Choose Language

April 5, 2018

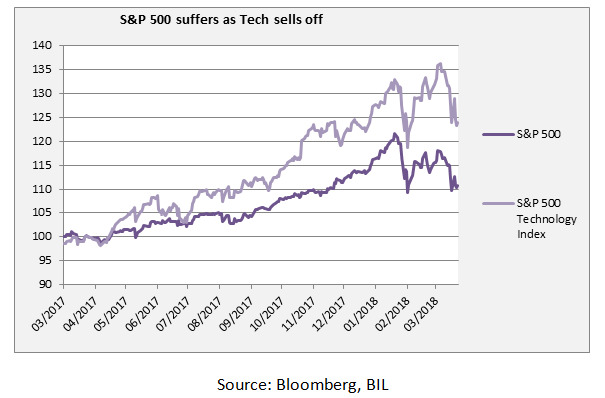

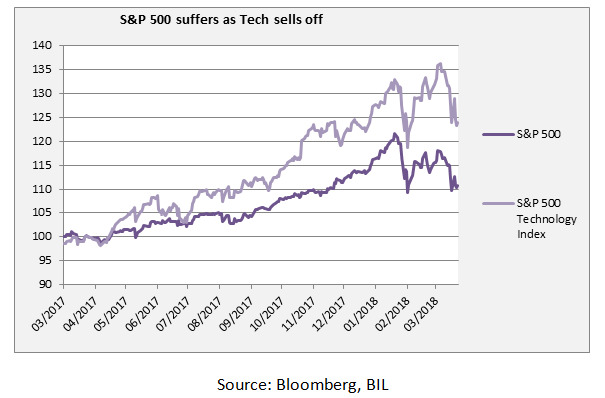

NewsTech Sector: Idiosyncratic risk ≠ systematic risk

Technology stocks, the stock market darlings that powered equity indices to record highs, have had a rough ride in the first quarter of 2018. In March, FAANG stocks (that is Facebook, Amazon, Apple, Netflix and Google) suffered their worst one-day loss as a collective group, falling 5.6% as Tech investors struggled to swallow an amalgamation of new risks and setbacks which have emerged, particularly around regulatory concerns. The rout continued and as a whole, US stocks began the first day of Q2 in correction territory.

However, whilst the unpleasant ride for investors is likely to continue in the short-term, it’s important to consider that the nature of the risk in the Tech sector, is, for now, idiosyncratic. This means, that each of the companies whose share price is being battered faces its own company-specific risk. These are unsystematic - it just so happens that all of these have come in a gust, impacting the sector at large.

Firstly, there is Facebook. The company has been embroiled in a scandal in which a data company, Cambridge Analytica stands accused of aiding and abetting the Trump administration to win the hearts and minds of voters by harvesting the personal data of millions of Facebook users without permission. Though Facebook has pointed its finger at a third party app, Mark Zuckerburg, the CEO, has been called to testify in front of Congress. Facebook likely faces steep financial penalties from regulators in light of the scandal, as well as increased regulatory scrutiny.

Then there is Amazon. The company has lost around $60Bn in market value since it was revealed that Trump wants to ‘go after’ the company. CEO Jeff Bezos has fallen into Trump’s firing line, as he also owns the Washington Post which openly criticises Trump. In a Twitter fusillade against the company Trump has claimed, amongst other things, Amazon harms brick-and-mortar retailers whilst weighing too heavily on the postal service. Amazon may be hit with higher taxes.

Though it is not a FAANG stock, trouble at Uber is also causing investors to switch into a more defensive mindset, out of Tech. Nvidia has suspended self-driving car tests after a recent fatality involving an Uber autonomous vehicle. There are also concerns about Tesla’s production plans.

Undoubtedly the various issues have dampened sentiment. Whilst heightened volatility can be expected as each of these companies work to resolve the issues at hand, fundamentals remain strong and eventually we expect a degree of stabilisation. Tech stocks typically benefit from rising bond yields and as central banks take their foot of the gas in terms of QE, yields are headed north, and Tech – a very late cycle performer should pick up. For this reason we have a slight overweight in select Tech names. We are however reluctant on semi-conductor names – these are highly cyclical and if PMIs start to recede and growth momentum slows, this sector will likely suffer.

More

March 22, 2024

BilboardBILBoard April 2024 – Shifting sands ...

The sands in the investment landscape have shifted in that it appears major central banks have tamed inflation without triggering a deep economic downturn. At...

March 11, 2024

NewsAre we watching an AI bubble inflate?

After hitting a new all-time high at the beginning of March, the S&P 500 might be on track for one of its best first quarters...

March 7, 2024

NewsWeighing the impact of global warming...

It’s peak ski season, but snow sport aficionados are arriving on European slopes to discover that a crucial ingredient is in short supply: snow....

February 23, 2024

BilboardBILBoard March 2024 – Rate cut ...

Spring is around the corner. The days are getting a little longer and brighter, while the cherry blossom tree in the BIL...