Choose Language

April 23, 2020

NewsPandemic infects dividends & buyback policies: Part II

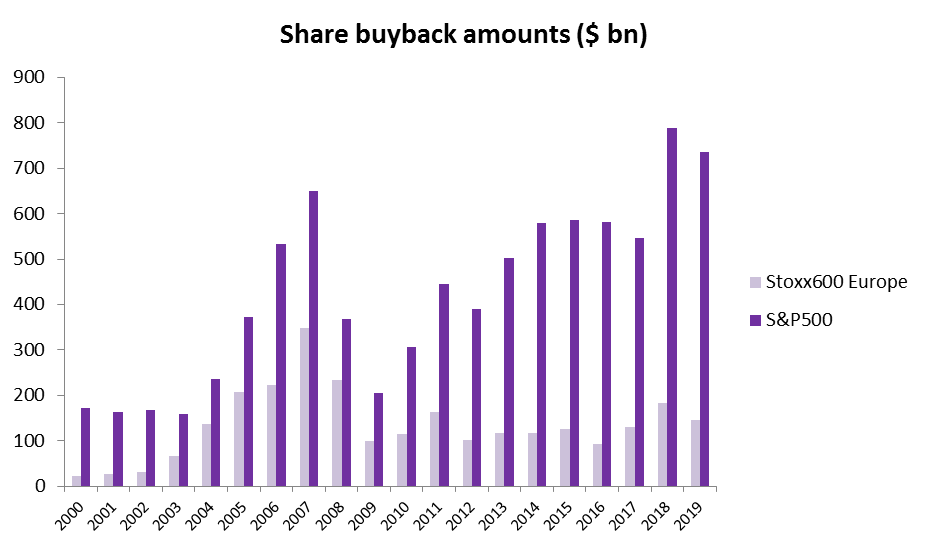

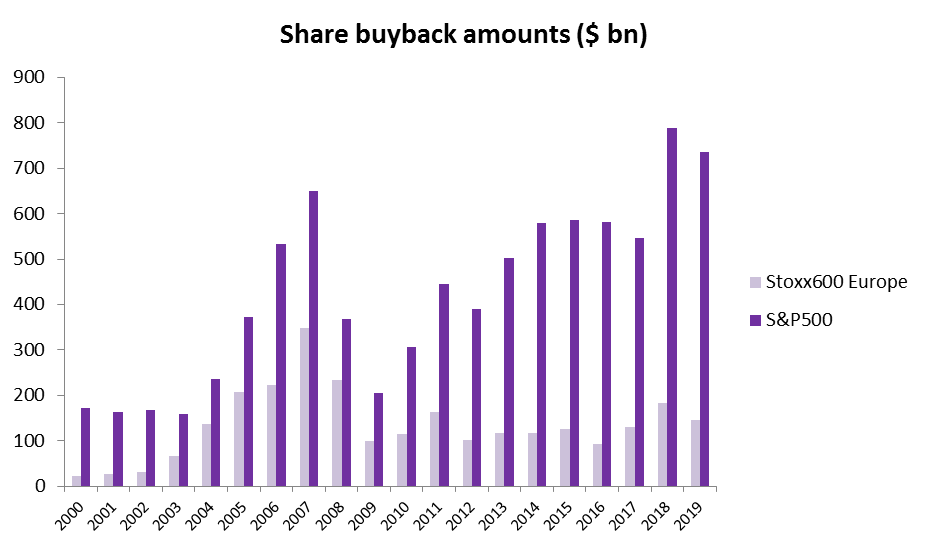

Should we fear a collapse in buybacks?

There are several ways in which a company can return wealth

to its shareholders. Although stock price appreciation and dividends are the

two most common ways, share buybacks are another classic way.

In a buyback, a company goes into the market and buys its

own shares at the prevailing market price from a willing seller and then

retires those shares, reducing the number of shares outstanding. Reasons for

buybacks are multiple. A company might buy back shares because it believes the

market has discounted its shares too steeply, or it my wish to invest in

itself, or it may wish to improve its financial ratios or it may do so simply

because of a lack of alternative productive ideas to utilize accumulated cash,

..etc.

We are living an unprecedented experience. The “Great

Lockdown” is also unchartered territory for economists and financial analysts.

Never before have governments intentionally discouraged production. This crisis has called into

question the value of economic modelling. Nevertheless, it is reasonable to

expect that governments will carry a greater weight in our economies. New or

reinforced rules and regulations are to be expected as part of the price tag.

Voices decrying share buybacks will get louder. Arguments

about the manipulation of earnings and undue rewards to insiders versus

stakeholders/shareholders will gain traction. At the same time, massive

government bails-out will probably mean that even the more prominent

neo-liberal countries will have to restrict buybacks. This mood will percolate into

corporate boards as well. Board members will most likely be circumspect to

agree on debt issuance to finance share repurchases.

According to Kepler-Cheuvreux, “It is estimated that company share buybacks have contributed a net US$4trillion to the US equity market since the beginning of 2009. Corporations have been by far the major net source of demand for equity. In fact, the only constant source of demand. Most estimates of the fall in net buybacks on Wall Street this year compared with 2019 are in the range of 50-70%. The recycling of the low cost of debt has probably been arrested since the outbreak of the corona world pandemic, marking the climax of the great corporate buy-back boom” [1]

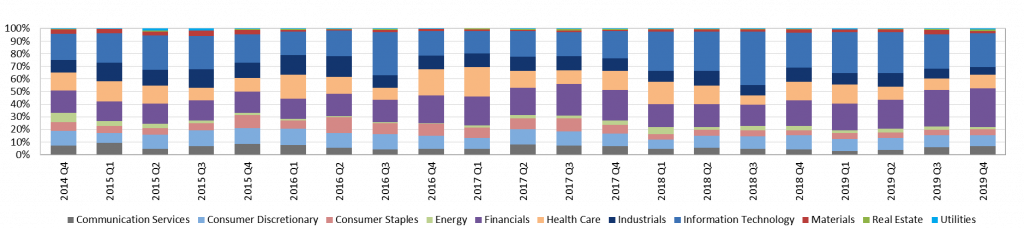

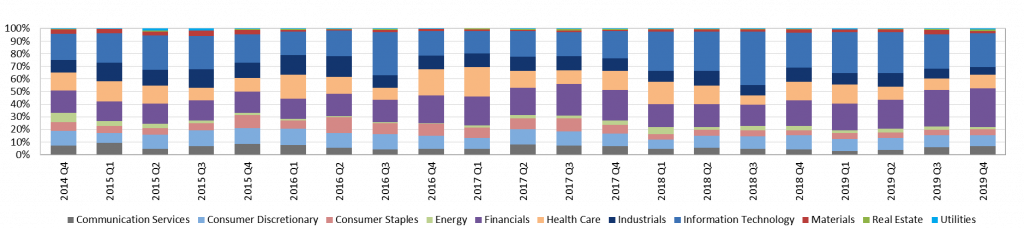

S&P500 Sector Buybacks: Quarterly rolling contribution (as % of total quarterly buyback)

The largest companies based on share repurchases in 2019

were in the technology and banking sector, according to data from Factset.

Apple, Oracle, Cisco Systems, Microsoft

and Alphabet rounded off the top 10 companies purchasing a combined $164

billion of company stock. Following the Trump tax cuts, corporate America has

lavished investors with a multi-trillion dollar share buyback spree over the

past two years instead of saving up for a rainy day. In March, eight of the biggest

US banks — including JPMorgan, Citigroup and Bank of America — said they would

suspend their multibillion-dollar share buyback programmes until at least July.

Given the scale of buy-back activities, the implications for

equity markets will be significant. One of the most common techniques for balance

sheet optimization is now off the table.

Trying to gauge the historical impact of share repurchases on market direction is mostly inconclusive. The same is valid for the broader insider activity which has mostly been a case of selling high and buying low. But the bottom-line is clearly that one of the major (mostly US) marginal buyers of equities from the last couple of years has been lost indefinitely. The length of this “indefinitely” is the million dollar question. The benefit to long term investors is that the value of a company is equal to the present value of expected cash flows from now until infinity. So, a few bad quarters because of an exceptional event should not merit perspectives of infinite doom.

Whatever goes on, part of our duty in the current context is

also to shed some light inside of the tunnel. As such we would like to share this inspiring quote from

a fund manager: “A crisis puts us in survival mode first. While the challenges

are not to be underestimated, often the long-term benefits outweigh the

short-term difficulties”. Stay healthy and safe and don’t forget that mixing

emotions and investment decision is a toxic combination.

[1] Christopher Potts – Kepler Cheuvreux "Strategic Frame” n°65

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...