June 3, 2024

NewsEuropean energy – everything under control?

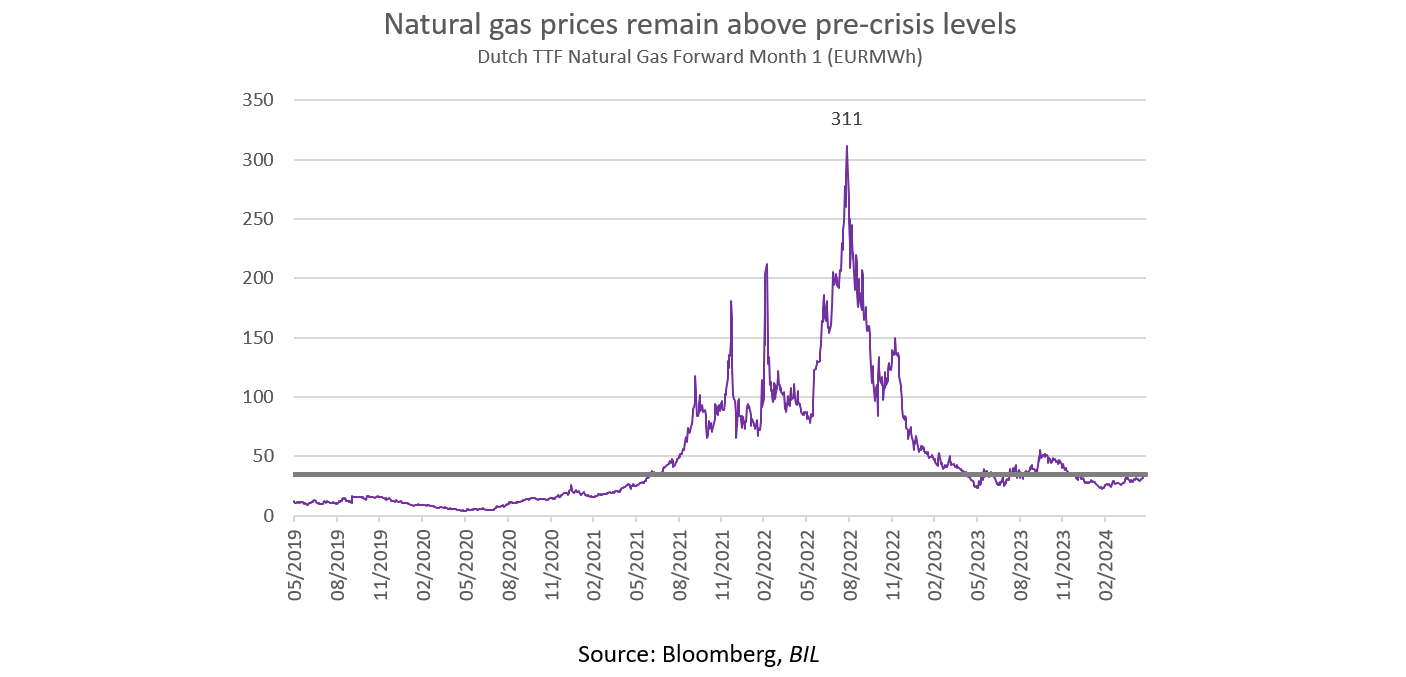

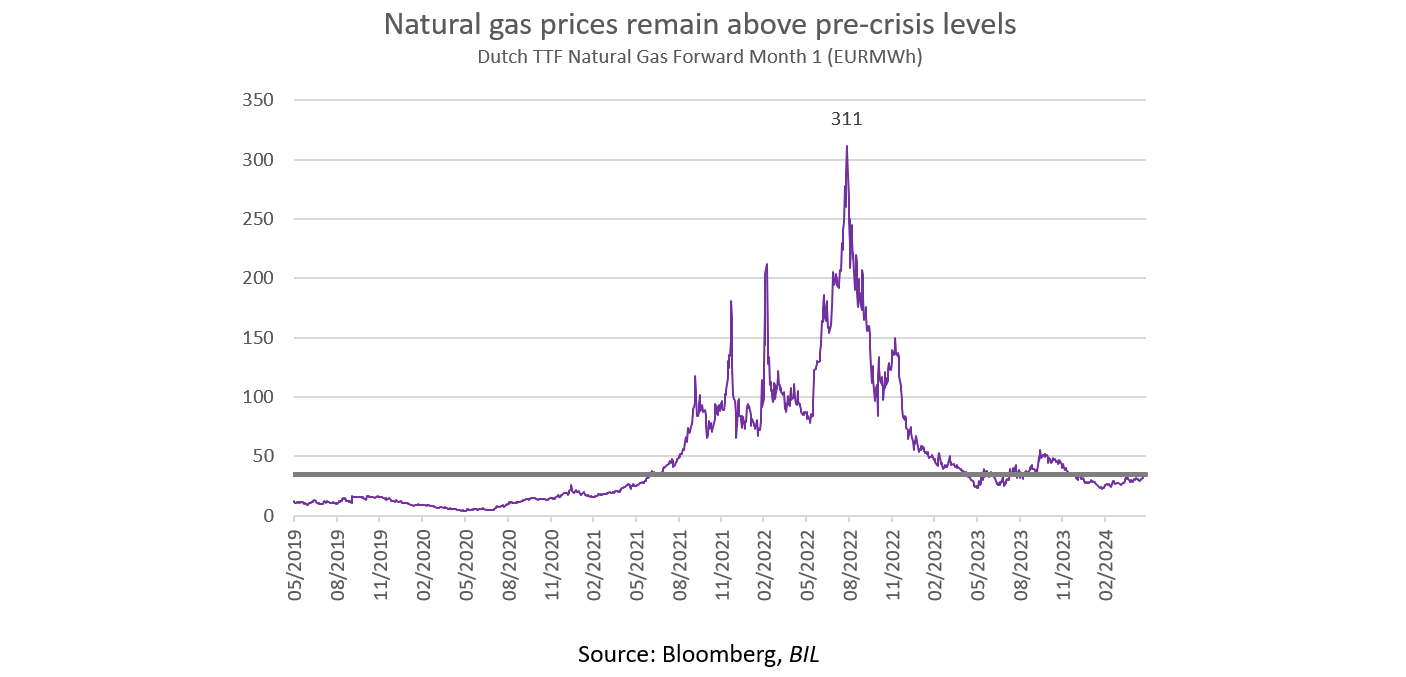

Prior to the invasion of Ukraine in February 2022, the lion’s share of Europe’s energy imports came from Russia. It accounted for 28% of the continent’s total crude oil imports, while Russian pipelines delivered 44% of all imported gas. The outbreak of war and the subsequent sanctions therefore resulted in a huge supply shortfall and a global market shock that sent prices skyward. In the aftermath, wholesale gas prices rose tenfold, while crude rose above 120 USD/bbl.

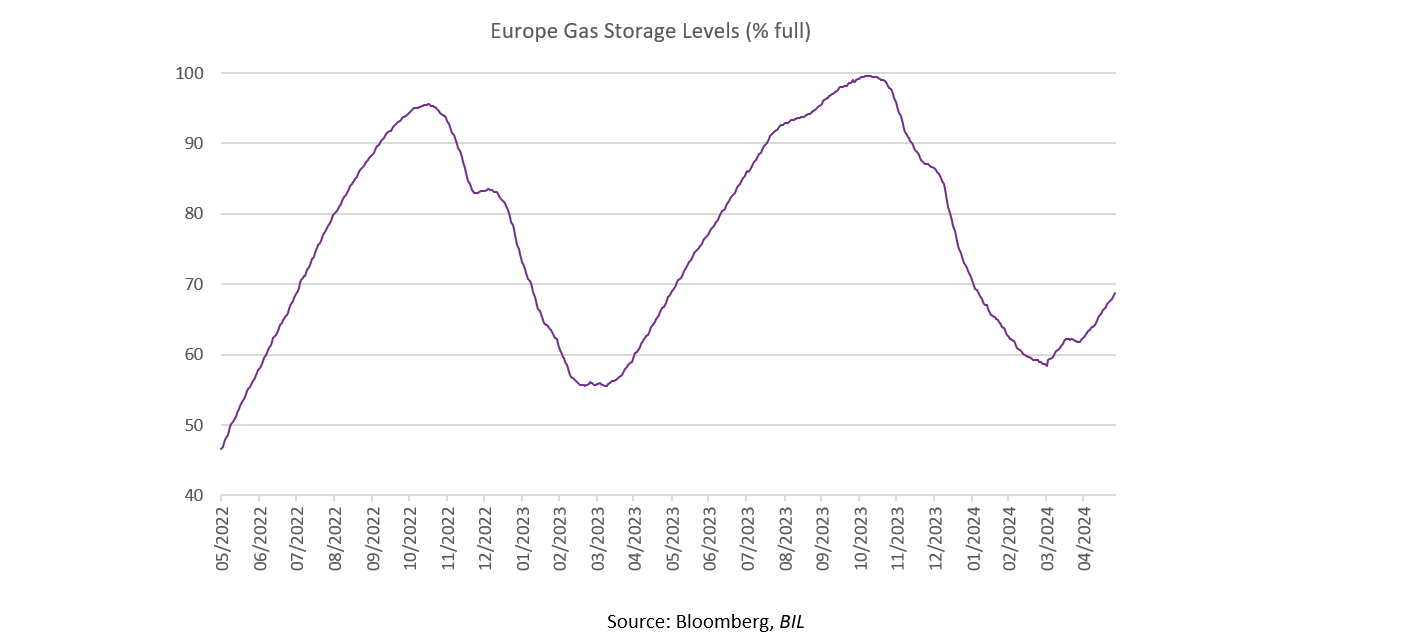

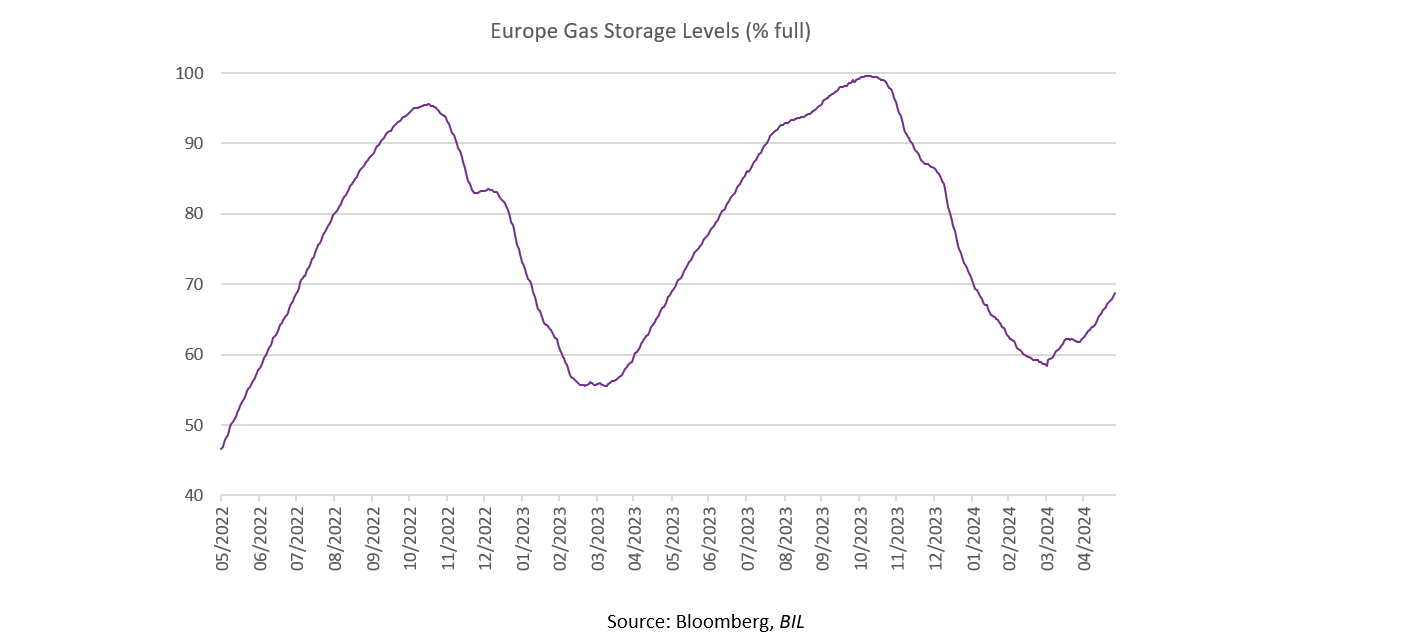

Fast forward to today, there are clear signs that Europe’s energy crunch is easing. For example, just two years on, the continent has emerged from winter 2023-24 with gas storage at record-high levels (59% full), while wholesale prices have come down substantially. Current dynamics suggest the EU will meet its target to fill facilities to 90% well ahead of the November deadline. Despite ongoing geopolitical tensions, the price of crude has also eased, and currently trades at around 80 USD/bbl.

Various factors have led to the amelioration of Europe’s energy situation.

The first might be considered luck: exceptionally mild weather.

At least when it comes to gas, the second factor is a fall in demand. Last year, European countries consumed 20% less natural gas relative to the average recorded across 2019-2021.[1] Industrial demand has been particularly depressed and has not yet shown signs of recovering, despite a decline in wholesale gas prices. Household demand is more volatile; it is very seasonal with gyrations in demand driven by temperatures.

The third key factor is reactivity on the part of policymakers to secure alternative energy sources.

In the past, European countries mainly relied on piped gas to satisfy their needs and absorbed excess supply from the global liquefied natural gas (LNG) market when the price was right. Today, Europe has joined the likes of China and Japan to become a major LNG importer, with its imports surging by almost 60% YoY in 2022 alone. This has involved significant investments to expand regasification infrastructure which will allow the EU to further tap the LNG market in the future. Germany, which had no LNG terminal until late- 2022, has outlined plans to build several such facilities.

In terms of the origins of that gas, the US has emerged as Europe’s primary supplier. While total US LNG exports expanded by just 10% in 2022 due to supply constraints, flows towards Europe more than doubled (+140%).

Looking at oil, the decrease of crude imports from Russia was compensated by increased imports from traditional partners like Saudi Arabia, the US and Norway, as well as less traditional suppliers like Brazil and Angola.

Nuclear has also played a role in filling the supply gap. In 2023, France (Europe’s biggest nuclear power operator with 56 reactors), became a net exporter of electricity. This summer, its first new reactor in 25 years is scheduled to be connected to the grid in Normandy, and the country plans to build at least six new reactors in the late 2030s (though a skills shortage is a potential obstacle to these ambitions).

In the short-term, these factors combined have helped Europe avert the worst-case scenario of a severe energy shortage leading to extreme measures like rationing.

Fragilities remain

However, looking at the bigger picture, Europe’s energy situation is far from comfortable. It must now rely on global energy markets which are vulnerable to supply shocks, or even perceived threats of them.

Perhaps the most obvious threat today is the fraught geopolitical landscape.

Due to attacks in the Arabian Peninsula, for several months, tankers carrying fuel products between the Atlantic and Pacific basins have had to take a costly detour around the horn of Africa. This is leading to a fragmented global marketplace whereby traders are pairing shipments with destinations that are geographically close (e.g., US imports are being directed towards Europe and Middle Eastern exports towards Asia). These efforts will likely intensify when fuel demand mounts ahead of winter, when shipping costs usually also rise. Such fragmentation will make it more difficult to divert supply between regions if there is an outage at an export plant, a sudden surge in demand, or an unforeseen event (like the recent drought in the Panama Canal).

Also worth noting is the fact that European wholesale gas prices are still almost double their pre-crisis levels, which is tangibly impacting the competitiveness of Europe’s energy-intensive industries. Ironically, the recent softening we have seen in energy prices is due to muted demand stemming partly from the energy crisis itself. A rebound of the European economy, particularly industrial powerhouses like Germany, could therefore reinforce a feedback loop.

Lastly, an uptick in Chinese activity would signal the return of a significant LNG market buyer, again potentially pressuring prices upwards and highlighting Europe’s dependence on more expensive sources.

A coordinated approach

Insofar as now, Europe’s band-aid fixes to the energy crisis have proven highly effective, but the ultimate cure - reducing the level and volatility of energy prices in European wholesale markets - could be years in the making. That solution will be multi-faceted and will require coordinated policies, with the EU leaning on its strength as an economic bloc. One part of it might entail pooling demand and then getting involved in the commercial negotiations to strike long-term deals that offer suppliers a predictable revenue stream while ensuring gas security and affordability to European countries. Another part will clearly have to focus on increasing domestic supply, most likely through accelerated investment in alternatives.

[1] https://www.bruegel.org/dataset/european-natural-gas-demand-tracker#:~:text=Compared%20to%20the%20average%20across,the%20Baltic%20states%20and%20Finland.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...