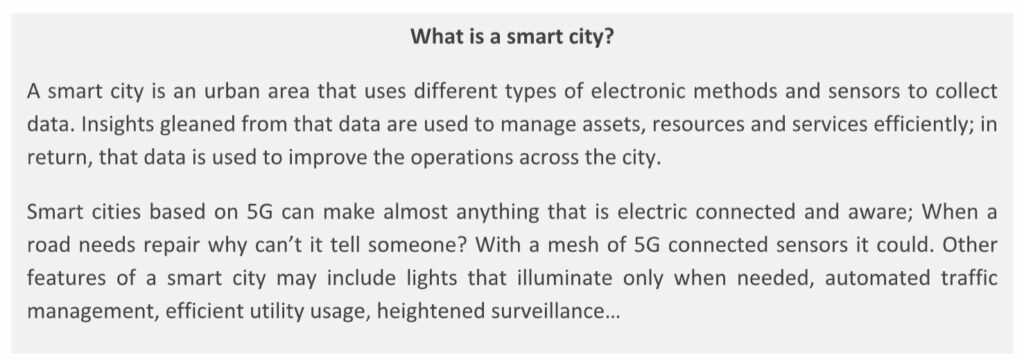

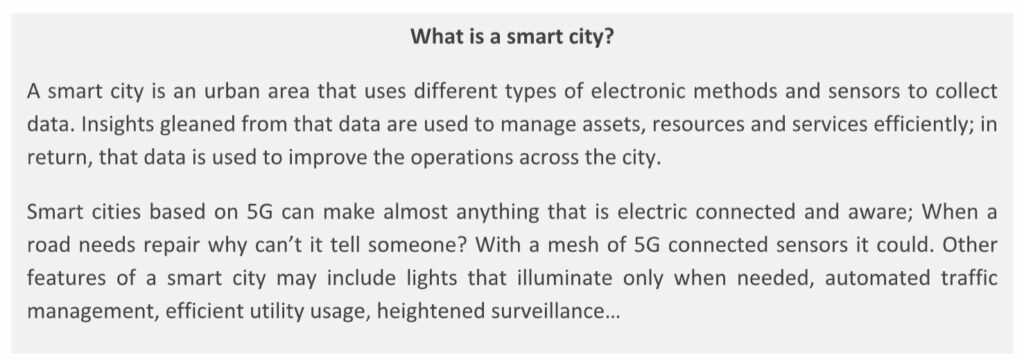

Dense connections: in a given square kilometre, 4G can only manage to connect about 1/10 of the amount of devices that 5G can. This capability is essential for the development of connected smart cities of the future, connecting all kinds of devices and sensors through the internet and allow them to communicate without any human involvement.

Wider bandwidth: 4G could only muster about 200 megabits per second of data while 5G can handle up to 1 gigabit (or 1000 megabits) per second, meaning ultra-fast data sharing is possible. The increased speed is achieved partly by using additional higher-frequency radio waves in addition to the low and medium band frequencies used in previous cellular networks (collectively referred to as the 5G spectrum).

It is worth noting that the higher frequencies can’t carry data as far, which is where small cells come in. These are small versions of the large cellular towers we all know, which will use processes such as beamforming to efficiently aim transmissions, rather than spraying signals everywhere. We will need new phones, tablets, portable hot spots and so on with 5G receptors in order to connect to the new networks that current generations can’t tap into it.

5G Use Cases

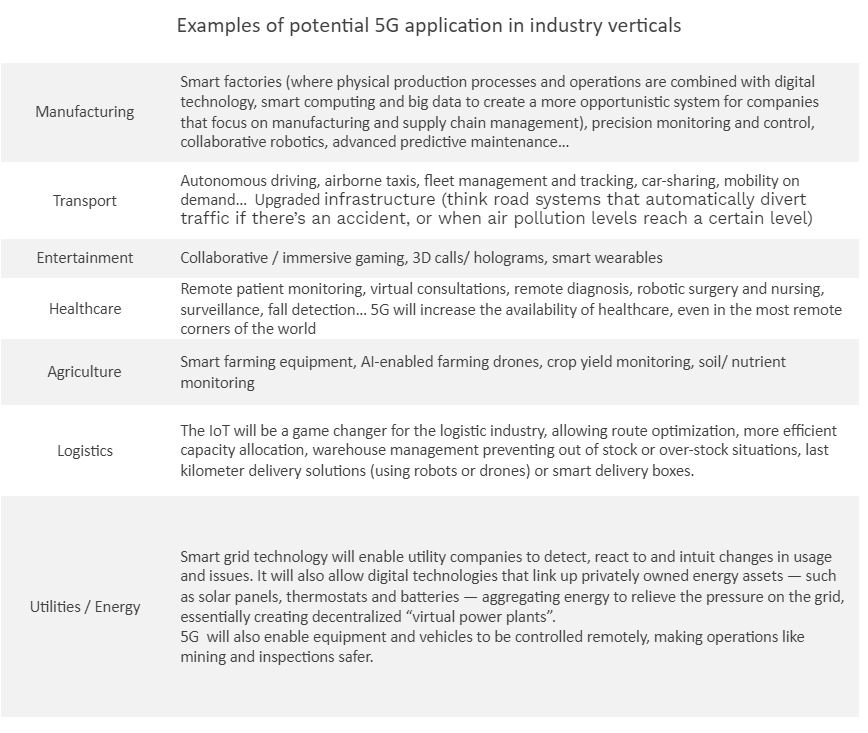

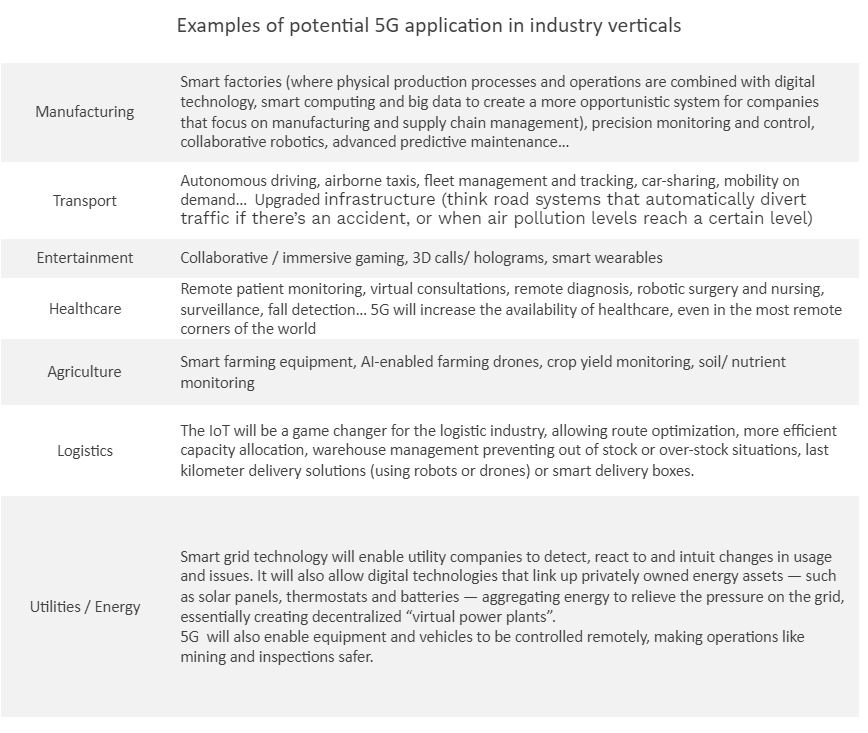

5G is not about meeting the needs of existing mobile customers, it’s about meeting the needs of machines and systems with virtually limitless data growth. While we as consumers will experience the benefits with almost-instant downloads and streaming and upgrades to our homes and cities, the industrial benefits are potentially even more interesting. 5G is the enabler of what is described as the 4th Industrial Revolution, the automation of manufacturing and industrial practices by using smart technology, machine-to-machine communication and the internet of things (IoT) for increased automation, improved communication and self-monitoring.

In all, 5G networks are set to become the digital nervous system of “smart everything”, enabling a variety of use cases in multiple domains.

Rollout status

Initially, the pandemic slowed the progress of 5G, but it soon turned into a catalyst. As people became reliant on communications networks for leisure, work and education, the need for high-speed, high-bandwidth connectivity became acute and many operators doubled down on their 5G deployment efforts.

“Since the industry last met in Barcelona in February 2019, the number of 5G networks increased from three in South Korea; to 165 networks in over 65 countries worldwide” - Mobile World Congress 2021

In Europe and the US, we appear to be on the cusp of a major 5G upgrade cycle and widespread adoption seems highly likely with Apple scaling up its production of its 5G equipped iPhone 12 and other players launching more mass-market versions of their 5G smartphones.

Recently, France announced that it will invest roughly €1.7 billion to expand and grow the country’s 5G market by 2025. Between now and 2022, the government will spend €480 million to support priority project and the country has begun auctioning off 5G frequencies. It is thought that an increase in 5G frequencies will greatly benefit the country’s agriculture, automotive, transportation and hospitality industries and create 20,000 new jobs.

Meanwhile, the UK government has announced a £28 million investment in nine nationwide projects that will trial innovative uses of 5G networks, including trailing 5G-powered cargo ports.

5G Winners

The adoption of 5G technology will have far-reaching consequences for many companies and it is expected that there will be far more winners in the 5G story than losers, meaning that for investors, opportunities are abound. Research conducted by Nokia Bell Labs finds that 5G has the potential to contribute $8 trillion to global GDP by 2030. [2]

To upgrade network infrastructures and end-devices from 4G to 5G, many critical components are needed. IT names, communications equipment providers, fiber providers, semiconductor manufacturers, cloud providers and software developers all stand to benefit from this advancement. We are still in the early stages of piloting 5G in factories and while we believe adoption will be gradual, we also believe that it will be ubiquitous, bringing efficiency, cost savings and greater control for manufacturers.

Communications service providers have a key role to play. As well as providing and managing the networks, there are many opportunities for them to advise governments and industry to ensure that we exploit 5G to its full potential. Skeptical investors argue that the costs of deployment will tally in in the billions for most telco operators, while the near term opportunities to monetize this appear low, thus creating a drag on return on invested capital. This is probably true but is definitely only valid in the short-term. The long-term benefits for telco and other sectors will be transformative. Even for telco, the long-term model will move from being subscriber driven to connected-devices driven and on aggregate 5G should open up additional revenue streams from connected factories, cities, cars, devices, etc. As famously predicted by Masayoshi Son, the founder of SoftBank, we might expect one trillion connected devices by 2035.

Platforms offering digital services also stand to benefit as 5G will greatly enhance their offering. For example, online shopping will become faster and more convenient by facilitating instant purchases on-the-go and 5G will be used to provide a more immersive experience for the customer. Likewise, streaming services may soon offer immersive viewing using AI.

Considerations

But 5G is not exempt from controversies, from security concerns (cybersecurity as well as espionage), fear and anxiety about the health effects of wireless signals, and even Covid-19 conspiracy theories linking the pandemic with 5G technology.

Since 5G is a new technology, its long-term effects on the environment are unknown. Energy usage is also on the list of controversies; according to estimates from telecom operators, energy consumption could double to meet increasing traffic demands, network improvements and the overall 5G rollout.

But breaking the energy curve is feasible. While denser 5G networks coupled with increasing data traffic volumes is going to increase energy consumption, telecommunications networks are becoming more energy efficient and relying more and more on renewable energy.

We believe that the final outcome will be net positive, with 5G improving our overall energy efficiency, helping us to reduce greenhouse gas emissions, minimize waste, and even protect wildlife by enhancing our understanding and therefore decision-making about the weather, agricultural matters, diseases, and industry,.. Unsurprisingly, 5G is one of the key areas of investment identified by the EU Commission for a digital and green recovery.

5G will also support the usage of smart contracts, allowing embedded and automated control systems. In the domain of sustainable development, the perspective of having embedded certification should definitely be a game changer, forcing companies to “walk the talk”.

However, we should not only consider energy consumption but also life cycle impacts. New infrastructure, new mobile phones, manufacturing devices and sensors means more mining and the use of many non-renewable metals. There are strategies that can and should be deployed to lessen the environmental impacts of 5G. From an investor lens, ESG integration will be key to identify sustainable disruptors in the sphere.

With regard to health concerns around the micro frequencies emitted by 5G technology, these are classified by scientists as non-ionizing radiation. You have to move up to x-rays, gamma rays and cosmic radiation to find the kind of emissions that will harm human cells, and 5G is far below those. It is good to know that 5G follows the inverse square law, losing power rapidly at even a small distance from the small cell.

Implications for investors

5G will take years to rollout and significant investments, but the complexity of that deployment and debugging should be worth the wait, as it will usher in a world where everything is connected, aware and responsive.

5G will be one of the most critical building blocks of our digital economy and society in the next decade, and investors should be prepared for the take-off of this promising technology. It is and will be a source of revenue growth for many companies and these companies deserve to be on the radar of investors for the coming years.

But again, the real disruption will come from new use cases for the technology, fostering new ways for businesses to operate. The technology is here but it will take many years for infrastructure providers and platform providers to fully deploy their services and capabilities, generating many years of benefits. While encouraging investors to capitalize on 5G’s significant growth potential in their portfolios, investors should also understand that this is a long-term growth story, not a guarantee on returns for the months or quarters to come.

Sources:

- CNET – How 5G works and what it delivers

- The Asset – 5G set to change investing landscape; 07/05/2021

- Alliance Bernstein - 5G Transformation: enabling the fourth industrial revolution; July 2020

- European Commission – Shaping Europe’s digital future Q&A

- Statista - Total number of 5G subscriptions in South Korea from April 2019 to April 2021

- Market Intelligence & Consulting Institute - Development of 5G in China 2021 and Beyond; June 2021

[1] https://digital-strategy.ec.europa.eu/en/policies/5g-qa

[2] https://www.nokia.com/about-us/news/releases/2020/10/11/nokia-5g-set-to-add-8trn-to-global-gdp-by-2030/

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...