Choose Language

July 28, 2022

NewsFed Flash: A second 75bp hike

- On Wednesday, the Fed delivered a second 75bp rate hike, in line with forward guidance

- Dovish undertones in the Fed’s statement suggested the pace of hiking could slow

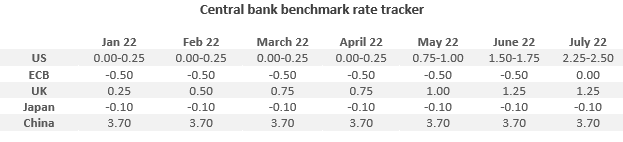

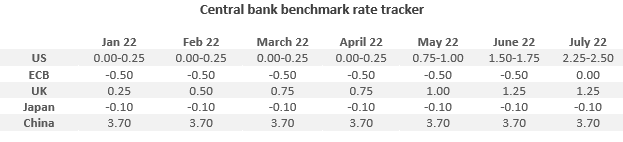

Continuing its battle with 40-year-high inflation, the Federal Reserve has delivered a second 75 bp rate hike, as expected. This lifted the target range to 2.25% - 2.50%, in line with the Fed’s long-run “neutral” rate – considered to be that at which rates are neither stimulating nor stifling economic growth. It is also the highest level since December 2018, when the Fed completed its last hiking cycle.

Despite the fact that “recent indicators of spending and production have softened”, Chair Powell made clear that more tightening is appropriate as inflation remains high and the labour market still strong. The US CPI continued its relentless rise in June, reaching 9.1%. In its statement, the Fed added food prices to the worries over oil and “broader” price pressures:

"Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures"

In a slightly more dovish tone, Powell added that monetary policy kicks in with a lag and that the full effects of its prior hikes this year are yet to be felt. Additionally, he said "unusual" moves of this size (i.e. 75bp) should not be viewed as the norm (until last month, the Fed had not hiked by such a magnitude since 1994) and that “at some point”, the Committee would begin to raise rates at a slower pace. The size of hikes from here will be data dependent and judged on a meeting-by-meeting basis (echoing the ECB’s July message). If data continues to soften as it is doing now in the eight weeks to the September meeting, we think a 50bp hike is more likely.

Today, the US Q2 GDP print will be released and according to the Atlanta Fed GDPNow tracker, it could come in at -1.2%. This would mean two consecutive quarters of negative growth for the US – fitting some common definitions of a “technical” recession. Powell pushed back on this idea stating, “The US is not currently in a recession, and the reason is that there are just too many areas of the economy that are performing too well.” Pointing to strong jobs growth, he said, “it doesn't make sense that the economy would be in a recession with this kind of thing happening."

After this reassurance from Powell and the possibility of slower hikes from here on out, US stocks closed higher (the S&P 500 up by more than 2.5%, the Dow by around 1.4% and the Nasdaq by 4%). The yield on two-year Treasuries, which are sensitive to policy, declined to below 3% and the dollar softened.

In all, market attention is turning to the end of this cycle. This second 75bp hike from the Federal Reserve will further tame inflation expectations, which have really come down markedly in the past months. While the recent 9.1% inflation print is noteworthy, it is not pivotal. Inflation expectations matter more. The 2yr inflation breakeven is now down to the 3% area, having been at 4.5% in mid-June (and 5% in March).

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...