- Chinese stocks have rallied, despite a struggling economy

- Much of the gains appear to be driven by domestic institutional investors, potentially reducing bubble risk

- Some of China's USD 22 Trillion in household savings could flow into stocks

Chinese stocks have surged this year, posting double-digit gains, even as the broader economy struggles with a prolonged real estate downturn, weak consumer sentiment, and lingering deflationary pressures. While we know that markets are forward-looking, often responding to early signs of stabilisation before hard data confirms a durable recovery, the disconnect is still quite striking. For investors, the question is what lies beneath this rally, and can it sustain?

Institutional forces

What differentiates this rally from previous surges is its composition: institutional money, flowing from life insurers and other large domestic players, appears to be doing much of the heavy lifting here.

Indicators that help us gauge retail participation, for example, the number of individual stock accounts opened at the Shanghai stock exchange, imply an absence of retail euphoria that has typically been a feature of more fragile surges in Chinese equities. Many will recall 2015 amid similar economic circumstances that spurred policy easing; a wave of retail speculation, amplified by leverage, inflated a market bubble, only for it to collapse the following year. Today’s environment seems to be different. The economy is still struggling, but thus far, the capital underpinning equities appears to be more disciplined and less prone to sudden flight.

If institutional flows are the current backbone of the rally, household savings could potentially bring a new wave of liquidity. Chinese households are sitting on some USD 22 Trillion in savings, about USD 7 Trillion of which are considered “excess savings”.

And for stock markets, the math is becoming increasingly compelling. The one-year fixed-term deposit rate for savings is now less than 1%, while 10-year government bonds yield just 1.8%. By contrast, the CSI 300 Index, even after its rally, offers a gross dividend yield of around 2.5%. In light of these dynamics, there are very early signs that households are starting to shift money out of deposits and bonds and into equities. Should even a modest share of that vast savings pool flow into the stock market, the impact could be powerful.

Also worth noting is that we have not seen a jump in the volume of onshore stocks held by overseas entities. That also might imply, according to some analysts, that there is a lot of dry powder on the sidelines, waiting to be deployed.

The macro backdrop: tentative signs of stabilisation, but no lift off

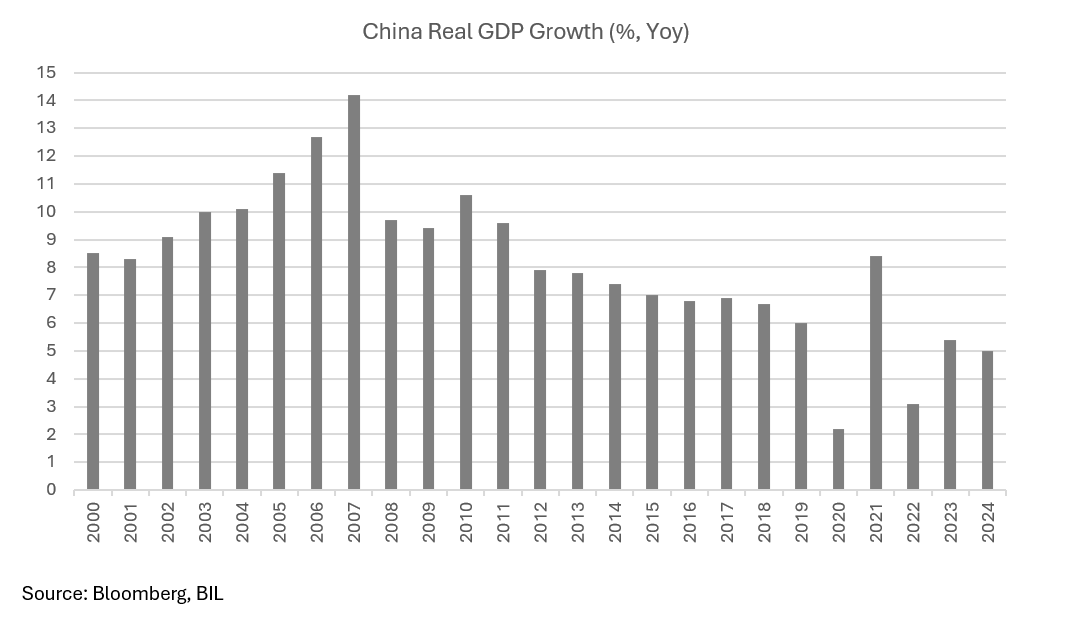

Beneath the surface, the Chinese economy remains fragile. Real GDP is tracking close to 5% in 2025 – enough to meet Beijing’s official target but still well below the near-7% average achieved in the years running up to the pandemic.

Exports provided a boost early in the year, driven by the front-loading of shipments to the US ahead of trade tariffs, while fiscal measures have breathed some life into consumption and business investment. The real estate sector remains the biggest drag on the economy and until we see a bottoming out there, it will be difficult for consumption – a strategic priority for Beijing – to recover convincingly. The property downturn has depressed household wealth and dampened spending, creating a deflationary impulse across the broader economy.

Beijing has responded with a mix of targeted measures and investors appear to be finding some encouragement in the proactive approach to policy. In August, two new interest subsidy programs were launched to further stimulate consumer spending and to support the service sector. The PBoC is exercising caution with regard to broad-brushed measures such as rate cuts, which could put undue pressure on the yuan. But liquidity has been channeled into areas such as technology and green investment. The approach appears to be one of pragmatism, while also reflecting the strategic goal of reorienting the economy toward new growth drivers.

The result is a gradual stabilisation without clear signs of acceleration. The future trajectory of the economy will be heavily dependent on the policy stance adopted in Beijing.

Trade and Technology: Tailwinds and tensions

External dynamics are adding complexity. On the trade side, an extension of the US-China negotiation deadline into November provides near-term breathing room, especially as American retailers build inventories for the holiday season. In parallel, Beijing is steadily diversifying its export markets, with a growing portion going to Emerging Asia. While no one can deny that US tariffs will have an impact, it is worth keeping in mind that only around 3% of the gross value added originating in China ultimately flows to the US. This helps explain how China, despite trade frictions, is on track to register a record trade surplus of more than USD 1.2 Trillion this year. Ultimately, while the direct hit from US tariffs might be contained, the greatest risk probably lies in the indirect effects of rising protectionism that could hurt supply chains and also sentiment. Interesting to note is that in April, after Liberation Day tariffs were announced, onshore Chinese equities were more insulated during the market selloff.

Meanwhile, strategic sectors such as semiconductors and AI continue to attract heavy state support. Beijing’s “Big Fund” is a multi-billion dollar program designed to boost China's semiconductor industry through direct investment in companies across the value chain. It highlights Beijing’s determination to achieve self-sufficiency in chipmaking and indeed, domestic firms are becoming increasingly sophisticated in this domain, with a growing trend towards hardware-software codesign, which could ultimately allow them to carve out unique advantages. Momentum in these strategic sectors could also add fresh energy to equity markets.

Risks remain

Despite green shoots of optimism, risks remain considerable, with structural weakness in consumption and investment casting a long shadow. While institutional buying gives the rally a relatively firmer foundation, the risk of speculative excess cannot be dismissed.

Policy makers face a delicate balancing act: rolling out too many pro-growth measures could fan speculative flames and inflate a bubble, while under-delivering could mean economic momentum fizzles out. The lesson of 2015 looms large: rallies that run too hot can quickly turn south.

The bottom line

A combination of institutional flows, untapped household savings and strategic support for select sectors suggests that Chinese equities have potential. At the same time, structural economic challenges, cautious consumers and geopolitical uncertainty serve as reminders that the economy is not yet out of the woods.

For investors, the key is not to attempt to time the bottom in terms of economic developments, but to calibrate exposure to evolving dynamics. For those that have the risk appetite, onshore Chinese equities, in particular, might offer new opportunities, while also bringing diversification benefits at a time when developed market valuations look stretched and when fiscal concerns dominate in the West.

Thus far, the equity surge does not appear to be built upon exuberant retail speculation but on steadier institutional foundations, with the possibility of household savings gradually joining the flow. However, the ultimate deciding factor as to whether this rally can continue to gallop into the Year of the Horse, will be whether Beijing can strike the right balance between supporting growth and avoiding excess.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

February 23, 2026

Weekly Investment Insights

The US Supreme Court has ruled that President Trump’s trade tariffs are illegal. In a decision issued on Friday, the court found that Trump had...

February 16, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Major US stock indices ended last week in the red, as concerns that AI could have a disruptive impact on entire industries continued...

February 9, 2026

Weekly InsightsWeekly Investment Insights

Market Snapshot Japanese stocks soared to record levels on Monday as Prime Minister Sanae Takaichi secured a landslide win in a snap general election. The...

February 5, 2026

BILBoardBILBoard February 2026 – Weathe...

Based on the Asset Allocation Committee of February 2 2026 This month, Emily Brontë’s classic novel Wuthering Heights will hit the big screen, taking...

January 30, 2026

Weekly InsightsWeekly Investment Insights

Midweek, the S&P 500 rose above the 7,000 milestone for the first time, as the headlines around US ambitions in Greenland faded. The rally...