Choose Language

July 22, 2019

NewsEuropean car sales in reverse

Last week brought more ominous news for the

European Auto industry, with ACEA[1]

figures revealing that new car sales had slipped by a substantial 7.8% in June.

The data

comes at a time when car manufacturers are already grappling with a host of challenges

such as heavier regulation, the demonization of diesel, Brexit, the trade war, changing consumer

attitudes towards car ownership and the shift towards electric vehicles

(meaning a lot of cash needs to be siphoned into R&D). The share prices of

major auto makers slipped on the news, with the market value of certain high profile

names already dented from profit warnings issued earlier in the year.

Sales

year-to-date are down 3.1%, and the ACEA predicts that for 2019 in its

entirety, sales will come down 1%: with total EU car sales projected to be just

above 15 million units at the end of the year. Previously it had predicted a 1%

rise.

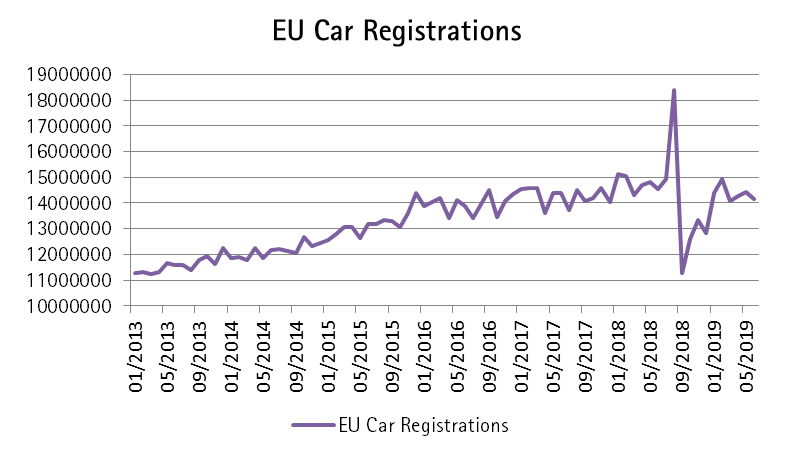

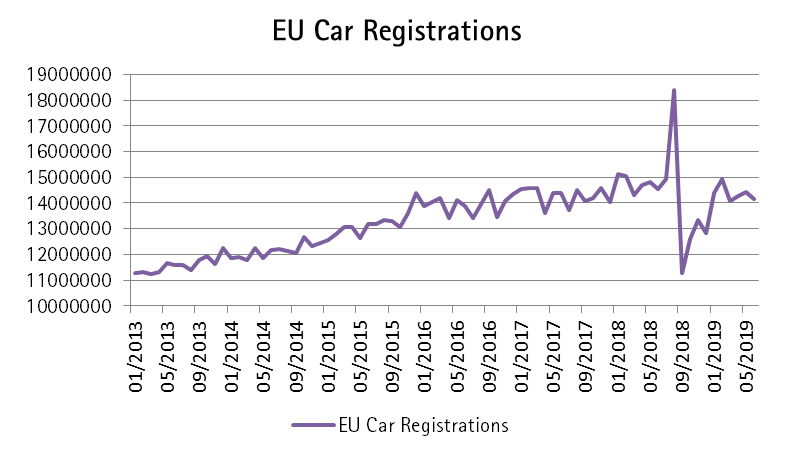

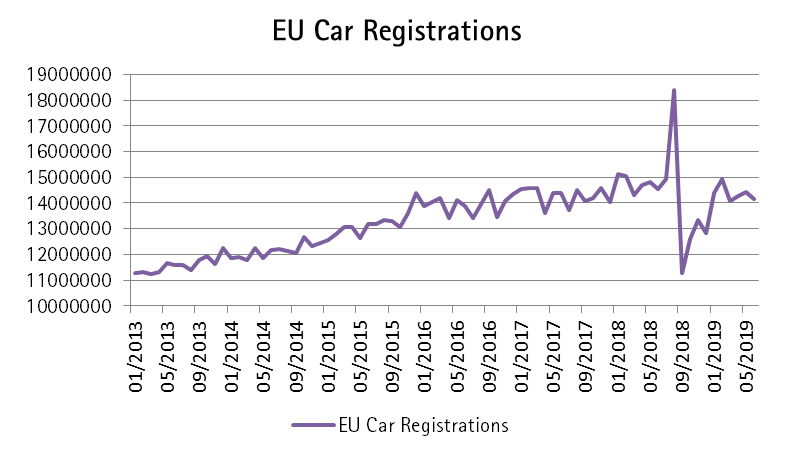

What is important to remember is the fact that the roll-out of emissions standards in September 2018 skews the data as is visible in the below chart. In August 2018, car registrations in Europe were given an artificial boost ahead of the new WLTP emissions test that was applicable on all new car registrations from 1st September 2018. This led most manufacturers to slash prices in order to offload pre-WLTP vehicles - it will be after September when a base-effect in the data stops having such a strong influence on this year’s figures.

But calendar

reasons aside, the automotive industry is in crisis mode, with margins being

squeezed from all angles. On one hand, there is the possibility that the car

market has hit its peak. Millennial generations do not have the same ‘emotional

connection’ to cars and see them rather as a means of getting from A to B. They

are consequently more drawn to alternative solutions such as short-term

rental (Uber model), peer-to-peer sharing (Blablacar or SnappCar), the

on-demand model (Flexdrive) to Airbnb-style models (Turo). Sales in China,

which was the new hot market for autos, are also on the decline. 2018 will be

marked as the first year in almost three decades that negative growth has been

recorded in China’s auto industry. 2019 continues on the same path with onslaught

of new CO2 regulations and with consumers postponing purchases because of trade

war uncertainty and in anticipation of government incentives which analysts say

could potentially materialize in 2020 (they ascribe a 20% probability to this).

Simultaneously,

whilst sales are falling, costs for car manufacturers are rising. The unprecedented

shift to electric and autonomous vehicles is capital intensive, as is the

investment needed to remain compliant with new ‘green’ regulations. Yet in

order for new ideas about electro mobility to have a chance, they must be

affordable to customers. Today they are more expensive than traditional

vehicles and it is going to be difficult for automakers to strike a balance

between affordability and a level whereby they can cover their costs.

Such margin

compression explains why car manufactures are trading at a 15 year low

(in terms of valuations) against the wider market. And this is just the tip of

the iceberg. There is also the risk of a no-deal Brexit, or Donald Trump’s threat of tariffs on auto

imports into the US which floats on the horizon – that could really be the

straw that breaks the camel’s back for industry which plays a crucial role in Europe’s

economic fabric.

[1] European

Automobile Manufacturers' Association

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...