Choose Language

September 13, 2018

BILBoardBILBoard August / September 2018 – Summer shakeout leaves Emerging Markets attractively valued

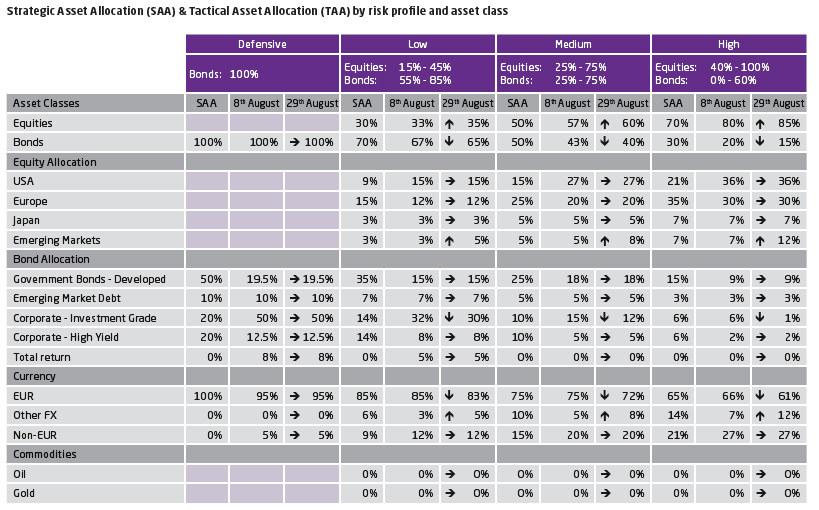

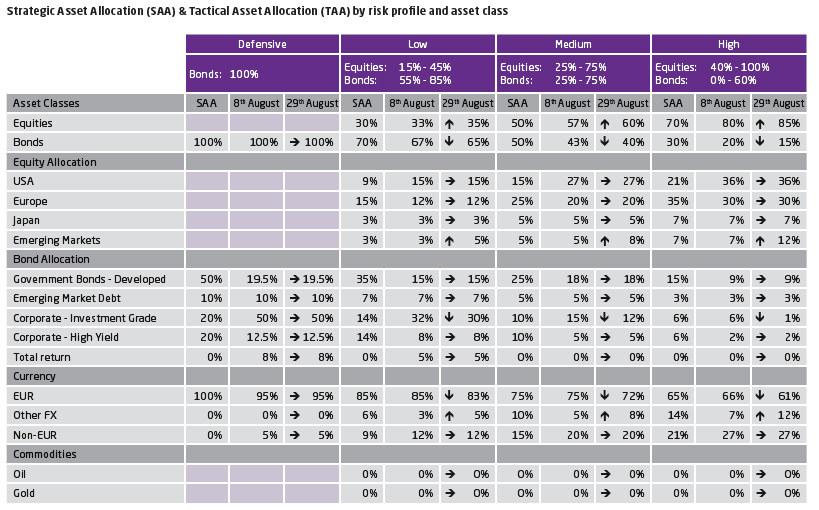

Hoping that the dust will settle after the summer correction, we believe EM equities offer value in a world where good value is hard to come by. We are taking the opportunity presented by lower valuations to re-enter the market, and see enough long-term value to accept the volatility that could potentially play out in the coming months.

Despite decent fundamentals and continued global growth, in 2018, EM assets fell out of favour with investors: yields shot upwards, currencies plummeted and equities fell into correction territory. This was instigated by a stream of protectionist trade policies emanating from the White House and a stronger dollar, but was compounded by unique idiosyncratic risks (Turkey, Argentina, Venezuela…). Heading into the summer months, when liquidity is typically tighter (making stock prices more sensitive to noise), we de-risked our portfolios by reducing our positioning in EM and European equities. In doing so, we avoided the summer bloodbath that later ensued in EM assets. However, EMs are now starting to look attractive, especially EM equities, whose prices appear to have fallen out of sync with fundamentals.

Equity

Amidst the summer rout, a chasm has developed between the unrelenting US equity market and other global indices. We expect it to close before long, especially as EMs – which are hovering some 20% below their January peaks – play catch-up. The price reactions seen across EM equities this year do not square with analyst expectations for earnings, implying that the outlook for EM stocks may be brighter than current valuations suggest.

Recent developments have allayed at least some fears for EM investors: China has taken action to put a floor under its sinking currency (a move commended by US Treasury Secretary Steven Mnuchin) and the US has reached a preliminary trade deal with Mexico. Additional de-escalation in trade tensions would likely reignite sentiment. Even so, it’s worth noting that 30% of the MSCI EM index is made up of IT (a sector somewhat insulated against traditional trade tariffs). Undoubtedly, the risks are still high within this mercurial asset class, but current valuations and solid global growth act to balance these, and it seems that EMs have priced in enough negative news relative to incoming data for the time being.

Alongside our EM exposure, we also continue to be overweight the seemingly bulletproof US equity market, which is basking in the afterglow off the Republican fiscal stimulus package. Trump’s protectionist push has not, for the time being, acted to the detriment of American manufacturers, who may even have received a boost from policy – as indicated by the ISM manufacturing index, which surged to a 14-year high in August.

US companies are surpassing high expectations with flying colours: EPS growth on the S&P 500 tallied in at 25.3% for Q2 (the second-highest earnings growth since Q3 2010 (34.1%) and sales growth at 9.5%. Following the blockbuster earnings season, US indices have skipped from new high to new high and record buybacks should support equities from a supply/demand perspective moving forward. Year-to-date, buyback authorisations have reached $754 billion, as firms put the cash garnered from tax cuts to work. Corroborating the case for US equities is the fact that American consumers are exhibiting their highest confidence levels in 18 years. As this confidence translates into looser purse strings, corporate America’s collective bottom line should receive an additional boost.

With regard to the European equity market, we are reluctant to increase our holdings. It is true that the eurozone economy stabilized in Q2, with GDP growth revised upward to 0.4%; but at the same time, risks are no less abundant. Turkey is the third-biggest contributor to the EU trade surplus, weaknesses remain in the banking system, uncertainty surrounds Italian politics as the coalition seems to be on a collision course with the EU over its budget, and Brexit is still an elephant in the room… Spare capacity is almost non-existent in Germany and Holland, and is concentrated in peripheral countries. This accentuates the challenges faced by the ECB when withdrawing accommodative policy from a set of nations operating at different stages in the cycle.

Fixed income

As the global central bank collective pares back loose monetary policy, higher rates and rising yields are on the cards. Because higher yields equate to lower prices for bonds, the fixed income market offers few places to run, and even fewer places to hide. However, we see European Investment Grade (IG) bonds, especially corporate hybrids, as the best option for investors looking for yield. Europe is far behind the US in the credit cycle and most European corporates are still in de-leveraging mode. This translates to stronger balance sheets, and we are seeing credit rating agencies award European corporates with more upgrades than downgrades. It is true that compelling yields can also be found in the US IG space, but for euro-based portfolios, hedging costs of roughly 3% erode much of the upside. Investors in European IG should not expect significant spread tightening, but can benefit from the yield, as well as from diversification into an asset class in which risk is contained. For an additional layer of protection in the event of a downturn, we have a small selection of sovereign government bonds (Bunds/US Treasuries).

Summary

Certainly, the investment landscape has been difficult to navigate this year, with risk coming from almost every angle. But at the heart of the matter, the fundamentals which underpinned our bullish outlook for global growth remain intact, and give us confidence in our equity overweight. We will not promise an easier ride through the second half of the year, as midterm elections and trade tensions will likely keep investors on their toes. However, with the economy still in an expansionary phase, it seems that equity investors can still achieve some upside if they’re prepared to ride out the volatility.

Download the pdf version here (in French)

Download the pdf version here (in German)

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...