Choose Language

December 14, 2022

NewsThe changing face of US inflation

According to a new Fed model, US inflation - which was initially a by-product of global supply-chain issues – is now largely driven by heightened demand. This has implications for monetary policy, galvanising the case for “higher for longer”.

US CPI continued its downward journey in November with the headline falling from 7.7% YoY, to 7.1%, below expectations of 7.3%. While this a welcome development, and quite a bit below June’s peak of 9.1%, we cannot forget that prices are still growing at a speed that is triple the Fed’s desired pace of 2%. The Fed’s preferred inflation measure, the personal consumption expenditure price (PCE) index, increased by 6% YoY in October (next print due December 23rd), again, down from a peak hit in June, of 7%.

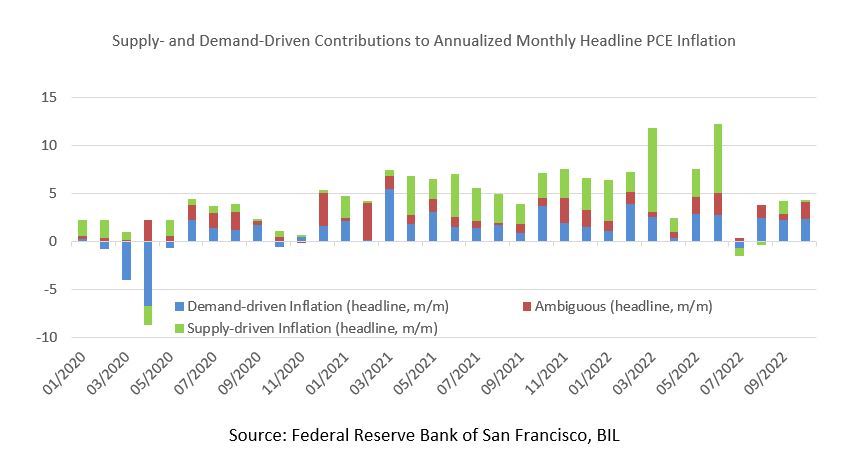

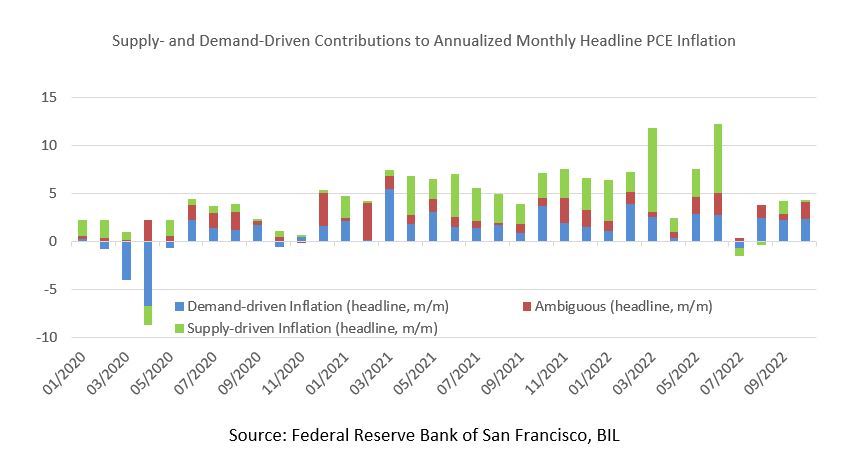

No matter how you cut it, inflation is still too high. The Fed must continue to coax it down, but future actions must take into account what type of inflation it is dealing with. A new model developed by economists at the Federal Reserve Bank of San Francisco helps with this, by breaking inflation down into three categories: supply-driven, demand-driven and “ambiguous”, where it is not obvious given how difficult it is to disentangle the two.

Using this new model, it would appear that demand is taking over as the chief driver of US inflation.

This has implications for the future pathway of monetary policy. If inflation was largely supply-side driven, this might imply a dovish Fed pivot was warranted – the Fed’s toolbox has a limited effect when it comes to resolving shortages of goods and materials and clearing supply chain congestion. Trying to use it to this end would probably result in overtightening in areas that didn’t actually require it while international supply chains normalised on their own accord.

However, if the bulk of inflation is stemming from heated demand, the Fed can tighten financial conditions to the end that there is less money sloshing around in the system to be spent.

Looking into the November data, indeed, inflation seems to be concentrated in the services sector (+6.8% YoY from 6.7%), where demand is still strong with people eager to catch up on missed experiences. Airfares, for example, are still growing at a clip of 36%. Admissions to movie theatres and concerts at 7.4%. Shelter (+7.1%), a category strongly linked to the strength of the labour market, plays a big role on the demand-driven side, in part just because of its outsized weight in monthly household budgets.

For demand-driven inflation to keep coming down we need to see the pillars holding up consumption weaken. The first – pandemic-era excess savings – are gradually declining, now estimated to have fallen to less than half of the initial $2.3 trillion amassed during lockdowns. The second pillar supporting spending is the labour market. So far, it has remained resilient in the face of tightening and upwards pressure on wages is very much present. November payrolls grew by 263k versus 200k expected, and average hourly earnings were up 5.1% YoY, also well above the 4.6% expectation, leading Fitch Ratings chief economist Brian Coulton to declare, ‘The Fed is tightening monetary policy but somebody forgot to tell the labour market’. Indeed, there are 1.7 jobs for every unemployed worker: Prior to the pandemic this rate was steady at about 1.2.

This is where the Fed can have greater influence and indeed, officials have acknowledged that getting inflation under control will require a sustained period of low growth as well as higher unemployment. This likely supports the case for a more prolonged tightening campaign. We see the terminal rate settling around 5%, implying rates will continue to rise at least through March. From there, we expect they will stay “higher for longer”. Will this result in recession? It looks likely. However, with the US economy still quite strong, particularly the labour market, we believe a downturn in 2023 will be short, shallow, and potentially even necessary in order to bring about some moderate demand destruction.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...