Choose Language

May 7, 2018

BILBoardBILBoard April / May 2018 – Corporate earnings: seeing is believing

Earnings season has kicked off to a positive start and, if it materialises, a robust first-quarter earnings season should assuage investor concern that the market has become overstretched.

Looking through the volatility that has reared its head in markets, the sound macroeconomic backdrop remains largely unchanged. In the US, a confluence of strong data points such as business investment, industrial production and consumption allow inflation pressures to continue building. Capacity utilisation, for example, is ticking upwards and approaching the 79% figure deemed inflationary by the Fed. In Europe, economic readings have come down from elevated levels but still indicate that the economy is in an expansionary phase. Bolstered by the still-solid global economy, revenue growth, and higher cash flows stemming from December’s corporate tax cut, earnings should continue to increase. In fact, PMI strength year-to-date suggests that corporate earnings could grow at a double-digit pace in the first quarter.

According to Bloomberg, 80% of S&P 500 gains have come during earnings seasons since 2013. The investment community and markets are on standby as the results from Q1 2018 are being disclosed. So far, so good, but it is early days. Considering the lofty estimates analysts have set for US earnings results, seeing will be believing for the majority of investors and a ‘meet’ rather than a ‘beat’ with regards to expectations will suffice to confirm confidence in corporate fundamentals.

Taking a longer view, S&P 500 earnings-per-share (EPS) growth is expected to peak at 20.7% in 2018. Whether the boost from tax cuts will continue to support profit growth beyond this calendar year largely depends on how companies use the extra cash to support increased productivity. As such, the guidance which accompanies the release of earnings data detailing how the funds will be employed is key. Buy-backs would appease markets in the very near term, but investments will make earnings more sustainable, keeping the equity bull healthy for longer.

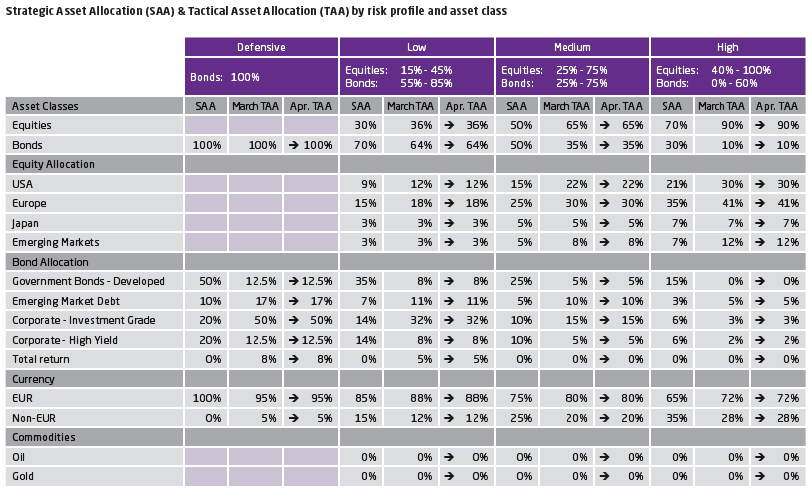

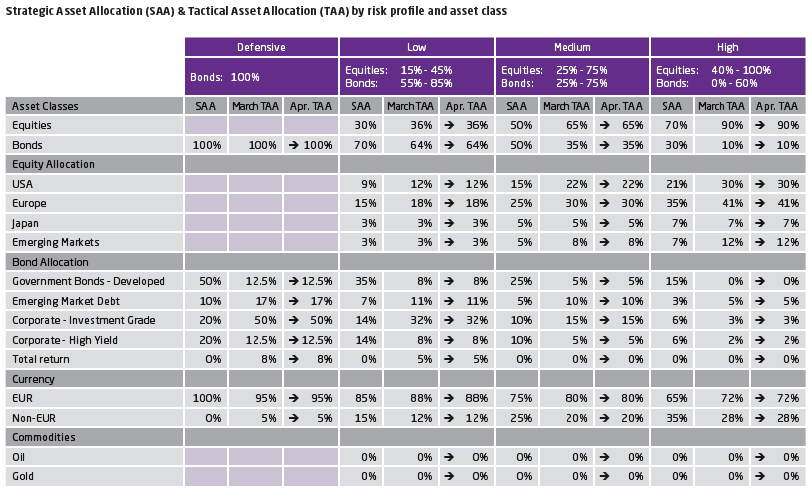

Equities

Whilst geopolitical tensions and a potential trade war have dominated markets, economic activity remains robust, making it premature to take our chips off of the table in terms of our equity bets. Top line growth – a figure unaffected by cost-cutting or buy-backs - has been strong. Since January, equity technicals have improved and valuations no longer appear stretched; the S&P500 is now trading at 16.5x forward earnings. At the same time, investor sentiment is no longer showing complacency and typical end-of-cycle indicators are not flashing red.

We maintain overweights in select pro-cyclical sectors, giving preference to companies with solid fundamentals that have delivered positive surprises in the past two earnings seasons, and which have strong guidance.

In terms of Europe, consensus foresees only 7.3% EPS growth. We see room for pleasant surprises, and maintain our overweight in European Financials, which typically benefit from rising rates. To provide a degree of protection against potential strengthening in the euro, we also diversify into the stocks of mid-cap EMU companies, which tend to conduct a higher proportion of their business activities within the bloc.

The weaker USD continues to be a short-term driver for Emerging Market equities, and this region trades with an attractive 24% discount to developed markets, based on earnings multiples. However, whilst trade war talk and other risks float in the background, we continue to exercise caution.

Fixed Income

We believe that any potential overheating of the economy presents a greater risk to fixed income than to equities, at least in the near term. A reduction in accommodative central bank policies paired with rising rates make us especially reluctant on duration.

In the latest dot-plot released at the March Fed meeting, additional hikes for both 2019 and 2020 were added to forecasts, resulting in expectations of 3 in 2019 and 2 in 2020. 2 more hikes are expected for 2018.

Whilst being underweight government bonds and high yield, we are still mildly positive on certain segments of the investment grade bond universe. A bounce in hedging costs make the US market uninteresting at this stage, but across the pond in Europe, the outlook is more temperate. Significant support still flows from the ECB and talk is circulating that QE could be staggered beyond September 2018 so that the unwinding is gradual. Traditional low issuance in April should be a relief for the market - around EUR 16bn is expected, with EUR 37bn of IG bonds maturing within three months. At present, it is difficult to identify potential drivers of meaningful spread tightening, but at the same time, major widening from current levels also seems unlikely.

Whilst we have not adjusted our overall exposure to EM debt, within this category, we have swiveled out of the most risky tranche of the market (local currency bonds), and into hard currency corporates. In doing so, we reduce exposure to volatile currencies – something deemed prudent in view of increasing idiosyncratic risks (Russian sanctions, Brazilian politics, etc.). We are allocating the proceeds to EM hard currency (HC) corporates because the average duration is almost two years shorter for an ever-so-slightly lower yield-to-maturity of 5.59% (vs 5.87% for HC sovereigns). Further still, on average, HC corporates come with a better rating than HC sovereigns (BBB- versus BB+).

Overall, in light of increased volatility and some unsavoury headlines, it is easy to forget that we are still in an extremely benign macroeconomic environment which is expected to give rise to the strongest year of EPS growth since 2010. Earnings are one of the most powerful drivers of stock market performance over time.

Seeing is believing, and if Q1 earnings cross the high hurdle set by analyst estimates, we may expect a visible sigh of relief in stock prices.

Download the pdf version here (in French)

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...