Choose Language

April 5, 2018

NewsTech Sector: Idiosyncratic risk ≠ systematic risk

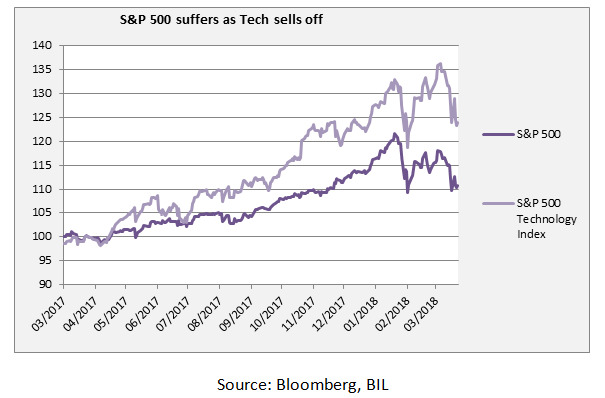

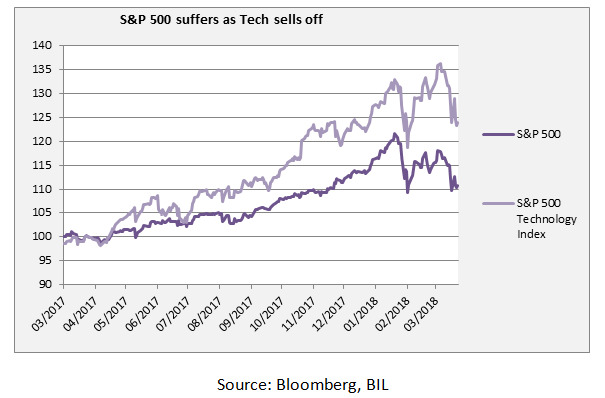

Technology stocks, the stock market darlings that powered equity indices to record highs, have had a rough ride in the first quarter of 2018. In March, FAANG stocks (that is Facebook, Amazon, Apple, Netflix and Google) suffered their worst one-day loss as a collective group, falling 5.6% as Tech investors struggled to swallow an amalgamation of new risks and setbacks which have emerged, particularly around regulatory concerns. The rout continued and as a whole, US stocks began the first day of Q2 in correction territory.

However, whilst the unpleasant ride for investors is likely to continue in the short-term, it’s important to consider that the nature of the risk in the Tech sector, is, for now, idiosyncratic. This means, that each of the companies whose share price is being battered faces its own company-specific risk. These are unsystematic - it just so happens that all of these have come in a gust, impacting the sector at large.

Firstly, there is Facebook. The company has been embroiled in a scandal in which a data company, Cambridge Analytica stands accused of aiding and abetting the Trump administration to win the hearts and minds of voters by harvesting the personal data of millions of Facebook users without permission. Though Facebook has pointed its finger at a third party app, Mark Zuckerburg, the CEO, has been called to testify in front of Congress. Facebook likely faces steep financial penalties from regulators in light of the scandal, as well as increased regulatory scrutiny.

Then there is Amazon. The company has lost around $60Bn in market value since it was revealed that Trump wants to ‘go after’ the company. CEO Jeff Bezos has fallen into Trump’s firing line, as he also owns the Washington Post which openly criticises Trump. In a Twitter fusillade against the company Trump has claimed, amongst other things, Amazon harms brick-and-mortar retailers whilst weighing too heavily on the postal service. Amazon may be hit with higher taxes.

Though it is not a FAANG stock, trouble at Uber is also causing investors to switch into a more defensive mindset, out of Tech. Nvidia has suspended self-driving car tests after a recent fatality involving an Uber autonomous vehicle. There are also concerns about Tesla’s production plans.

Undoubtedly the various issues have dampened sentiment. Whilst heightened volatility can be expected as each of these companies work to resolve the issues at hand, fundamentals remain strong and eventually we expect a degree of stabilisation. Tech stocks typically benefit from rising bond yields and as central banks take their foot of the gas in terms of QE, yields are headed north, and Tech – a very late cycle performer should pick up. For this reason we have a slight overweight in select Tech names. We are however reluctant on semi-conductor names – these are highly cyclical and if PMIs start to recede and growth momentum slows, this sector will likely suffer.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...