Choose Language

January 23, 2022

NewsThe metaverse: Digitalisation’s next frontier?

Beyond our traditional financial and macro analysis, at BIL, we are increasingly focused on longer-term investment themes and the arising opportunities that they may offer our clients.

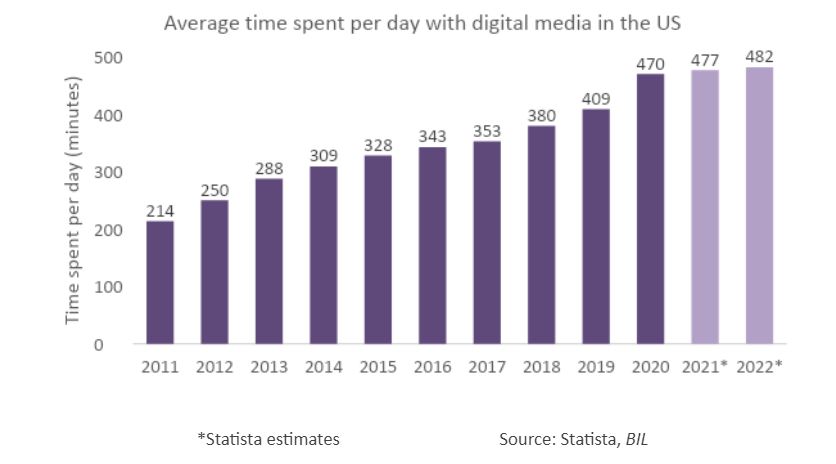

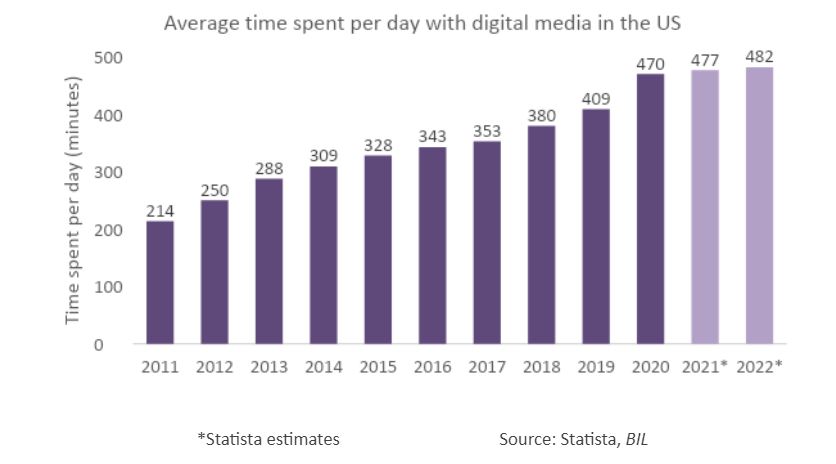

Digitalisation is undeniably one of the most important secular trends shaping the future. Under the cloud of the Covid-19 pandemic, digitalisation took a great leap forward, leaving us on the brink of a turning point in human history – the point at which we spend more time in the digital world than in the real world. Statista [1] found that in 2020, American adults spent an average of 470 minutes per day using digital media (that’s 7 hours 50 minutes – almost half of their waking lives if we account eight hours of sleep). This metric is only projected to rise further as the diffusion of new digital technologies such as the internet-of-things, smart devices, artificial intelligence (AI) and augmented reality (AR), further blur the lines between our physical and digital lives. Beyond this, a new frontier is gaining credence: the metaverse. Touted as the next iteration of the internet, this concept would essentially bring about the convergence of the physical and digital realms.

What is the metaverse?

The metaverse is a universal computer interface that allows users to live, work and play in alternative virtual worlds. Its name is a portmanteau combining ‘meta’ meaning ‘beyond/after’ in Greek, and ‘universe’. While nascent versions exist, the technology is far from maturity. Ultimately, in its fullest form, users would wear virtual reality (VR) headsets to enter an alternative reality– one could “go to the office” and interact with colleagues without leaving the sofa. More diluted versions involve acting through 2D avatars on our existing screens or smartphones, or AR glasses that superimpose digital images onto the real world (imagine you could try on an outfit or new hairstyle while looking in your mirror at home). For investors keen to have a preliminary glance at what the metaverse might look like, Steven Spielberg’s movie Ready Player One is a good place to begin.

Companies are betting big on the metaverse

The metaverse, if it catches on, could become a whole alternate economy. Bloomberg calculates that the global revenue opportunity could approach $800bn in 2024 (up from about $500bn in 2020), and already big-name companies are engaging in what looks like a digital land-grab to affirm their presence in this new world.

Facebook (which changed its name to “Meta” in October 2021 to reflect its ambitions in this new realm) has pledged $10bn per year for the next decade to create its own immersive virtual word, while Microsoft recently agreed to buy Activision Blizzard, the video game maker behind franchises such as Call of Duty, for a staggering $68.7bn. Satya Nadella, chair and chief executive of Microsoft said “Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms”.

Just as people use their clothes to reflect status in the physical world, retailers preempt that they will wish to do the same in the digital world. To capitalise on this, Nike, for example, recently purchased a virtual shoe company, RTFKT Studios, and trademark applications show its intent to make and sell virtual sneakers and apparel.

If some were baffled by the blistering price rises in non-fungible tokens (NFTs), an understanding of the metaverse may help. NFTs are a new art form for artists, musicians, and creators, representing a unique digital asset or token (a “proof of ownership” on a piece of digital art). Proponents claim that NFTs based on art and collectables will have status as elements in the metaverse. Already, Sotheby’s has opened a prime-location gallery within Decentraland, the first virtual world owned by its users. [2]

Even national governments are entering the fold. In 2021, the South Korean government announced the creation of a national metaverse alliance with the goal to build a unified national VR and AR platform.

Investment Implications

The metaverse has not been built yet and while it may be the world of tomorrow, the technologies that enable it may create opportunities for investors today. The metaverse has several prerequisites:

- Speed is paramount and the latency offered by 5G technology (and laterally 6G) will be essential.

- Blockchain will play a crucial role in ensuring data authenticity and ownership.

- Cloud-based infrastructures are key given that massive amounts of data need to be transmitted wirelessly and stored.

- The Metaverse will need a lot of computing power, making semiconductors crucial (they will largely need to use advanced process nodes which only a handful or chipmakers currently have the ability to produce).

- Hardware - Seamless virtual experiences require advanced hardware, whether it be headsets, sensors or even clothing or cameras that capture movement.

- Cybersecurity – the more digital our lives become, the more vulnerable we are to cyber-attacks.

- Software that has interoperability across platforms.

Whether the metaverse as imagined enters the mainstream or not, what is sure is that soon, even greater proportions of our lives are set to take place in the digital realm whether it be entertainment, gaming, education or financial services... The ever-beating drum of digitalisation will create winners and losers in almost every sector and as such, gaining exposure is not simply about buying IT-related stocks. Assessing every company’s ability to innovate and adapt in this space should be integral to the investment-decision making process.

[1] https://www.statista.com/statistics/262340/daily-time-spent-with-digital-media-according-to-us-consumsers/#:~:text=In%202020%2C%20adults%20spent%20an,five%20and%20a%20half%20hours.

[2] https://decentraland.org/blog/announcements/sotheby-s-opens-a-virtual-gallery-in-decentraland/

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...