Choose Language

April 20, 2022

NewsProtecting your wealth as central banks attempt to tame inflation

The war in Ukraine has banished the “transitory” inflation narrative to the realms of fiction. Renewed supply woes have sent the prices of various commodities skyward, heralding another burst of cost-push inflation – the type which central banks have less influence over. With the last comparable episode having occurred decades ago, it is essential that investors and consumers refresh their memories about the corrosive effects of inflation – which are dramatic when compounded over a longer-time horizon - and act to counter them.

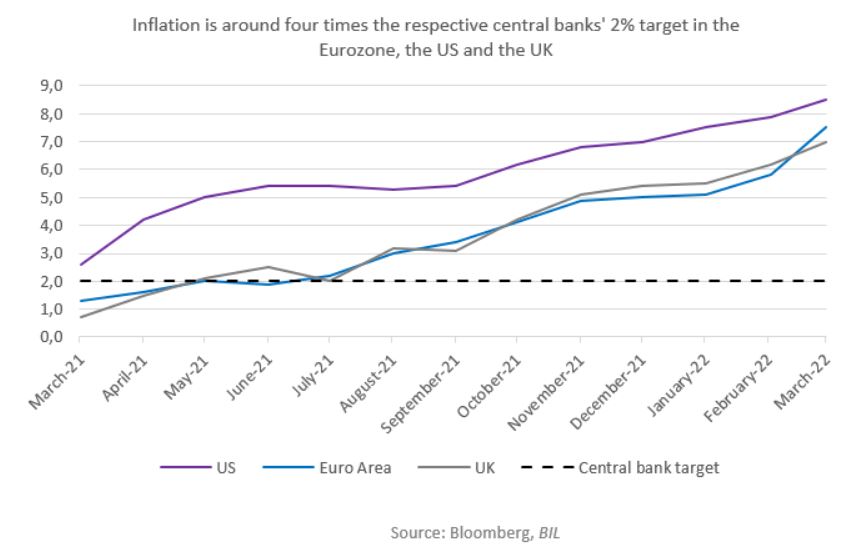

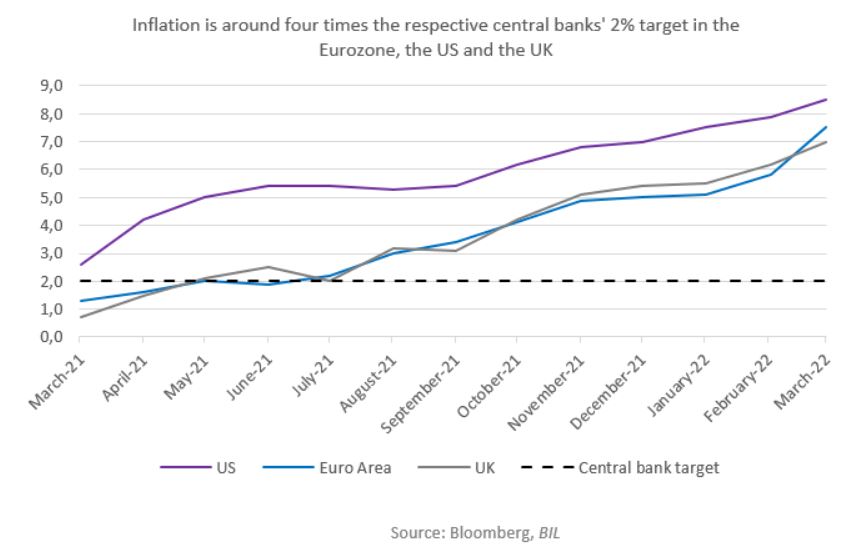

In March, inflation continued its relentless rise, turbo-charged by higher energy costs. In the Eurozone, it broke a new record for the fourth consecutive month, coming in at 7.5%. In the UK, it dialed in at a 30-year high of 7%, and in the US, it reached 8.5%, the highest rate since 1981. Originally, it had been hoped that inflation would peak early-2022 as pandemic-related kinks in global supply chains were ironed out: geopolitical developments, more military spending, strong demand and labour shortages have likely extinguished this hope.

Consumers, investors, nor central banks can afford to be complacent. With regard to the latter, a loudening chorus of criticism is pressuring our monetary guardians to do more to bring inflation under control. Speaking in the Financial Times, Otmar Issing, the ECB’s first chief economist when it was created in 1998, described inflation as a sleeping dragon that has now been awoken. He also said the ECB was suffering from a “misdiagnosis” of the factors behind the surge in prices, having “lived in a fantasy” that played down the danger of inflation spiraling out of control. At its meeting on 14th April, the ECB confirmed its intentions to end net asset purchases over the summer and to raise interest rates “some time after”.

Across the pond, James Bullard, president of the St Louis Fed and FOMC voting member, last week told the FT that it is a “fantasy” to think the US central bank can bring inflation down sufficiently without raising interest rates to a level where they constrain the economy. While other Fed officials generally support bringing rates towards a “neutral” level this year (at which they are neither stimulating nor curtailing growth, estimated to be roughly 2.4%), he argued that “neutral is not putting downward pressure on inflation. It’s just ceasing to put upward pressure on inflation.” From here, the direction of US rates is certain (North), as is the fact that the Fed will begin to reduce its balance sheet (at a pace of $1.1 trillion per year).

Even though inflation might retreat slightly from its current peak levels, we expect it to continue running well above the common 2% target on both sides of the Atlantic, maintaining pressure on central banks to pursue less accommodative monetary policy. As they try to tame the dragon, investors must act to protect their wealth in this new inflationary landscape.

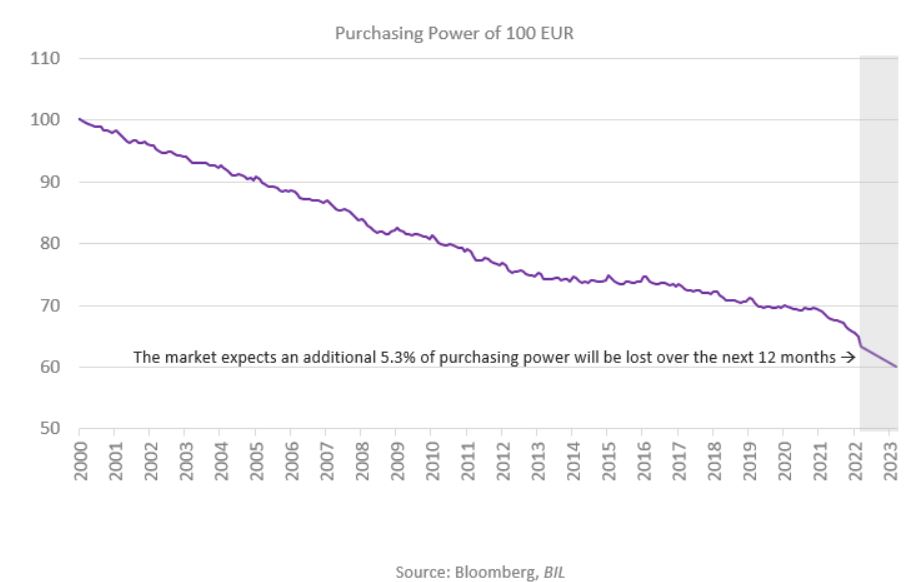

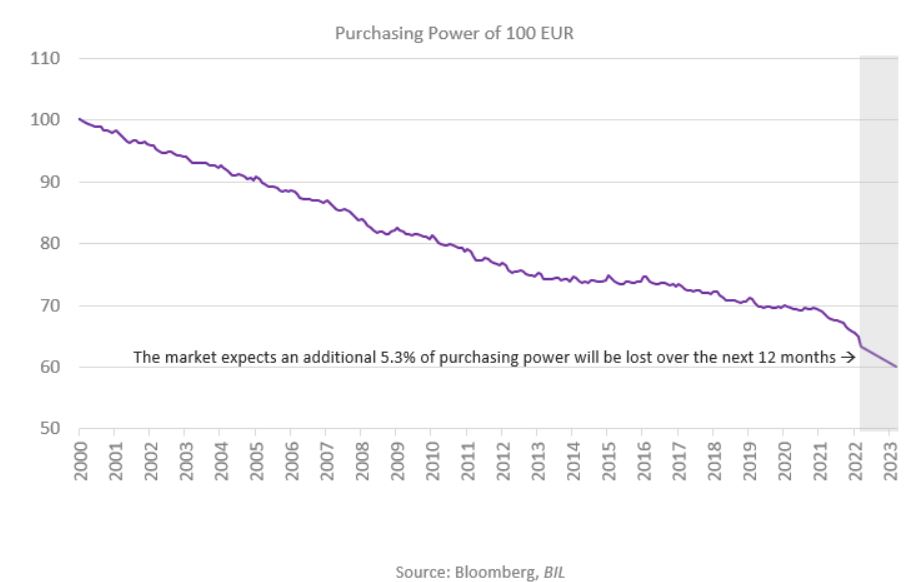

Normally, investors accept a degree of downside risk on their investments in exchange for upside potential over time. For those holding cash, inflation represents a guaranteed loss, with no upside potential.

In the long run, staying invested is the only way to protect purchasing power. Those who kept their cash under the mattress have lost 37% of their purchasing power since 2000. In the coming 12 months, financial markets currently expect an additional 5.3% of lost purchasing power.

While no investment is fully inflation-resistant, the good news is that different asset classes are not evenly impacted by its power of decay. As such, one of the best defenses is to curate a portfolio of those assets which better resist its corrosive effects.

One way to partially fend off inflation is with a well-diversified stock portfolio. Though we envisage slower growth this year, a recession is not our base case, and the investment case for equities remains intact, underpinned by robust earnings expectations - particularly in the US. On top of that, sectors such as Materials and Energy tend to benefit from higher commodity and energy prices, while Financials typically receive a boost from higher rates (though investors should keep in mind that European financial firms are disproportionately affected by sanctions on Russia.)

While bond investors are generally considered to be more conservative, recently they have been living dangerously, especially if exposed to longer-dated instruments: Heightened inflation expectations and the prospect of monetary tightening have pushed core yields and credit spreads higher, leading to lower prices for such bonds. There are however some corners of the fixed income market that offer better shelter, for example instruments with a short duration or those with a high buffer protecting against rising rates, found in, for example, select pockets of the high yield segment. With the ECB and the Fed pretty clear about where they are headed (towards tighter monetary policy), reduced uncertainty should lead to a reduction of interest rate volatility, hence supporting credit investments (interest rate volatility is correlated with credit spreads).

Some are wondering whether they should move into typical inflation shields: Treasury Inflation-Protected Securities, more commonly referred to as TIPS. However, it seems as though that ship has already sailed. TIPS rise in value when expectations of future inflation rise and already-elevated inflation expectations limit further upside.

Holding some gold in a portfolio is generally a good inflation hedge over the longer term too, but we caution against being over-exposed, noting that rising real rates could eventually cap upside potential.

All in all, an inflationary spike is no longer the stuff of “once upon a time…”. After a decades-long slumber, inflation is back as the single most important factor for investors, savers and consumers, who must be cognizant about its corrosive effects on wealth. Those with cash under the metaphorical mattress are surely sleeping more uncomfortably than the Princess who had the pea under hers, if we are to keep our fairytale analogies going. While market volatility is expected to be higher this year, this is the price we pay for higher expected returns over time. Keeping cash is a guaranteed way to lose purchasing power, without any upside risk.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...