Choose Language

February 23, 2018

BILBoardBILBoard February / March – Stock markets fortified by fundamentals

After a prolonged skyward rally, stocks have pulled back – quite dramatically – in a unified global sell-off. But, beyond the ominous headlines, economic fundamentals are almost unequivocally positive. In light of this, we assume the recent sell-off to be technical in nature and take this as an opportunity to moderately increase our equity holdings in select markets.

The sell-off was ignited when US Labour Department data revealed rising wage numbers, sparking fears of inflation and rising interest rates. As volatility flickered back to life, the sell-off was exacerbated by an unwinding of instruments designed to short volatility (worth over USD 300 billion in total) and an evaporation of electronic liquidity. The longer the sell-off persists, the more likely it is to affect sentiment and future data points, but at present, fundamentals remain strong.

The market’s laser-focus on wage growth data was surprising, especially given that the data was positive and in line with the objectives the Federal Reserve (Fed) is openly pursuing. As the San Francisco Fed President noted in a speech entitled Expecting the Expected: Staying Calm When the Data Meet the Forecasts: “Consumer spending, manufacturing activity, and construction are all showing strong numbers. And it’s part of a global trend of stronger-than-expected growth...The outlook is positive.” Against this backdrop, the market sees two Fed rate hikes in 2018 as a ‘done deal’ with a third more firmly baked into expectations. The 10-year Treasury yield could reach around 2.95% by the end of the year. However, the risk to markets is the speed of rate rises – there will be a sharpened focus on Jerome Powell’s press conference after the March FOMC meeting and any signs of an acceleration in hiking will create jitters.

Positive economic momentum is mirrored in Europe and the IMF has recently upgraded growth forecasts for the region. However, inflation prints still dally below the ECB’s target of “below, but close to 2%” – in January, it was 1.3%. Mario Draghi has said an interest rate hike in 2018 is very unlikely, providing a green light for a continuation of the expansion. Whilst the Italian elections in March are likely to create some volatility, overall, risk is contained and the probability of an ‘Italexit’ has subsided.

Equities

Relative strength indicators show that equities were oversold during the sell-off, which the IMF’s Managing Director, Christine Lagarde, has called a “welcome correction”. It is true that 2018 may be the year we see PMIs roll over or move sideways, but in the meantime, data points to stronger revenues, margins and multiples on the horizon. Given the strong underlying fundamentals, for those who can palate higher volatility, there is an opportunity to increase equity exposures in order to benefit from the last leg of the cycle and a potential consolidation at higher levels. The BIL Investment Committee has thus taken the decision to maintain a strong European overweight, whilst adding further to US and Emerging Market (EM) equity holdings.

It is an opportune moment to buy US equities; the dollar is low whilst the US forward P/E ratio has de-rated (from 18.7x to 16.7x) owing to higher earnings-per-share estimates in light of tax reforms. Though the US is late in the cycle, signs of overheating are scarce. Normally, if the market was peaking, we would expect to see excess leverage in markets (growth of margin debt in NYSE stocks has been slowing), recession signals (these are mild – the NY Fed Probability of recession in the US over the coming 12 months is only 10.4%), and a real rate above 2% (the Fed funds effective rate less Consumer Price Inflation currently gives a negative figure). In terms of US sectors, we prefer: IT for exposure to secular growth themes; energy, given that this sector’s performance has lagged the +45% oil price surge that has played out since June 2017; and financials – this is the most sensitive sector to rising bond yields and banks are key beneficiaries of tax reform.

Whilst cyclical sectors have started to outperform, cyclical regions are yet to catch up, which bodes well for Europe and Japan. To allay fears of a rising euro, investors can consider European small caps, which have less exchange-rate sensitivity. We also favour financials in this region as a hedge against rising rates.

EM are attractive in terms of valuations and there is room for a degree of catch up vis-à-vis developed markets, which rallied towards the end of 2017. EM were among the most oversold asset classes in the global equity correction and we take this as an opportunity to increase our positioning. This is in light of the house view that the USD should consolidate and trade sideways in the near term.

Fixed Income

Bond yields are still artificially suppressed by structural factors and expectations for interest rates and inflation are rising (detrimental to fixed income). To mitigate some of the risk associated with these trends, in our Defensive and Low-risk profiles, a proportion of corporate bonds have been sold in favour of convertibles (these act conversely to standard fixed income instruments). In our High-risk profiles, developed government bond exposure has been brought down to zero.

We maintain a positive outlook on EM debt; investor sentiment is positive whilst fundamentals remain supportive for the majority of emerging countries, with GDP growth picking up and inflation under control. Moreover, this asset class still offers some yield; hard currency sovereigns, for example, offer a yield-to-worst of 5.25%.

All in all, fundamentally speaking, equities are still in a “Goldilocks” period for now. However, the current cycle is in its final stages and will be more sensitive to shifts in expectations for inflation and interest-rate increases going forward. This means that the smooth journey enjoyed by equity investors in 2017 is in the rear-view mirror and we can expect a rockier road from here on out, albeit with opportunities still to be had.

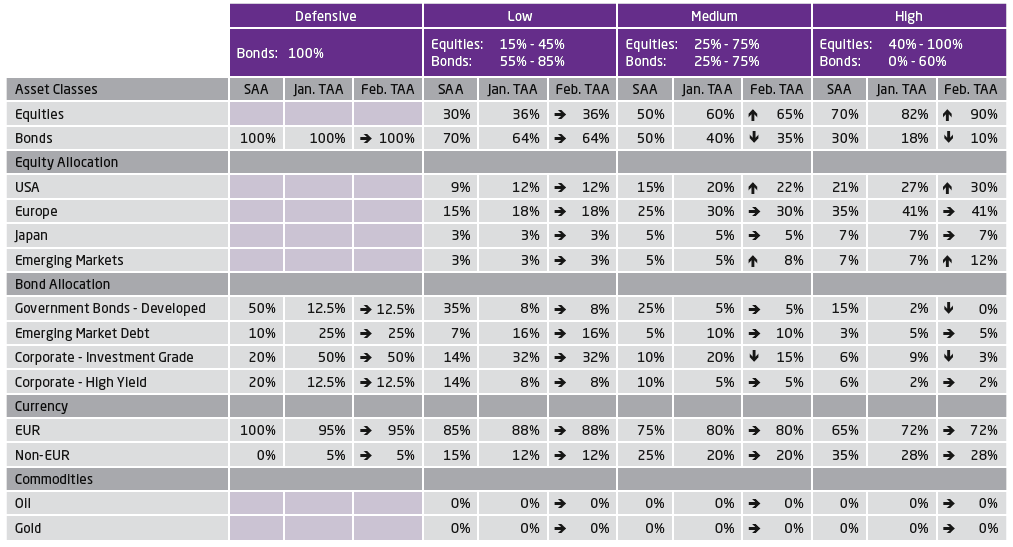

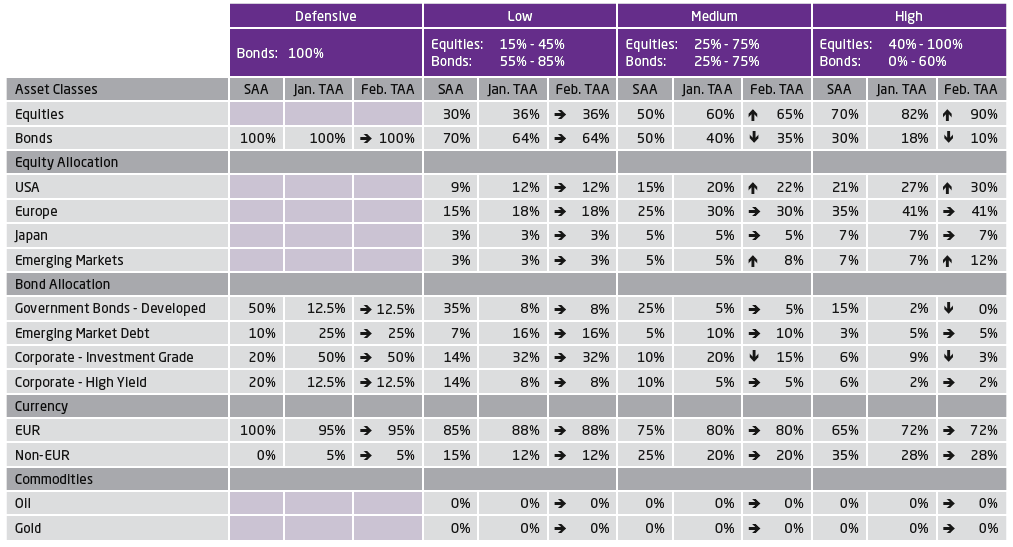

Strategic Asset Allocation (SAA) & Tactical Asset Allocation (TAA) by risk profile and asset class

Download the pdf version here (in French)

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...