Choose Language

November 10, 2017

NewsChina’s 21st Century Silk Road Ambitions Enshrined in Constitution

- The One Belt, One Road Initiative has been sewn into Communist Party constitution

- Initiative could develop much-needed infrastructure in developing nations, promote international trade, and support economic expansion in more than 60 countries

- Firms begin to weigh up opportunities

During the 19th National Congress of the Communist Party of China on 18-24th October, President Xi Jinping’s ambitious ‘Belt and Road Initiative’ (BRI) was cemented into his Party’s constitution, emphasising its significance and signalling an acute dedication to realizing the vision.

“… following the principle of achieving shared growth through discussion and collaboration, and pursuing the Belt and Road Initiative.”- Additional statement added to China’s Constitution

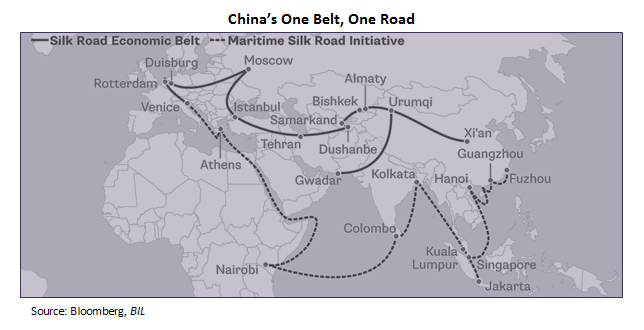

The project, which was first unveiled by Xi Jinping in 2013, is a loosely-defined set of interconnected bi-lateral trade agreements and infrastructure projects that seek to link China with Central Asia, the Middle East, Europe and Africa. It aims to revive the ancient Silk Road, connecting China to over 68 countries which combined, account for a third of the global economy. The initiative was catalysed by concerns about slowing domestic growth and over-production in China. Supporters believe that the BRI has the potential to help solve a global infrastructure gap, catalyse growth in developing nations and increase trade whilst generating investor returns.

Lloyds List, a maritime intelligence unit noted that with a minimum spend of $1.4 trillion on total infrastructure investment, the BRI is estimated to be 12 times bigger in absolute US dollar terms than the Marshall Plan — the $12Bn initiative to help rebuild western European economies after World War II.

Already this year, a significant symbolic milestone was passed – the first freight train travelled from China to London, taking 18 days.

As Beijing has tightened its grip on foreign acquisitions by Chinese firms, whilst remaining accommodative to those which fall in sync with the BRI, we have seen an array of deal-making activities by Chinese firms arising in BRI states, such as the $11.6 billion buyout of Global Logistics Properties in Singapore by a Chinese private equity consortium.

A white paper by consultancy firm PriceWaterhouseCoopers (PwC), suggests that there is significant opportunity for international investors and credit providers to partner with Chinese companies by providing capital and investments. BRI projects are often directly or indirectly supported by the Chinese government and therefore may offer an improved risk-return ratio in certain scenarios. A foreign company which has already positioned itself to benefit from BRI is General Electric. The company has evolved from being a supplier of construction equipment to an integrated solutions provider in financing and operations. It reported in June that its total orders from Chinese engineering, procurement and construction companies had grown threefold in the space of one year, according to PwC. The consultancy firm, Deloitte, has recently invested an additional $200 million in its Chinese business, with $40 million of this syphoned directly towards helping Chinese companies participate in BRI.

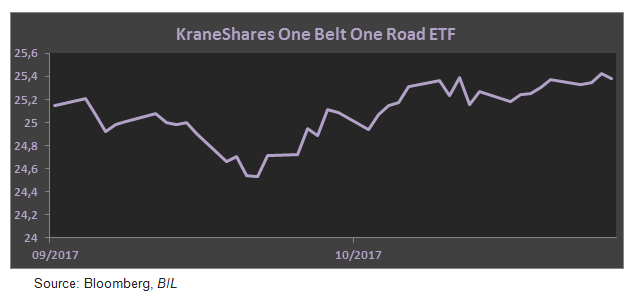

So vast are the perceived opportunities, various exchange traded funds (ETF) have arisen, offering exposure to firms involved in the BRI project.

Nonetheless, some view the project as over-ambitious and are sceptical that the roll-out will go smoothly given the inconsistencies across the various the regulatory regimes of the countries involved. Geopolitics could create major roadblocks, especially given that over the long life-span of the project, governments will likely change, bringing with them new foreign policy. Further, investors must consider that many of the participating nations have low or no credit ratings. In October Bloomberg reported that 60% of BRI partners have junk status or are not rated, for example Afghanistan, Iran and Syria. Therefore, investors and companies must be selective as to which specific programs they get involved in.

China is the world’s growth locomotive and the Chinese Producer Price Index is the primary reflation signal. Heavy government spending and a reduction in China’s domestic overcapacity could keep this figure supported. Furthermore, such strong dedication to the project could provide a boost for commodities, such as cement and steel. According to PwC, the construction of railways, pipelines and other projects along the BRI trade route could create demand for 272 million tonnes of steel. BHP Billiton, the world’s largest mining company estimates that the project could create enough demand to keep China’s steel mills operating at their current level for a decade. Such demand for commodities, could seep into inflation prints causing a gradual uptick in long-term yields.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...