Choose Language

May 30, 2018

BILBoardBILBoard May / June 2018 – Sticking to the script

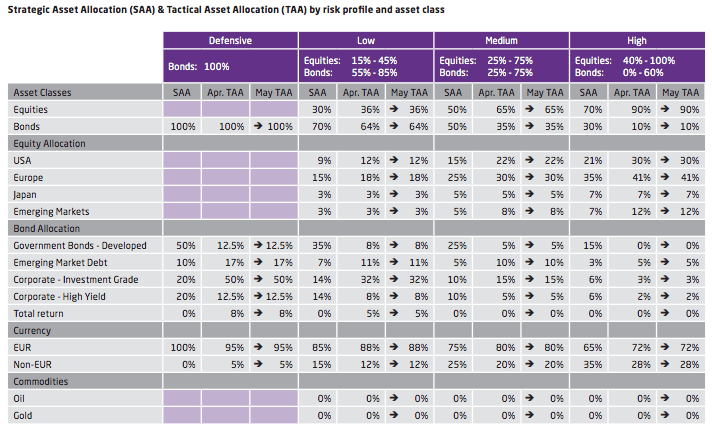

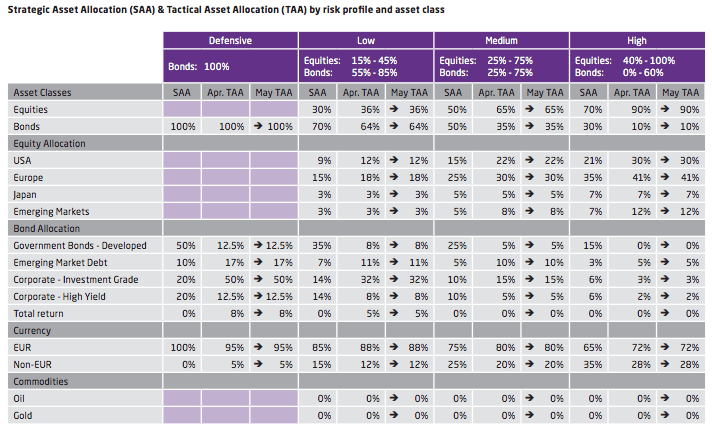

Into the second quarter, our long-term thesis for higher rates and healthy equity performance remains unchanged. As our base case plays out, we hold our tactical allocation steady in order to continue taking sap from the global expansion, while cushioning our portfolios from rising rates where possible.

All is relatively calm in terms of the macroeconomic landscape. Growth readings and PMI figures have come off the boil, receding from elevated levels, but the world economy is still expanding. Though inflation dynamics are building, signs of overheating are not present. This, coupled with the fact that markets are still highly liquid, leaves us without any compelling reason to de-risk at this stage. At its May meeting, our investment committee therefore voted to maintain our current allocation with a tactical overweight in equities.

It is however acknowledged that equity markets face heightened volatility compared to the abnormal tranquillity of 2017. Already, the first quarter of 2018 has been a tale of two halves with January delivering some of the best monthly equity returns in years, quickly superseded by a correction of roughly 10%. But volatility is part and parcel of equity investing, and thus far we have been able to use it to our advantage; for example, in February the tactical correction was taken as an opportunity to add to our exposure. We are poised to take advantage of similar opportunities that may arise in the months ahead.

Equities

Our equity strategy is centred around the US and Europe. In the US, GDP growth outpaced expectations of 2% in Q1, coming in at 2.3%, with corporate investment growing at a robust pace of 7.3%. As we have entered the later stages of the US cycle, our analysts produced a special report delving into the financial health of American corporates and consumers. Looking at data on debt and delinquency rates, no warning signals are flashing red at this stage in terms of credit.

Q1 earnings-per-share growth on the S&P500 came in at a staggering 24% (with the majority of names having reported). Not only is earnings growth strong, top lines and profit margins are also rising at a good pace – a true sign of corporate health. As firms begin putting the cash saved from Trump’s $1.5 billion tax cuts to work, we believe that the US market can hum along through summer. It is unlikely that such stellar earnings results will be repeated in Q2, but if figures can meet analyst expectations, this alone should be enough to keep markets supported. We maintain selective overweights in pro-cyclical sectors as well as in energy names – a bet that continues to perform as the oil price rallies (WTI recently went above $70 per barrel).

Europe has had a slow start to 2018 but the European Central Bank (ECB) has emphasised that it does not believe this to be a portent of worse to come. Indeed, temporary factors such as extreme weather, French labour strikes, and capacity constraints in supply chains have weighed on sentiment and it seems that the region’s stream of disappointing data may now have run its course. While 2017 was the pinnacle for European growth, hitting a decade high of 2.4%, the outlook for 2018 is still robust with the Bloomberg consensus forecasting 2.3% growth. In light of this, and a softer euro, the equity market may still be tracking an upswing. We favour financial names which benefit from rising rates and industrials. We do however note that while the US-China trade dispute prevails, European equities which rely quite heavily on exports are likely to experience bouts of volatility. We have diversified into mid-cap names which conduct more business within Europe as a buffer.

Fixed Income

What is more concerning to us than a normalisation in volatility on equity markets is the harsh reality facing fixed income markets. As the 10th anniversary of the credit crunch approaches, central banks are sticking to their scripts in terms of gradually withdrawing ultra-accommodative monetary policies that propped up major economies after the crisis. Thus, bond yields which have been artificially suppressed are on the rise, which will erode value (price and yield are inversely correlated). This makes us reluctant on the majority of fixed income assets. By the end of 2018, our analysts see the US 10-year Treasury around the 3.1% level and the Bund at around 0.9%. In anticipation of rising rates, there has already been a general repricing of risk, seen mainly in higher beta instruments such as high-yield and corporate hybrids.

In Europe, QE continues according to plan and the ECB is expected to communicate tapering intentions in June or July. A likely scenario is that QE will be extended into December. Investors in investment grade (IG) corporates continue to enjoy the huge stimulus while it lasts and spreads have been relaxed; month-to-date, European IG spreads have only widened by 1 basis point. However, down the line when tapering becomes a reality, this will change. We are maintaining exposure to convertible bonds, added in February, in order to benefit from their equity-like features.

Geopolitical tensions were highlighted as a rising risk by the investment committee. To name but a few, there is the trade war rhetoric, the Iran nuclear deal, an incoming populist government in Italy… all of which could have wider political ramifications. However, empirically speaking, geopolitical events are unlikely to single-handedly ignite a bear market. Nevertheless, these risks will undoubtedly generate volatility.

So, what is important to remember is that 2018 doesn’t promise a rose garden. Along with the sunshine, there is going to be a little rain sometimes – this is something that may have been forgotten after 2017 – the Goldilocks year when everything was ‘just right’, with the maximum drawback on the S&P 500 having been a mere 3%. But if you can stand the pullbacks that are an inherent feature of equity markets and stick to the script despite short-term fluctuations and noise, over the longer term, fundamentals imply that there is still value left in stocks.

Download the pdf version here (in French)

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...