Private markets consist of all the investments that are not traded on a

public exchange or market. They can encompass a wide array of underlying assets,

from securities to properties and everything in between. In this note, we

define private markets as closed-end funds investing in private equity, real

estate, private debt, infrastructure, or natural resources, as well as related

secondaries and funds of funds. For further understanding on private equity

please refer to “what is private

equity?”.

Active management lives on

In one of

our previous focus pieces[1]

we looked at the seismic shift in investor preference from active to passive fund

management over the past decade. While everyone talks about the impressive

growth of the exchange traded fund (ETF) market, the real show stealer (in

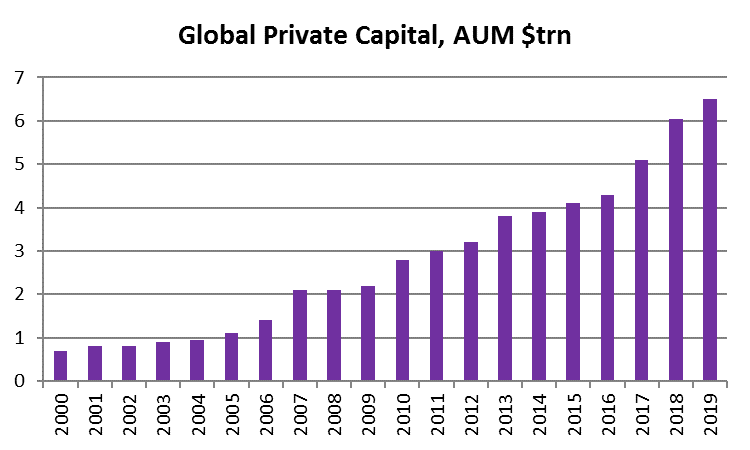

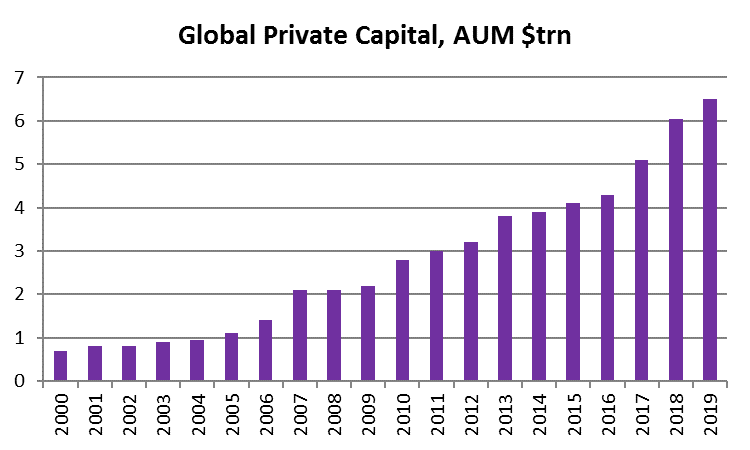

terms of asset growth) is the private realm. According to McKinsey Global

Private Markets Review 2020[2],

total AUM across private markets has hit another all-time high of $6.5 trillion

as investors continue to shift capital from public asset classes in search of

more upside. According to JPMorgan, pools of private capital grew by 44% in the

five years to the end of 2019. A different way to capture the scale of the

private party is to look at the quartet of Wall Street firms that specialize in

managing private investments for clients—Apollo, Blackstone, Carlyle and KKR.

Their total managed assets have risen by 76% in the past five years, to

$1.3trn.

While

passive investment is not (yet?) feasible in private assets, it is worth

understanding that private markets have been growing at twice the pace of ETFs.

In essence, those who fear that the end of active management is in sight (relative

to the growth in ETF vs. traditional funds) should understand that active

ownership is alive and kicking as the main engine of performance for private

assets. In private equity, for instance, it’s commonly accepted that 60% of

returns are driven by active ownership, achieved through asset improvement.

Why are more companies giving preference to

being private?

In

observing financial markets, the broad expansion of private assets is visible

through the fact that companies remain private for longer and the fact that it

the delisting of public companies (to go private) is becoming more common[3].

By staying private, companies can embark on long-term, innovative, and sometimes

high-risk, high-return ventures. They aren't bound by the pressures of

quarterly results, meaning they can take a longer term view. Running a public

company can be an arduous task. The rules and regulations that govern

operations and disclosure requirements have become increasingly complex over

the years and the corresponding expenses to stay compliant are considerable.

With the number of new listings in decline and an increasing number of firms

quitting the stock market to go private, the proportion of publicly listed companies

should continue to fall. Between 2000 and 2018, the number of private

equity-backed companies in the US rose from around 2,000 to around 8,000. At

the same time, the number of publicly listed companies fell from 7,000 to roughly

4,000. Albeit, those listed firms are still worth more than ten times the private-equity

backed ones (due to their bigger size, on average).

Considering

that there are half as many public companies as there were two decades ago,

everyday investors are left with fewer places to store their money.

According

to The Economist, a large and growing share of assets allocated by big pension

funds, endowments and sovereign-wealth funds is being redirected into private

markets. Across a panel of 10 of the

world’s largest funds examined, the median share has reached 23%.

Private assets are now an integral feature of capital

markets

It’s becoming

clear that private assets are now a core feature of the investment landscape

for investors and entrepreneurs and they are here to stay. A generation ago, a

promising startup would typically aim for an initial public offering (IPO) within some

years. Now, the remaining active investors in public markets are less willing

to take a punt on small firms. Midsized companies are not big enough or liquid

enough to fall under the umbrella of passive investing. While private asset

management is the antithesis of passive management, the growth in both of these

areas is feeding some sort of self-reinforcing rationale.

While private

investments were once considered as hard to access, opaque, complex and niche, they

are now valued and accepted as an

attractive way to diversify an investment portfolio and achieve enhanced

long-term return potential; clearly this underpins the strong appetite shown by

high net worth and institutional investors.

Key drivers behind the rise of PE

Regulation is also altering the playing field. After the

financial crisis of 2007-09 new rules made it costlier for banks to lend. The biggest

banks were incentivized to lend to consumers and blue-chip firms at the

detriment of midsized firms: The gap in corporate credit has been filled by

private assets funds. Early June, the US administration paved the way for

ordinary savers to invest in private equity funds through their

employer-sponsored retirement accounts. The US labour department, which governs

401(k) retirement accounts, said private equity could be used within the

professionally managed funds on offer to savers. The new rule will level the

playing field for ordinary investors vs. institutional investors, helping to

democratize access to private assets.

Some intellectual evolution is also at play

among investors. The redirection of the endowments of large and well-established

American universities during the ‘80s towards having a larger exposure to

private assets has been followed by a larger band of investors. A 2014 study[4]

found that venture and buy-out funds on average did better than the S&P500

index by around 3% a year after fees (with considerable dispersion around

winners and losers and without accounting for leverage). But as cautioned by

one of the authors, “what private equity is going to do going forward, God only

knows”.

Depressed interest rate levels around the globe (often described

as financial repression) mean that the earnings for savers are entrenched below

the level of inflation. This is a strong driver behind flows into the private

realm. The quest for low correlations in portfolio construction is also at

play. While listed equity indexes disconnect regularly from fundamental

perspectives, an increasing number of investors are holding cash, remaining

skeptical of public market dynamics. While doing the necessary research is not

an easy task, more and more investors are willing to take their chances with

private debt and equity.

Private

equity has a sulfurous reputation of cold-blooded capitalism, somewhat

illustrated by Danny De Vito’s character of “Larry the Liquidator” in the ’90s

movie, “Other People’s Money”. The asset stripping and job cutting[5]

is a biased perspective about a single part of the broader picture. While

takeovers of public companies by PE firms are, from media coverage, associated with

restructuring and job losses, Larry the Liquidator is long gone and has been

replaced by less colourful but more efficient corporate players. Private equity

funds were previously considered as raiders, stone-cold financiers, gaining

control of a company through a leveraged buyout (LBO) to dismantle it by

selling its most profitable elements while scarifying whatever remained (i.e.

human capital). These days this is not the reality, cash is abundant and private equity practitioners are adopting buy-and-build

mentalities, while fighting obsolescence. Private equity is also more than LBO.

Private equity takeovers of listed companies are only a small part of the

scope. A far greater part of private

equity activity is related to takeovers of non-public companies, not to mention

venture capital, which is helping build tomorrow’s disruptors.

Is there a downside?

Let’s be

realistic, the smoothed returns of private equity understate the true economic

risk and are an artifact of the lack of mark-to-market for illiquid assets. In

short, although PE has low reported risk, it is economically riskier and has

higher exposure to the equity risk premium than public equities. But looking

through the glass-half-full perspective, if the growing interest in private

equity before the current pandemic was supposed to drive richening valuations,

a headwind for future returns edge over public equity, the ongoing context is a

reasonable opportunity for new joiners. As stated by AQR[6],

“the full risk of PE is most likely to materialize in prolonged bear markets,

not in a relatively fast one” (nor a short one).

Conventional

wisdom is that you should receive an additional premium for holding illiquid

assets. But what if this illiquidity is perceived as a “feature and not a bug”[7]? Knowing that we are all suffer

from behavioral biases, sometimes detrimental to our investment ambitions,

illiquidity could mean that the madness of crowds associated with market timing

is out of reach. Keep in mind that for euro-based investors, negative interest

rates also mean that time value is upside down. Liquidity, as such, could also

be upside down. Counter-intuitive, but illiquidity could do more positive than

negative for some investors. It will not be inconceivable to face illiquidity-discounted

expected returns.

The shape of PE in a post-Corona future

The

Covid-19 pandemic has majorly disrupted economic activity and private equity. The

extent or duration of disruption is unknown at present, hence, forecasting

demand and short term cash flow is difficult. We are reassured that private

equity activity has the innovative capabilities and resilience to work through

this unprecedented moment. Clearly, some transactions have been disrupted or

put on hold. Pricing assets is also challenged by the long list of

uncertainties and this will take more than a couple of weeks to resolve. But

the industry is supported by various factors. Prior to Covid-19, it was well documented

that dry power waiting to be invested was pilling up. Funds nearing the end of their predefined

duration could find it tricky to exit investments. Those funds are likely to

increase their holding period and work through the crisis to sell in better

times, as long as they have the ability to do so. On the other hand, new buyouts

may need a bigger investment than they have been used to secure financing but

private equity is also likely to benefit from borrowing at historically low

interest rates while seizing opportunities at discounted valuations. According

to Bloomberg calculations, the private equity M&A market share proportionally

increased since the pandemic erupted to reach roughly 30% of all M&A volume

in 2020. From the same source, “private equity buyout volume is also on the

rise. $101.3 billion in proposed, pending, and completed private equity buyouts

have been announced in the U.S. this year, which represents a 15% increase from

the same period last year”. While private equity may not see the “extreme

money-making” of past years, the industry is continuing to make deals and is

poised to seize upon targets with lower multiples; cheap acquisitions could be

sowing the seeds of a great vintage year down the line.

Real estate

The

Covid-19 pandemic is also accentuating existing trends. For private real

estate, lower rents and expected income streams could push values down, but the

fall in interest rates will also buffer the effects of this through lower

discount rates. At the end of the day, the real estate risk premium required

today would have to be larger given the higher level of uncertainty. Having a

significant pipeline with many pre-identified assets may not be attractive to

investors anymore, not only because of the anticipated adjustments in asset

values, but also because of the changing tenant demands that should impact

longer-term price trends in the real estate sector - structural trends were

already quite visible before the pandemic.

The office market in aggregate entered the crisis in good shape. A limited pipeline and low vacancy rates are still at play even if some occupiers are suffering, and some will go out of business. Furthermore, the rise of home working will reshuffle the office market. Remote working could ultimately erode tenants' demand for traditional office space and dampen overall occupancy and rent levels in the market. At the same time, the experience of the pandemic may change corporate behavior, and if social distancing becomes the norm, employers may have to grant more personal space to employees than is currently standard. The battle between the out-of-office model and the need for creativity and interactions around the coffee machine is at play.

But working

from home is not new. The development of remote-working capabilities started

years ago, as companies began to focus on improving their employees' work

flexibility and work-life balance, while reducing real estate costs. While location

has always been paramount in real estate, office space in prime locations is

likely to appreciate. Just consider that some businesses reduce the number of

their workforce who work in the office, they might prefer to have the select

few move to more central and prestigious locations. There will also be a

heightened demand for healthy buildings with enhanced air and water quality. The

structural trend to obtain social and green certifications for office buildings

will continue to gain traction.

Retail real

estate is another segment in which the pandemic is exacerbating prior difficulties,

with a significant oversupply and a shift to online shopping. The misfortune of

retail is the strength of the logistics sector. The acceleration of online

sales will likely boost demand for logistics facilities, though there won’t be

immunity to economic cyclicality. While the current

pandemic is affecting

companies' capacity and willingness to pay contractual rents, we expect

landlords to feel the impact. Nevertheless, S&P Global Ratings estimates

that office landlords will not see rents decline by more than 5% in 2020. At

the same time, weak economies and remote working pose longer-term threats to

the demand for office space. This compares favorably with S&P’s assumption

of a 15%-20% drop in rental growth for European retail landlords in 2020.

The residential

sector will suffer from the recession shock as many tenants went into the

crisis with fragile balance sheets. While difficult to gauge if the boom of

larger houses in the countryside is a short-term phenomenon, the ‘operating

procedures’ for elderly housing are likely to be amended in the wake of the

crisis but the demographic trend of an aging population will remain.

Finally, infrastructure investment has been resilient during previous crises, but the severity of the current economic shock is a significant litmus test for the asset class. In our view, some sectors of infrastructure investment will face structural challenges and others, structural opportunities. Airports are confronted by the stress of airline companies and passenger traffic. Oil and gas faced the supply glut and the energy transition. On the other hand, infrastructure related to datacenters, telecommunication, renewable energies are gaining traction.

Conclusions

Private

assets, like any other asset, are currently finding a new equilibrium. If

history is a guide, previous crises offered attractive investment opportunities

to private market investors. Nevertheless, investors should understand that

Covid-19 is very different from previous crises and will impact private markets

very differently than other crises have done over the past 40 years. Private

assets are not uniform. Drivers of returns vary significantly. An understanding

of the nature of cash-flows in underlying business models, the level of

leverage and the duration of debts are essential.

As of

today, no-one has certainty as to capital injections. What we know for sure is

that any new capital injections will dilute the holdings of existing investors,

while presenting a potentially attractive opportunity for new investors to

lock-in attractive valuations. In a recent interview with the FT[8],

Joe Bae from KKR explained that the firm is currently “capitalising on the

unprecedented level of volatility and dislocation in the markets to buy

high-quality businesses at attractive prices”. The same article goes on, quoting one adviser

to KKR, saying that he has “taken out the playbook and is using every chapter

on how to deploy capital” during the crisis. “It’s auction processes, it’s

proprietary deals, it’s public, private, control, single-percentage minority,

carve outs, it’s all sectors… there’s no rock unturned.”

The bottom-lines

in real estate will stay unchanged. These are typically anchored on real assets,

often backed by long-term leases. Office landlords with the longest leases are

better protected against the risks of tenant exits and negative re-leasing

spreads over the coming quarters amid the current uncertainty around market

rents. The scarcity of prime-quality assets and low vacancy rates should partly

mitigate a potential fall in demand in the major office markets this year. The

“value-add” strategy which aims to create value at each acquired estate level,

is best suited to mitigate market uncertainties and to manage investment

downside risk(s). Going forward, health issues, ESG issues and technological

induced changes will hasten existing assets obsolescence and drive further value-add

strategies and investment. Asset “sustainability” and qualitative certifications

have evolved from being “nice to have” to being must-haves.

We believe

private assets are long term investments that offer superior returns for

investors looking through the cycle. While the jury is still out as to how the

recovery will look, private assets have historically been a good diversifier to

traditional asset classes with low correlation. With lower valuations come

buying opportunities as shown by the vintage years born of previous crises.

Resilience in some long life assets should ultimately help to maximize debt

recoveries. Acknowledging trends towards sustainability, ESG and energy

transition is vital for private assets. Investment towards private assets provide

the most direct pathway to generating impact outcomes for both the environment

and social challenges with tangible solutions, creating intentional and

positive outcomes.

[1] BIL Investment Insights: Active versus passive: Are efficient

markets make believe? https://www.bilinvestmentinsights.com/active-versus-passive-are-efficient-markets-make-believe/

[2] “A new decade for private markets” McKinsey Global Private Markets

Review 2020

[3] According to Dealogic, deals involving public companies being taken

private by domestic private equity sponsors increased more than 27% from 2018

to 2019

[4] “Private Equity Performance: What Do We Know?” ROBERT S.

HARRIS TIM JENKINSON STEVEN N. KAPLAN

[5] See for

instance FT: “Private equity takeovers of listed companies hit jobs hardest,

study finds” October 2019 https://www.ft.com/content/dfe3d4f4-e821-11e9-a240-3b065ef5fc55

[6] Demystifying Illiquid Assets: Expected Returns for Private Equity, Antti

Ilmanen, Swati Chandra, and Nicholas McQuinn

[7] AQR – The

illiquidity premium https://www.aqr.com/Insights/Perspectives/The-Illiquidity-Discount

[8] FT: “Private equity steps in where others fear to tread during pandemic”

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...

June 11, 2025

News2025 Midyear Outlook: Going Deeper

A choppy start to 2025 When we published our 2025 Outlook, Tides of Change, we anticipated a year defined by turbulence—and indeed, the first half...

June 5, 2025

Weekly InsightsWeekly Investment Insights

Published early, on 5 June 2025, in light of the public holiday weekend As ash and gas billowed from Sicily’s Mount Etna, some steam also...